Trading apps put the markets in your pocket, letting you monitor your trades and take action wherever you are. For traders who want to stay in the game, being connected at all times is key.

| Name | Logo | Markets | Overnight Fees | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Markets 13,500 |

Overnight Fees 2.5% +/- SONIA |

GMG Rating |

Customer Reviews 3.8

(Based on 124 reviews)

|

Download App 69% of retail investor accounts lose money |

Account Types:

|

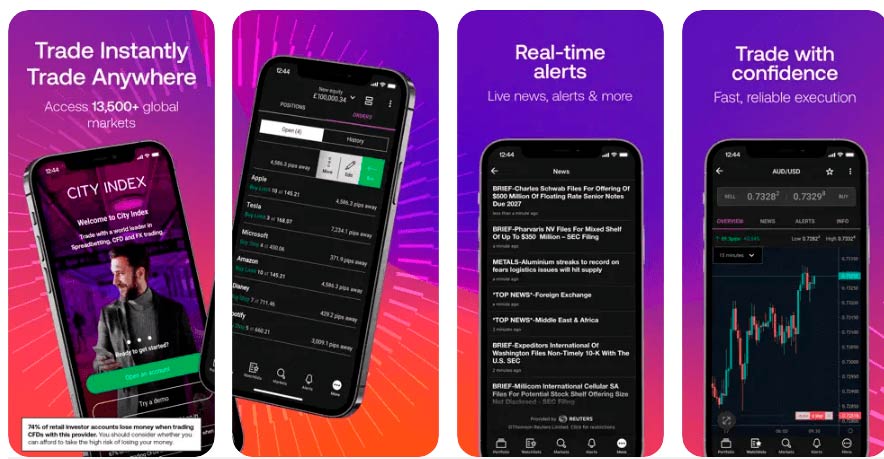

City Index Trading App Review: great signals and data on the go Account: City Index Trading App Description: City Index’s mobile app provides access to 12,000 markets through spread betting and CFDs has just had a facelift with some behind-the-scenes improvements as well. Is the City Index trading app any good? Yes, when I traded on the City Index app I was able to able to access asset overviews, news, and alerts as well as key market info. But, one of the stand-out features of the City Index app is the inclusion of Performance Analytics. Performance Analytics gives the full breakdown how where you have been profitable or not in the past and provides feedback on whether or not you are sticking to your trading plan. Both, mean that the app has a bit more use than just a way to monitor the market when not in front of your normal trading screens. It’s a well laid out trading app, with the major instruments front and centre, but also the peripheral markets like sectors, thematic indices (like blockchain, NFTs and cannabis), trending markets and options quickly available. The app also has quick access to popular markets, so you can keep an eye on where the days trading volumes are going. Using and navigating the app is intuitive, with icon-based menus for markets, watchlists, alerts etc. There is a news feed and economic calendar, as well as technical analysis from Trading Central. You can draw and edit charts on the app and add up to four indicators to them. The mobile charting package includes logarithmic sizing and switches between landscape, there is the usual suite of technical indicators from Trading View, but you can’t execute direct from the chart on mobile yet. Overall City Index’s trading app is a good addition to it’s main platform and should suit traders looking for stimulus and research on the go.

Pros

Cons

Overall4.9 |

||

|

Markets 7,000+ |

Overnight Fees 2.5% +/- SONIA |

GMG Rating |

Customer Reviews 4.2

(Based on 19 reviews)

|

Download App 74% of retail CFD accounts lose money. |

Account Types:

|

FOREX.com Won Best Forex Broker in our 2025 Awards Provider: FOREX.com Verdict: FOREX.com is one of the largest forex brokers operating globally and owned by Nasdaq-listed institutional broker StoneX. Forex.com offers traders access to 7,000+ assets including 80+ currency pairs, thousands of stocks, popular commodities, indices and cryptocurrencies (pro accounts only in the UK & EU). Pricing is competitive, especially for those on the RAW spread account or active trader programmme.

Is FOREX.com a Good Trading Platform? FOREX.com won Best Forex Broker in the 2025 Good Money Guide Awards. 24-Hour FOREX.com Test I took FOREX.com out for a 24-hour test drive, to trade with real money and try out some of the key features on the streets of the City of London. Here’s what happened… “For FX sake”, I thought to myself when faced with writing a review about a forex broker. Firstly because all these brokers do is offer access to the forex market (or so I believed). Secondly, because I’ve never had much success with forex trading. I find the nuances of intra-day technical analysis too complicated. I’m an old-fashioned trader – I like to look at the market and think it’s either overvalued or undervalued and, in my mind anyway, that’s easier when looking at a company’s share price, an index or even a commodity. But for some reason, with forex trading, I’ve never really got the hang of it. Having said that, I have dealt currency for about 20 years now, but more as a broker rather than as a trader. For instance, I used to do some prime brokerage for institutions that would hedge their currency exposure when buying aeroplanes. But I was so frustrated with how opaque pricing was in currency trading, that I decided to start up my own currency brokerage specialising in high-value currency transfers (£250,000 upwards) and undercutting everyone. It was called Berry FX, you can still see the demo on YouTube. Basically, personal service with the best rates anywhere ever. But now I just let other currency brokers compete for clients by trying to offer the best exchange rates. But you want to know what I think of FOREX.com. 24 Hour Test I took FOREX.com out for a 24-hour test drive around the City of London, putting some real trades on whilst going about my business to see if I could make any money. I started out at the Bank of England with £10,000 on account at 11:30am. Lunch was a few minutes’ walk from the tube station, so I took the opportunity to put some trades on using FOREX.com’s trading signals. I’ve used these for years; back in 2018, they were known as GetGo and it was a standalone forex trading app. When I reviewed it then, I said these were the future of forex trading signals but are they still? There are a couple of things that make these signals better than the rest.

When I was walking down King William Street to L’Antipasto to meet some contacts for lunch, I put a few trades on. First, I looked at the traders that had a historic success rate of over 50% and followed them. Then I looked at trading signals that had a success rate of less than 50% and traded against them. It’s a pretty simple strategy that generally works (not always, though). I used the classic stop/limit risk/reward ratio, aiming for twice the potential loss as a potential win. Again, simple forex trading strategies. The market is not hard to call, but if you get a trade right, it often pays to let it run for longer, but if it’s wrong, close it sooner. Trading Central On the way to my next meeting, I took a few moments on London Bridge to look at some of the other signals on FOREX.com: Trading Central. Now, Trading Central has been providing technical analysis to brokers for decades and supplies a constant stream of manually and automatically updated trading ideas throughout the day to give traders an indication of where the markets may go. It’s not as fluid as the trading signals, as you have to put the trades in manually, but still gives you a bit of stimulus. This is great for someone like me because I generally have an idea of what I want to do from eyeballing a chart (I did, after all, run a technical analysis division for 5 years), but it’s nice to get confirmation of your thoughts one way or another. Execution When you are actually trading there are some great other features on the app:

Post-Trade Analytics Once you’ve done a bit of trading, you can review your trading history and see where you do well and where you can improve. This is a great feature as it can break down how well you trade by time of day, markets or volatility. You can also set up “Play Maker” if you have a trading strategy and want to stick to it. Obviously, you can’t get that sort of data in a 24-hour test drive, so I’ll have to revisit that another time. Demo Account FOREX.com has a pretty good demo account. In fact, it’s hard to tell the difference between the demo and live trading platform. You get the same functionality and as trades are OTC, the same prices. However, when I opened a demo account to test it, I already had a real account. So after I got my demo account login details, I clicked through to the “Webtrader” portal and (funny or alarming, depending on how you look at it) my live account details were auto-filled in by Google Chrome. Now, had I not been checking my email, to ensure that the platform had sent me through my credentials, I might not have noticed that I was logging into a live account. It could have been disastrous if I’d started trading away thinking it was paper money. Even more so as you get £10,000 in demo funds and I’d deposited £10,000 in my live account when I took FOREX.com on a 24-hour trading signal test drive. It reminded me of when a trader thought that he was trading on a demo account and put $1bn worth of orders through and then sued his broker because it voided his €10m profits. TradingView & MetaQuotes I had a good play about with TradingView, as it’s now the go-to destination for traders. TradingView is a sort of social network for traders where you can view charts (they are excellent) and post trading ideas (take with a pinch of salt). As TradingView has grown, it has also become an execution venue, so you can link your FOREX.com trading account and deal straight from the charts. This shouldn’t be too much of a stretch for most traders as the charts on the app and web-based platform are provided by TradingView (which, incidentally, is one of the largest financial-based websites in the world now). You can also trade on MT4 or MT5 (but only MT5 in the EU), if you are into that sort of thing… Am I a Forexpert? I did make money on day one, mainly thanks to putting on a GBP-USD trade that covered most of the losses from some of the other trades. When I used the trading signals 5 years ago, I also made money. Day 2 wasn’t so good. On my way to an investor show, I gave back a few pennies but still ended up on top. But I have to admit my traders were calculated guesses rather than heavily researched positions. I don’t like holding positions overnight, as day trading reduces not only your margin requirements but also increases the amount of sleep you get because you don’t wake up with cold sweats in the middle of the night worrying about Asian interest rates. Overall would I recommend forex.com? Yes, if you are going to trade forex and don’t know where to start, as it’s a massive brand with global reach and owned by a listed brokerage with an institutional pedigree. As far as box-ticking is concerned, it ticks the lot. Or should I say pips the lot… Pros

Cons

Overall4.6 |

||

|

Markets 1,350+ |

Overnight Fees 2.5% +/- SONIA |

GMG Rating |

Customer Reviews 4.6

(Based on 86 reviews)

|

Download App 71.9% of retail investor accounts lose money |

Account Types:

|

Pepperstone Trading App Review: Access cTrader, MT5 & MT5 on the go Account: Pepperstone Trading App Description: Pepperstone has four trading apps, MT4/MT5, cTrader and TradingView which provide access to CFDs and spread bets on the major markets for active traders with tight spreads. Pepperstone has also just released it’s own proprietory trading app. Does Pepperstone have a good trading app? Pepperstone has a good version of the MT4 app for tight spreads on forex and is one of only two brokers to offer spread betting via TradingView in the UK. Pepperstone’s version of the MT4 trading app, will connect you to your MT4 account with Pepeprstone but when I tested it the algo and automatic trading functions of the desktop version are not available through the app. The cTrader Pepperstone App, though is feature-rich including, market sentiment, market depth economic calendars, and technical analysis from Autochartist which displays regularly updated trading signals. There is no stand-alone trading signal feed, but once you are looking at a market, Autochartist will display the most recent signal from 15 minute, 30 minute, 1 hour and 4 hour time frames and automatically display a buy or sell one-click order button based on if it is a long or short signal. The app also breaks down your trading statistics based on previous trades per asset. So for example, if you are trading a US stock on the app, it will tell you how well you have done in the past with your overall net profit, what commission you have paid, your best and worst trades and how long you generally hold a position in that stock for. Market access is narrow and pricing is tight.

Pros

Cons

Overall4.8 |

||

|

Markets 2,000+ |

Overnight Fees n/a |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Download App 76% of retail investor accounts lose money |

Account Types:

|

Plus500 Expert Review 2026: A user-friendly platform with access to global markets Provider: Plus500 Verdict: Plus500 is one of the largest online trading platforms and operates in more than 50 countries worldwide. Founded in 2008, it has more than 26 million customers today.

Plus500 is headquartered in Israel, however, it’s listed in the UK on the London Stock Exchange (it’s a member of the FTSE 250 index). Here in Britain, its platform is operated by Plus500UK Ltd, which has offices in London.

In the UK, you can only trade CFDs with Plus500. CFDs are financial instruments that allow you to profit from the price movements of a security without owning the underlying security itself. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money. Is Plus500 a good broker? Yes, Plus500’s trading platform has evolved nicely over the years from a simple interface to an intuitive execution venue for CFDs on the major markets and stocks. Opening a Plus500 account is really simple:

Pricing: It’s dynamic so moves with the market for minimum spreads. Plus500 does not charge any trading commissions when you place a CFD trade. However, there are some fees you need to be aware of including:

Withdrawals are free of charge no matter how many you make per month. Deposits are also free of charge. Market Access: Very good, Plus500 are always first to try new asset classes With Plus500, you can trade CFDs on a range of assets and instruments including:

Overall, there are over 2,800 assets you can trade with CFDs. The maximum amount of leverage you can use with Plus500 varies depending on the asset class as shown in the table below. If you are trading forex, you can potentially borrow up to 30 times your own money. For shares, you can only borrow up to five times your own capital. Plus500 margin rates:

Platform & Apps: Basic execution, but it does the job well Plus500 trading apps and platform also offers several tools to help traders manage risk including:

Customer Service: Plus500 doesn’t have a phone option, but its live chat is sufficient Plus500’s customer service options are limited to online chat, email and WhatsApp. So, you can’t contact the company by telephone. However, don’t let that put you off. We contacted the company via online chat and were very impressed with the service and support offered. It’s worth noting that support is available 24/7. This is a big plus – some other CFD providers only provide support during the week. If you are a larger or professional trader you can get access to Plus500’s Premium Service Package which includes:

The premium service is invitation only. To become a premium customer, you must have a real-money trading account. However, if you want better margin rates but are not interested in the premium package you can upgrade to a professional account. The Plus500 professional account is an account designed for professional traders. With this account, you have access to higher levels of leverage (e.g. 1:20 for shares). To be eligible for a professional account, you must meet two of the following three criteria:

Research & Analysis: Some sentiment, but limited education and analysis. Plus500 offers a range of additional features designed to help traders make money, including:

Pros

Cons

Overall4.6 |

||

|

Markets 8,500 |

Overnight Fees 1.5% +/- SONIA |

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Download App 59.7% of retail investor accounts lose money |

Account Types:

|

Interactive Brokers: UK's Best Trading App For Sophisticated Investors Account: Interactive Brokers Trading App Description: As with the main trading platforms, Interactive Brokers’ trading apps are some of the best around. I tried all three different apps on offer, IBKR Mobile, IBKR GlobalTrader and IMPACT. Is Interactive Brokers' trading app any good? Yes, IBKR is one of the best app for sophisticated and professional traders is the IBKR Mobile as which replicates some of the functionality of the Interactive Brokers desktop TraderWorkstation platform. IBKR Mobile is the mobile version of the main trading platform and has the most functionality, where you can view your derivatives and investment portfolio, view charting, trade options, futures, and CFDs. You can also access the iBot feature which helps you search for things like dividend dates, corporate earnings reports, and economic events around stocks or markets you are interested in trading. Charting is initially simple, but under the settings, you can add indicators, show live orders, and annotations and change the bar size and chart type. There is also the IMPACT lens features that measures your portfolio and gives it a ranking based on how ethical your positions are. The news section also lets you filter and search for IBKR news and analysis from The Fly Swawkbox, Real Vision (an excellent premium analysis vlog from Raoul Pal) and Bloomberg. IBKR GlobalTrader has a slightly easier feel and is focussed more on stock traders. You get inspiration for investing in stocks, based on their sector, price moves, news flow. News is also filtered down based on the positions in your portfolio. For more ethical investors the IMPACT app is focussed on helping you make more ethical investment decisions. You get access to the same markets to trade in by the app ranks your portfolio by how ethical they are. It will also show you a more ethical alternative, with a similar investment profile which you can switch to with the click of a button. Overall, Interactive Brokers’ trading apps, are some of the best around with excellent functionality and access to one of the widest selection of markets and investment products around.

Pros

Cons

Overall4.3 |

||

|

Markets 10,000 |

Overnight Fees 3% +/- SONIA |

GMG Rating |

Customer Reviews 4.3

(Based on 257 reviews)

|

Download App 61% of retail investor accounts lose money |

Account Types:

|

Spreadex: Best UK Trading App For Customer Service Account: Spreadex Trading App Description: Spreadex’s trading app has access to the same 10,000 markets which you can trade by spread betting or CFDs (no physical investing yet). Pricing is very competitive in the major markets but does get wider the more exotic the product. Spreadex has always been very good at offering access to smaller cap stocks, some of which are also available on the app, as well as the main platform and over the phone. Is Spreadex's trading app any good? Yes, the Spreadex trading app, as with the main trading platform, offers some of the best customer service and is suited to traders who just require a click-and-trade app and won’t be using it for research or signals. The watchlists, highlight, popular market, the risers and fallers, but there is not much in the way of cluttered educational content or analysis. you can view market updates, weekly analysis, and financial trading blogs, but these are just links to webpages from the app. One good feature I found when testing it though is that you can talk directly to customer support via live chat through the app. This is one area where Spreadex has always excelled as a smaller UK broker, offering good customer service where you can get in touch with someone who knows what they are talking about quickly. Overall, the app is a good compliment to Spreadex’s service.

Pros

Cons

Overall4.6 |

||

|

Markets 15,000 |

Overnight Fees 2.5% +/- SONIA |

GMG Rating |

Customer Reviews 3.9

(Based on 678 reviews)

|

Download App 68% of retail investor accounts lose money |

Account Types:

|

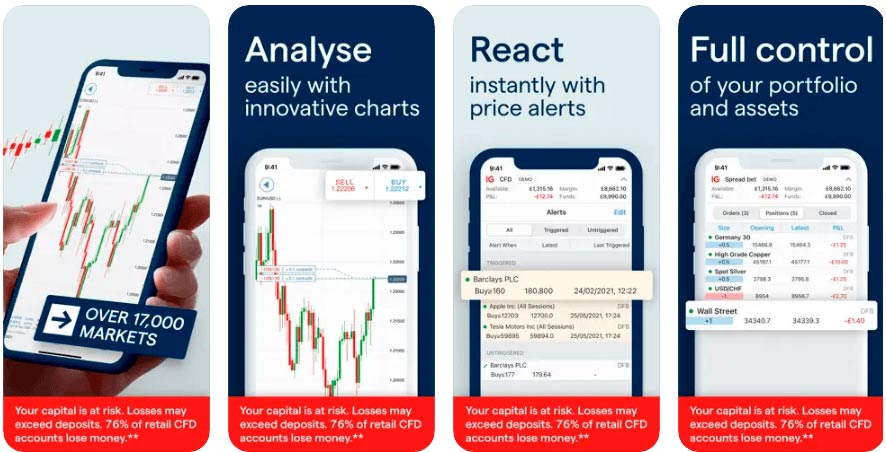

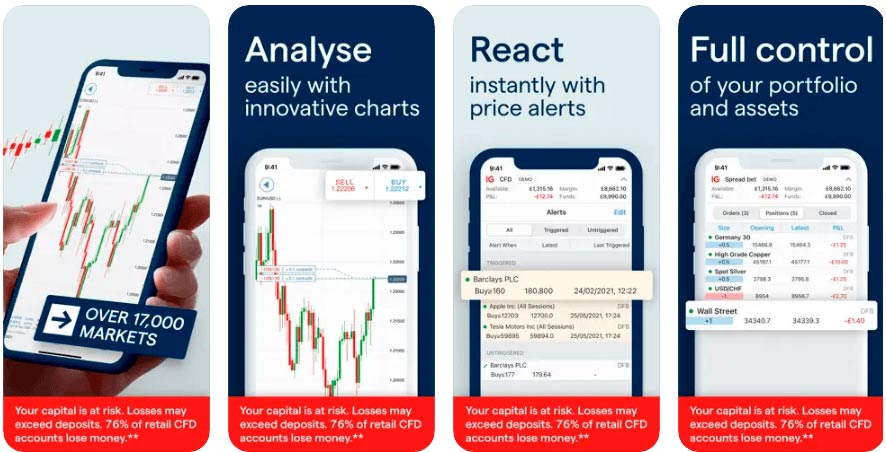

IG Trading APP Expert Review: Best Trading App 2025 Account: IG Trading App Description: IG’s trading app offers access to the same range of markets and account types as the main platform. You can trade CFDs and spread bet on over 17,000 instruments and invest in longer-term products like ISAs and physical shares. Is IG's trading app any good? Yes, IG is one of the best trading app for market range and DMA trading. It was nice to see that when I used the IG trading app I could also get access to trading signals from Autochartist with entry, exit and stop levels that can be executed on mobile with the signal data on the same screen as the order ticket. IG’s trade analytics package is also available so you can review your trading win rate, return, and profit and loss ratio as well as see whether you are a better short or long-term trade, the app will also highlight your best and worst markets. The app trade analytics will also show your total financial exposure and your most recent trades. The app’s news, section, whilst not as comprehensive as the web version can be filtered down by asset class, you can see what is most relevant to you. There is also a macroeconomic event calendar and a diary of company announcements so you don’t get caught off guard with unexpected figures or can take advantage of upcoming market volatility. One key advantage of the IG app is that IG provides markets over the weekend so you can trade to reduce or increase your exposure on the move and out of normal market hours. You can also see level-2 data and trade DMA on shares. The app syncs with your accounts so watchlists and recently traded and viewed markets will be easy to see. Charting, is good, landscape and portrait, plus you can trade directly from the charts, as well as drag and drop, stop and limit levels. Overall, IG’s trading app is one of the best out there, with more features and markets than most of the competition.

Pros

Cons

Overall5 |

||

|

Markets 12,000 |

Overnight Fees 2.9% +/- SONIA |

GMG Rating |

Customer Reviews 3.7

(Based on 149 reviews)

|

Download App 64% of retail investor accounts lose money |

Account Types:

|

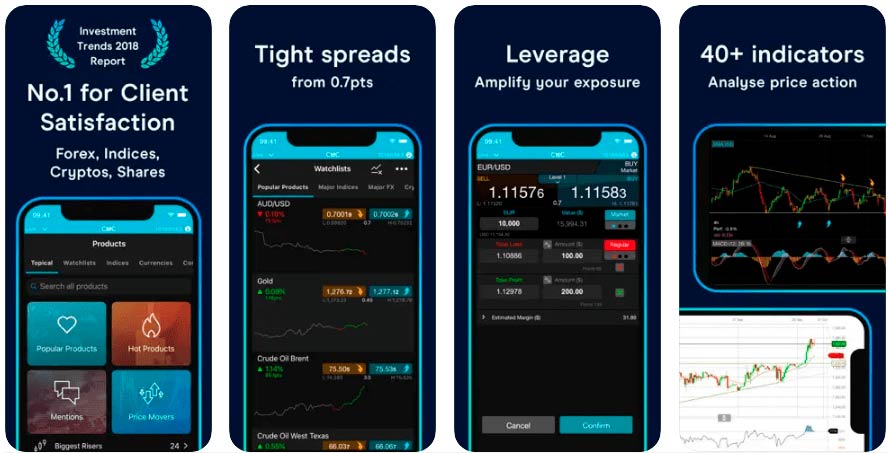

CMC Markets: Excellent Trading App Sentiment Indicators Account: CMC Markets Trading App Description: CMC Markets’ trading app lets you trade over 12,000 markets via CFDs and financial spread bets. It’s suitable for active traders and has the same fast-paced feel as the main platform. Is CMC Markets trading app any good? Yes, CMC Markets’ trading app lets you trade over 12,000 markets via CFDs and financial spread bets. It’s suitable for active traders and has the same fast-paced feel as the main platform. One of the things that makes CMC Markets app stand out for me when I tested it is the focus on media as well as execution. Instead of providing an app that is just a slimmed-down version of the main platform, there is a huge amount of educational and news content available as video. So the app provides a bit more than just a way to stay connected to the markets, it can be a resource and a way to learn whilst on the move. The analysis section provides insights and intraday updates, news from Reuters, economic calendars and CMC TV can keep you informed and entertained. There are also some quite good platform tour videos, so you can get to know the platform better, some educational videos on how to trade and you can join live events. The app quite nicely highlights trending, popular and typical markets, which are ranked by activity so you can see the most liquid markets and what is being traded. One of the standout features though is CMC Markets’ client sentiment data, which is displayed around the order tickets. When you bring up an asset you can see what percentage of clients are long or short, related products and also break it down between which way the profitable and non-profitable clients are trading. Overall, CMC Market’s trading app is an excellent resource for active traders on the move.

Pros

Cons

Overall4.5 |

||

|

Markets 2,000 |

Overnight Fees +8.5% / -5.8% |

GMG Rating |

Customer Reviews 4.6

(Based on 136 reviews)

|

Download App 72% of retail investor accounts lose money |

Account Types:

|

XTB: A Great App For Multi-Asset Trading Provider: XTB Trading App Verdict: XTB’s trading app provides access to about 2,100 markets through CFDs and does provide some added value over the more basic apps from other brokers. Is XTB's trading app any good? Yes, XTB has some pretty good trading apps. They offer MT4, MT5 and xStation Mobile, for traders to trade on the move. Of those, I would say that XTB’s xStation mobile is very good, especially compared to basic CFD mobile trading apps like eToro. Specifically, the app highlights your favourite markets, and what is “hot” at the moment so you can see what traders are trading as well as sentiment indicators for those most popular markets. You can filter XTBs client trader sentiment by buyers and sellers, and also by asset class, so you can see where order flow has been going and decided if you want to follow or take a contrarian position. Charting is nicely layed out, but you cannot trade from the charts on the app (you can on desktop), but the crosshairs feature, does give you a visual of where your orders are relative to support and resistance on the same screen, which is a nice touch. I did find when trading on the app though there is a good “Discover” section where you can view popular markets such as stocks that have exposure to “inflation protection”, environmental assets, top ETFs that are being traded and also a tab for stocks and markets that are being talked about on Reddit. You can get access, via the app, to XTBs educational videos, such as their Masterclass, and interviews with people like Jamie Rogozinksi from WallStreetBets. Overall, the app has some good features and is a good complement to the main trading platform.

Pros

Cons

Overall3.8 |

||

|

Markets 8,600 |

Overnight Fees 3% +/- SAXO RATE |

GMG Rating |

Customer Reviews 3.6

(Based on 74 reviews)

|

Download App 62% of retail investor accounts lose money |

Account Types:

|

Saxo Trading App Expert Review: Professional grade trading in your pocketAccount: Saxo Markets Trading App Description: Saxo Markets’ trading app is a real workhorse and offers excellent market coverage and functionality. The app provides access to over 30,000 CFD markets as well as on-exchange futures, options, and physical investing. Is Saxo's trading app any good? Yes, Saxo Markets’ trading app very good but compared to another institutional-grade platform like Interactive Brokers, it’s not quite as good. Saxo’s app is excellent for professional and institutional traders who want to trade DMA, and is essentially a mobile version of Saxo’s excellent TraderGo platform. But, whereas Saxo only have one app IBKR, has a huge range of apps for all different types of investors including private investors, algo traders, options strategists and ethical investors. Even though Saxo is traditionally a trading platform for short-term speculation on the markets going up or down. It is also an excellent choice for longer-term investors as Saxo is a very well-capitalised company, heavily regulated in the UK and all the regions they operates in, and has excellent customer service for small and large customers. When I used the Saxo markets trading app I got access to a lot of the functionality of the main platform including, level-2 prices, positions, orders, watchlist, trade blotters, charting, options chain tables, stock screeners, price alters, and SaxoSelect Investments. SaxoSelect lets you invest in longer-term capital-grown investment products run by leading asset managers such as Blackrock and Morningstar who create automated portfolios based on your investment objectives. So, as well as having full access to Saxo’s full range of derivatives products you can also manage your investment portfolio from the app. The SaxoTraderGo app also provides access to Saxo’s research services where you can view Saxo Wire, and get an overview of the major market movers per asset class, news is filtered by what is trending in the “Hot Topics” section. There is quite a good integration of Autochartist as well where you can trade directly from the signals, choosing if you want to add stops and limits. There are also some quite good educational videos on topics such as technical analysis, risk management, fundamental analysis, and some general “how-to” guides on how to get the most out of the platform. Through the app, you can view live and previous webinars including Saxo’s quarterly outlook and new feature training. Overall, one of the best trading apps on the market suitable for experienced and sophisticated traders who want more than just trading and charting.

Pros

Cons

Overall4.9 |

✅ Here’s what Good Money Guide used to hand-pick the best trading apps in the UK:

- 30,000+ consumer votes and reviews in the Good Money Guide awards

- Our reviewer’s own experiences testing the trading apps with real money

- A deep dive and analysis of any stand-out features

- Good Money Guide’s exclusive interviews with the trading app CEOs and senior management

- Find out more about how we rate and review financial product providers

What is a Trading App?

A trading app is a mobile platform provided by stockbrokers, CFD, spread betting, and forex brokers. It allows you to buy and sell underlying securities or OTC (over-the-counter) products directly from your smartphone.

All trading apps are different and specialise in certain things. For example, City Index has some of the best trading signals and post-trade analysis for traders that want a bit of stimulus and to improve their execution strategy. Meanwhile, IG can have better liquidity than the underlying exchanges so is excellent for larger traders.

How to Choose a Trading App

Here are the factors you should take into account:

- Market access: Check how many stocks, commodities, indices, and forex pairs are available

- Account types: Look for platforms offering spread betting (tax-free profits), CFDs, Spot FX, and futures

- Trading experience: Assess whether the app suits beginners or experienced traders

- Regulation: Ensure the app is regulated by the Financial Conduct Authority (FCA) in the UK

- Costs & fees: Compare brokers to find the cheapest option for your trading style

- Added value: Look for trading tools, analysis, or education to boost your skills

- Voice brokerage: Some platforms allow you to manage complex orders via phone

Can You Make Money on a Trading App?

Yes, you can make money trading via an app. Around 20% of traders on trading apps in the UK from regulated brokers make money. But keep in mind that trading is a high risk form of investing and you can also lose money quickly.

Pros & Cons of Trading Apps

Pros

- Margin: Trade on margin to leverage your risk capital

- Tax efficient: Profits can be tax-free through financial spread betting

- Low cost: No stamp duty is payable for short-term speculation on CFDs

Cons

- Risky: Trading is a very high-risk form of investment

- Complex: Trading order types can be hard to understand

- Short-term: Expensive for long-term investing

Industry experts told us...

"All traders should certainly consider the mobile version of a broker's main platform when picking brokers as it's imperative to stay connected to the markets when you have high-risk leveraged positions open for responsible risk management."What is the Best Trading App for Beginners?

IG is ranked by Good Money Guide as the best trading app for beginners. It offers many educational guides, webinars and analysis to learn from. The IG trading app also has a clear interface with simple-to-use features. If you’re new to trading, it’s important to remember that derivatives are a high-risk form of speculation so ensure you fully understand the risks of trading before you start.

| Beginner Features: | Trading Signals | Educational Webinars | Client Sentiment | Leverage Control | Low-Risk Products | Investment Account |

|---|---|---|---|---|---|---|

| City Index | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Interactive Brokers | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ✔️ |

| Plus500 | ❌ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| CMC Markets | ❌ | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Pepperstone | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Spreadex | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Saxo | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| IG | ✔️ | ✔️ | ✔️ | ❌ | ✔️ | ✔️ |

| XTB | ✔️ | ✔️ | ❌ | ❌ | ❌ | ✔️ |

| eToro | ❌ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

✅ Good Money Guide only recommends FCA-regulated trading apps

All trading apps that operate in the UK must be regulated by the FCA. The FCA is the Financial Conduct Authority. It ensures UK trading apps are properly capitalised, treat customers fairly and have sufficient compliance systems. We only feature trading apps that are regulated by the FCA, where your funds are protected by the FSCS (Financial Services Compensation Scheme).

The UK’s Best Trading App for Professional & Advanced Traders

Saxo Markets has one of the best stock trading apps for professional traders. The Saxo Markets app provides direct market access CFDs, futures trading, options and access to its wide range of investment products.

IG is one of the best stock trading apps for high-net-worth individuals for two reasons. First, it can often offer better liquidity on the major instruments than the underlying exchanges due to its clients’ trading volumes and internal matching. Secondly, IG has one of the only apps you can trade with direct market access (DMA).

| Advanced Features: | Voice Brokerage | Corporate Accounts | Level-2 & DMA | Algo/API Trading | Prime Brokerage |

|---|---|---|---|---|---|

| City Index | ✔️ | ✔️ | ❌ | ❌ | ❌ |

| Interactive Brokers | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| Plus500 | ❌ | ❌ | ❌ | ❌ | ❌ |

| CMC Markets | ✔️ | ✔️ | ❌ | ❌ | ✔️ |

| Pepperstone | ❌ | ✔️ | ❌ | ❌ | ❌ |

| Spreadex | ✔️ | ✔️ | ❌ | ✔️ | ❌ |

| Saxo | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| IG | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| XTB | ❌ | ✔️ | ❌ | ❌ | ❌ |

Top Trading App for Market Access

IG’s trading app currently offers the most market access with 15,000 stocks, indices, commodities and forex pairs available on mobile in the UK.

| Market Access: | Total Markets | Forex Pairs | Commodities | Indices | UK Stocks | US Stocks | ETFs |

|---|---|---|---|---|---|---|---|

| City Index | 13,500 | 84 | 25 | 21 | 3500 | 1000 | n/a |

| IG | 15,000 | 80 | 38 | 34 | 3925 | 6352 | 2000 |

| CMC Markets | 12,000 | 338 | 124 | 82 | 745 | 4968 | 1084 |

| Pepperstone | 1,350 | 90 | 32 | 28 | 192 | 880 | 107 |

| Saxo | 8,600 | 182 | 19 | 29 | 5000 | 2000 | 675 |

| Interactive Brokers | 8,500 | 100 | 20 | 13 | 500 | 3500 | 1100 |

| Spreadex | 10,000 | 60 | 20 | 17 | 1575 | 2110 | 160 |

| XTB | 2,000 | 60 | 22 | 25 | 230 | 1080 | 138 |

What Trading App Has the Most Account Types?

Saxo Markets, IG and Interactive Brokers’ trading apps all offer access to the most account types. However, no trading app offers access to all accounts in our matrix. The Interactive Brokers and Saxo apps don’t offer spread betting, which gives UK traders tax-free profits.

City Index is one of the best stock trading apps for spread betting. The company is owned by US broker StoneX which is listed on the NASDAQ, and offers over 12,000 markets to trade. It has some unique spread bet trading tools like performance analytics that let you check where you trade profitably.

For more information on spread betting see our rankings of the best spread betting brokers.

| Account Types: | CFD Trading | Spread Betting | DMA | Pro Accounts | Investments | Futures & Options |

|---|---|---|---|---|---|---|

| City Index | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ |

| Interactive Brokers | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| CMC Markets | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ |

| Pepperstone | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ |

| Spreadex | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ |

| Saxo | ✔️ | ❌ | ✔️ | ✔️ | ✔️ | ✔️ |

| IG | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ❌ |

| XTB | ✔️ | ✔️ | ❌ | ✔️ | ❌ | ❌ |

What Trading App Has the Cheapest Commission & Fees?

CMC Markets has the tightest spreads of the CFD brokers consistently and spread betting platforms we feature.

Trading apps will be free to download, and the costs and fees should be the same as if you deal on a broker’s main platform. The two specific costs you should be mindful of when trading through an app are execution costs and overnight financing.

Overnight financing is the cost of holding a position overnight and is charged as a percentage of your position value. This is a cost often overlooked by traders but can add up for longer-term positions. To see how much trading apps charge in overnight financing rates you can compare rates on the most popular traded markets on apps here.

Commission and spreads are the other cost to consider. Apps like Saxo Markets and Interactive Brokers will charge a commission on CFDs, whilst apps from IG, City Index and CMC Markets will charge a spread. The commission is deducted from your account post-trade, whilst spreads are included in the buy-sell price quoted on your app and will be roughly equivalent to the commission.

| Trading Costs | FTSE 100 | DAX 30 | DJIA | NASDAQ | S&P 500 | EURUSD | GBPUSD | USDJPY | Gold | Crude Oil | UK Stocks |

|---|---|---|---|---|---|---|---|---|---|---|---|

| City Index | 1 | 1.2 | 3.5 | 1 | 0.4 | 0.5 | 0.9 | 0.6 | 0.8 | 0.3 | 0.008 |

| IG | 1 | 1.2 | 2.4 | 1 | 0.4 | 0.6 | 0.9 | 0.7 | 0.3 | 0.28 | 0.001 |

| CMC Markets | 1 | 1 | 2 | 1 | 0.5 | 0.7 | 0.9 | 0.7 | 0.3 | 3 | 0.001 |

| Pepperstone | 1 | 0.9 | 2.4 | 1 | 0.4 | 0.09 | 0.28 | 0.14 | 0.05 | 2 | 0.001 |

| Saxo | 1 | 1 | 3 | 1 | 0.5 | 0.6 | 0.7 | 0.6 | 0.6 | 0.5 | 0.0005 |

| Interactive Brokers | 0.01% | 0.01% | 0.01% | 0.01% | 0.01% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.02% |

| Spreadex | 1 | 1.2 | 4 | 2 | 0.6 | 0.6 | 0.9 | 0.7 | 0.4 | 3 | 0.002 |

| XTB | 2 | 1 | 3 | 1 | 0.5 | 0.9 | 1.4 | 1.4 | 0.35 | 3 | 0.0008 |

- You can see what commission and spreads stock trading apps charge in our comparison of UK share trading platforms.

Our Best App Choice for CFDs

IG is the best app for trading CFDs as it offers the most markets (around 15,000), is well established, founded in 1974, and is publicly listed on the London Stock Exchange. On the app, you also get trading signals and trade analytics so you can see where you are successful, along with news and analysis. There is also the separate IG Trading academy app, which can teach you to be a better trader.

- For more info on CFD trading see our rankings of the best CFD brokers.

Our Top-Rated UK Trading App for Forex

Saxo is an excellent app for trading forex as you get direct market access to currency futures as well as on exchange and OTC FX options.

CMC Markets is also one of the best trading apps for forex as it offers the most forex pairs to trade. There are currently 71 forex pairs available to trade on the CMC Markets app.

- For more information on forex trading see our rankings of the best forex brokers.

CMC App – Best for Commodities

We have ranked CMC Markets as the best app for trading commodities as it offers over 100 commodities markets – far more than any other broker. The app also groups commodities together by popularity and industry such as agriculture and energy, and you can trade either the cash or forward price. CMC Markets also lets you trade ETFs on individual commodities or commodity sectors.

- For more information on commodities trading see our rankings of the best commodities brokers.

Which is the Top Trading App for Indices?

City Index is one of the best apps for trading indices. You can trade over 30 indices from around the world on their app as a CFD or spread bet.

Plus, you get trading signals from Smart Signals and you can use their Performance Analytics feature to see what indices you trade best at what time of day and in what market conditions.

UK’s Best Stocks & Shares Trading App

IG offers the most UK shares on its app where you can trade large, medium and small-cap stocks through the IG trading app as a CFD or spread bet. You can also invest, rather than trade in stocks via the IG app with an investment ISA account.

As a US broker Interactive Brokers offers the best access to US stocks via its trading app through physical shares or CFDs. IBKR does not, however, offer spread betting on US shares so you cannot trade USD shares in GBP as you can with financial spread betting brokers like IG.

Trading App FAQs:

Trading apps issued by Financial Conduct Authority-regulated online trading platforms are safe, and your funds are protected up to £85,000 by the Financial Services Compensation Scheme (FSCS) if a broker goes bankrupt. However, CFDs are a high-risk type of speculation, and around 80% of traders lose money on them.

No, a broker’s main trading platform will have more functionality and features. Pricing and market access will be the same, but apps are very useful for staying connected to the markets and for exiting positions on the move.

Yes, you can trade crypto on a stock trading app. eToro is the best trading app we feature for cryptocurrency. However, it is important to note that the FCA has banned cryptocurrency derivatives for retail traders to trade cryptocurrency via CFDs or spread betting. So when you trade cryptocurrency, you have to buy and sell it as an investment on a non-leveraged basis. If you qualify, you can still trade crypto on an app if you have a professional trading account, but you do not get the same protection from the FCA that retail traders get.

Saxo Markets provides access to all the futures markets; you can trade on its online platform via DMA connectivity. The futures trading app is robust and has good order execution options.