The DAX index (Deutscher Aktien Index or German stock exchange in English) is an equity index which tracks the performance of Germany’s leading stocks. Historically, the DAX index was known as the DAX30 because it comprised 30 major German stocks. Launched in 1988 with an initial 1,000 index points, the index has become a major barometer on the German stock market. Stocks like the sporting giant Adidas (ADS), luxury automaker Mercedes-Benz (MBG) or Siemens (SIE) are all members of the DAX index.

DAX30 to DAX40

However, in September 2021 a major revamp was conducted to widen the constituents of the DAX index. This is due to the constant expansion of German companies over time. Forty, instead of thirty, largest stocks listed in the Frankfurt stock exchange now made up the DAX index. To be selected for this prestigious index, the company has to be among the largest stocks and fulfilled the minimum liquidity and reporting requirements. The DAX index is traded in Germany’s native currency, the euro. The sponsor of the DAX Index is Deutsche Börse, itself a major stock exchange group and a constituent of the DAX index.

The Index

According to the calculating agent Qontigo,

DAX is primarily calculated as a performance index and is therefore one of the few major country indices that also takes dividend yields into account, thus fully reflecting the actual performance of an investment in the index portfolio.

Strict protocol must be followed when calculating and maintaining the DAX index. Constituents are ranked periodically and are then included in the index at each review. The DAX is a capitalisation-weighted index, meaning larger stocks will have a bigger price influence on the index. But there is a 10% cap on any individual stock. Check out this document (June 2023) for a more detailed discussion of the DAX equity calculation.

Apart from the DAX, there are other related equity indices, including the MDAX (mid-caps), SDAX (small caps) and TecDAX (tech stocks).

While not exciting as the Nasdaq, the performance of the DAX Index in the past decade has been superb. Ample returns for German shareholders for sure. More interestingly, despite the turbulent economy in the past year or so, the German index scaled new highs as recently as May this year. Bullish is what most would describe DAX’s long-term price trend below:

How Can You Trade And Invest In The DAX?

Germany is a major pillar in Europe. Apart from being a member of the elite G7 (Group of Seven Industrialised Nations), the country is a founding member of the European Union. Naturally, the German stock market, one of the largest in the world, attracts international capital. Many funds trade German shares; and investors desire a slice of the country’s vibrant industrial landscape.

- Related guide: Best brokers for DAX trading compared and reviewed

Given the prominence of the DAX Index, major investors and speculators have been using modern financial instruments to capitalise on DAX’s returns. But in the past, before the introduction of exchange-traded funds, you could not ‘buy an index’. You had to use futures or options to gain exposure to the index movements. Now there are many ways to invest in the DAX index, including:

- Futures – Futures contracts are derivatives that track some underlying instrument. Here DAX serves as the underlying. DAX futures (FDAX) are traded on the Eurex exchange.

- Options – Options are derivative contracts with some embedded leverage and an expiry date. Most DAX-based options (ODAX) are European options, that is, holders can only exercise on expiry dates. Like DAX futures, ODAX are traded on the Eurex exchange.

- ETFs – Exchange-traded funds are funds that can be traded like a stock. An ETF can hold a portfolio of stocks (physically) like DAX. There are a few ETFs that are suitable passive investors.

- Shares – Shares are the most straightforward way to invest in DAX. You can to buy all the constituents’ shares – all 40 of them. But this would be very time-consuming and costly. A fund like ETF is better suited for this task.

- CFD – Contract For Difference enables traders to place financial bets on the directional movement of an underlying instrument. Many brokers offer CFD services on DAX indices to clients who have sufficient capital. Traders do not own the underlying DAX; they just bet on the difference between the opening price and the subsequent closing price.

A brief overview of the abovementioned derivatives is exhibited below:

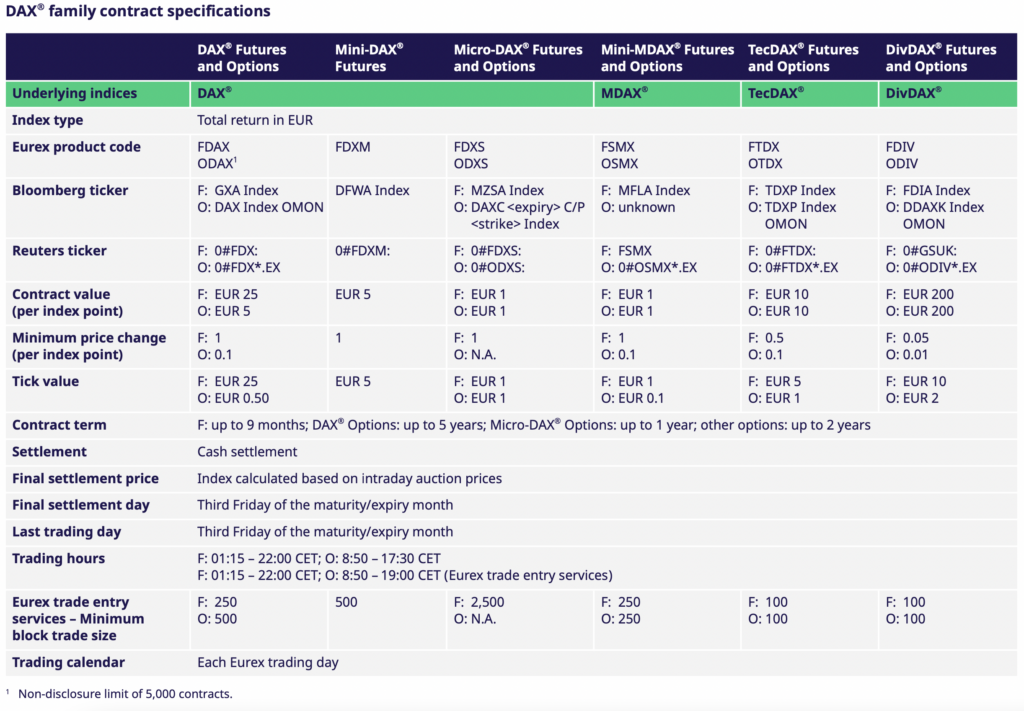

Source: Eurex.com

How To Trade DAX Shares

There are many heavyweight world-class German companies.

These companies, whilst not having trillions in market cap like FAANG, are profitable and enjoy a wide moat in many industries. That’s why long-term investors like you should always consider investing in European companies, especially durable German companies. They have been thriving for decades and may continue to do so over the medium term.

A partial list of DAX constituent stocks, together with their weightings (as of March 2023), is shown below:

Source: wiki-dax

While the DAX index is not a technology-oriented club like Nasdaq, it has many major and dominant players in automotive (BMW, Porsche, Benz), chemicals (BASF, Bayers, Covestro) and even insurance (Allianz, Munich Re, Hannover Re).

An important point worth making is that many of these German companies are major global conglomerates. They derived plenty of their earnings from emerging markets and Asian countries. They are sufficiently diversified and are benefitting from the spending boom in Asia.

From the perspective of UK investors, you can buy and hold these German stocks in your normal broker account. For example, in your ISA (individual savings account). Share price aside, when contemplating German shares you have to pay attention to a few other factors like:

- Transaction costs – foreign shares cost more to buy and sell

- Foreign exchange rates – the rate to convert GBP to Euro (when buying) and the rate to convert the Euro back to GBP (when selling). Interactive Investors , for instance, charges 1.5% of foreign exchange fees per leg of the transaction.

Some of these costs can stack up if you trade too frequently. In addition there are other items to consider like dividends or capital gains tax, When transacting foreign shares, perhaps taking a longer view is more appropriate.

Note: The Deutsche Börse Xetra is open from 9:00 am to 5:30 pm (Mon-Fri) Central European Time (8:00 am to 4:30 pm GMT).

How To Trade DAX Futures

FDAX futures contracts are a permanent and exciting feature in most developed capital markets.

These derivatives enable trading of the underlying at a faster pace – due to a greater degree of leverage. DAX futures are financial futures. This means that there are four standard quarterly futures per year (March, June, September, December).

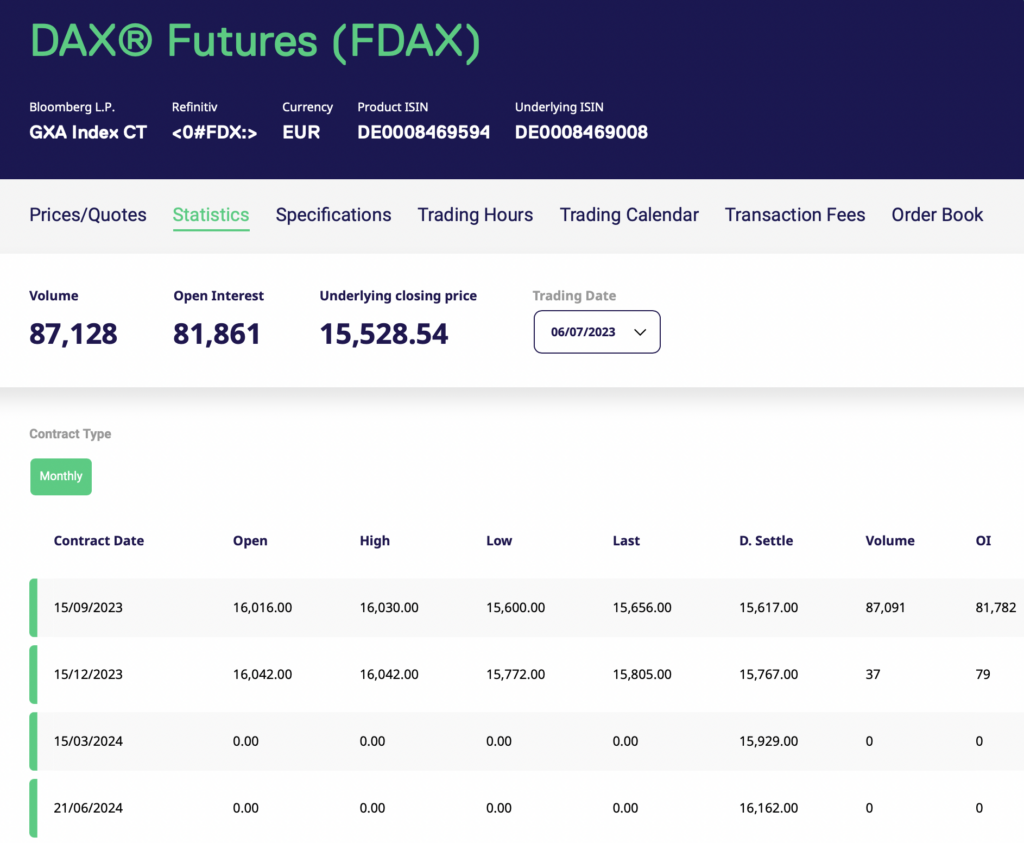

For example, in July traders would focus on the nearest DAX contract – September ’23 – as it will expire at the earliest (on the third Friday of September). When it does, trading migrates to the next nearest contract (December ’23) and so on and forth. The process of this migration of future contracts is called ‘roll over‘.

Typically volume is concentrated on the nearest contract, as liquidity is better. As you can see below, the open interest and volume of the September DAX future is significantly higher than the December future. As a trader you might want to concentrate on this derivative.

The chart below depicts the DAX (Sep’23) contract. Note the thin price movements earlier in the year. Traders then were focussed on the March and June contracts. Only after the expiry of these contracts did volume on the September contract rise markedly. This contract will the main one to trade until it expires in September.

Source: BarChart.com

The tick size of the DAX is one index point. For the future, the added leverage is 25x. For example, if the DAX is at 15,500 the full contract size is 15,500 times euro 25, which equals euro 387,500. A small 100-point move in the DAX Index will lead to a euro 25 times 100 (euro 2,500) monetary fluctuation in the future contract.

Imagine a 7-percent drop from, say 15,500, on a fearful session. This creates a four-digit point move and a five-digit monetary fluctuation in the future contract. In other words, the DAX future is a large contract.

According to some brokers like Saxo Markets, you will need about euro 35,000 just to open a position in DAX future (known as ‘initial margin‘). This is only about 9% of the total contract value. Traders should have much more capital buffer than this to cover price trends in DAX futures. If not, you will receive an unpleasant ‘margin call‘ to top up the trading account should prices move against the open position. Should losses deplete capital quickly, the broker is most likely going to cut the position (‘forced liquidation’) to stem the losses.

In view of this large contract which discourages small traders, the exchange has created two smaller DAX contracts:

- Mini Dax future (FDXM, Eurex spec) – which only has euro 5 per index point move

- Micro Dax future (FDXS, Eurex spec) – that has a euro 1 per index point move (essentially very low leverage).

These contracts have similar features as the main DAX futures but have a lower leverage. This means that the amount needed to open and maintain the positions are smaller.

Source: Eurex.com

DAX futures are traded through an electronic system maintained by Eurex. You can buy and sell futures between 09:00 – 17:40 in Central European (CET) time. Out of hours prices (17:40 – 22:00 CET time) are available. In the UK, DAX is available to trade from 07:00 to 21:00 (UTC).

How To Trade DAX Options

Futures apart, financial options are popular with traders. Eurex is the main exchange that conducts DAX options trading.

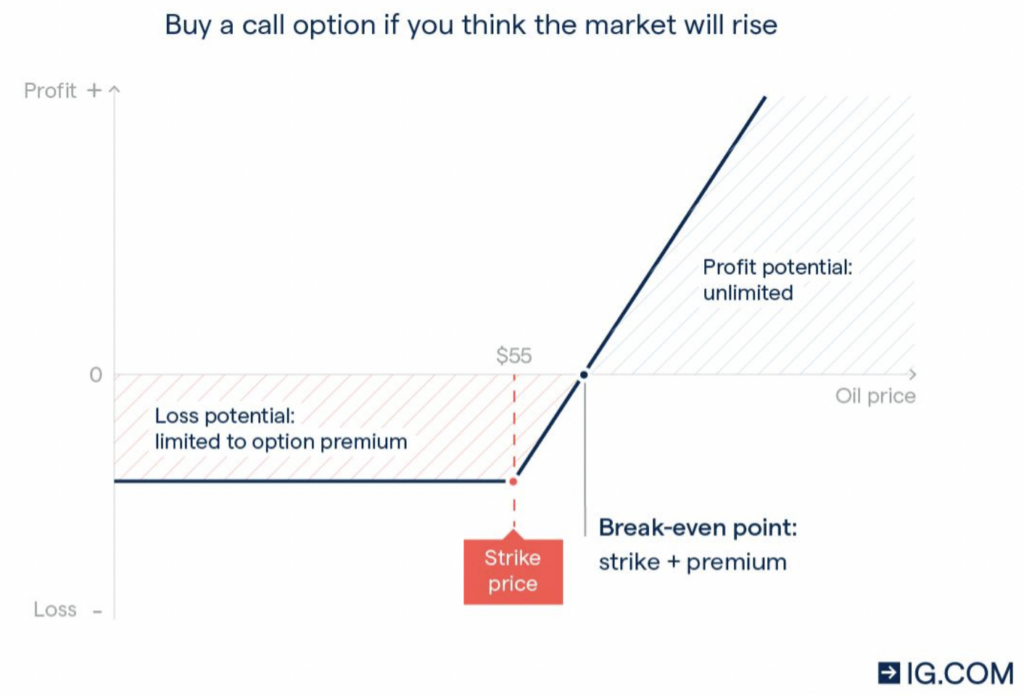

Options are the time-limited bets on the movement of the equity index. The first main separation of options is whether it is a call or put option. Call options are the right to buy; put options are the right to sell. The other elements to know are the strike price and the time to expiry. There are various levels of strike price available for traders to buy or sell options. These days, maturity dates can be quite short (weekly). Based on these known factors, traders use the Black-Scholes model to calculate the premium.

Graphically, buying a call option has a profit-and-loss profile like this:

Source: IG.com

For put options, the profit-and-loss profile is the opposite. If the underlying depreciates, the right to sell becomes more profitable. Selling options are riskier since losses are uncapped – unless sellers hedge their positions.

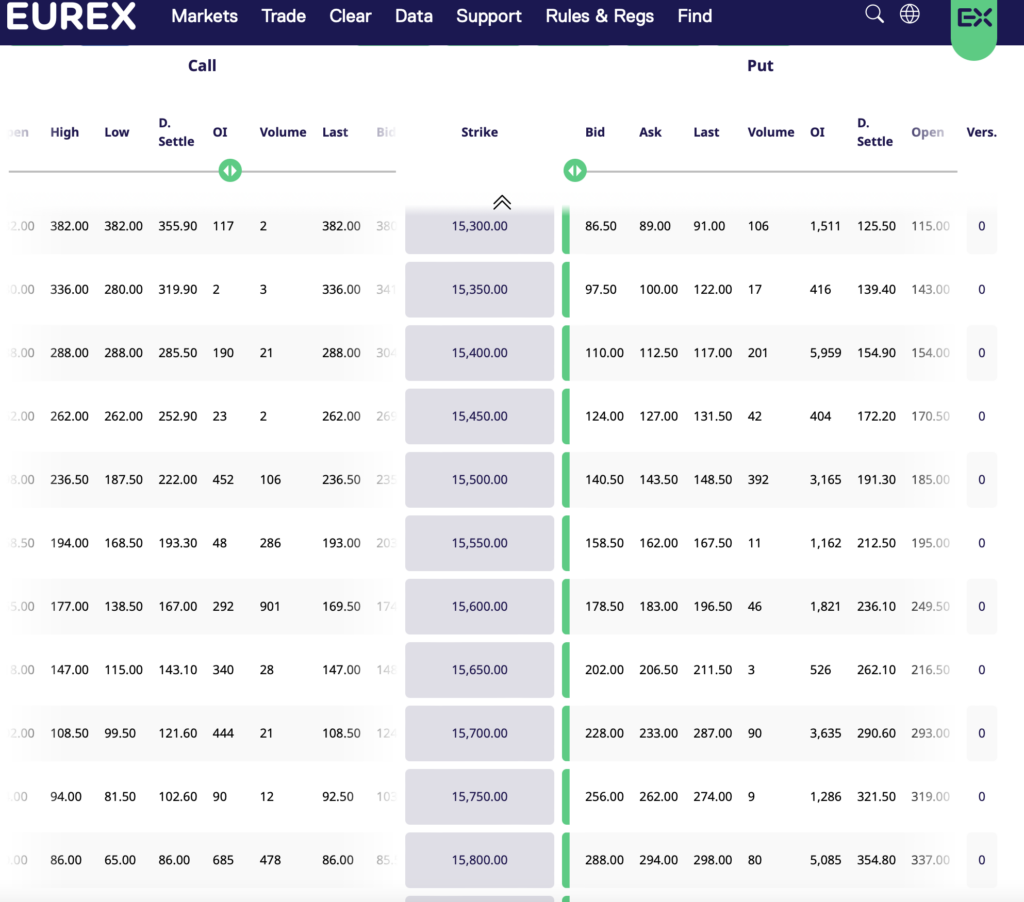

Market makers provide quotes for many levels of strike levels on both put and call options. Some have better liquidity; some are harder to trade. Depending on your view of the DAX index, you choose the strike price to price to buy and sell options.

Trading option contracts generate commission and bid-ask spreads. To have a positive return means profits have to be greater than these trading costs. If the underlying has moved in your desired direction, option buyers can sell the option for a profit.

When the underlying instrument is very volatile, option premium increases as the risk is seen to have risen.

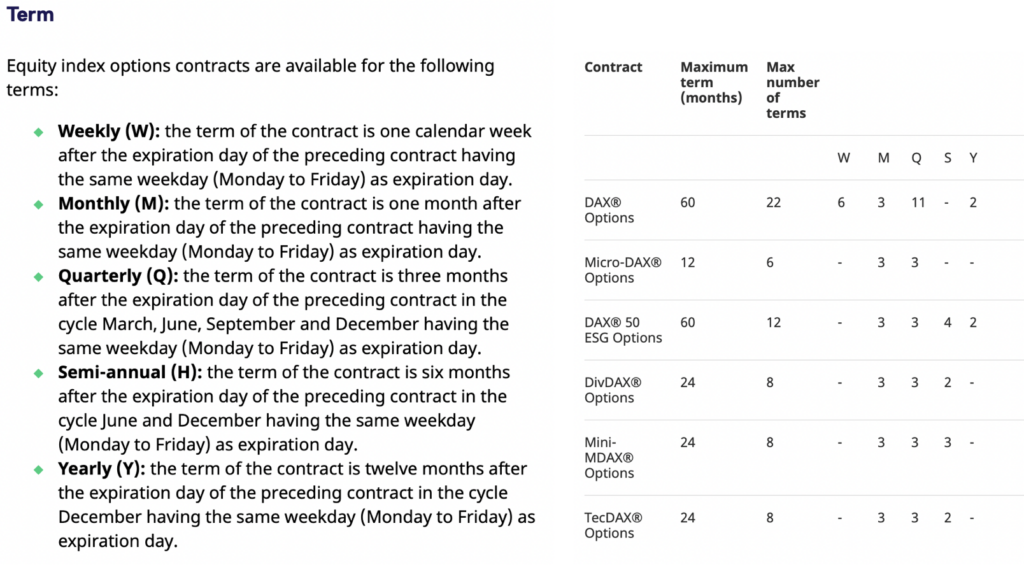

Apart from DAX Index, there are options available on DAX 50 ESG, DivDAX and TecDAX. The multiplier for DAX index and DAX micro index option are euro 5 and euro 1 respectively. The lower the multiplier, the lower the leverage.

Source: Eurex.com

The last point about DAX options is that there is an array of expiry dates, from weekly to monthly. Assuming all other factors are constant, the longer the option the larger the premium.

Source: Eurex.com

How To Trade DAX ETFs

Exchange-traded funds are extremely popular with investors these days.

One reason for this is the low cost of passive equity ETFs. In the US, the most popular is the S&P 500 ETF (SPY). Gross expense ratio for $420 billion trust fund totalled only 0.095 percent! No wonder investors love ETFs.

For DAX, one of the most popular ETFs that track this index is the iShares Core DAX ETF (DE). The euro 5.5 billion fund has a gross expense ratio of about 0.16 percent (DE/DAXEX ETF factsheet). Chartwise, the ETF exhibits a trend like the DAX. Unfortunately, this ETF does not appear to be ISA eligible. So you will need to buy it in your normal stock account.

Of course, there are other similar DAX-related ETFs sponsored by different financial companies, ETFs like the Lyxor DAX ETF (DAXX), or the xTrackers DAX ETF (XDAX). Another is the Wisdom Tree Germany Hedge Equity Fund (US:DXGE) The problem with these ETFs is the liquidity is not as good as the larger ETFs.

In the US, the more popular Germany ETF is the iShares MSCI Germany (EWG, factsheet), with net assets of $1.4 billion.

The point about these German ETFs is that there are generally smaller than their US counterparts. Many investors outside the Eurozone prefers a pan-European approach when investing in the region. For example, the Vanguard FTSE Europe (US:VGK) has about $18 billion in AUM – about 10x largest than the German-focussed ETF (EWG). Another is the $8-billion iShares MSCI Europe ETF (US: EZU).

Lastly, there is a suite of European single-country focussed ETFs in the US, including iShares MSCI Italy (US: EWI), iShares MSCI Belgium (US:EWK) or iShares MSCI France (US:EWQ).

DAX FAQs

You can’t trade the DAX index directly. Rather, you used financial proxies like financial futures to invest in the index. First, you must have an account with a recognised broker to buy and sell DAX futures and options. Second, your account must be sufficiently capitalised to trade the DAX.

The best way to invest in DAX is to buy shares of the DAX constituents. There are a few ways to do this. One, purchase shares directly with your stock broker, although you will have to watch for exchange rate movement, fees and tax. Two, buy exchange-traded funds (ETFs) that are invested in large-cap German stocks. Three, buy funds that research and hold German stocks.

DAX is a major German index and a popular global equity index. It is therefore very liquid. The best time to trade the index is when European markets are opened. DAX derives its value from changes in the share prices of the constituents. Liquidity is highest during the opening and closing hours of the local trading time (CET).

You need to have access to a broker which can transact DAX futures on your behalf. Moreover, if you’re outside the Eurozone, the broker needs to be able to hold a foreign currency account on your behalf. One such broker is Interactive Brokers. After depositing sufficient capital into the broker account, you can buy and sell DAX future contracts depending on your margin.

DAX is a blue-chip equity index that is derived from large-cap German stock traded on the Frankfurt stock exchange. Most traders used DAX derivatives to bet on the index. These derivatives are mostly traded on the Eurex exchange (Eurex.com).

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.