- Barclays under pressure from poor UK macro performance in 2022

- Fundamentally the bank is a good shape and shareholder returns were good over 2021/22

- Stock amidst a counter-trend rally; City remains bullish on the bank

Not so long ago, Barclays (BARC) could still count as one of the biggest companies in the world by market cap. Its valuation of $ 66 billion at the end of 2007 was the 119th largest globally. Viewed another way, Barclays at that time was worth about 45 percent of JP Morgan (US:JPM).

Now this figure has shrunk to a minuscule 8%. Yes, that’s right. Barclays’ current market cap of £27 billion is peanuts when we compared it to JP Morgan’s mammoth $404 billion. Relatively speaking, Barclays has shrunk dramatically after the 2008 banking crisis. More worryingly, BARC is not even in the top 500 global stocks by market cap anymore.

Is Barclays a good investment in the long term?

With this history in mind, should we even look at Barclays as a long-term investment? The good thing about this bank stock now is that it is relatively small – so small that the room to grow is bigger than its American counterparts. As most investors know, doubling a stock is much easier when the base is much lower.

Moreover, the UK banking equity sector is not valued highly. Sterling’s poor form has made UK stocks even cheaper for foreign buyers.

That said, the UK equity market is not exactly a market that investors are piling into right now. Too many structural problems waiting to be solved, like Brexit. And if the country’s property market were to grind to a halt (Halifax recorded four consecutive monthly decline already), the hit to UK banks would be colossal. Lower consumer spending would be detrimental to card providers too.

A quick glance at Barclays’ long-term chart show it is still recuperating from the 2008 crisis. At 170p, Barclays’ share prices now are no higher than the level traded twenty-seven years ago!

In all, buying Barclays is a bet that the UK economy will outperform the current bearish expectations. This may happen, or it may not. But fundamentally, Barclays seems to be in a good shape. Its balance sheet has some margin of safety that should see it through a period of economic turbulence.

When is the best time to buy Barclays’ shares?

Technically, the stock is near-term overbought as prices rallied from 152p to 172p. This area, stretching up to 180p, has been the range resistance over the past few months. Naturally I expect the ceiling to hold and that Barclays’ share price to consolidate in the coming weeks.

For buyers who already have positions in the stock, I would wait for a pullback to add. And for potential investors on the sideline, a fall into the region of 140p is a nice level to initiate modest buys. But a word of caution: a break of this floor may result in a further decline to 120p.

Lastly, for longer-term investors holding over an economic cycle, if Barclays were to drop into double-digits that would be highly attractive and worth buying more. However, I doubt a drop into this region is on the cards at the moment unless the macro outlook deteriorates significantly.

Is the Barclays share price overvalued or undervalued at the moment?

Fundamentally, the bank is probably “undervalued”. This bullish view is based on Barclays’ financial results observed over the past couple of years.

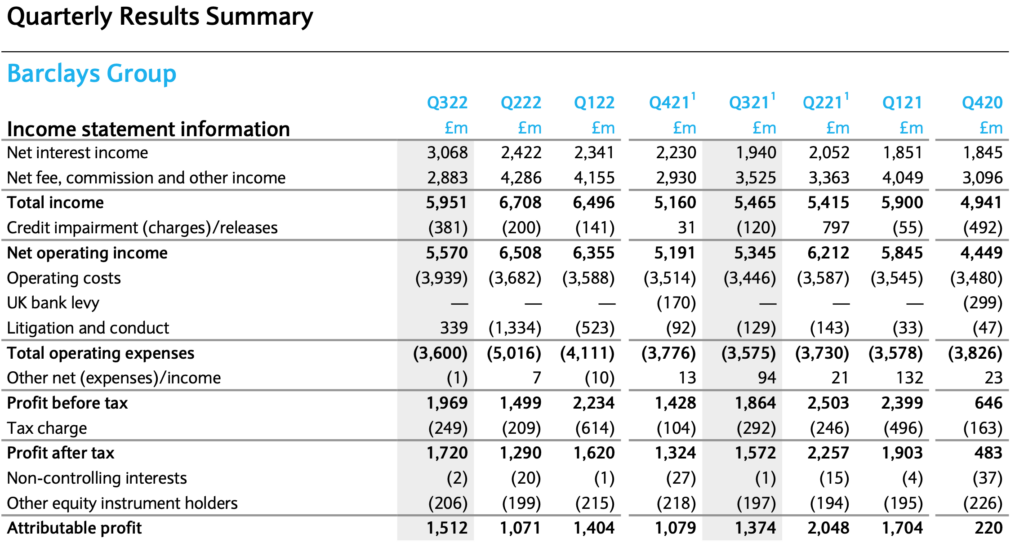

In the last three quarters (ending September 2022), the bank earned about £4 billion after tax (see below). A rough back-of-the-envelope calculation shows its annual full-year profit to be in the region of £5 billion. Now compare this figure to its current market cap of £27 billion. The market is valuing Barclays at a relatively modest multiple.

Apart from dividends, Barclays is sufficiently cash rich to initiate multiple share buy back programs. In 2021, the bank announced two buybacks (£700 million in February; £500 million in July). Last year another £1,500 million was conducted. Perhaps we may see more of such returns for shareholders in the future.

Therefore, the bank is not under huge financial stress at the moment.

Source: Barclays plc

Why has Barclays’ share price risen recently?

While the general market sentiment has been depressed by multiple macro concerns over the past few quarters, Barclays recently managed a counter-trend rally for three reasons:

- New UK administration – investors were heartened to see a new UK administration that reversed the disastrous ‘mini budget’

- Waning hawkish bets – on the Fed, as investors are anticipating the rate hikes to slow from 75bps to 50bps this year

- Less bearish outlook – on the UK economy (eg, 10-year gilt yields have dropped below 4%)

As a result, the UK banking sector has been on a recovery mode since late October.

What is the Barclays’ share price prediction?

Turning to the analysts’ view on the UK bank, most are optimistic. Out of more than 20 analysts, 13 are holding either ‘Outperform’ or ‘Buy’ recommendations (see below). Many brokers felt the bank is sufficiently strong to weather a period of economic turbulence.

According to a panel of 17 analysts aggregated by the Financial Times, the median price target for Barclays is at 245p – 45 percent higher than the current price of 172p. This is a fairly bullish target and if attained it would put the stock at a multi-year high. Barclays last traded at 245p back in 2015.

Source: Financial Times

What is the current Barclays (LON:BARC) share price?

The current Barclays (LON:BARC) share price is 180p which is a change of -3.14 or -1.71% from the last closing price of 180 with 104,809,376 shares traded giving Barclays a market capitalisation of £33,722,973,000. The most recent daily high has been 180.48 and daily low 176.24. The Barclays share price 52 week high has been 194.8 and the 52 week low 128.12. Based on the most recent Barclays share price opening of 180, the current Barclays EPS (earnings per share) are 0.27 and the PE (price earnings ratio) is 6.69.

Pricing data automatically updates every 15 minutes

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.