There are five ways to invest money on eToro. You can either buy investments, short the market with CFDs, copy another investor’s portfolio or become a popular investor. In this guide, I’ll explain what each one is, its pros and cons and how you can profit from them.

eToro may seem confusing if you have never invested before, but it’s actually a very simple investing platform for beginners. In this guide, we answer the question: “Can you make money on eToro?”.

#1 Buying investments on eToro

This is the most common way people try and make money on eToro. If you think that a share price will go up, you can buy shares in a range of over 3,000 stocks from 17 stock exchanges. The most popular stocks that people invest in are the main market US stocks that everyone has heard of like Tesla and Netflix.

One good thing about buying shares with eToro is that they are commission-free, but they are not completely free. For UK investors, you have to pay stamp duty (0.5%), you also get charged when you deposit GBP into your account (0.5%) and convert it into USD (if you are buying US stocks) are also charged if you withdraw your money ($5).

One of the key advantages of eToro is that you can try and make money, even if you don’t have a lot of it as you can buy a fractional shares. So instead of buying 1 Tesla share for $434 (as of 7/1/26) you can buy $100 of Tesla shares. This can help you diversify your portfolio and reduce your risk.

The old saying, “don’t keep all your eggs in one basket” applies here.

⚠️However, on the downside, it is hard to make money investing in single stocks as prices are volatile. So if you time the market wrong, you will lose money.

You can also buy ETFs that track the underlying performance of stock exchanges like the S&P 500 (which I’m sure you;ve seen people on TikTok say is the best way to invest) or commodities like Gold.

Side note, if you want to know if you should invest in Gold, you should definitely read the excellent The Secret History of Gold, by Dominic Frisby.

ETFs like the VUSA Vanguard ETF (LON:VUSA) which tracks the price of the S&P 500. These are the 500 biggest stocks in the US. Over the past 5 years the S&P 500 index is up around 57%. But beware, over the last month, the index is down nearly 0.19%. So if you are considering investing in ETFs, you should take a long-term view, rather than trying to invest money in the short term.

It is not possible to make money quickly investing with eToro without being a professional trader, and even then, it is not guaranteed.

⚠️Warning – as with all investing, past performance is no indication of future returns. When you invest, your capital is at risk.

- Related guide: How to invest in the S&P 500

#2 Shorting the market

You can make money on eToro when the market goes down by shorting stocks, indices, or commodities by trading CFDs. CFDs are contracts for difference, where your profit or loss is based on the opening and closing price of a trade. But in practice, it is the same as buying or selling stocks. For instance, if you wanted to buy Lloyds shares, if you were investing in physical stock, you would buy 10,000 shares, and to get an equivalent CFD position, you would buy 10,000 CFDs.

The key benefit of this is that if you hold Lloyds shares, but think they will go down, but don’t want to sell them to realise a capital gains tax charge, you can short an equivalent amount of Lloyds with a CFD and buy it back when the share price drops instead of selling your physical shares and buying them back later. The net result is the same, except you have not realised a taxable profit on your investment. However, you will have a taxable profit on the CFD position.

There is a way around this if you use a spread betting broker, where trades are structured as bets, where profits are not liable for capital gains tax.

Unfortunately, eToro does not offer financial spread betting.

The main advantage of CFDs is that you can sell stocks without owning them and profit when their share prices go down. You also don’t pay stamp duty (saving 0.5%) when you buy the shares back and you can trade on leverage, which means you can buy £5,000 worth of shares with only £2,500 on account.

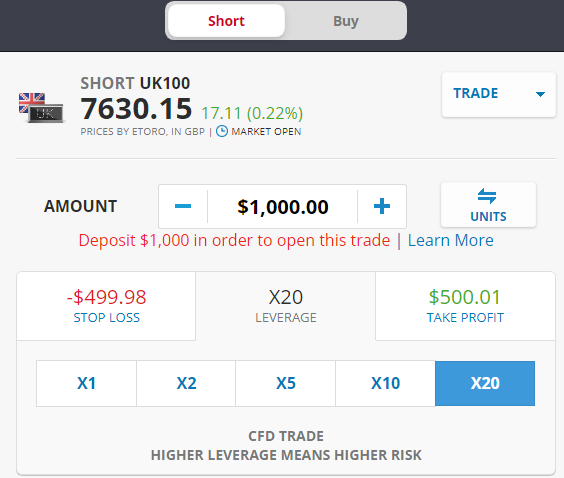

If you want to reduce your risk, eToro actually lets you reduce your margin rates. This is particularly good if you are hedging your portfolio by shorting the market. Say, for example, you have a portfolio of $1,000 of UK-listed stocks, and think the market will go down in the short term, but don’t want to close your positions. You can sell $1,000 worth of the FTSE (the index that tracks the 100 biggest companies on the UK stock market).

⚠️Risk Warning: Trading with leverage involves high risk!

In this scenario, you can invest money when the market goes down, and that will offset the losses from your portfolio. You can also set your leverage from either 1x (if you want to be fully hedged with cash) or 20x if you want to free up your risk capital to be used elsewher,e as you’ll only need $50 to open the position.

⚠️There are two significant disadvantages when using CFDs though.

- The first is that because you are trading on margin, the risks of loss are multiplied.

- Plus, if the market continues to go up, you will lose money if you are not long underlying stocks. Or if you are short the market on CFDs to hedge a long portfolio, you won’t invest money on your investments because you will be losing on your CFD positions.

⚠️Final warning on shorting, with shorting, you only make money if the market goes down, so if it goes up, you will lose money. If you have a professional trading account with no negative balance protection, your losses could be unlimited.

#3 Copying other investors’ portfolios

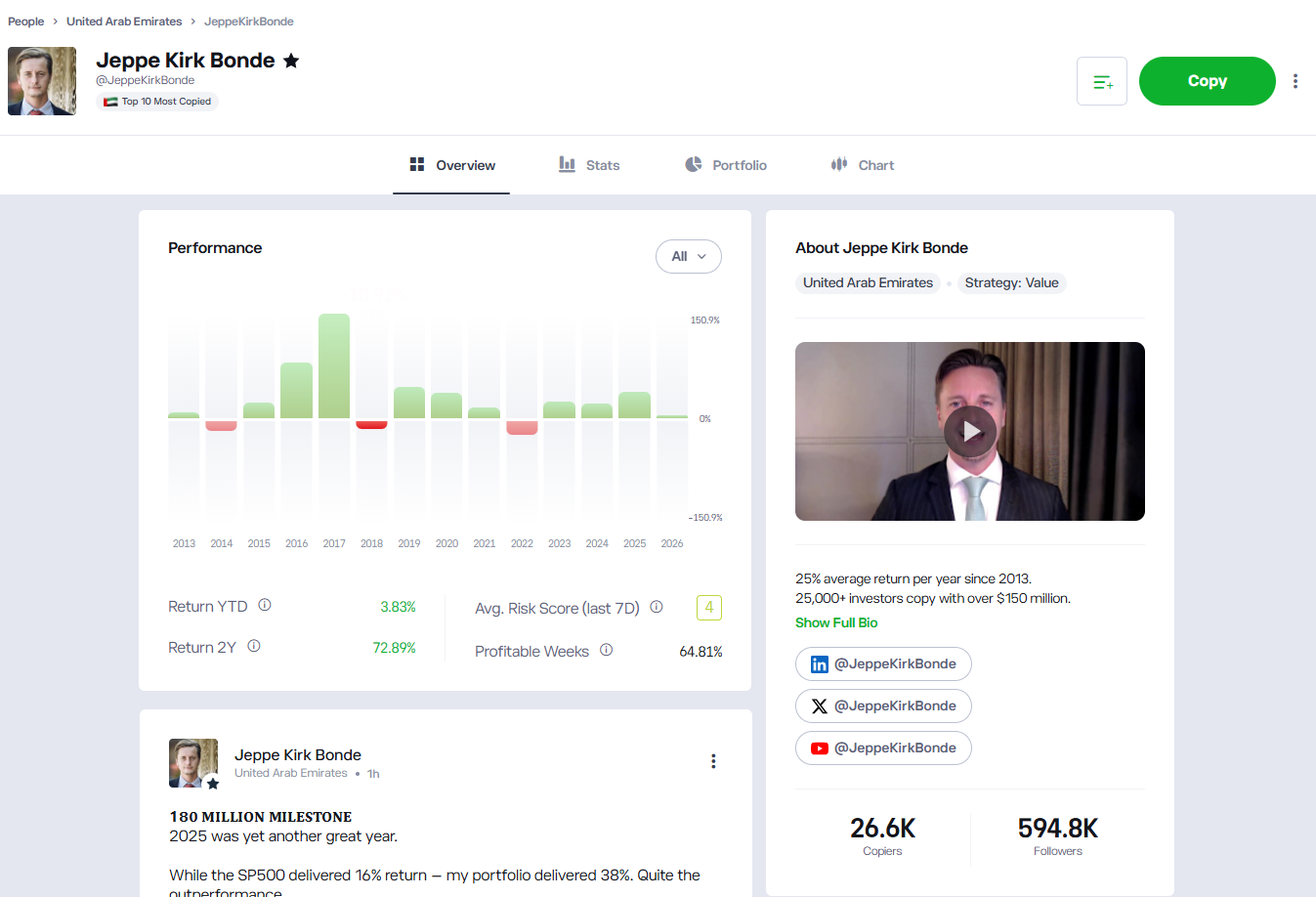

One of the main selling points of eToro and what draws many new clients in is the ability to invest money by following other people’s portfolios. I was listening to a great podcast from Jeppe Kirk Bonde whose eToro portfolio has made on average 25% a year over the past 10 years. So if you had followed him and copied his trades from the beginning, you would have made pretty decent money. He just posted an updated on Linkedin, claiming that while the SP500 delivered 16% return – his portfolio delivered 38%.

But making money from social trading on eToro is just as hard as picking stocks. Historical performance is no guarantee of future results. For instance, even though his portfolio has done well over the last 10 years on average, if you had followed him during 2022, you would have lost 19% of your money. This is slightly more than if you had invested in the S&P 500, which was only down 18.01%.

Also in 2021, the S&P returned 28%, whereas his portfolio only returned 15%.

Plus, the S&P 500 is an index run but Standard and Poors, a huge institution. The most popular S&P ETFs like the SPDR S&P 500 ETF (SPY) are managed by State Street Advisors, one of the largest asset managers in the world that looks after $3.8 trillion in assets.

If you want to know more about S&P, you can see our interview with them about SPIVA and how their indices are measured.

What happens if a trader you are following loses interest or changes tactics?

Cough, cough, Neil Woodward.

⚠️ Be careful here too, if a popular investor starts losing money, so will you! You will copy their losing trades and portfolios as well.

#4 Become a popular investor and earn commission from your followers

The final way to invest money on eToro is be become a popular trader like Jeppe Kirk and generate commission when people copy your portfolio (as well as from your own investments).

However, not anyone can become a popular trader. When I interviewed an old friend of mine Daniel Moczulski the UK eToro, Managing Director, he told me that they put a lot of effort into ensuring that popular traders are vetted and have a solid track record before people can copy their traders.

Using Jeppe as an example again, you can see from his profile above that he has 26,000 traders copying his portfolio. That is a huge responsibility for an unregulated individual, especially as $180m is actually bigger than some regulated funds.

If Jeppe Kirk has $180m following him, based on the 1.5% then he should be earning $2.7m a year from his eToro copiers. Obviosuly he has moved to Dubai now, just like all the other finfluencers, presumable so he doesn’t have to pay income tax on his income, or maybe he just likes the weather. I don’t know, I’ve never met him. Although I did ask him once if he’d like to be interviewed, but he wasn’t interested.

To invest money as a popular trader on eToro you need to get qualified as a “Cadet” by being active on eToro for more than two months, setting out your strategy, having a visible profile, and not losing money. Once you have progressed to a “Champion” you can start to earn up to $500 a month from your followers (based on how much money is following you). But the real money-making ability comes from being a popular trader on eToro, which comes when you are classified as an “Elite” investor where you can earn up to 1.5% a month of annual AUC (accounts under copy).

⚠️Keep in mind that it’s also possible to lose money as a popular investor. If you are investing do become a profitable trader and you don’t pick winning investments will lose money and your capital will be at risk.

#5 Earn passive income on eToro with dividend shares and stock lending

eToro hate it when you mention two things, if you can make money on their platform, and also use the phrase “passive income” with anything to do with their services or products. I think this is probably becuase “passive income” is one of the biggest social media scams going where influencers and ads try and sell courses in the hope of suckering in people to buy courses or invest in dodgy schemes.

Which is a shame, because, one of the great things about investing is that you can create regular passive income streams, through buying dividend stocks.

All you need to do to generate a passive income on eToro this way is to buy a range of stocks that pay their dividends at different months. You can use a site like Dividendmax to see a calendar of when these are paid.

Dividend stocks are great investments because they are usually well-established profitable companies (dividends are a slice of the profits they pay to investors), and generally go up slowly and steadily. However, obviously, nothing goes up in a straight line, and some go down, and some go bust, so make sure you pick your stocks well.

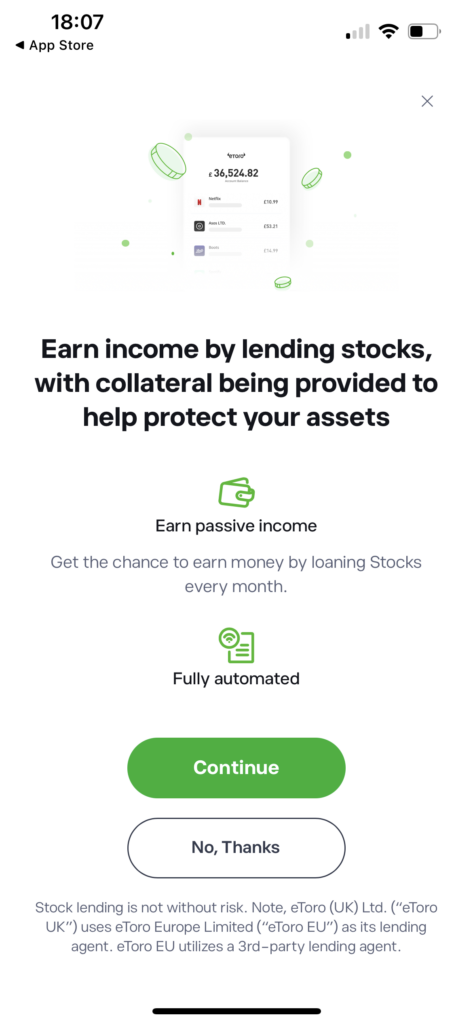

The second way to earn a passive income on eToro is through their stock lending program. Now even though eToro is constantly asking me not to use the phrase “passive income” when writing about them they have started doing it themselves so I’m assuming it’s ok.

In December 2025, eToro launched stock lending, which basically means that if you own some shares in a company like Tesla, and someone else wants to short Telsa, they need to borrow some shares from someone, so they can sell them to someone else, in the hope of buying them back cheaper, and then give them back to the person they borrowed them from.

All brokers have huge stock lending departments and they do make a lot of money, because they charge interest or a fee for lending their customers stock out. Historically, brokers have always kept all the money, but now, in a grab to get more customers, brokers are sharing some of that income with their clients.

So, if you have some fully paid-up stock held in your eToro account that you are not planning on selling anytime soon, you can join eToro’s stock lending program and lend your shares to someone else who is going to bet against you.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.