BP shares are down 7% this week as the US CEO resign. In this analysis we look at why the BP share price has dropped and if this is a buying opportunity.

BP share price drops as CEO resigns

The BP share price has dropped because of the CEO’s resignation. The market does not like sudden and unplanned change.

Losing a CEO suddenly in a major company is always a rocky process. Just a few weeks ago, the top executive of BP (LON:BP.) Bernard Looney resigned with immediate effect following a string of allegations. Soon after, the CEO of BP America Dave Lawler also left the oil company.

While the integrated energy firm swiftly appointed Murray Auchincloss as its interim chief, a major shakeup at the top has cast a long shadow on BP’s share price.

Initially, the market was unperturbed. As a matter of fact, BP’s share price even extended its rally towards its spring peak (around 570p). Then, BP’s third quarter results disappointed the market. Price gapped down, which stretched the correction from its October highs to double digits.

Suddenly, questions swirled about the company’s strategy, and whether BP’s newly installed chief is able to handle the complex machinery of an oil major.

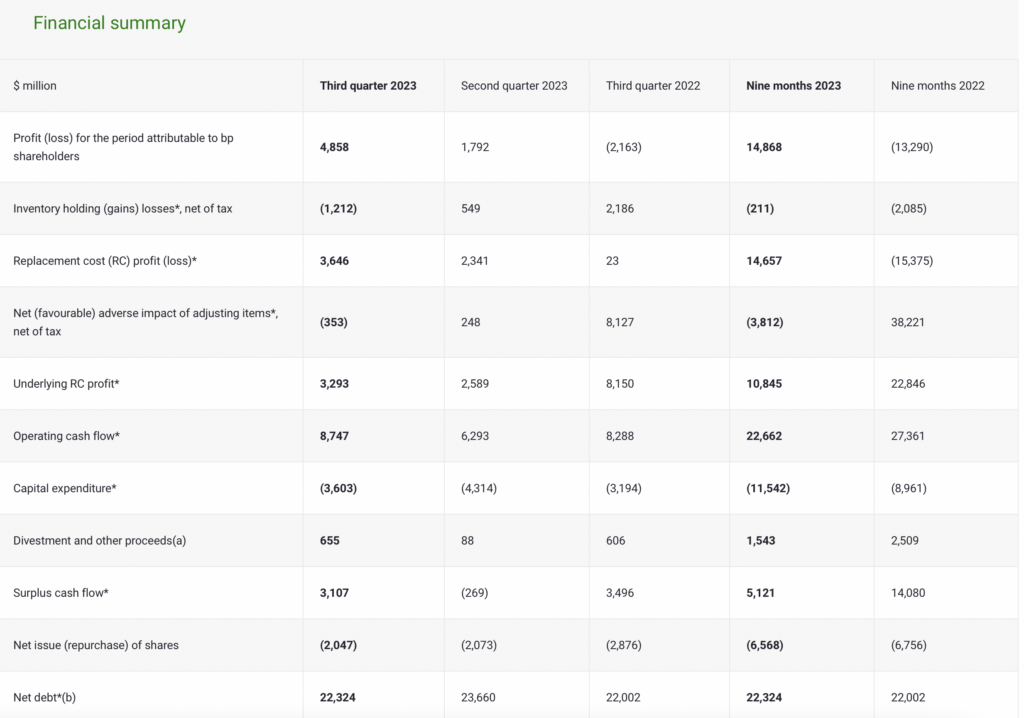

Compared to a year ago, BP’s third quarter profits of $3.3 billion has more than halved ($8.2 billion). Net debt of $22.3 billion is slightly higher than 3Q’22 (see below). While BP increased its share buybacks by another $1.5 billion, the market wasn’t overly impressed. According to the company, the buybacks will eat up 60 percent of its 2023 free cash flow.

Perhaps earnings expectations were too bullish on BP after the sharp rebound in oil prices during the summer.

In contrast, Shell’s (LSE:SHEL) third-quarter results on Nov 2 exceeded market forecasts and its share price bounced up nearly 2 percent at the time of writing.

Source: BP plc

Should you buy BP shares?

Given the relative underperformance of BP’s shares, should we overweight the energy stock?

The major driver of BP’s share remains that of the buoyant oil price. Given the recent announced coordinated oil cuts (by Russia and Saudi), oil prices are expected to stay high into 2024. Geopolitical tensions in the Middle East are inducing more stockpiling of the black gold. Against this backdrop, profits from BP’s operations are likely to stay high in the near term.

Of course, the negative camp may argue that there are other oil companies that are larger and better managed- such as Shell or Exxon (US:XOM). The latter has been on an acquisition spree; it snapped up Pioneer Natural Resources for $60 billion.

At this point, BP’s market cap is small – only £80 billion ($100 billion+) – compared to Exxon or Shell. Therefore, some argued that BP is unlikely to have enough financial resources to keep with the ‘big boys’ – a gap that will only widen over time.

Lastly, the turmoil at the top may continue to dent investor perception of the company.

In all, I suppose BP still hold some attraction for value investors. Sustained profitability, share buybacks, and good dividend yields are all that matters for a conservative portfolio. In this regard, the recent correction could open up a window of opportunity to buy BP shares at cheaper prices.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com