Hargreaves Lansdown has announced its first major fee shake-up in more than a decade, cutting platform and share dealing charges in a move the company says will deliver “even greater value” for the UK’s growing base of DIY investors and savers. The new pricing will take effect automatically from 1 March 2026.

HL, the UK’s largest stockbroker and savings platform, which now serves more than two million clients, said the changes reflect how customer behaviour has evolved, with far more investors actively trading funds today compared with when fees were last updated. HL described the overhaul as an “investment into the tens of millions of pounds” aimed at making investing simpler and more accessible.

HL’s changes will benefit many clients through lower platform and share dealing fees, but the introduction of fund dealing charges, new share custody costs, and relatively expensive FX rates means some customers, especially active fund traders and international investors, could end up paying more.

HL Account Charges Reduced

Under the new structure, HL’s headline platform fee will fall from 0.45% a year to 0.35% for Stocks and Shares ISAs, SIPPs and Fund and UK Share Dealing Accounts. At the same time, online share dealing fees will drop sharply from £11.95 to £6.95 per trade, with trading remaining free for clients who invest monthly through regular savings or dividend reinvestment.

Free Regular Fund Investing

The most notable new charge is a small £1.95 fee for buying and selling funds online, again waived for regular monthly investors. HL said this change reflects a shift towards more frequent fund trading over the past 12 years.

HL believes the overall impact will be positive for the vast majority of clients. The company estimates that 8 in 10 customers will either be better off or pay the same, while 94% will see a reduction, no change, or an increase of no more than £5 per month.

Reduced Pension Fees

There are also enhancements to HL’s Ready-Made Pension Plan, with the account charge applied to holdings dropping from 0.45% to 0.15%, taking the all-in cost down to 0.45% a year, which HL claims is cheaper than most workplace pension schemes.

Interim CEO Richard Flint said HL was founded to provide “the best products and the best support at the best value,” adding that the group will continue investing in technology, service and product choice.

Hargreaves Lansdown is still one of the most expensive investment platforms in the UK, but, many customers who have left reviews on Good Money Guide feel as though this is offset by the customer service, for which HL has won many awards.

Why HL’s 2026 fee changes could be bad for customers

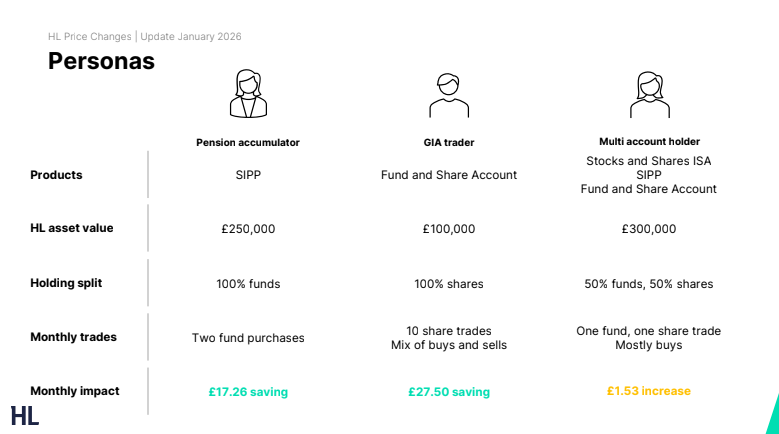

The below image from HL shows how different types of clients can benefit from the new pricing structure, but it’s not good news for some types of Hargreaves Lansdown investors.

Although Hargreaves Lansdown says “8 in 10 clients will be better off or pay the same” and that most increases will be small, there are clear downsides depending on how you invest.

1. Fund investors now face a new dealing charge

The biggest negative change is the introduction of a £1.95 fee every time you buy or sell a fund, unless you invest through a regular monthly plan.

For investors who make occasional top-ups, switch holdings, or rebalance portfolios manually, this represents an entirely new cost that did not exist before. HL argues this reflects increased fund trading behaviour, but for many long-term investors, it looks like a new “pay-per-use” penalty.

2. Share investors face a new platform charge and capped custody fee

HL is also introducing a 0.35% fee for holding shares, capped at £150 per year per account.

That means investors who mainly hold ETFs, investment trusts or direct equities could see their costs rise compared with the previous structure. HL itself notes that 2.5% of customers would see fee increases of more than £10 per month, largely due to the standardisation of custody caps.

3. Foreign exchange charges remain a weak point

HL’s foreign exchange costs remain another sticking point for overseas investors.

From March 2026, FX charges will still apply on overseas trades, and even Junior ISA investors will now have FX fees payable on international dealing. HL’s tiered FX rates (up to 0.99% on smaller trades) can significantly increase the true cost of buying US shares or overseas ETFs.

How does HL’s new pricing compare to interactive investor’s recent changes?

interactive investor recently changed it’s commission structure for 2026, but, instead of adding new per-trade fund fees, ii recently announced that it was cutting FX fees and simplifying pricing, positioning itself as better value for customers who invest internationally.

That puts pressure on HL, particularly as more UK investors diversify into US markets, global ETFs and overseas equities.

If competitors continue cutting FX fees and simplifying costs, HL’s new structure may not feel like “greater value” for everyone.

It’s still a great broker for larger accounts that want personal service, but for those just starting to invest low or zero cost investing apps like Lightyear and Freetrade may be more appealing.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.