Stocks & shares ISAs are tax-efficient investment accounts. You can invest up to £20,000 a year within an investment ISA and all the capital gains and income generated from your investments are completely tax-free.

Our experts have tested and reviewed the best stocks and shares ISA accounts in the UK.

Read on to compare the UK’s best ISA accounts that are FCA regulated and offer excellent customer service and account platforms.

AJ Bell: Cheapest self-select investment ISA

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- ISA account charge: 0.25%

- ISA dealing fee: Shares £3.50 – £5, funds £1.50

AJ Bell Stocks & Shares ISA Review

Name: AJ Bell Stocks & Shares ISA

Description: AJ Bell is an award-winning, low-cost online investing platform for the UK DIY investor. You can invest stocks in more than 20 markets, over 2,000 funds, ETFs, and bonds.

Capital at risk.

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £500

- ISA account charge: 0.25%

- ISA dealing fee: Shares £3.50 – £5, funds £1.50

Fees: AJ Bell charges 0.25% of the value of your portfolio for their ISA. But, share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 where there were 10 or more online share deals in the previous month.

Special Offers:

- Recommend a friend, and you’ll both get £100 gift vouchers – When you recommend a friend to AJ Bell that invests more than £10,000 in a SIPP or ISA, you and your friend can get One4All gift vouchers worth £100.

- Switch your share dealing account and receive up to £500 to cover exit fees – If you transfer your share dealing general investment account valued at more than £20,000 to AJ Bell they will help cover any exit fees charged by your current provider. They will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person.

- Free subscription to Shares Magazine worth £220

Get a free subscription to Shares (worth over £220 per year) by maintaining a balance of £4,000 or more across your AJ Bell investing accounts.

Pros

- Pick your own shares, funds and bonds or use their investing ideas

- Low ISA account fees capped at £2.50 a month for shares

- Lots of account types

Cons

- High phone dealing charges

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.2Wealthify: Best managed stocks & shares ISA for pre-built portfolios

- Investments: Pre-made portfolios

- Minimum deposit: £1

- ISA account charge: 0.6% annual charge

- ISA dealing fee: £0

Capital at risk

We ranked Wealthify as the best stocks and shares ISA account in our 2023 awards as they offer low account fees, good research and a wide range of managed investments.

Wealthify won best stocks and shares ISAs in our 2023 awards. It’s very simple to use as you just choose an investment style based on your risk tolerance. The platform then builds your plan and manages it for you. You can start investing with just £1. Wealthify won the 2021 Good Money Guide award for best robo advisor.

Wealthify’s Stocks & Shares ISA offers five different investment options. The options are: Cautious, Tentative, Confident, Ambitious, and Adventurous. All of these strategies are constructed with a mix of low-cost passive investments such as ETFs and funds. Investors also have the option to build an ethical portfolio.

One downside to Wealthify is that, like Nutmeg, there are only a few investment options to choose from. There is not a lot of flexibility and you cannot invest in individual shares and funds.

Wealthify charges an annual fee of 0.60% for managing your investments. Other costs can apply, however, Wealthify aims to keep these as low as possible – around 0.16% for original plans and 0.71% for ethical plans.

Generally speaking, beginner investors require platforms that are easy to use, cost-effective, offer access to products that are well suited to beginners such as ready-made portfolios, and are available to those with small amounts of money to invest.

Wealthify Stocks & Shares ISA Review

Name: Wealthify Stocks & Shares ISA

Description: Wealthify, part of the Aviva Group, lets you invest in an ISA in either an original portfolio of investments from the UK and overseas or choose an ethical investment plan made from a blend of environmentally and socially responsible investments.

Capital at risk

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £1

- ISA account charge: 0.6% annual charge

- ISA dealing fee: £0

Fees: Wealthify charge an account fee of 0.6% for their ISA. There are also investment costs of on average 0.16% for original plans and 0.7% for ethical plans.

Special Offer: Refer a friend to Wealthify and get a £50 boost in your portfolio if they invest more than £250 and leave it there for six months. Terms apply.

Pros

- Managed ISA portfolios

- Low minimum deposit of £1

- Low ISA account fee of 0.6%

Cons

- Cannot trade individual shares or ETFs

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.1Hargreaves Lansdown: Best self-select (DIY) stocks and shares ISA

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- ISA account charge: 0.45%

- ISA dealing fee: Shares £5.95 – £11.95, funds £0

Capital at risk

Hargreaves Lansdown was ranked as the best self-select investment ISA in 2023 in our awards, as they offer a huge range of investment options backed up by industry-leading customer support and research.

Hargreaves Lansdown Stocks & Shares ISA Review

Name: Hargreaves Lansdown Stocks & Shares ISA

Description: Hargreaves Lansdown’s Stocks & Shares ISA offers access to a vast range of investments. Investors have access to domestic and international equities, over 3,000 funds, bonds, and more. Another advantage is that the platform offers plenty of research and investment tools to help you make investment decisions.

Capital at risk.

Summary

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- ISA account charge: 0.45%

- ISA dealing fee: Shares £5.95 – £11.95, funds £0

Fees: Hargreaves Lansdown’s ISA costs 0.45% of the value of your portfolio. However, share account fees are capped at £45 per year. Funds are charged at 0.45% for the first £250,000. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month.

Pros

- Thousands of UK and international shares, bonds & funds

- Ready-made portfolios with different levels of risk

- Excellent research and analysis

- An established and listed company on the LSE.

Cons

- Can be expensive for large fund portfolios

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(5)

-

Research & Analysis

(4.5)

Overall

4.5Interactive Investor: Cheapest fixed-fee stocks and shares ISA account

- Investments: Shares, ETFs, bonds & funds

- Minimum deposit: £1

- ISA account charge: £9.99 per month

- ISA dealing fee: £3.99 – £5.99

Capital at risk

For larger ISA accounts, Interactive Investor is generally one of the cheapest DIY platforms. It offers a flat-fee structure. Its lowest monthly fee is just £9.99.

Interactive Investor Stocks & Shares ISA Review

Name: Interactive Investor Stocks & Shares ISA

Description: Interactive Investor won the 2022 Good Money Guide award for best stocks and shares ISA account as they offer one of the cheapest investment ISAs that provides access to over 40,000 shares and 3,000 funds, as well as investment trusts, ETFs and bonds. They are a good choice for people that want to take control of what they invest in.

Capital at risk

Is the Interactive Investor ISA any good?

Yes, we rate the Interactive Investor ISA as very good, especially for high-value accounts as the account costs do not rise with your portfolio value. Plus, there are DIY and managed ISA options. However, for smaller accounts the fixed monthly fee is expensive.

Fees: The Interactive Investor’s ISA account is a flat £9.99 per month, this also includes a free Junior ISA to help you save for your children. Dealing commissions are a free trade every month, then UK Shares and Funds, US Shares charged £7.99 or upgrade to a £19.99 “Super Investor” account 2 free monthly trades and deal for £3.99. Regular investing is free.

Special Offer:

- One free trade per month – One buy or sell order is free every month, after that, the cost is between £3.99 and £5.99 depending on what plan you are on.

- Free investing for your friends and family – You can give up to five people a free investment account subscription with Interactive Investor’s Friends and Family plan. You pay a single extra fee of £5 a month, and their monthly cost is zero. Each member can invest up to £30,000 in an ISA or a general investing account with free regular investing and no account fees. However, they will still pay normal dealing commissions when they buy and sell investments.

- Get £200 when you refer a friend to Interactive Investor – Recommend a friend or family member to ii and get a £200 reward. Your friend will get their first year’s service plan for free – saving £120. To qualify, your friend must transfer or fund their account with at least £10,000 in combined cash/investments. However, your friend will not receive the usually monthly free trade.

Pros

- Pick your own investments or use their model portfolios

- £1 minimum deposit makes it easy to get started

- Fixed account fee that does not increase with your investments

- Joint account options

Cons

- Fixed fee expensive for very small accounts below £1,000

-

Pricing

(5)

-

Market Access

(4.5)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.5Determining the cheapest investment ISA platform is not an easy process. That’s because fees tend to vary depending on the size of your account, the assets you invest in, and the number of trades you make.

Two of the cheapest managed ISA platforms are Nutmeg and Moneybox. Nutmeg charges a fee of 0.45% per year on assets up to £100,000 (0.25% above this) and average investment fund costs of 0.19% per year. Moneybox charges an annual fee of 0.45% along with annual fund provider costs of 0.12% to 0.30%. There is also a £1 monthly subscription fee but this is waived for the first three months.

IG: Best ISA for US stocks & Smart Portfolios

- Investments: Shares, ETFs, investment trusts & pre-made portfolios

- Minimum deposit: £250

- ISA account charge: £24 per quarter

- ISA dealing fee: Shares £3 – £8

Capital at risk

IG Stocks & Shares ISA Review

Name: IG Stocks & Shares ISA

Description: IG offer a very cheap way to include US stocks directly in your investment ISA. But, if you prefer not to trade in individual equities you can take advantage of and invest in a range of Smart Portfolios that are selected and managed by BlackRock on IGs behalf.

Capital at risk.

Summary

- Investments: Shares, ETFs, investment trusts & pre-made portfolios

- Minimum deposit: £250

- ISA account charge: £24 per quarter

- ISA dealing fee: Shares £3 – £8

Fees: IG charge £24 per quarter in custody fees for an ISA account. There is zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month. Standard dealing fees are £8 for UK and £10 for US shares. Smart Portfolio fees are 0.5% – capped at £250 per year. Fund management charges are 0.13% and transaction costs are 0.09%.

Special Offer:

- Free US stock investing – There is zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month.

Pros

- Low-cost ISA investing account

- UK & international shares

- Pre-made ISA portfolios

Cons

- Also provides access to high risk investment products

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.2Saxo Markets: Best ISA for experienced and professional investors

- Investments: Shares, ETFs, funds, bonds

- Minimum deposit: £1

- ISA account charge: €10 per month or 0.12%

- ISA dealing fee: Shares 0.1% – 0.05%

Capital at risk

Saxo Markets Stocks & Shares ISA Review

Name: Saxo Markets Stocks & Shares ISA

Description: Saxo Markets’ platform lets you invest in more than 11,000 ISA-eligible stocks, ETFs, bonds and commodities, from 60 leading exchanges worldwide.

Capital at risk.

Summary

- Investments: Shares, ETFs, funds, bonds

- Minimum deposit: £1

- ISA account charge: €10 per month or 0.12%

- ISA dealing fee: Shares 0.1% – 0.05%

Fees: Saxo Markets charge a custody fee of 0.12% for an ISA. when you buy and sell shares Saxo Markets charges a commission based on a percentage of transaction size. They are very competitive though and UK shares trading commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders.

Special Offers:

- Platinum – if you have £200,000 or more on account, you can apply for 30% lower transaction and account costs.

- VIP – For accounts with portfolios over £1m, you get even better pricing, direct connection to experts, 1:1 SaxoStrats access and propriety event invitations.

Pros

- ISA investing with direct market access

- Excellent ISA investment platform

- Low ISA dealing commissions

Cons

- May be too complicated for beginners

- Subscription fees for live pricing

-

Pricing

(4.5)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.5Bestinvest: Best ISA for investment advice and low costs

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- ISA account charge: 0.2% to 0.4%

- ISA dealing fee: Shares £4.95, funds £0

Capital at risk

Bestinvest Stocks & Shares ISA Review

Name: Bestinvest Stocks & Shares ISA

Description: Bestinvest has combined low-cost online ISA investing and share dealing with personalised expert advice to help clients choose the right investments for their portfolio. A good choice for large long-term investors.

Capital at risk.

Summary

- Investments: Shares, ETFs, funds

- Minimum deposit: £1

- ISA account charge: 0.2% to 0.4%

- ISA dealing fee: Shares £4.95, funds £0

Fees: Bestinvest’s ISA costs 0.2% if you invest in a ready-made portfolio, which reduces to 0.1% above £500,000. For other investments like shares and bonds the account fee is 0.4% up to £250k. Dealing commissions £4.95 per online share trade, fund dealing is free.

Special Offer: Free investment guidance for potential customers.

Pros

- Expert advice from professionals

- Low minimum deposit of £1

- Very low ISA account fees from 0.2%

Cons

- No bond investing

-

Pricing

(4.5)

-

Market Access

(3.5)

-

Online Platform

(3.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.1Nutmeg: Best stocks and shares ISA for beginners

Approved by Nutmeg on the 11 September 2023

- Investments: Pre-made portfolios

- Minimum deposit: £500

- Management fee: 0.75%-0.45%

- Dealing fee: £0

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future

Beginners

Nutmeg offer one of the best stocks and shares ISA for beginners and are now owned by JP Morgan. With Nutmeg you choose a goal, timeframe and amount you’d like to invest and then select your desired risk level. The platform shows what kind of investments it will use to build your portfolio, which is then rebalanced over time. There is a more expensive “fully managed” option, where your investments are proactively managed by experts.

Nutmeg Stocks & Shares ISA Review

Name: Nutmeg Stocks & Shares ISA

Description: Nutmeg offers off-the-shelf portfolios across its ISA range to suit five different investment styles. Investors can choose between four different portfolios, including fully managed, Smart Alpha powered by J.P.Morgan Asset Management, socially responsible and fixed allocation.

Capital at risk. Tax treatment depends on your individual circumstances and may change in the future.

Is Nutmeg's ISA any good?

Yes, Nutmeg’s ISA lets you invest in pre-made portfolios with a minimum deposit as low as £500 with discounted account fees of 0.45%

Fees: Nutmeg charge 0.75% for their managed ISA portfolios which drops to 0.35% for balances over £100k. For their fixed allocation ISA portfolios, they charge 0.45% dropping to 0.25% for balances over £100k. For all portfolios, there is an additional charge by the investment fund managers of around 0.2% and the market spread on buying and selling portfolios is currently between 0.04% and 0.09%.

More information on products and charges can be found here.

Pros

- Simple ISA investment platform for beginners

- Regular ISA investing available (one off payments or Direct Debits)

- Scaled account fees that reduce as your ISA grows

Cons

- Cannot invest in individual shares

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.1Moneyfarm: Best for simple risk-based investment ISAs

- Investments: Pre-made portfolios

- Minimum deposit: £500

- ISA account charge: 0.75%

- ISA dealing fee: £0

Capital at risk

Moneyfarm Stocks & Shares ISA Review

Name: Moneyfarm Stocks & Shares ISA

Description: Moneyfarm’s ISA invests in ETFs to keep the costs low, so you aren’t paying for active managers. Instead, you are benefiting from tracking a series of diversified indices that are regularly rebalanced. This should mean you get to keep most of your returns rather than paying hefty fees to fund managers.

Capital at risk.

Summary

- Investments: Pre-made portfolios

- Minimum deposit: £500

- ISA account charge: 0.75%

- ISA dealing fee: £0

Fees: Moneyfarm’s ISA investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%

Pros

- Risk-based ISA portfolios

- Low-cost ISA investing

- Easy-to-use investment ISA

Cons

- Limited amount of individual shares

- No US shares available

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

3.8Dodl: Easy to use stocks and shares ISA for beginners

- Investments: Shares, ETFs, funds

- Minimum deposit: £100 or £25 per month

- Account types: GIA, ISA, Pension, LISA

- Account charge: 0.15%

- Dealing fee: £0

Capital at risk

AJ Bell Dodl Stocks & Shares ISA Review

Name: AJ Bell DodlStocks & Shares ISA

Description: AJ Bell Dodl’s ISA is a great option of beginner investors as costs are super low making it ideal for small portfolios. The app is user friendly and as they are part of AJ Bell new investors are in safe hands.

Capital at risk.

Summary

- Investments: Shares, ETFs, funds

- Minimum deposit: £100 or £25 per month

- Account types: GIA, ISA, Pension, LISA

- Account charge: 0.15%

- Dealing fee: £0

Pros

- Low fees

- Easy to use

- Simple investment choices

Cons

- Limited market range

-

Pricing

(4.5)

-

Market Access

(3)

-

Online Platform

(4)

-

Customer Service

(4.5)

-

Research & Analysis

(3.5)

Overall

3.9❓Methodology: Our experts chose the best stocks and share ISA accounts based on:

- 17,000+ votes in the renowned Good Money Guide annual awards

- Our experts’ own experiences testing the ISA accounts with real money

- An in-depth comparison of the features that make them stand out compared to alternative products

- Good Money Guide’s exclusive interviews with the ISA account provider CEOs and senior management

What Is A Stocks and Shares ISA?

Stocks and shares ISA accounts work in the same way as a general investing account, except a certain portion of your profits are tax-free. They are an excellent way to start investing, particularly as they are often free to open.

Stocks & Shares ISAs are available to UK residents aged 18 and over. For those under the age of 18, the Junior ISA is available. You can own multiple Stocks & Shares ISAs, however, you can only contribute to one per tax year.

The maximum amount that can be paid into a Stocks & Shares ISA per tax year is currently £20,000. This is the annual ISA allowance. The annual allowance covers all types of ISAs meaning that if you own different types of ISAs, you can only invest a total of £20,000 across them in any one tax year.

Pros & Cons Of Investing In A Stocks And Shares ISAs

There is no doubt that a stocks and shares ISA is a great way to invest for your future, but there are limitations and risks. Here we highlight the main pros and cons of investment ISAs.

Pros

- Tax efficiency. Within this type of ISA, all investment gains and income are completely tax-free. Over the long term, you could potentially save tens or even hundreds of thousands in tax by investing within a Stocks & Shares ISA.

- High returns, at least potentially. Through a Stocks & Shares ISA, you can gain access to a wide range of investments including shares, funds, investment trusts, ETFs and bonds. Over the long term, these kinds of assets tend to generate much higher returns than cash savings. UK shares, for example, have returned around 5% per year in real terms (above inflation) over the long run, according to the Barclays Equity Gilt study.

- Flexibility. Stocks & Shares ISAs are generally very flexible. They allow you to build an investment portfolio that matches your own financial goals and risk tolerance. You can also access your money at any time.

Cons

- There are ISA contribution limits. You can only invest a maximum of £20,000 per tax year. If you are looking to invest more than this, you will have to invest the excess capital in another type of investment account such as a General Investment Account or Self-Invested Personal Pension (SIPP). The annual ISA allowance cannot be rolled forward.

- You can lose money. A Stocks & Shares ISA doesn’t have a fixed return. Instead, its overall performance depends on how well the underlying investments perform. While assets such as shares, funds, and ETFs tend to generate strong returns over the long term, they can generate negative returns at times. So, there’s always the chance that your Stocks & Shares ISA could fall in value.

- Withdrawals can impact your ISA allowance. In most cases, if you withdraw money and then put it back into the ISA in the same tax year, it will count towards your annual allowance. Some ISAs, however, do allow you to take money out and pay it back into the account in the same tax year without affecting your annual ISA allowance. These are known as ‘flexible ISAs.’

Stocks & Shares ISA Returns Calculator

See how long it would take you to become an ISA millionaire based on your expected returns in the stock market. You can compare this against what you would earn if your money was in a cash ISA earning 5%. When using this ISA calculator please take into consideration that you only get tax relief on up to £20,000 a year.

👀 Spoiler alert: It would take around 20 years to build a pot of £1m with expected returns of 7%. However, with the same monthly contributions of £1,666 and a starting balance of £20,000 it would take an additional 5 years to reach £1m in a cash ISA earning 5%.

Please note these returns do not incorporate account or underlying investment fees. Past performance is no guarantee of future results.

Compare UK Stocks & Shares ISAs

Use our ISA account comparison to choose the best ISA account by comparing account fees, if they are DIY or managed by experts and what the minimum deposit is.

| Investment ISA | DIY or Managed | Minimum Deposit | ISA Account Fees | GMG Rating | More Info |

|---|---|---|---|---|---|

| DIY | £1 | £4.99 a month | Visit Broker Capital at risk |

|

| DIY | £1 | 0.45% per year | Visit Broker Capital at risk |

|

| DIY | £500 | 0.25% per year | Visit Broker Capital at risk |

|

| Managed | £500 | 0.75% | Visit Broker Capital at risk |

|

| Managed | £500 | 0.75% | Visit Broker Capital at risk |

|

| DIY | £1 | £0 | Visit Broker Capital at risk |

|

| DIY | £1 | £0 | Visit Broker Capital at risk |

|

| Managed | £1 | 0.6% | Visit Broker Capital at risk |

|

| DIY | £1 | 0.2% | Visit Broker Capital at risk |

|

| DIY | £1 | 0.12% per year | Visit Broker Capital at risk |

|

| Managed | £100 | 0.15% | Visit Broker Capital at risk |

Things You Need To Know About Investment ISAs

These mini guides explain some important aspects of running a stocks and shares ISA accounts, such as transfers, investments and allowances.

How To Open An ISA

Opening a savings or stocks and shares ISA (Individual Savings Account) is generally a smart move. Within these accounts, all capital gains, dividends, and interest are tax-free. Interested in opening an ISA but not sure where to start? This guide will walk you through the process of opening a stocks and shares ISA.

How to open an ISA account

Opening an ISA is a relatively straightforward process.

Here are the main steps involved.

ISA Type

The first step is to determine what type of ISA you want to open. Your options are:

- A Stocks and Shares ISA

- A Cash ISA

- A Lifetime ISA (if eligible)

- An Innovative Finance ISA

- A Junior ISA (for your child)

Here, you should give some thought to your financial goals and investment strategy. For example, if your goal is to build wealth over the long term, a Stocks and Shares ISA may be more appropriate than a Cash ISA.

Provider

Once you have determined what type of ISA you want to open, it’s time to choose a provider.

Now, there are many different ISA providers today and they all have their advantages and disadvantages. For example, some offer more investment options than others while some have lower fees than others.

When choosing a provider, it can help to read some reviews. You can find plenty of ISA provider reviews right here at Good Money Guide.

Apply

When you have chosen a provider, the next step is to go to the provider’s website and apply to open an ISA account.

At this stage of the process, it’s likely that you will have to provide the ISA provider with some personal information including your:

- Full name (you may have to provide proof of identity)

- Date of birth

- Residential address

- National Insurance number

- Email address

- Bank details / debit card number

Often, ISA accounts are opened instantly. However, sometimes the provider needs to run additional verification checks, and these can take a few days.

Fund

Once your ISA account is open, the final step is to fund it. You can usually do this instantly with your debit card.

Who can I open an ISA with?

Today, you can open an ISA with a wide range of companies including:

- Banks such as HSBC, Lloyds, and Santander

- Investment platforms such as Hargreaves Lansdown, AJ Bell, and Interactive Investor

- Digital banks such as Monzo, Marcus, and smile

- FinTech companies such as Moneybox, Wealthify, and Nutmeg

You can find reviews of a lot of these ISA providers here at Good Money Guide. Every year, we review and compare ISA providers and give awards to the best providers.

When can I open a new ISA?

You can open a new ISA whenever you want to.

However, you can only open and contribute to one of each type of ISA per tax year.

Can I open more than one ISA?

Yes. There is no limit as to the number of ISAs you are allowed to have.

However, you can only pay into one of each type of ISA in each tax year.

And the total amount you put in across all ISAs must not exceed the annual ISA allowance of £20,000.

Can I close an ISA and open another in the same year?

Yes, you can. However, the total amount you contribute to all ISAs for the year must not exceed the annual ISA allowance of £20,000.

What to consider when opening a Stocks and Shares ISA

When choosing a Stocks and Shares ISA provider, there are a number of things to consider including:

- The range of investment options on offer – Some ISA providers offer more investment options than others. For example, some offer access to a wide range of investments including domestic and international shares, investment trusts, funds, ETFs, and bonds. Others, however, only offer access to certain asset classes or products.

- Fee structures – Every ISA provider has a different fee structure. Fees and charges to consider include annual custody charges, entry and exit fees, trading commissions, and FX charges.

- Platform design – Some Stocks and Shares ISAs (such as those offered by Hargreaves Lansdown and Interactive Investor) are designed for do-it-yourself (DIY) investors. Others (like those offered by Nutmeg and Wealthify) are more aimed at beginner investors or those who don’t want the hassle of managing their own money.

- Research and investment tools offered – Some ISA providers offer a range of features designed to help you make investment decisions. Others, however, just offer basic trading and investing services.

- User-friendliness and reliability – Ideally, you want a platform that is well laid out, easy to use, and can be accessed via an app so that you can monitor your account and place trades on the go. You also want a platform that is reliable and always available.

- Customer service levels – Some investment providers are better than others when it comes to providing support. Service and support can be important, particularly if you are new to investing.

Managing Your ISA

In this guide, we look at some top tips for making more money with an investment ISA including the best stocks to hold, performance, contributions, fees, regular investing and what to buy.

How can I make more money in my stocks and shares ISA?

There are two main ways to improve the performance of your Stocks & Shares ISA.

The first way is to invest in better underlying investments. This is easier said than done, however. No one knows how an investment will perform in the future and past performance is not an indicator of future performance. That said, if you have a managed ISA and it has consistently underperformed other managed ISA products in the past, it may be worth transferring the ISA to another provider.

The second way is to reduce fees. Over time, fees can have a large negative impact on investment returns. It’s important to ensure that the fees you are paying are reasonable.

How do I choose what shares to buy for an investment ISA?

Historically, shares have delivered excellent long-term returns for investors. Over the long run, UK shares have returned around 5% per year in real terms (i.e. above inflation) according to the Barclays Equity Gilt study. That compares to around 1.3% for UK government bonds and around 0.7% for cash. US shares have performed even better. Since 1926, the main US stock market index, the S&P 500, has returned about 10% per year.

It’s important to understand, however, that not every stock has performed this well. To obtain these kinds of returns from the stock market, you need to own a whole portfolio of shares. It’s also important to understand that shares do not rise in a straight line. In the short term, share prices move up and down. To generate good returns from shares, you generally need to invest for the long term.

When choosing shares to invest in, there are a number of things to consider including:

- The company’s growth prospects. Companies that grow substantially over time tend to be good investments.

- The company’s level of profitability. Companies that are highly profitable tend to be good investments over the long run. Companies that are not profitable are generally higher-risk from an investment point of view.

- The company’s balance sheet. Companies that have weak balance sheets tend to be higher-risk investments.

- The company’s dividend track record. Companies that consistently increase their dividend payouts tend to be good long-term investments.

- The company’s valuation. Companies that have very high valuations tend to be higher-risk investments.

It’s important to think about your financial goals and risk tolerance when choosing stocks for your ISA. If your risk tolerance is low, it’s sensible to invest in lower-risk, dividend-paying shares. If your risk tolerance is high, you may want to allocate some capital to higher-growth shares. It’s important to remember that, in investing, risk is directly related to return. The higher the potential return on offer, the higher the risk.

You can sell and rebuy shares in an ISA, normally without affecting your annual ISA allowance. However, you do need to check with your ISA provider to ensure that this is definitely the case.

- Further reading: How to buy shares.

Most popular shares in Stocks and Shares ISAs

- Lloyds Bank tops list of the most popular buys in HL Stocks and Shares ISAs in January.

- Retail investors are riding the AI wave, investing in Nvidia, Microsoft and AMD.

- Defence company, BAE Systems has been in demand amid geopolitical tensions.

- Surge in price of uranium sparks enthusiasm for Yellow Cake.

- Glencore remains popular as investors eye up its role in the green transition.

- Investors focus on oil prices with BP making the top ten of most popular picks in ISAs.

- Bargain hunters snap up shares which have been hit by losses this month, with enthusiasm for JD Sports.

Top Ten bought shares in Stocks & Shares ISAs

Below is a list of the most (net) bought shares for ISA accounts in January 2024, suggesting that HL clients think these are best stocks to own of ISA investing.

- Lloyds share price analysis

- NVIDIA share price analysis

- Glencore share price analysis

- JD Sports share price analysis

- Microsoft share price analysis

- BAE Systems share price analysis

- Phoenix Group Holdings share price analysis

- Yellow Cake share price analysis

- Advanced Micro Devices AMD share price analysis

- BP share price analysis

Source: Hargreaves Lansdown from Jan 2024

Should I make regular ISA investments?

There are many different approaches to investment, but a popular method of reducing risk is to drip feed money into an ISA over the course of a year. This ensures that the investor is protected against drops in the value of the equities. For example, if £5,000 is invested in a fund in March and it drops in value by 20%, then the investor will be left with £4,000. A drip feeder would buy £2,500 in March, which would be worth £2,000 in April, and could then buy a further £2,500 at the lower price. This would leave the investor with £4,500 and a larger stake in the fund than the non-drip feeding example.

How do I reduce the risk of losing money in my stocks and shares ISA?

Investing within a Stocks & Shares ISA involves risk. However, there are a number of ways you can reduce the investment risk within your ISA.

One way is to invest in lower-risk investments. These kinds of investments are available on both managed and DIY ISA platforms. Wealthify, for example, offers a ‘Cautious’ plan. Meanwhile, Hargreaves Lansdown offers access to many lower-risk funds.

Another way to reduce investment risk is to diversify your portfolio so that it contains a mix of different assets. This will help reduce overall portfolio risk.

It’s worth noting that if your ISA provider is regulated by the FCA, you will be covered by the Financial Services Compensation Scheme (FSCS) if the provider fails (up to £85,000). The FSCS does not cover regular investment losses, however.

How can you track the performance of an investment ISA?

By logging into your ISA account you can view the performance of each underlying investment and the overall performance of your portfolio.

Providers offer charts showing how your portfolio has performed over time. This will include a mix of deposits you have made, as well as how your investments in the ISA have performed.

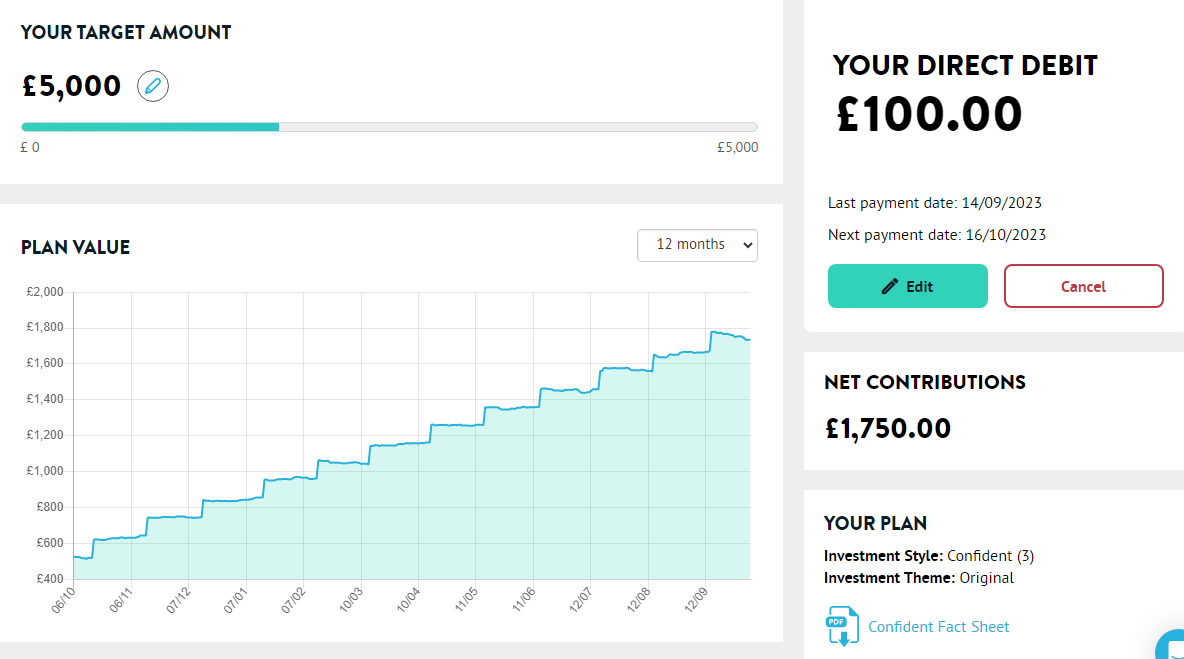

Here is an example of how Wealthify displays performance. You can see the regular contributions of £100, as the chart gaps up, followed by how the market has performed between jumps.

What happens to the money in my stocks and shares ISA when I die?

If you die, money and investments held within your Stocks & Shares ISA will be passed on to your beneficiaries.

After your death, your Stocks & Shares ISA will retain its tax benefits until one of the following things happens:

- The administration of your estate is completed

- The Stocks & Shares ISA is closed by your estate executor

If neither of these things happen within three years and one day of your death, your ISA provider will close your account.

In your will, you can leave your ISA to whoever you like. If you have a spouse or civil partner, they can inherit your ISA’s tax-free status as a one-off boost to their own ISA allowance.

Self Select/DIY ISAs

A self-select Stocks and Shares ISA could be for you if you’re looking to choose your own ISA investments. With this type of account, you have full control over your ISA savings. Interested in learning more about self-select Stocks and Shares ISAs? Here’s a look at how they work, and how to select one.

What is a self-select Stocks and Shares ISA?

A self-select Stocks and Shares ISA is an ISA account that enables you to pick your investments yourself.

Sometimes called do-it-yourself (DIY) ISAs, they are aimed at more experienced investors who want to make their own investment decisions.

Self-select Stocks and Shares ISAs typically offer access to a range of investments including stocks, investment funds, investment trusts, exchange-traded funds (ETFs), and bonds.

They are offered by a range of companies including Hargreaves Lansdown, AJ Bell, Interactive Investor, Barclays, and Fidelity.

What are the advantages and disadvantages of self-select ISAs?

Self-select ISAs have both advantages and disadvantages.

Advantages include:

- More control – With these accounts, you decide how your money is invested.

- More investment options – Self-select ISAs tend to offer access to far more investments than managed ISA accounts offer.

- More flexibility – With these ISAs, you have a lot of flexibility.

Disadvantages are:

- Risk levels are higher – Self-select ISAs can be higher risk than other types of ISAs. You are responsible for your own investment decisions and there is no guarantee that you will make money.

- More time is needed – Managing a self-select ISA takes time and effort. With these ISAs, you need to keep an eye on your investments.

- Platforms can be more complex – Self-select ISA platforms tend to be more complex than managed ISA platforms.

Self-select ISAs vs managed ISAs: what’s the best option?

The best type of Stocks and Shares ISA for you will depend on a few factors, including:

- Your investment experience – Self-select platforms are more suited to those with a lot of investment experience who are comfortable managing their own money. By contrast, managed platforms are generally more suited to beginner investors who don’t want to choose their own investments.

- The time you have to devote to managing your investments – Self-select platforms are more suited to those who have time to manage their money. If you don’t have the time to manage your investments, a managed ISA product may be more suitable for you.

Best self-select ISAs

The best self-select Stocks and Shares ISA for you is one that:

- Allows you to build an investment portfolio that is in line with your financial goals and risk tolerance.

- Provides access to the assets you want to invest in (e.g. shares, funds, ETFs, etc.).

- Is easy to use and offers a good level of customer service.

- Has competitive fees and charges.

- Is regulated by the Financial Conduct Authority (FCA) and provides protection under the Financial Services Compensation Scheme (FSCS).

If you’re looking for recommendations, some providers to consider include:

Hargreaves Lansdown

With Hargreaves Lansdown’s Stocks and Shares ISA, you get access to a vast range of investments including domestic and international stocks, over 3,000 funds, bonds, and more.

You also get access to plenty of research and investment tools to help you make investment decisions.

On the downside, fees are higher than those of some other self-select ISA providers.

For funds, the annual account charge is:

- 45% on the first £250,000

- 25% on the value between £250,000 and £1m

- 1% on the value between £1m and £2m

- 0% on the value over £2m

For shares, the annual account charge is 0.45%, capped at £45 per year.

Investors also face charges to place share trades. These are:

- £11.95 per trade if you made 0 to 9 deals in the previous month

- £8.95 per trade if you made 10 to 19 deals in the previous month

- £5.95 per trade if you made 20+ deals in the previous month

AJ Bell

With AJ Bell’s Stocks and Shares ISA, you get a solid platform that is well laid out and very user friendly.

You also get access to a wide range of investments including stocks in more than 20 markets, over 2,000 funds, ETFs, and bonds.

On the downside, there are less investment options than on Hargreaves Lansdown.

Annual account charges for AJ Bell’s Stocks & Shares ISA are as follows:

- 25% per year on the first £250,000 of funds

- 10% on the value of funds between £250,000 and £500,000

- 00% on the value of funds over £500m

- 25% (max £3.50 per month) on shares (including investment trusts, ETFs, gilts, and bonds)

Trading fees are as follows:

- £9.95 for shares

- £4.95 for shares if you made 10+ share deals in the previous month

- £1.50 for funds

Interactive Investor

With Interactive Investor’s Stocks & Shares ISA you get a solid platform with a flat-fee structure. This means that annual account charges do not get bigger as your account grows in size.

You also get access to more than 40,000 UK and international investment options.

On the downside, Interactive Investor doesn’t offer as many investing tools as some other providers do.

In terms of fees and charges, Interactive Investor offers three different service plans. These are:

- Investor essentials – This is a low-cost plan for those investing up to £50,000. It costs £4.99 per month and trades are £3.99 each.

- Investor – The monthly fee for this plan is £9.99 and trades are £3.99 each. You get one free trade per month.

- Super Investor – The monthly fee for this plan is £19.99 and you get two free trades per month. Other trades cost £3.99 each.

Self-select ISA comparison

You can use our stocks and shares ISA comparison table to find out which account is best for you. When comparing self-select Stocks and Shares ISA platforms, there are a number of things to consider including:

- The range of investment options each platform offers – Some providers offer more investment options than others.

- The research and investment tools offered by each platform – Some ISA providers offer a range of features designed to help you make investment decisions. Others, however, just offer basic trading and investing services.

- The fee structure of each platform – Fees and charges to consider include annual custody charges, entry and exit fees, trading commissions, and FX charges. Some ISA providers offer fee calculators that allow you to compare fees. These can be useful when comparing platforms.

- The user-friendliness and reliability of each ISA platform – Ideally, you want a platform that is well laid out, easy to use, and can be accessed via an app. You also want a platform that is reliable and always available.

- The customer service levels of each ISA provider – Some investment providers are better than others when it comes to providing support.

When choosing an ISA, it can be a good idea to read user reviews of a few different providers. Our reviews can give you a better idea of the provider’s customer service levels and reliability.

Becoming an ISA Millionaire

Investment ISAs or Individual Savings Accounts allow you to save and invest money within a government-approved tax-free wrapper. A select group of investors have used the product and its annual allowances, to become ISA millionaires.

Having a million pounds in your ISA may sound difficult, but it’s actually easier than you might think. At the end of May 2024, there were 1,160 people with a million pounds or more a Stocks & Shares ISA with Hargreaves Lansdown.

Here’s what you need to know about becoming an ISA millionaire:

What is an ISA millionaire?

An ISA millionaire is simply an ISA investor whose ISA portfolios have a value of £1.0 million or more. ISAs have been available since 1999 however, the maximum annual investment started out at just £7000 and that figure was split between a cash ISA limit of £3000, and a stocks and shares ISA limit of £4000. Even as recently as the tax year 2015/16, the total subscription limit was just £15240 per annum. Only jumping to the current £20,000 per annum in 2017/18.

So even the most assiduous and well-healed investor, who made full use of their ISA allowances over those 23 years, couldn’t have saved £1.0 million into ISAs over that time frame.

- Related guide: Compare Stocks & Shares ISA accounts

How do you become an ISA millionaire?

First of all, you’ll need to be a committed long-term investor who takes full advantage of the ISA allowances each year whether thats through an annual lump sum investment or regular monthly savings throughout the year every year.

Assuming that ISA allowances stay at the current £20,000 limit for the next 10 years if you max out your allowance each year you could save as much as £200,000 in that time.

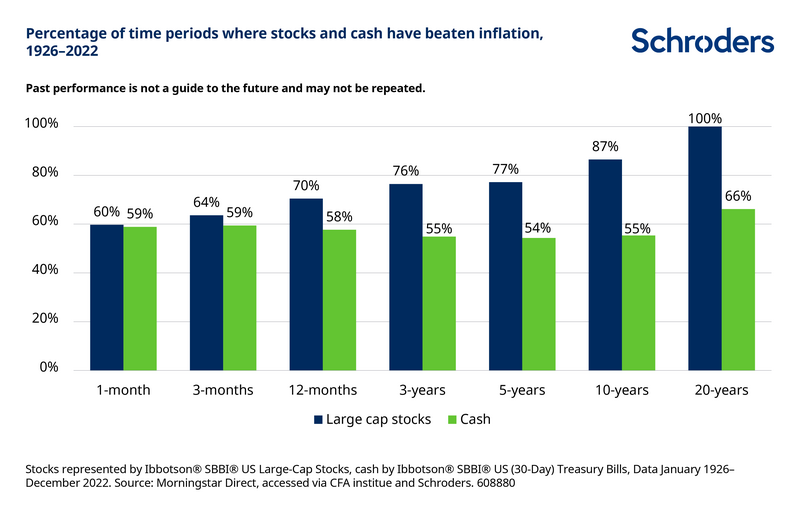

Time in the market is also your friend, data from Bank of America shows that the longer you leave your money invested in the stock market, the lower the probability of negative returns.

For example, money invested in equities for 10 years at any point between 1929 and 2020 had a just 6% chance of producing negative returns, compared to a 38% chance of loss if the money was invested for just one month.

The final piece of the jigsaw is fund and stock selection or asset allocation – in other words, what you do and don’t invest in will have a major impact on the performance of your ISA portfolio.

- Related guide: How to invest £1m

What do ISA millionaires invest in?

Hargreaves Lansdown is one of the country’s largest ISA providers and the broker has dug down into its data to shine a light on the trends and traits among iSA millionaire investors.

The age range among the ISA millionaire cohort is surprisingly broad and spans investors in their 30s to those over 100 years old. The average age of Hargreaves Lansdown clients who are ISA millionaires is 73 and there are clusters of investors at the ages of 74 and 76 years.

The ISA millionaires have built their fortunes over time getting rich slowly.

The 573 ISA millionaires at the broker have not been excessive risk takers either, but they do invest as much of the funds in their ISAs as possible, into what the broker calls a diverse and balanced portfolio.

A majority of ISA millionaires prefer to invest in managed funds rather than individual equities and they hold a broad range of international funds, not just UK-specific investments.

According to Hargreaves’ research, the larger portfolios among ISA millionaires often have holdings in special situations and global opportunity funds.

Popular managed funds among the ISA millionaires include Lindsell Train Global Equity, Fundsmith Equity, Fidelity Global Special Situations, BNY Mellon Global Income and the IFSL Marlborough Multicap Income Fund.

How long does it take to become an ISA millionaire?

As Hargreaves Landsdown notes many of their ISA millionaires have gotten rich over time by allowing their investment returns to compound and perform over multi-year periods even decades.

Of course, it might be possible to achieve ISA millionaire status over a shorter period of time.

For example, if you had had an ISA pot of £100,000 pounds in 2018 and had invested it all into EV Manufacturer Tesla (TSLA) you would have seen a +940% return on your money taking your pot to a value of £940,000.

Alternatively, £15,000 invested into graphics chip maker Nvidia (NVDA) in 2013 would have returned more than +8500% to date and would have seen your relatively modest stake grow into £1.28 million.

How much money do you need to start with to become an ISA millionaire?

The honest answer is as much as possible, simply because the more money you have invested over the longest possible period, then the bigger the chance you have of achieving ISA millionaire status, allowing compounding and the reinvestment of dividends to play their part.

Reading between the lines of the Hargreaves Lansdown research ISA millionaire status has happened to quite a few of their clients as a by-product of a disciplined and diversified approach to investing.

Can you become an ISA billionaire?

In theory yes you could become an ISA billionaire however in practice it would be pretty hard to achieve and to do that you would have to outperform the best professional money managers year in and year out, which is not impossible but is highly unlikely.

ISA Investment Ideas

In this guide, I look at ISA investing ideas across five asset classes and highlight some of the best investments in each one so you can build a diverse ISA portfolio.

ISA Investing Ideas

Each year ISA investors get the opportunity to add to their tax-free portfolios but it’s not just a case of squirrelling away up to £20,000 in a tax-free wrapper, because there is also the small matter of how to make that money work efficiently for you, within the ISA.

Deciding how to allocate your ISA allowance, and into what asset classes, indices, sectors and individual stocks, is not an easy task. It’s one that’s not been made any easier by inflation, and thanks to higher interest rates, the return of cash (in cash ISAs), is a viable alternative to risk assets.

Shares

Stock and share ISAs have become increasingly popular with self-determined investors. That’s not so surprising when you consider that over the last five years, an investment into SPY, the S&P 500 tracker has returned in excess of +57.00%, whilst chip maker Nvidia has delivered a +700% return to shareholders in that time.

Risk and reward are intimately linked of course, and trying to balance the two is another part of the investing jigsaw. The good news for ISA investors, who are often saving for the longer term, is that time in the market is definitely on your side.

Research by Bank of America found that the longer you are invested in the stock market the less likely you are to suffer negative returns.

Looking at data back to 1929 the bank found that if you stay in the market for ten years then, on average, you have just a 6.0% chance of negative returns. Compared to a 26.0% chance if you keep your money invested in stocks for just one year.

What stocks should ISA investors be buying?

One way to answer that is to look at what ISA investors at the UK’s largest stockbroker, Hargreaves Lansdown, are doing.

The direct-to-consumer investing firm, which has 1.80 million clients, has just published its latest quarterly review of client activity.

This showed that clients were cautious, with many keeping their money in cash and near cash instruments. However, when they were putting money into the market, they were buying technology, growth and alternative energy stocks.

They were also buying into UK dividends, infrastructure and mining. Energy transition is a popular theme that spreads across several sectors and is one that could play out over the next few decades.

The FTSE 100 has dramatically underperformed many of its global counterparts in 2023.

However, that underperformance could present an opportunity for ISA investors, because it means there are plenty of decent dividend yields available within the index.

They range from the staid and secure National Grid, which has an annual yield of 5.75% out to fund manager M&G which has a yield of just over 10.0%.

Of course, a high dividend yield could be a sign that the market thinks that this level of return is unsustainable.

One way to try and eliminate that concern is to look for stocks with an established track record of dividend payments, and ideally dividend growth.

Paper and packaging group Smurfit Kappa has racked up 11 years of dividend growth and over the last decade has grown its dividend by almost +16.50%.

Whilst the London Stock Exchange can point to 13 years of continuous dividend growth and a 10-year dividend growth rate of 14.96%, according to data compiled by dividenddata.co.uk.

The beauty of dividend income investing is that you are being paid to own the asset and of course, there is always the opportunity to reinvest your dividends which should allow you to compound your portfolio growth.

Another way to screen for attractive stocks could be to look for buy-rated names that are trading well below their target prices.

Here is a list of selected UK stocks that fit that bill (Buy rated but trading well below target prices)

| Company | Sector | Current Price | Market Cap | Consensus Analyst Rating | Consensus Price Target |

BATS British American Tobacco | Consumer Defensive | GBX 2,473.50 +1.1% | £55.41 billion | Moderate Buy (Score: 2.67) | GBX 3,775 (52.6% Upside) |

Lloyds Banking Group | Financial Services | GBX 43.40 +0.4% | £27.58 billion | Moderate Buy (Score: 2.78) | GBX 62.33 (43.6% Upside) |

PRU Prudential | Financial Services | GBX 889.60 +0.6% | £24.46 billion | Buy (Score: 3.20) | GBX 1,655.67 (86.1% Upside) |

BARC Barclays | Financial Services | GBX 153.06 0.0% | £23.27 billion | Moderate Buy (Score: 2.75) | GBX 237.25 (55.0% Upside) |

WPM Wheaton Precious Metals | Basic Materials | GBX 3,478 -2.8% | £15.75 billion | Buy (Score: 3.00) | GBX 4,700 (35.1% Upside) |

SGRO SEGRO | Real Estate | GBX 730 +0.1% | £8.98 billion | Moderate Buy (Score: 2.71) | GBX 959 (31.4% Upside) |

WPP WPP | Communication Services | GBX 710.41 -0.4% | £7.60 billion | Moderate Buy (Score: 2.86) | GBX 1,064.63 (49.9% Upside) |

JD JD Sports Fashion | Consumer Cyclical | GBX 130.85 -4.8% | £6.78 billion | Moderate Buy (Score: 2.67) | GBX 372.14 (184.4% Upside) |

ENT Entain | Consumer Cyclical | GBX 940.40 +0.6% | £6.01 billion | Buy (Score: 3.00) | GBX 1,718.50 (82.7% Upside) |

ICP Intermediate Capital Group | Financial Services | GBX 1,346.50 -0.2% | £3.91 billion | Moderate Buy (Score: 2.67) | GBX 2,022 (50.2% Upside) |

Source: Marketbeat.com

Bonds

Bonds are effectively government or corporate IOUs, they have been safe haven and an important source of income for investors for decades.

However, recent gyrations in bond markets have left investors with tough choices.

During covid, bond yields fell to zero or lower, however, since then bond prices have fallen and yields have risen, as interest rates rose to counter persistent inflation.

However, the sharp fall in bond prices does mean that investors can now find quality bonds below par, (or their redemption price), once again.

For, example the UK Treasury 3.25% bond due 31/01/33 is priced around £91.82 at the time of writing, and offers a yield of around 4.33%, with just under 10 years to maturity.

Alternatively, the UK Treasury 3.25% bond, maturing in 2044, trades at circa £97.20 with a yield of 4.77%, and just over 20 years to redemption.

Of course, its not just government bonds that offer attractive yields Corporate bonds can do too.

However, the issue for most ISA investors is that many corporate bonds are not denominated in retail tranches. Instead, they often come in £100,000 or $100,000 clips which puts them beyond the reach of many ISA holders.

Thankfully there are what are known as retail bonds, which are typically structured in units of £1000.00 and which were introduced specifically to appeal to retail investors.

These bonds have been issued by names such as BT Group, Legal and General, HSBC Glaxo Smithkline, Wessex Water, Lloyds Bank and others.

For example, bankers HSBC have a 5.375% bond due on August 22 2033 that’s currently yielding just under 5.70%. Whilst GE Capital UK has a 5.875% coupon bond maturing in January 2033, that yields a fraction over 6.0%. at the time of writing.

A selection of long and medium-dated UK gilt issues

| Name | Coupon | Maturity Date | Time To Maturity | Price | Yield |

| 1 1/8% Treasury Gilt 2073 | 1.13% | 22-Oct-2073 | 50 years 18 days | £33.93 | 4.41% |

| 1 5/8% Treasury Gilt 2071 | 1.63% | 22-Oct-2071 | 48 years 17 days | £43.54 | 4.51% |

| 3 1/2% Treasury Gilt 2068 | 3.50% | 22-Jul-2068 | 44 years 290 days | £78.27 | 4.66% |

| 4 1/4% Treasury Gilt 2046 | 4.25% | 07-Dec-2046 | 23 years 57 days | £91.74 | 4.85% |

| 0 7/8% Treasury Gilt 2046 | 0.88% | 31-Jan-2046 | 22 years 112 days | £46.59 | 4.81% |

| 3 1/2% Treasury Gilt 2045 | 3.50% | 22-Jan-2045 | 21 years 103 days | £82.29 | 4.84% |

| 3 1/4% Treasury Gilt 2044 | 3.25% | 22-Jan-2044 | 20 years 102 days | £79.73 | 4.83% |

| 4 1/2% Treasury Gilt 2034 | 4.50% | 07-Sep-2034 | 10 years 328 days | £100.35 | 4.46% |

| 0 7/8% Green Gilt 2033 | 0.88% | 31-Jul-2033 | 9 years 290 days | £72.16 | 4.41% |

| 3 1/4% Treasury Gilt 2033 | 3.25% | 31-Jan-2033 | 9 years 109 days | £91.40 | 4.39% |

| 4 1/4% Treasury Stock 2032 | 4.25% | 07-Jun-2032 | 8 years 236 days | £99.73 | 4.29% |

Source: Dividenddata.co.uk

A selection of longer-dated UK Retail Bonds

| Name | Coupon | Maturity Date | Time To Maturity | Price | Yield |

| Lloyds Bank | 6.50% | 17-Sep-2040 | 16 years 340 days | £108.65 | 5.69% |

| SEGRO | 5.75% | 20-Jun-2035 | 11 years 249 days | £100.00 | 5.75% |

| GlaxoSmithKline Capital | 5.25% | 19-Dec-2033 | 10 years 66 days | £100.23 | 5.22% |

| Wessex Water Services Finance | 5.75% | 14-Oct-2033 | 10 years 0 days | £95.50 | 6.37% |

| HSBC Bank | 5.38% | 22-Aug-2033 | 9 years 312 days | £97.60 | 5.70% |

| GE Capital UK Funding | 5.88% | 18-Jan-2033 | 9 years 96 days | £98.90 | 6.03% |

| Vodafone Group | 5.90% | 26-Nov-2032 | 9 years 43 days | £101.58 | 5.67% |

| Legal & General Finance | 5.88% | 11-Dec-2031 | 8 years 57 days | £102.95 | 5.42% |

RCB Bonds Charities Aid Foundation | 3.50% | 08-Dec-2031 | 8 years 54 days | £75.08 | 7.67% |

| Tesco | 6% | 14-Dec-2029 | 6 years 60 days | £103.75 | 5.27% |

Source: Dividenddata.co.uk

ETFs

ETFs or Exchange Traded Funds have become one the most most popular asset classes among investors. Not every ETF is ISA eligible, however.

For example, US-listed ETFs, which don’t produce Key Information Documents, or KIIDs, are off limits to UK retail investors, luckily, the are still plenty of eligible ETFs to choose from.

Interactive Investor produces a monthly list of the most purchased ETFs among its ISA and SIPP investors. Which, in September, included sterling-based S&P 500 tracker funds, FTSE 100 tracker funds, and an all-word equity fund among others.

If we look back what ETFs Interactive Investors customers were buying in April 2023 there were three world, or all world equity funds in the mix, including a high dividend fund, a physical gold ETF and three S&P 500 trackers.

Interactive Investor’s most purchased ETFs September 2023

| Position | ETF | One-year return (%) | Three-year return (%) |

| 1 | Vanguard S&P 500 UCITS ETF GBP (LSE:VUSA) | 8.3 | 41 |

| 2 | Vanguard S&P 500 ETF USD Acc GBP (LSE:VUAG) | 8.3 | 41 |

| 3 | iShares Core MSCI World ETF USD Acc GBP (LSE:SWDA) | 9.3 | 33.6 |

| 4 | iShares Core FTSE 100 ETF GBP Dist (LSE:ISF) | 14.7 | 43.8 |

| 5 | Vanguard FTSE All-World UCITS ETF GBP (LSE:VWRL) | 8.5 | 29.2 |

| 6 | WisdomTree NASDAQ 100 3x Dl Short ETP GBP (LSE:LQQS) | -66.8 | -81.6 |

| 7 | Lyxor Smart Overnight Return ETF C GBP (LSE:CSH2) | -5.2 | 12.7 |

| 8 | Invesco EQQQ NASDAQ-100 ETF GBP (LSE:EQQQ) | 19.7 | 38.3 |

| 9 | iShares Core S&P 500 ETF USD Acc GBP (LSE:CSP1) | 8 | 40.6 |

| 10 | Vanguard FTSE 100 UCITS ETF (LSE:VUKE) | 14.6 | 43.7 |

Source: Interactive Investors

I note though that among September’s top 10 ETFs is a leveraged inverse fund, on the Nasdaq 100 index. Such instruments are not suitable for anything other than short-term trading, and are not for long-term investing.

Funds

Managed funds have taken a bit of a back seat in recent years thanks to the growth in and rising popularity of ETFs. However, there is still quite a healthy fund sector out there.

Fund specialists Trustnet lists 628 managed funds in its UK databases, and just over 4500 funds when taking into account other geographies.

When assessing managed funds we need to think about the fund’s performance, the track record of the managers, the fund style and objectives, the liquidity of and costs within the fund etc.

One way to try and distil that information down into something more manageable is to utilise specialist fund research.

For example, the table below shows a selection of UK funds that are rated at four or five crowns by Trustnet. They include equity, mixed asset and fixed-income funds.

A selection of UK funds with four or five crown ratings from Trustnet.

| Name | Asset class | FE fundinfo Risk Score | Yield | 1 y (%) | 3 y (%) | 5 y (%) |

| Aberforth UK Small Companies | EQ | 111 | – | 9.7 | 45.2 | 10.9 |

| Artemis SmartGARP UK Equity I Acc | EQ | 120 | 3.43 | 11.2 | 61.4 | 45.3 |

| Artemis UK Smaller Companies I Acc | EQ | 98 | 2.1 | 4.1 | 35.3 | 9.1 |

| AXA Framlington Managed Income Z Gross Acc | MA | 32 | 5.16 | 8.9 | 6.9 | 10.7 |

| BNY Mellon Inflation Linked Corporate Bond Institutional W Acc | FI | 50 | 4.22 | 14.8 | 8.4 | 16.6 |

| Consistent Opportunities Unit Trust Acc | EQ | 94 | 1.72 | -0.5 | 23.5 | 24.8 |

| Credo Dynamic A Retail Acc GBP | MA | 58 | – | 4.4 | 20.2 | 30.4 |

| Fidelity UK Smaller Companies W Acc | EQ | 109 | 2.29 | 13.7 | 53.1 | 40.9 |

| FTF Franklin UK Gilt W Acc | FI | 75 | 2.64 | 2.8 | -27.4 | -15.3 |

| Invesco UK Opportunities (UK) Z Acc | EQ | 108 | 2.32 | 20.8 | 71.5 | 47.9 |

| Liontrust UK Equity X Acc GBP | EQ | 105 | 2.35 | 20 | 25.9 | 13.8 |

| Liontrust UK Micro Cap I Acc | EQ | 71 | 0.67 | -1.3 | 17 | 36.9 |

| M&G UK Inflation Linked Corporate Bond I Acc | FI | 28 | 0.74 | 7.3 | 5.6 | 10.9 |

| Merian UK Equity Income I Acc GBP | EQ | 116 | 4.38 | 14.6 | 56.7 | 34.1 |

| Montreux Healthcare A1 ILS | EQ | 47 | – | -0.3 | 26.8 | – |

Source: Trustnet

Investment Trusts

Unlike managed funds and ETFs investment trusts are closed-end funds. that is the number of shares or units in the trust is fixed rather than floating. And the share price of the investment trusts reflects the performance of the managers and the valuation of the assets that the investment trust owns and the supply and demand or fund flows in to and out the trust.

Trustnet lists 278 UK investment trusts in its database, and they are a varied cross-section of asset classes and management styles. Spanning equities, property, mixed assets, hedging, commodities/energy and money markets.

A popular way to look at investment trusts is to consider the discount of the NAV or net asset value of a trust, relative to its underlying share price of the trust. The thinking here is that a wide discount to net assets should narrow over time and that by buying assets at a discount you may get your hands on a bargain.

Of course, there may well be very valid reasons why an investment trust trades at a substantial discount to NAV.

Investment Trusts with a wide discount to NAV

| Name | Asset class | NAV | Prem/Disc | 3-Yr % Performance | 2021 % performance |

| CEIBA Investments Limited Ord | PR | 85.96 | -58.12 | -44.2 | -24.3 |

| Marwyn Value Investors Ltd Ord LD | EQ | 167.53 | -52.25 | -11.8 | 19.8 |

| Chrysalis Investment Limited Ord | EQ | 136.86 | -49.88 | -60.6 | 30.4 |

| Macau Property Opportunities Limited Ord USD0.01 | PR | 114.05 | -48.71 | -32.6 | -31.7 |

| Augmentum Fintech PLC Ord GBP 0.01 | EQ | 168.53 | -47.49 | -29.7 | 17.8 |

| Baker Steel Resources Trust | CE | 66.3 | -46.91 | -47.2 | 1.4 |

| Chelverton Growth Trust plc | EQ | 54.73 | -46.10 | 1.7 | 85.7 |

| Balanced Commercial Property Trust Limited ORD 1P | PR | 117.12 | -44.76 | 13 | 37.2 |

| Abrdn Property Income Trust Limited ORD 1P | PR | 83.8 | -40.87 | 11.5 | 42.1 |

| Gore Street Energy Storage Plc Ord GBP0.01 | MA | 116 | -39.66 | -18.7 | 20.8 |

| Caledonia Investments PLC Ord | MA | 5203 | -38.69 | 31.8 | 44.1 |

| Hansa Investment Company Limited Ord 1P(DI) | EQ | 320.08 | -37.36 | 27.3 | 5.5 |

| Menhaden Resource Efficiency PLC ORD 1P | CE | 152.38 | -37.00 | 9.7 | 13.1 |

| Alpha Real Trust Limited | PR | 216.2 | -36.63 | -14.1 | 5.4 |

Source: Trustnet

When we pick ISA investments we are usually investing for the long term and choosing assets to perform well over five, ten, and fifteen-year time horizons is a very different skill to timing stocks and other assets for short-term trading, Investing over the longer term can provide us with the opportunity to diversify. However at the same time to focus on particular investment styles such as growth or income, and to have a good look at how much risk we want in our portfolios. Often that judgement is determined by our age and here are in our investment journey.

ISA Transfers

When you move your money from one ISA account to another, it’s called an ‘ISA transfer’. ISA transfers can be useful if you want to switch between ISA providers or different types of ISA accounts. If you plan to move your savings from one ISA account to another, it’s important that you go through the proper ISA transfer process so that your money doesn’t lose its tax-free status. With that in mind, here’s a look at how to transfer an ISA.

How do you transfer an ISA?

When transferring money from one ISA to another, it’s crucial that you complete an ISA transfer form. If you just withdraw your money from your current ISA account and move it manually to another ISA account, your money will lose its tax-free status.

Transferring an ISA is otherwise a simple process. All you need to do is contact the ISA provider that you wish to transfer your money to and complete an ISA transfer form. The provider will then take care of the transfer process for you.

ISA transfer rules

When transferring an ISA, there are a few rules to be aware of. Here’s a look at some of the main rules:

- You can transfer your ISA from one provider to another at any time.

- You can make as many ISA transfers as you want. However, you cannot contribute more than the annual ISA allowance (currently £20,000) to the different ISA accounts.

- You are allowed to transfer between different types of ISAs. For example, you can transfer a Cash ISA to a Stocks and Shares ISA.

- If you wish to transfer money you’ve invested in an ISA in the current tax year, you must transfer all of it. For money you’ve invested in previous tax years, you can choose to transfer all or part of it.

- If you transfer ISAs from previous tax years, the transfer won’t impact your current tax year ISA allowance.

- If you transfer cash or assets from a Lifetime ISA to a different type of ISA before the age of 60, you will have to pay a withdrawal fee of 25%.

The benefits of transferring an ISA

There can be a number of benefits to transferring an ISA including:

- Access to more superior ISA products – You could use an ISA transfer to transfer a Cash ISA to a provider offering a higher interest rate than your current provider is offering. Similarly, you could use an ISA transfer to transfer a Stocks and Shares ISA to a provider offering more investment options than your current provider is offering.

- The ability to consolidate ISA accounts – This can be useful if you have multiple ISAs and you want to bring them together to simplify things.

- Access to different types of investments – If you’ve previously held money in a Cash ISA but now wish to invest your capital in the stock market, you could transfer your money to a Stocks and Shares ISA.

The drawbacks of transferring an ISA

Some drawbacks of ISA transfers include:

- Processing time – ISA transfers can take time to process. Sometimes, they can take over a month. If you have money invested within a Stocks and Shares ISA, this can mean you’re out of the market for a while.

- Fees – ISA transfers can attract fees. Before starting an ISA transfer, you should check with your current provider to see if there are any exit fees.

Does transferring an ISA count as opening a new one?

No. Transferring an ISA does not count as opening a new one.

If you had contributed to an ISA and then transferred it to a new provider in the same tax year, you would still be able to pay into the new ISA.

Is transferring a Cash ISA to Stocks and Shares ISA a good idea?

Transferring a Cash ISA to a Stocks and Shares ISA can be a good idea if you plan to invest your money. With a Stocks and Shares ISA, you can invest in a range of assets including stocks, investment funds, ETFs, and investment trusts. These kinds of assets are not available in a Cash ISA.

How long does an ISA transfer take?

The processing time for an ISA transfer depends on a few factors including the type of ISA you wish to transfer and the provider you wish to transfer to. But here is a rough guide to transfer times:

- Transferring from one Cash ISA to another Cash ISA – Up to 15 working days.

- Transferring from a Cash ISA to a Stocks and Shares ISA – Up to 30 days.

- Transferring from a Stocks and Shares ISA to a Cash ISA – Up to 30 days.

- Transferring from one Stocks and Shares ISA to another Stocks and Shares ISA – Up to three months depending on the complexity of the investments held.

It’s worth noting that some ISA providers provide a breakdown of approximate ISA transfer times. For example, AJ Bell says that for transfers to its platform, the typical time taken is:

- Cash only – 2 to 4 weeks

- Shares – 4 to 6 weeks

- Funds – 6 to 8 weeks

- International shares – 10 to 12 weeks

How to transfer an ISA in three simple steps

- Step 1. Decide on the provider you wish to transfer your ISA to.

- Step 2. Contact that provider and get hold of an ISA transfer form (you can often find and complete these forms on providers’ websites).

- Step 3. Complete the ISA transfer form.

ISA Allowances

If you’re thinking of putting money into an ISA (Individual Savings Account) to save or invest tax-efficiently, it’s important to be aware of the different ISA allowances. These dictate how much money you’re allowed to contribute to your account every year. Here, we’re going to look at the different ISA allowances and explain how they work. We’ll also answer some frequently asked questions in relation to these allowances.

What is the tax-free ISA allowance?

The tax-free ISA allowance is the maximum amount of money you can contribute to an ISA account every tax year. In the UK, the tax year runs from the 6th of April to the 5th of April the following year.

You can choose to split your ISA allowance across different types of ISAs (e.g. Cash ISA, Stocks and Shares ISA, Lifetime ISA, etc.) or invest it all in one type of ISA. However, you can only contribute to one of each type of ISA per tax year.

What are the current ISA allowances?

For the 2023/2024 tax year, the ISA allowances are:

- Cash ISA – £20,000

- Stocks and Shares ISA – £20,000

- Innovative Finance ISA – £20,000

- Lifetime ISA – £4,000 (contributions into a Lifetime ISA count towards your £20,000 Stocks and Shares ISA, Cash ISA, or Innovative Finance ISA annual allowance)

- Junior ISA – £9,000

The key takeaway here is that adults in the UK generally have an annual ISA allowance of £20,000. However, if one makes a contribution to a Lifetime ISA, this counts towards that £20,000 allowance.

What is the ISA deadline?

The ISA deadline is the last day that you can contribute to an ISA for that tax year. It falls on 5th April every year.

Pros and cons of ISA allowances

ISA allowances today are quite generous. The ability to save or invest up to £20,000 per year tax-free can really be helpful when building wealth for the future.

One downside to ISA allowances, however, is that you can’t carry them over to the next tax year. If you don’t use your ISA allowance in a specific tax year, that allowance is gone forever.

Historical ISA allowances

ISA allowances haven’t always been as high as they are today. In the past, they were a lot lower.

For example, for the 2000/2001 tax year, the total ISA allowance was £7,000 while the Cash ISA allowance was just £3,000.

Only in the 2017/2018 tax year was the allowance for both Stocks and Shares ISAs and Cash ISAs increased to £20,000.

Cash ISA allowances

For 2023/2024, the annual allowance for Cash ISAs is £20,000. This is the same as the annual allowance for Stocks and Shares ISAs.

Note that if you make a contribution to a Cash ISA, this will reduce the amount that you can put into a Stocks and Shares ISA.

For example, if you were to put £5,000 into a Cash ISA, you would only be able to contribute £15,000 to a Stocks and Shares ISA that tax year.

Examples of how ISA allowances can be used

One attractive feature of ISA allowances is that they can be split across several different types of ISA.

For example, an individual could invest £10,000 of their annual £20,000 allowance in a Stocks and Shares ISA and £10,000 in a Cash ISA if they wanted to.

Alternatively, they could invest £10,000 in a Stocks and Shares ISA, £4,000 in a Lifetime ISA (assuming they were eligible for this type of ISA), and £6,000 in a Cash ISA.

ISA allowance tips

If you are keen to make the most of the various ISA allowances available, here are some tips:

- Consider contributing on behalf of your spouse. Every adult currently has a £20,000 annual ISA allowance. This means that a couple can potentially contribute up to £40,000 per year into ISAs.

- If you are planning to invest a large amount of money, consider investing it over several tax years so that you can invest more tax-free within an ISA. For example, by investing £20,000 in an ISA in late March – before the ISA deadline – and £20,000 in an ISA in mid-April – after the ISA deadline – you could potentially invest £40,000 tax-free within a month.

- If you have maxed out your own ISA allowance as well as your spouse’s ISA allowance, you may want to consider making contributions to Junior ISAs on behalf of your children.

Can you pay into more than one investment ISA in a single year?

Yes, you can. For example, if you are eligible for a Lifetime ISA, you can pay into this type of ISA as well as a Stocks and Shares ISA.

You can only contribute to one of each type of ISA per tax year, however. So, for example, you can only contribute to one Stocks and Shares ISA per year.

What happens to your ISA allowance if you make a withdrawal?

The implications of taking money out of an ISA depend on whether your ISA is flexible or not.

With a flexible ISA, you can take out money and replace it in the same tax year without the replacement contribution counting towards your annual allowance.

By contrast, with a non-flexible ISA, if you make a withdrawal and then put the money back into your account, the contribution will be classed as a subscription and will count towards your annual ISA allowance.