As IG launches Turbo 24s, it’s often said that necessity is the mother of invention, that is good ideas spring up in the darkest of times. The last year has been a torrid one for the margin trading and spread betting industry, change has been forced upon them and participants have had to adapt or die.

Tightening their belts, upgrading as many of their customers to pro status as regulations allowed and trying to differentiate their offerings, from the competition, has become standard practice for brokers, over the last 15 months.

However, this week we have perhaps seen the first piece of genuine product innovation from a forex broker, real differentiation and a not just a quick fix. The innovation comes from the market leader IG Group in the shape of new on exchange derivative, the 24-hour Turbo.

What is IG’s Turbo 24s Warrant?

The Turbo warrant as it’s more formally known is not a new invention but IG has taken an existing product and embellished it.

Think of a Turbo warrant as a securitised options contact with a limited downside, which we can consider to be the option premium. The key feature of the Turbo is that it has a barrier or stop out level and if the price of the underlying instrument hits that stop out price then the option expires but if it doesn’t then option remains open.

What CFD broker IG has done is to create a series of Turbo warrants on a number of liquid underlying markets, such as, currencies, equity indices and commodities and then listed those structures on an exchange. In this case, the Spectrum MTF or Multilateral Trading Facility, a technology-driven electronic exchange based in Germany.

As Spectrum is an electronic marketplace trading takes place 24 hours a day, 5 days per week. Allowing the IG products to steal a march on similar warrants listed on more traditional exchanges, which trade for only a limited part of the day.

An example of a Turbo 24s Warrant trade:

A client is trading the DAX which has an underlying price of 11,000 and thinks the market will go up

The client picks a knock-out level of 10,900 (effectively a guaranteed stop level if the market moves against them, however they can close the trade at any time before this)

Long turbo = ((value of underlying – knock-out) + premium) ( x multiplier) [+spread around the mid]

= (11,000 –10,900) + 20) (x 0.01) [+0.01 point spread around the mid]

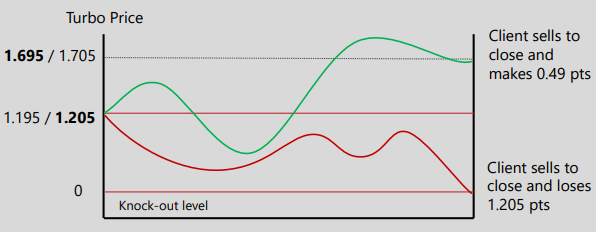

= 1.20 bid/offer therefore = 1.195 / 1.205

This means pricing is linear. If the underlying market goes up/down by a point, the turbo price increases/decreases by 0.01. If the knock-out level is reached, the turbo is closed and rendered worthless (including the premium).

This means pricing is linear. If the underlying market goes up/down by a point, the turbo price increases/decreases by 0.01. If the knock-out level is reached, the turbo is closed and rendered worthless (including the premium).

If the market rallied by 50 points to 11,050, the turbo would then be priced at 1.695 / 1.705* and the client would sell to close at 1.695 for a 0.49 point profit. If the market moved against the client by 120 points to 10,880, the turbo would hit the knock-out level and

close automatically. This client would lose 1.205 points.

Key Benefits of IG Turbo 24s Warranties Versus CFDs

| For Turbo Warrent Traders | For CFD Traders |

| 24-hour market access – trade outside normal market hours | Flexible leverage and risk – set your own leverage levels |

| Superior platforms and apps – on IG proprietory turbo trading platform | Transparent, on-venue trading – meaning transparent pricing |

| Zero commission – limited exposure to stake | Range of markets – trade on the highly liquid index, forex and commodities |

Perhaps the real selling of point of the new IG Turbos is the fact that the underlying client can choose the level of gearing or risk they wish to expose themselves to at the outset of the trade. This accomplished by setting the barrier or stop out for the option, effectively the equivalent of a guaranteed stop, so the maximum loss on the trade is known in advance.

As IG points out this means that clients can vary the risk they take by trade, or indeed by instrument rather than leverage being dictated at the account level.

What is the downside of IG Turbo 24s Warrants?

Of course, apart from potentially losing all your money traders can only buy the 24-hour Turbo’s not short them. If you want short exposure to a market or instrument you simply buy a put warrant. If you want to be exposed to the upside you buy a call warrant, this helps to keep client risk profiles as vanilla as possible.

The pricing of the 24-hour Turbo does look slightly opaque at first, but in laymen’s terms, the cost of the warrant is the difference between the current value of the underlying instrument the warrant is over, less the value of the knockout, plus a variable premium, plus or minus a modest bid-offer spread.

Individual clients cannot trade directly on the Spectrum MTF and must do so through a broker. IG Europe has become the first broker to join Spectrum and clients can access the exchange and its products through them, but be aware that IG Group is also the owner of the Spectrum exchange.

Who can trade IG Turbo 24s Warrants?

Spectrum will list these new products in multiple European jurisdictions, France, Germany, Italy, Norway, Spain, Sweden and the Netherlands but not the UK. At the moment it’s not clear if UK clients will be able to access the products via IG Europe.

UK traders shouldn’t get too upset though, the UK is still the only country that gets the tax breaks for trading financial spread betting.

Spectrum and its owners (also IG) hope that they can attract other product listings and participants to the exchange, listing formalities can be concluded in a day, the exchange says, and costs are likely to be lower than those offered by competitors.

In an ideal world, we would like to see a competitive market making landscape in these products, just as one finds in the ETF market. Where firms other than the originator of the product make prices and compete against each other for business in them.

That hasn’t been the structure of the existing turbo warrants market to date, but now with a dedicated exchange and all trades cleared by Clearstream, a division of Deutsche Bourse, we’d like to think that could ultimately happen here and we will watch the progress of both the 24-hour Turbo’s and the Spectrum exchange with interest.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.