-

Reviews By Richard Berry

- Updated

General investment accounts (GIAs) let you buy and hold assets like shares, investment funds, exchange-traded funds (ETFs), and bonds. Whether you’re a DIY investor or prefer expert guidance, a GIA gives you the power to build your ideal portfolio.

| Name | Logo | GMG Rating | Customer Reviews | GIA Annual Fees | Dealing Commission | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

| GMG Rating | Customer Reviews 4.3 (Based on 1,123 reviews) | GIA Annual Fees £59.88 | Dealing Commission £3.99 | See Offer Capital at risk | Features:

| interactive investor General Investing Account Review: Low cost fixed fee investingAccount: interactive investor General Investment Account Description: The interactive investor (ii) GIA is an all-rounder with an attractive fixed fee pricing model. There’s access to a wide range of markets including UK and international shares, bonds and ETFs. Capital is at risk. Capital at risk Is Interactive Investor a good general investing account? Yes, ii’s GIA won our award for best general investment account in 2023 and 2022. This is because of its excellent fixed-fee pricing, which makes it a good choice for investors with over £10,000 to invest. ii’s fixed fee keeps your total account costs low no matter how big your portfolio gets. You can also invest in a markets ranging from UK and international shares to funds, trusts, bonds and ETFs. Special Offers: New customers opening an ii General Investment Account (GIA) by 31 January, 2026, are also eligible for £100 in free trades. Like the ISA offer, no minimum deposit is needed. You also get free investing for your friends and family. You can give up to 5 people a free investment account subscription with ii’s Friends and Family plan. You pay a single extra fee of £5 a month (free if you’re on the Super Investor plan), and their monthly cost is zero. Each member can invest up to £50,000 in an ISA or a general investing account with free regular investing and no account fees. However, they’ll still pay normal dealing commissions when they buy and sell investments. Plus you can claim up to £200 when you refer a friend to ii. Recommend a friend or family member and get a £200 reward. Your friend will get their first year’s service plan with no account fees – saving £59.98. To qualify, your friend must transfer or fund their account with at least £5,000 in combined cash/investments. New pricing is due to start on 1 February, 2026. Fees A GIA with ii costs from £4.99 a month with its Investor Essentials plan. With this basic plan, trading on UK and US stocks is £3.99. There are two plans above that which include free trades. You can set up regular orders as small as £25 for free with ii’s regular investing service. Is ii’s GIA Better than its ISA? The GIA is better if you have lots of money to invest as the maximum you can put in an ISA tax-free each year is £20,000, so anything above that you should invest in a GIA. However, if you have less than £20,000 to invest each year, the ii ISA is better option as your profits will be tax free. What is ii’s Platform Like to Use? ii’s platform is very easy to use and it gives lots of market data on potential investments. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.8 (Based on 275 reviews) | GIA Annual Fees 0% | Dealing Commission £1 | See Offer Capital at risk | Features:

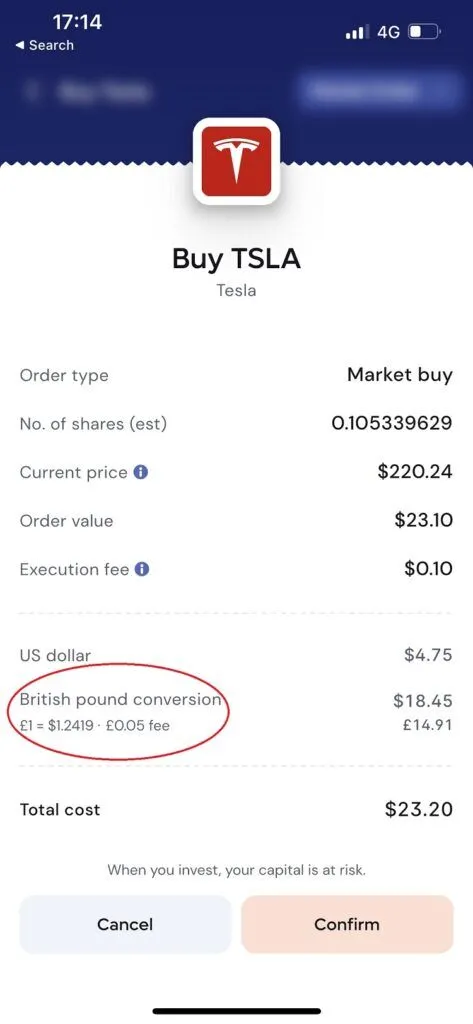

| Lightyear is an Easy to Use Investment App With Very Low FeesProvider: Lightyear Verdict: Lightyear is one of the better free investing apps as it provides access to US stocks and local markets with FX fees as low as 0.35%. Lightyear is a new investment app that offers low cost investing in UK, European and US shares. The company was founded by one of the first Wise (Transferwise) employees, Martin Sokk with a similar objective of making investing as cheap and easy as possible. Is Lightyear Good for Investing? Lightyear is a simple and approachable way to invest in stocks and ETFs without unnecessarily large fees. A very well-designed low-cost investing app with discounted FX charges, limit and recurring orders for investing in local and international markets. Special Offer: Sign up with a promo code GOODMONEYGUIDE, deposit at least £50 and get 10 trades for free (T&Cs apply). Capital at risk. Fees: Lightyear is cheap for investing. The GIA has no account fee and charges only £1 commission for UK trades and up to $1 for US stocks. Lightyear makes its money from FX fees. Lightyear adds FX fees to the interbank rate, so conversion costs are transparent. When I interviewed Martin Sokk, he told me Lightyear planned to expand internationally fast so that its users could invest in both their local and the US markets, since many people want to invest in US stocks. And rightly so: US shares are all household names, and one of the key drivers for investing is to buy companies you love and use. Lightyear will make money charging 0.1% per trade (or $1, whichever is bigger) and converting GBP, HUF & Euros, etc. into USD when people buy US stocks. It charges 0.35%, which is higher than Interactive Brokers’ 0.02% but much lower than the 0.5% charged by AJ Bell, Saxo Markets and IG, or the 1% from Hargreaves Lansdown and Interactive Investor. FX must be a key part of Lightyear’s monetisation strategy: if you charge very low commission and account fees, you have to make money somehow. So Lightyear aims to make its money in the background, initially from foreign exchange fees. FX is a good way to make money because a) no-one really understands how the pricing works and b) you don’t see the charge, it’s built into the buy/sell spread. You can see in the example below what the fees were when I bought some Tesla shares while testing the app. Market Access: Lightyear has just added 1,300 new instruments, bringing the total up to almost 5,500. These include well-known UK names such as Rolls-Royce, easyJet and IAG; to defense ETFs, US stocks. This is great because one of my concerns about new investing apps is that they normally just cater to the most heavily traded apps. It’s great to see Lightyear providing wider market access. Plus, it’s proactive. Lightyear says it has put live 98% of non-complex US instruments asked for by customers in the past 3 months. One of the other really cool things about Lightyear is that you can listen to earnings calls directly on the app. Multicurrency account & order types Another point to make here is that you also get a multi-currency account, where you can hold foreign currency. The advantage of this is that you don’t need to do as many FX conversions which can help keep costs down. Related guide: Compare FX rates for buying US stocks from the UK. Lightyear comes with features like fractional US shares, limit orders, and regular investing. You can also quickly see which shares pay the highest dividends or make the most money relative to their share price to help you pick stocks. Progression to servicing local customers and local markets When Lightyear first started, you could only invest in a handful of UK stocks, and they were ADRs listed in the US denominated in USD, rather than the local listings on the LSE. So, you were paying an FX fee when you really shouldn’t have to. Admittedly, there is no stamp duty so technically paying 0.35% on FX rather than 0.5% to HMRC is cheaper. Lightyear has a cash and investment ISA, but no SIPP account, but I suspect that is next on the “product roadmap”. But anyway, if you want to invest in UK shares like Lloyds, you can actually buy them on the LSE, something that eToro is yet to do. With eToro, you still have to buy USD-denominated shares. I’ve mentioned how annoying that is many times and yet eToro continues to serve itself as a global broker instead of its customers as locals. It’s nice to see that Lightyear fixed that problem early on. Like Transferwise, like Lightyear To draw on one final Transferwise comparison, it is very easy to use app-as-a-tool to help you start investing as cheaply as possible. The thing is though is that, transferring money is like car insurance. No-one really has any loyalty to their insurer, they just do it and move on. Investing is different. Investing is not like insurance, when you open an investing account, you could be using it for the next 30 years. I think there will always be a place for traditional investment platforms because they provide excellent customer service and brand loyalty, they are mature platforms for mature investors and fees will eventually come down, as they have done in the past. Same as with Simpsons Tavern, it may not be as good for you as veganism, but if it survives, people will continue to go because they like it. But, if low-cost investing apps are a gateway to getting more people to invest for their future, then they are the future too and will hopefully mature along with their customers, and Lightyear, in particular, is a great place to get started. Pros

Cons

Overall4.2 | ||

| GMG Rating | Customer Reviews 4.6 (Based on 2,564 reviews) | GIA Annual Fees 0.6% | Dealing Commission £0 | See Offer Capital at risk | Features:

| Wealthify General Investment Account ReviewAccount: Wealthify General Investment Account Description: Wealthify is a robo-advisor that lets you invest in a portfolio of investments from the UK and overseas or you can choose an ethical investment plan made from a blend of environmentally and socially responsible investments. Is Wealthify’s GIA a Good Account? Wealthify, part of the Aviva Group, uses automation to create a portfolio suited to your risk appetite. You can opt for an original portfolio of investments from the UK and abroad, or choose an ethical plan. As with all platforms authorised by the Financial Conduct Authority (FCA), if Wealthify were to go bust, your funds would be protected by the Financial Services Compensation Scheme (FSCS) up to £85,000. Fees It costs 0.6% to start investing with Wealthify, which is one of the cheapest robo-advisor GIA fees. There are also investment costs of, on average, 0.16% for original plans and 0.7% for ethical plans. What is Wealthify’s Platform Like to Use? Wealthify’s investment platform lets you fine-tune your portfolio based on risk, and shows you good visuals of what it may be worth in the future. The user interface is slick, offering you options for setting investment amounts, monthly investment amount and your investment style, as shown below. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.5 (Based on 1,330 reviews) | GIA Annual Fees £0 | Dealing Commission 0.05% | See Offer Capital at risk | Features:

| Interactive Brokers General Investment Account Review: Excellent low-cost investing and tradingAccount: Interactive Brokers General Investment Account Description: Interactive Brokers’ (IBKR’s) GIA is aimed at sophisticated investors, and offers access to derivatives, options, and futures. The platform is one of the cheapest across all asset classes. Capital is at risk. Is IBKR's GIA a Good Account? IBKR’s GIA is its “universal account” that lets you invest in all asset classes via shares, CFDs, futures, options or funds. The account is excellent for sophisticated investors who want to manage their own portfolios with complex order types. It’s ideal for active investors who need access to a wider range of investment products like derivatives, options, and futures. IBKR is also one of the cheapest investment platforms across all asset classes, as it was built on offering electronic discount brokerage. Fees There is no account charge for general investment accounts at IBKR. When you buy and sell shares minimum dealing commissions are £1 in the UK or 0.05% of the deal size. Special Offers IBKR clients can earn $200 for each qualified referral while giving their friend the opportunity to earn up to $1000 of IBKR stock. What is IBKR’s Platform Like to Use? The investment platform is a slimmed-down version of its exceptional desktop trader station. For investing it gives you a good overview of shares and funds. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.4 (Based on 235 reviews) | GIA Annual Fees 0% – 0.75% | Dealing Commission £3.95 | See Offer Capital at risk | Features:

| Moneyfarm Digital Wealth Management ReviewProvider: Moneyfarm Verdict: Moneyfarm is a digital wealth manager that aims to make personal investing simple and accessible. It was launched initially in Italy in 2012 by Italian bankers Paolo Galvani and Giovanni Dapra and entered the UK in 2016 and has big-name financial backers such as Allianz Global Investors, Cabot Square Capital, United Ventures and Poste Italiane. Is Moneyfarm any good for wealth management? Yes, Moneyfarm is more of a digital wealth manager rather than a robo-advisor as the portfolios are put together by investment managers, rather than automatically. The automation, as it were, is fine-tuning your portfolio to match your risk/reward choices. Unlike with other robo-advisors, with Moneyfarm you can also top up your portfolio with individual shares and ETFs. Fees: Moneyfarm charges 0.75% to 0.6% up to £100k then 0.45% to 0.35% over £100k. Moneyfarm investing account fees are scaled between 0.75% for accounts between £500 and £50,000, then above £100k are 0.45% to 0.35%. Average investment fund fees are 0.2% and the average market spread when buying and selling is 0.10%. Market Access: You can invest in 7 pre-made portfolios, but also (unlike a lot of other digital wealth managers and robo-adviors) also buy individual shares, ETFs, bonds and mutual funds online. It’s a bit of a shame you can’t buy US stocks, But Moneyfarm is best really for setting up regular investments in a GIA, ISA or SIPP, then letting them grow over time without too much tinkering and speculating on Tech stocks. App & Platform: It’s really easy to use, plus it puts you through your paces to make sure you understand what you are investing in. Apparently, my Moneyfarm investor profile is “pioneering”, which means I want to take on more risk for potentially better returns. Customer Service: This is mostly online as you’d expect but solves all issues – I’ve had some good calls with Moneyfarm about how its products work over the years, and its people really know their stuff. If you want to find out more about the ethos, you can read my interview with the CEO Giovanni Daprà on how they are so much more than a robo-advisor. Research & Analysis: Not much to speak of other than a few guides, but that’s ok, as I don’t really want Moneyfarm spamming me with stock trading ideas. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.2 (Based on 1,094 reviews) | GIA Annual Fees 0% – 0.25% | Dealing Commission £3.50 – £5 | See Offer Capital at risk | Features:

| AJ Bell General Investing Account Review: Best Overall GIA 2024Account: AJ Bell General Investing Account Description: AJ Bell’s GIA offers share dealing in over 24 stock markets, bonds, ETFs and over 4,000 funds including a range created by its own team. The platform will suit those who are looking for low-cost investing when growing a small portfolio. Capital is at risk. Capital at risk Is AJ Bell's GIA a Good Account? Yes, AJ Bell’s GIA is one of the safest and cheapest ways to invest – outside your tax-free allowances in SIPPs & ISAs – for longer-term investors in the UK. AJ Bell won our award for Best Investing Account 2024 due to its excellent market access, low costs and customer service scores in our annual survey. Fees: AJ Bell charges 0.25% of the value of your investments for a general investment account, but share account fees are capped at £3.50 a month. Dealing costs are £1.50 for funds and £5 for shares but drop to £3.50 where there were 10 or more online share deals in the previous month. Market Access: AJ Bell’s GIA is most suited to investors who want the cheapest overall investment platform for starting to grow a small investment portfolio. It offers share dealing in over 24 stock markets, bonds, ETFs and over 2,000 funds (of which around 400 are investment trusts), including a range of the company’s own funds that have been created in-house so you can invest by how much risk you want to take, or by theme or region. App & Platform: Both apps and web version are really simple to use, no complaints. Customer Service: Top notch, you can actually phone someone up to ask a question. Research & Analysis: As well as being a super ealy platform for beginners AJ Bell is also a serious platform for serious investors and this in reflected in the quality of their research. There are some really in-depth reports on funds and shares, plus you get a free subscription to Shares Magazine worth £220 a year by maintaining a balance of £4,000 or more across your AJ Bell investing accounts. Special Offers: Recommend a friend, and you’ll both get £100 gift vouchers. If you recommend a friend to AJ Bell and they invest more than £10,000 in a SIPP, ISA or LISA, you’ll each get an Amazon gift card worth £100. Switch your share dealing account and receive up to £500 to cover exit fees. If you transfer your share dealing GIA valued at more than £20,000 to AJ Bell, it will help cover any exit fees charged by your current provider. AJ Bell will cover £35 per investment moved and up to £100 for general exit fees, up to an overall maximum of £500 per person. What is AJ Bell’s Platform Like to Use? AJ Bell’s investment platform is functional and well laid out. Key share and fund information is available to view at the time of execution. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 3.8 (Based on 1,763 reviews) | GIA Annual Fees 0% – 0.45% | Dealing Commission £5.95 – £11.95 | See Offer Capital at risk | Features:

| Hargreaves Lansdown General Investment Account: Excellent All-RounderAccount: Hargreaves Lansdown General Investment Account Description: Hargreaves Lansdown (HL) has plenty of account types including a GIA and several types of ISA, plus an excellent research portal. There’s access to thousands of UK and international shares, funds, ETFs, investment trusts and corporate bonds. Capital is at risk. Is HL's GIA a Good Account? HL is good for investors looking for more than just somewhere to buy and sell shares. The platform offers the most account types of all the investment platforms we compare, including a GIA, stocks and shares ISAs, lifetime ISAs, and junior ISAs. Plus, it has one of the best research portals to help you choose your own investments. And it boasts some of the widest market coverage, including thousands of UK and international shares, over 3,000 funds, ETFs, investment trusts, and corporate bonds. Fees There is no account charge for shares in a GIA with HL. Funds are charged at 0.45% for the first £250,000. There’s no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month. Is HL’s GIA Better than its ISA? It makes sense to open a GIA only after you have exhausted your ISA allowance. With the GIA from HL, you can invest as much as you like but with an ISA you’re limited to £20,000 a year in the tax-free wrapper. What is HL’s Platform Like to Use? HL’s investment platform is one of the best around. HL provides a huge amount of technical and fundamental data to help you choose investments. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 3.6 (Based on 74 reviews) | GIA Annual Fees 0.12% | Dealing Commission 0.08% | See Offer Capital at risk | Features:

| Saxo General Investment Account Review: Superb DMA Access & ServiceAccount: Saxo General Investment Account Description: Saxo’s GIA is one of the most advanced accounts for UK long-term investors with access to more than 50 stock exchanges around the world and 22,000 instruments available to invest in. Saxo’s forte is as a trading platform for professional and institutional short and medium-term speculators as it offers direct market access and very low commissions. A good choice for large, active investors. Capital at risk Is Saxo's GIA a Good Account? As well as being one of the best trading platforms, Saxo has good accounts for long-term investments. The platform has recently introduced mutual funds for investors who want to quickly build a diversified portfolio. And income investors can access a huge range of retail and institutional-grade bonds. On balance, though, I’d say that Saxo remains more of a trading platform than an investing account. So if you’re primarily a high-risk trader and you want to incorporate some longer-term “safer” investments into your portfolio, Saxo is a good place to invest alongside your shorter-term speculation. Saxo is also one of the best brokers for earning interest on your uninvested cash. Compared with other retail investing accounts like eToro, Saxo is a much better option because of market range, customer service and tax-free products like ISAs and SIPPs. Fees Saxo charges €10 a month or 0.12% a year (whichever is higher) based on the value of your portfolio. If you have a VIP account this fee drops to 0.08%. Dealing charges, which are a percentage of transaction size, are competitive – and UK shares trading commission starts at 0.1% (£100 if you buy £100,000 worth of stock) and drops to 0.05% for more active traders. Special Offers Platinum. If you have £200,000 or more on account, you can apply for 30% lower transaction and account costs. VIP. For accounts with portfolios over £1m, you get even better pricing, direct connection to experts, 1:1 SaxoStrats access and event invitations. What is Saxo’s Platform Like to Use? Saxo’s investment platform provides exceptional access to the global markets. Pros

Cons

Overall5 | ||

| GMG Rating | Customer Reviews 4.5 (Based on 38 reviews) | GIA Annual Fees 0.15% | Dealing Commission £0 | See Offer Capital at risk | Features:

| Dodl Expert ReviewAccount: Dodl by AJ Bell Description: Dodl is a low-cost investment app provided by AJ Bell. The app fees are lower than AJ Bells, and they cater to newer investors by offering commission-free investing in AJ Bell funds, themed investments and a small selection of main market shares. Is Dodl a good investing app? AJ Bell Dodl is a great way for the next generation of investors to invest with a “low-cost, little effort” app which focuses on making investing easy. Which it does well, Dodl is very user-friendly, has great educational content and is one of the cheapest ways to start investing. Pros

Cons

Overall4.3 | ||

| GMG Rating | Customer Reviews 4.1 (Based on 14 reviews) | GIA Annual Fees £120 | Dealing Commission £0 | See Offer Capital at risk | Features:

| CMC Invest General Investment Account Expert ReviewProvider: CMC Invest General Investment Account Verdict: The GIA from CMC Invest lets you invest in major UK shares, US stocks and ETFs without having to pay commission when you deal. The app is free to use when investing in a general investment account with the Core plan. But you can upgrade to a Plus account which includes a flexible stocks and shares ISA, access to UK mid-cap shares and a USD wallet. There’s also a Premium option that gives you access to a SIPP. CMC Invest cut the fees for Plus and Premium in 2025. Is the CMC Invest General Investment Account Any Good? If you are just starting out investing, then CMC Invest is a good general investment account (GIA) for some longer-term investments. But, if you are an established and experienced CMC Markets customer you may find the CMC Invest offering too basic. Better options for sophisticated investors would be Saxo, or Interactive Brokers. Investments: Shares & ETFs Minimum deposit: £0 Account types: GIA, ISA Account charge: £0 – £10.99 per month (Premium previously £25 a month) Dealing fee: £0 Fees: General investment accounts are commission and fee free. ISA accounts cost from £6.99 a month and are included in the Plus plan. For US shares there is a conversion fee of 0.39%-0.99% depending on your account. Investing Platform: CMC Invest’s app gives you access to major stocks, and has a screener to help search for potential investments. Pros

Cons

Overall4.4 | ||

| GMG Rating | Customer Reviews 3.9 (Based on 678 reviews) | GIA Annual Fees £96 | Dealing Commission £0 | See Offer Capital at risk | Features:

| IG General Investment Account Review: Great Mix Of High & Low-Risk InvestingAccount: IG General Investment Account Description: IG is primarily a trading platform (and one of the best, at that) but also has an investment account through which you can deal in physical stocks and shares, including ETFs, in the UK, Europe, US and Asian markets. If you don’t want to choose your own stocks, IG also has a managed investment product called Smart Portfolios. These are pre-made diverse portfolios with exposure to the global markets through shares, bonds, property and commodities. IG is a good choice for traders also looking for a cost-effective way to hold long-term investments in a GIA, or a stocks and shares ISA or SIPP. Capital is at risk. Is IG's GIA a Good Account? Yes, we rank IG as one of the best combined investing and trading platforms in the UK. You can invest with IG through a GIA, ISA or SIPP in either individual stocks or through pre-made Smart Portfolios. One letdown, though, is the lack of access to funds and bonds – you’ll be better served by a traditional stockbroker like Hargreaves Lansdown. And unlike some rivals, like Bestinvest, IG can’t provide advice on investments. Fees IG charges a flat custody fee of £24 a quarter (£96 a year) for its GIA. But if you have more than £15,000 in a Smart Portfolio managed fund, or place over three trades per quarter, that fee is waived. Standard dealing fees are £8 for UK and £10 for US shares. Smart Portfolio fees are 0.5% and capped at £250 per year. Fund management charges are 0.13% and transaction costs are 0.09%. Special Offer: Free US stock investing. There is zero commission on US share trades and just £3 on UK share trades when you trade three or more times a month. What is IG’s Platform Like to Use? IG’s investment platform is the same as its trading interface so this will be familiar to its short-term speculators. The platform offers good visuals of investments, with associated news and analysis. Pros

Cons

Overall5 |

Our experts have tested and ranked the UK’s best investing platforms and accounts that are regulated by the Financial Conduct Authority (FCA) and hand-picked the best investment accounts based on:

- User feedback. We analysed over 30,000 votes and reviews in the prestigious Good Money Guide annual awards

- Unbiased, real-world testing. Our team tests each GIA provider with real money to ensure you have a seamless experience

- In-depth feature comparison. We thoroughly compare features, highlighting those that make a platform stand out

- Exclusive insights from the top. Our exclusive interviews with GIA company CEOs give you insider perspectives to help you make the best decisions

Which General Investing Account Is Right For You?

To make choosing a GIA simple, we put together a list of which accounts best suit different types of investors:

Beginners. Lightyear is a great choice if you’re just starting to invest. Firstly, the app is easy to use. Secondly, you can buy fractional shares, so you don’t need much capital. Lastly, there are no account fees and commissions are low, so dealing fees won’t eat into your profits.

Intermediate. If you already have some experience investing and are growing a portfolio, then AJ Bell is a good choice because they offer a wider selection of markets, so you can invest in smaller-cap shares, more funds and also bonds to increase the diversification of your portfolio.

Advanced. For large portfolios, or if you want to trading more complex products with more dealing order types or access global shares in emerging markets, Interactive Brokers has professional-grade online platforms and apps, with low costs and direct market access.

Tax-wrapper focused. Hargreaves Lansdown offers a wide range of tax-efficient accounts including ISAs, LISAs and junior ISAs. Its UK-based customer service team can provide guidance on how to make the most of your tax-free investing allowance. This is useful if you’re investing outside of a general investment account.

Ethical/ESG investing. If you want to invest in ethical or sustainable funds, Wealthify has an “Ethical Plan”, that aims to exclude industries and activities that are considered harmful to society and the environment, including, tobacco, gambling, controversial weapons and adult entertainment.

What is a General Investing Account (GIA)?

A general investing account (GIA) is an all-purpose investing account where you can buy and sell stocks and shares (equities), bonds, funds and ETFs. GIAs don’t offer tax benefits – unlike ISAs, for example – so they can be a popular choice for investors who’ve already used up their tax-free allowances. There’s no limit on the amount you can invest into a GIA each year.

Investing is a long-term strategy. Financial experts recommend holding investments for at least 5 years so they ride out short-term fluctuations in the market. GIAs offer a flexible way to build your wealth over time, focussing on long-term growth.

The most popular types of investments for GIAs in the UK are:

General Investing Accounts: The Pros & Cons

Thinking of opening a GIA? Here’s what to consider:

Pros

- GIAs offer diversity. You can invest in anything from stocks and shares, to commodities, emerging markets, ethical investments and property funds.

- GIAs tend to be low cost. Many online investment platforms offer a cheap way to buy stocks and shares.

Cons

- Risk. It’s possible to lose money as well as make money through an investment platform.

- Limited access. Some investment accounts, like pensions and lifetime ISAs, lock away your money for a certain period of time and charge a penalty for early withdrawal.

- Fees. All GIAs charge fees and there’s no way to avoid paying something for having long-term investments.

Which is the Cheapest General Investing Account?

Cheapest Overall. Interactive Brokers is the cheapest overall account as it doesn’t charge you a custody fee (also known as an account fee), which is what the provider charges to keep the account open.

Cheapest for Large Accounts (over £50,000). interactive investor (ii) is the cheapest investing platform for buying funds and shares, thanks to its fixed fees. Your trading commission remains low at £3.99 for accounts with a £11.99 monthly fee.

Cheapest for Small Accounts. For smaller portfolios, investing apps like Freetrade offer free GIAs. However, these tend to have a limited range of markets and order types unless you upgrade to a premium account type.

How to Find the Cheapest Investment Platform

Different brokers have varying custody fee structures. Some, such as Hargreaves Lansdown (HL) and AJ Bell, charge a percentage based on the size of your account. Others, such as ii and Freetrade have a flat fee.

For accounts holding a large amount, fixed fees work out cheaper. But if you only have a small amount to start investing with, an account that charges a percentage will help keep your costs down.

The cheapest account isn’t always the best option. Generally speaking, you tend to get what you pay for with investment platforms. Those that have higher fees tend to offer more investment options, provide better customer service, be more reliable, and provide extras such as investment research and tools.

It’s worth considering pricing carefully because fees and charges can have a big impact on your overall investment returns. Costs to think about are trading commissions, annual custody charges, entry fees, and exit fees.

Which General Investment Account Offers Access to the Most Markets?

HL provides access to the widest range of markets through its GIA, including thousands of UK and international shares, over 3,000 funds, ETFs, investment trusts, and corporate bonds. The full range includes:

Other platforms like Interactive Brokers also offer access to a vast range of investments, including domestic and international shares, funds, ETFs, and bonds. But others like InvestEngine (which is free) only offer access to only certain asset classes or products like ETFs.

GIA with the Best Customer Service

HL also has the best customer service according to our 2022, 2023 and 2025 Good Money Guide awards, based on customer feedback. Many customers feel the platform is easy to use and HL staff are knowledgeable.

Hargreaves Lansdown also has the best customer service according to our 2022, 2023 and 2025 Good Money Guide awards, based on customer feedback.

Service and support can be important, particularly if you are new to investing, as you may need help placing a trade.

Customer service is a vital part of our review process. We take into account user ratings, and also how each GIA provider performs in our own reviews. Our aim is to highlight accounts that give you flexibility and value, and are backed up by great customer service.

Which Accounts Offer the Most Added Value?

Again, HL offers you the most added value as its platform features:

- Market data

- Fund, share and market analysis

- Multiple order types

- Excellent customer service

- Pre-made portfolios

- Educational videos & webinars

- Investment calculators

Full-service investment platforms like AJ Bell and interactive investor also offer features that can help you make better investment decisions, such as research, charts, and stock screeners. But others, such as Freetrade, just offer basic investment services.

Which GIA Provider Offers the Most Account Types?

Among platforms we’ve reviewed, AJ Bell and HL offer you the most types of account, including lifetime ISAs.

But when it comes to types of investment, including derivatives, we found that only IG, HL and Interactive Brokers offer access to the full suite. With that said, Interactive Brokers is more of a trading platform than an investing account and the derivatives offered by HL are provided through a partnership with IG. So the provider that offers the most investment options is technically IG.

| Account Types | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| GIA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| ISA | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ✔️ | ❌ | ✔️ |

| SIPP | ✔️ | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Pension | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ | ✔️ |

| Junior ISA | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ✔️ |

| Junior SIPP | ✔️ | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ❌ | ❌ |

| Lifetime ISA | ✔️ | ✔️ | ❌ | ❌ | ❌ | ❌ | ✔️ | ❌ | ❌ |

Some platforms offer access to a variety of different accounts such as GIA, stocks and shares ISAs, lifetime ISAs, and self-invested personal pension (SIPP) accounts. Others, though, only offer GIAs. Tax-efficient accounts such as ISAs and SIPPs can help you minimise your tax liabilities.

✅ FCA Regulation

Your peace of mind matters to us. That’s why every GIA we feature is regulated by the Financial Conduct Authority (FCA). The FCA ensures GIA providers are financially secure, treat customers fairly, and meet robust compliance standards.

Plus, your funds are safeguarded by the Financial Services Compensation Scheme (FSCS), providing an extra layer of protection and reassurance. This means that if a provider were to go bust, any money of yours in its accounts is protected up to £85,000.

General Investment Account FAQs:

Yes – general investment accounts are regulated by the FCA and can be considered safe. When an investment platform is regulated by the FCA, it is bound by the regulator’s rules and regulations.

FCA-regulated platforms are required to hold client assets and investments separately in the name of a nominee company or authorised third-party custodian. Meanwhile, clients’ cash must be held in trust accounts with authorised UK banks. This adds protection for investors.

If a FCA-regulated platform becomes insolvent, and investors suffer a loss as a result, they will be protected under the Financial Services Compensation Scheme (FSCS) up to £85,000 per client, if you have balances with a single financial institution that exceed this amount, you may wish to consider opening a new account with an investment provider under a separate banking licence to ensure your deposits are fully protected in case of investment broker collapse.

It’s worth stressing that regulation and FSCS protection will not protect you from investment-related losses. When you invest money, your capital is always at risk because of fluctuations in the markets.

Yes, some GIAs are free, for instance, a number of brokers such as Freetrade offer commission-free trading. However, it’s important to be aware of other costs. Freetrade, for example, charges £3 per month for its Stocks and Shares ISA and £9.99 per month for Freetrade Plus (which offers access to more investments). It also charges FX fees of spot rate +0.45% on international shares.

In terms of investing in funds, some brokers such as Hargreaves Lansdown allow you to buy and sell funds commission free. However, these brokers generally charge an annual custody charge on fund investments. Hargreaves Lansdown, for example, charges 0.45% per year on fund holdings up to £250,000.

You can have as many investment accounts as you want. There can be benefits of using several different platforms as some have strengths in specific areas. For example, some platforms are better than others for investing in funds. Others are more cost-effective for share trading. However, it’s generally much easier to manage and monitor your investments when they are all on the one platform.

It’s worth pointing out that you can open multiple Stocks and Shares ISAs. However, you can only pay into one of these ISAs per year and the annual allowance is £20,000.

Generally speaking, GIAs are good for investing after you have used up your tax-free investing allowance within a Stocks and Shares ISA. The key advantage of a Stocks and Shares ISA is that it shelters all your capital gains and income from HMRC. If you invest in a general investing account, you will have to pay capital gains tax on gains and income tax on income received.

Profits you make from trades in a GIA are subject to capital gains tax (CGT). Everyone has a CGT annual allowance (an amount of profit you can make before you have to pay tax). For the tax year 2025/2026 it’s £3,000. Profits from selling other valuable assets, such as paintings, are also covered by CGT. Dividends and interest you receive are subject to income tax. The rate you pay will depend on the tax band you’re in, and there are separate annual allowances for these. Tax rules can change at any time, and it’s a good idea to get advice about your own circumstances.