CMC Invest is rated positively on Good Money Guide as a straightforward, low-cost investing platform designed for long-term investors. Experts highlight its commission-free investing, simple app experience and backing from CMC Markets, making it appealing for beginners and cost-conscious investors. Customer reviews on Good Money Guide are currently limited, but early sentiment is generally favourable, with users appreciating the ease of use and pricing.

CMC Invest Customer Reviews

Easy to use, I like the bull vs bear feature I’m not sure but I Steven Talewa of Tari Hela Province of Papua New Guinea select only for the year Excellent tools and range of products Good CMC invest is very easy to use. they don’t charge any commision for purchasing shares. Also, they provide 2% interest on the wallet amount Excellent value and good performance Well priced, especially now it has Mutual Funds Spread betting is not for everyone Good value and instrument availability ok Generally ok Good service reasonable alroundTell us what you think of this provider.

Easy to use, I like…

I’m not sure but I…

Excellent tools and range of…

Good

CMC invest is very easy…

4/5

Excellent value and good performance

Well priced, especially now it…

Spread betting is not for…

Good value and instrument availability

ok

Generally ok

Good service

reasonable alround

CMC Invest Expert Review

CMC Invest Lets You Invest in Major Shares, ETFs and Funds with No Commission. A Great Way to Get Started.

Provider: CMC Invest

Verdict: A great investing app for beginners, CMC Invest offers SIPPs, a flexible stocks and shares ISA, a cash ISA with great interest rates and general investment accounts where you can invest in 3,500+ US & UK shares, 400+ ETFs and investment trusts, and 1,000 mutual funds. The Core plan offers £0 commission and FX fees of 0.99%.

Is CMC Invest Good for Investing?

Yes, CMC Invest is commission-free and gives you access to the most popular UK shares, US stocks and ETFs – a bonus for traders who want to also build a long-term investment portfolio. I tried it out for this review.

What is CMC Invest?

It’s an investing app that lets you invest for free on major markets. Is CMC Invest trustworthy? Yes, CMC Invest is regulated by the FCA (Financial Conduct Authority) in the UK. CMC Invest is owned by CMC Markets, a FTSE 250 company traded on the London Stock Exchange and worth £726m (as at 12/6/25).

Is CMC Invest Safe?

Your money is generally safe with CMC Invest as clients’ money must be kept separately from the firm’s money and assets, under FCA rules. But it’s worth knowing that deposits in its cash ISA aren’t protected by the Financial Services Compensation Scheme (see below).

CMC Invest lets you invest in the stock market for long-term capital gains, as opposed to its owner, CMC Markets, which lets you speculate in the short-term through CFD trading and financial spread betting.

What Can You Invest in with CMC Invest?

Since launch in the UK in 2022, the platform has increased the number of UK stocks from 100 to over 500 UK shares, 3,000 US shares and around 400 ETFs and investment trusts. Under its Core plan (which has no monthly fee), you can access over 4,600 global stocks and ETFs. The Plus (£6.99 a month) and Premium (£10.99 a month) plans offer over 6,100.

It’s still a relatively small universe of potential investments when you compare it to incumbent DIY platforms like Hargreaves Lansdown and interactive investor, but it’s catching up. CMC Markets has always excelled in building excellent in-house tech for traders to speculate on the most liquid and popular markets cheaply. And in reality, most of the volume that goes through trading platforms is in the top 10 traded assets like the FTSE, Lloyds shares, and EURUSD. Having loads of peripheral markets is great, but actually, all people want is to trade and invest in is what everyone else is trading and investing in.

When I opened an account with CMC Invest, it took less than a minute to get up and running and fund it with £500 to get started. Obviously, this was helped in part by the fact that it links to my existing CMC Markets account, reducing the need for additional checking on my identity.

There’s a general investment account, a stocks and shares ISA and a SIPP. You can also choose to invest by shares or amount, but unlike other investing apps where you can choose to buy £100 of something through fractional shares, CMC Invest rounds the purchase down to the nearest amount of whole shares. This was a shame because for this review I was going to try and buy the 5 ETFs that our man Jackson Wong suggested were all you need to build a globally diverse portfolio including the FTSE, a world ETF, gilts, property and gold. But of those he suggested, not all were available on the app. So in 2 different ways, I couldn’t just buy £100 of each. So instead, I backed Britain and bought £500 worth of an American-owned ETF that tracks the performance of the FTSE 100 (VUKE).

How Much Does CMC Invest Cost?

It’s free to invest with a CMC Invest Core account, which includes a flexible cash ISA, interest on univested cash and access to research tools. The FX fee is 0.99% .

The Plus account has a £6.99 per month subscription fee, but includes the stocks and shares ISA, a wider range of stocks and ETFs, a higher rate of interest on univested cash and a lower FX fee, at 0.5%.

The third option, Premium, is £10.99 a month. For this, you get the SIPP thrown in, along with everything in Plus. Premium gets you the highest rate of interest on uninvested cash and the lowest FX fee at 0.39%.

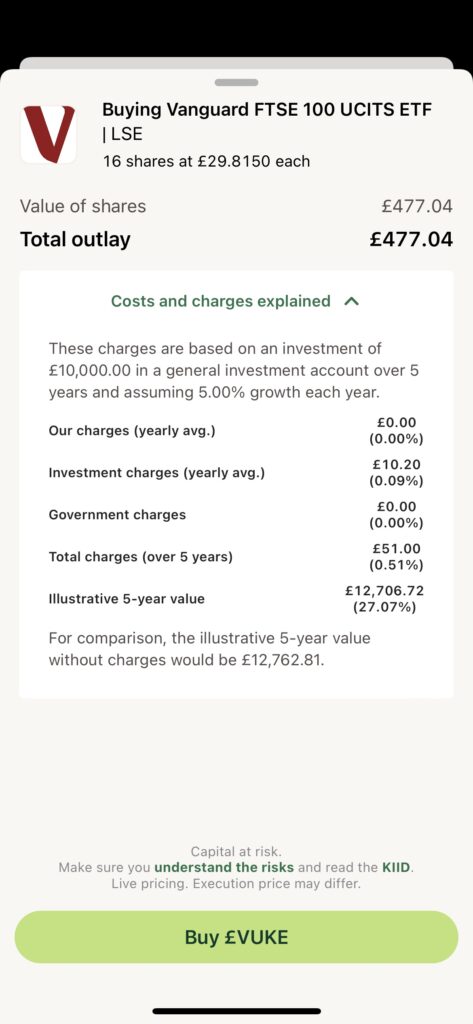

Thankfully, for those getting started, Meridyth Park, former Head of Marketing for CMC Invest, told me there will always be a free version. But as with all investing, there are other costs involved. For example, when I bought those 16 shares in the Vanguard FTSE 100 UCITS ETF, there were no charges levied by CMC Invest, but you still have to pay the Vanguard investment management fee, which is what Vanguard charges for providing and managing the ETF. There is no way around these fees with any investment app, for that particular ETF the cost was 0.09% (£10.20 a year which is £51 over a 5-year period).

It’s really good to see CMC Invest display these charges on the dealing ticket, because most investing apps I see hide this in the small print somewhere or do not really explain exactly what it is. It’s handy to see the fees calculated over a 5-year timeline as well, as that is the average time most investing accounts expect to see people invested for.

CMC Invest’s FX fees (when you convert GBP into USD) are fairly competitive – not as cheap as Trading 212 which charges 0.15%. It’s an important charge to be aware of, though, because US stocks are a massive gateway for new investors as they have had stellar returns, and are all over social channels, and are all household names so lots of those starting out investing will dabble in the US markets. The likes of Lloyds and Vodafone, don’t quite have the same appeal as investing in Netflix and Tesla (NASDAQ:TSLA).

How does CMC Invest Compare to Other Investing Apps?

CMC Invest has great tech, but at the start, it felt that this app was a little rushed out. I know there is a massive race between trading platforms to offer longer-term investing products, but I was quite surprised initially to see such a basic app on offer and no web version. I’d have much rather seen the exceptional trading platform offer the ability to buy and sell physical versions of the assets that can be bought as a CFD or spread bet. I think Saxo Markets does this best as everything is all in one place and when you look at a market you can choose to trade as a future, a CFD or a physical share. IG also does it where you get the same app and desktop platform, but you log in to a share dealing account rather than the trading platform.

But CMC Invest told me it hasn’t just been built to cross-sell to traders already signed up, it’s there to target an entirely different audience of long-term investors.

Freetrade has better functionality and more markets but in my mind, Freetrade is too early stage to put any proper money into. It seems to have grown too quickly and it makes me nervous. I’d prefer to invest through an app like CMC Invest which is backed by an already established, profitable and publically listed company (CMCX on the LSE).

Compared to the robo-advisors like Nutmeg and Wealthify, CMC Invest is much cheaper. If you are confident enough to pick your own investments, you can save in fees. For example, if you have £10,000 on account, that is only £60 a year, but as your account grows, if you have £100,000 invested then that is a massive difference of £3,000 over 5 years. If you’ve got the time and inclination you can just take a look at any robo-advisor’s ETF portfolio and replicate it for free. You do not of course get the benefit of the portfolio being managed or rebalanced on your behalf, though.

For a while, zero commission brokers were seen as a marketing gimmick, but now as major brokers like Interactive Brokers look to compete in the free investing market, the bigger platforms have all moved to embrace low-cost longer-term investors.

Should You Invest with CMC Invest?

I believe it’s good value. If you have a trading account with CMC Markets, the CMC Invest app is a great place to start building your long-term investment portfolio.

CMC has always innovated, always been at the forefront of its industry, and always listened to client feedback. Read CMC founder Peter Cruddas’ biography or interview with us, and you can see there is a huge passion for developing great products. He told us back in 2018:

“One of our top priorities at the moment is to improve the user experience for our customers.”

Before writing this review, I also got the chance to talk to Alister Sneddon, who was the Head of Product, and it’s quite clear that he too had a passion for the app. Plus having previously worked with AJ Bell on the Dodl app, Moneyfarm and interactive investor, he had some fairly valuable insider knowledge on what makes an investing app work.

So, if you want a feature added, sign up to the CMC Invest forum through the app and say what you want. You never know. You could have a hand in creating the investing app you always wanted where you can also deal for free…

Pros

- Free investing account

- Easy to use

- Backed by CMC Markets

Cons

- No fractional shares

- Slightly limited market range

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.3CMC Invest Video Demo

As part of our testing and analysis, we bought some Barclays shares using the CMC Invest app. It gives you a good overview of what the app is like once you have sighed up and the process of buying shares.

CEO Interview

Albert Soleiman, Head of CMC Invest on the sustainability of free investing apps and why you need to know why you are investing

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.