Many say that stock price is one of the best indicators for a company performance. After all, stock prices settled at levels which are based on the ‘collective wisdom’ of a crowd.

Look at British Airways (IAG). The stock was cruising at high altitude until February this year. Prices hit a severe air pocket when the company received a record £182 million fine from the regulator in March. Since then, the management mishandled one episode after another, from IT glitch to labour relations. All these led to further declines in its stock price. Investors are now pencilling a drop in BA’s future profits.

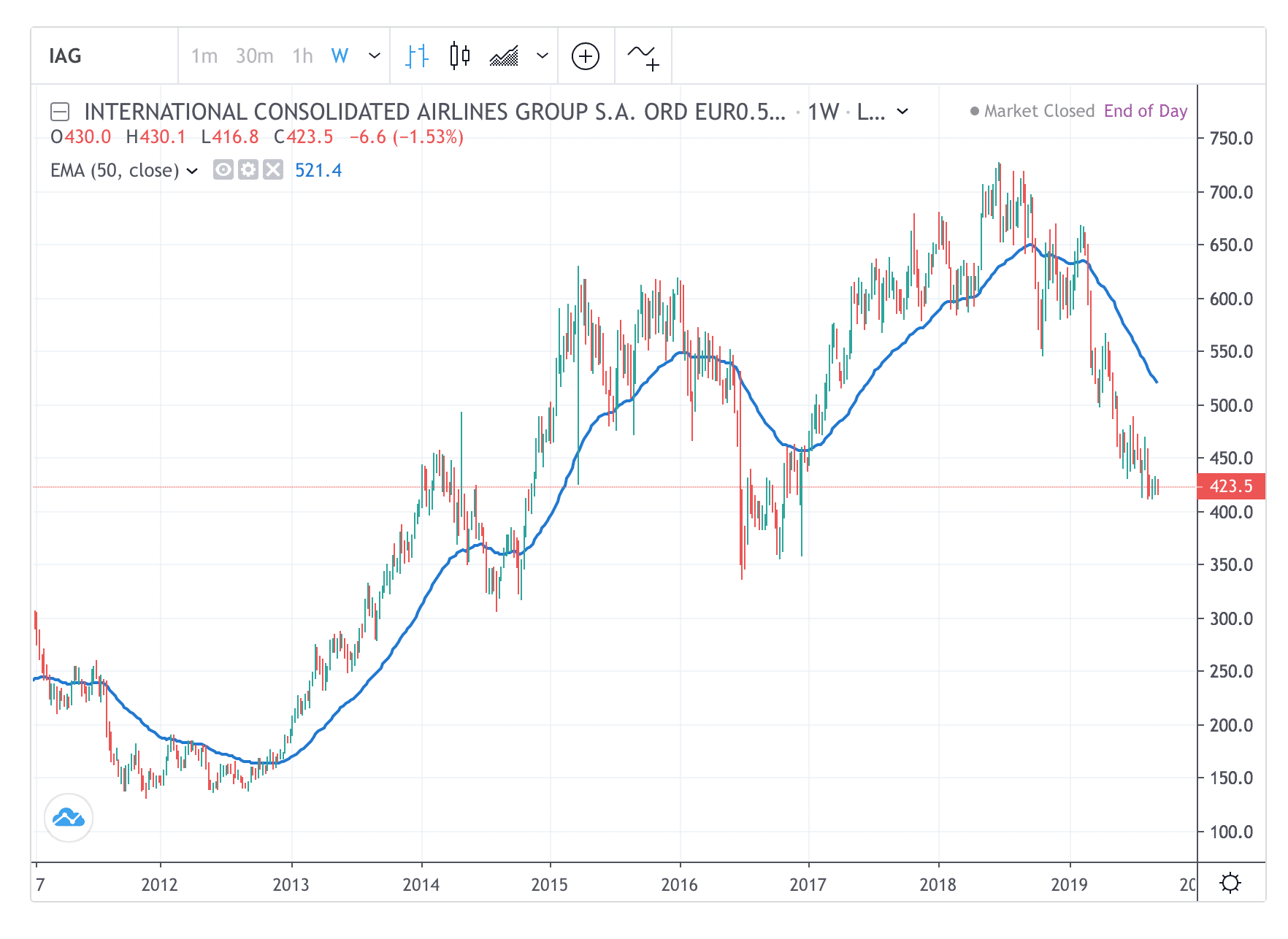

Technically IAG is mired in a well-defined downtrend (see Featured Chart). Lower lows and lower highs beneath its long-term trend indicator mean the stock is on route to test the 400p round number level. While there appears to be tentative support at 350-400p, developed from the lows established in 2016, until firm solves its pilot problem, bargain hunters are staying clear of this stock. One FT commentator aptly observes ‘pilot’s strike points to deeper British Airways malaise‘.

Sectorwise, Ryanair (RYA) is also mired in a long-term downtrend. Prices have halved since 2017. So IAG could also be suffering from sector negative factors like Brexit. See also Easyjet (EZJ), which is struggling to overturn its 18-month bear trend.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.