One of the most shocking developments in the market this year is the arrival of negative bond yield rates. So what should you trade and invest in?

In this brave new world, investors are hoarding cash in bonds/assets that are guaranteed to lose them some money. All these in the name of ‘safety’.

For example, if an insurance company has one billion euros at -50 basis points (-0.5%), it would cost the firm 5 million euros just to hold this pot of cash. Negative rates, in Warren Buffett’s mind, is a bizarre phenomenon that ‘distorts everything.’

In Denmark, it is widely reported that some banks are paying their mortgagors to borrow. Even in the European junk bond sector, where risky companies usually needed to pay more to borrow, some yields have plummeted below zero. Shocking but true.

Lower for Longer

Economic growth in Europe is falling. Coupled with indebtedness across the board, this means the European central banks are forced to pin interest rates to the floor to resuscitate the economy.

And this is happening even before we hit a recession, although you may say we are getting close. When a recession comes, it’s likely that the policy interest rats will go even lower in the next few quarters.

What happens when interest rates are stuck at zero across the yield curve? Well, growing capital with compounding – the eighth wonder of the world – becomes a wish. You might as well put your cash under your mattress.

Earlier, I pointed out why holding cash is a good idea because it gives the holder some ability to buy assets should prices fall dramatically in the coming months.

Negative interest rates means that you are now being penalised for holding this strategic asset. If rates were to slip further in the future, those cash sitting in portfolios and bank accounts will be suffer even more.

Should you, then, move it elsewhere where returns are higher?

Cash-Alternative Options

Well, let’s start with some the broad options:

- Pay the penalty – but keep a similar levels of cash

- Reduce cash holdings

Should you decide to go for the second option, where should you move it to?

2.1 Buy mid/long duration government bonds – carries investment risk

2.2 Buy stocks – carries investment risk

2.3 Buy short duration/money market funds

Now, depending on your reading of the market, you may decide that your portfolio has enough investment risk for now. So will need to buying into some very short-term bond funds/money market funds.

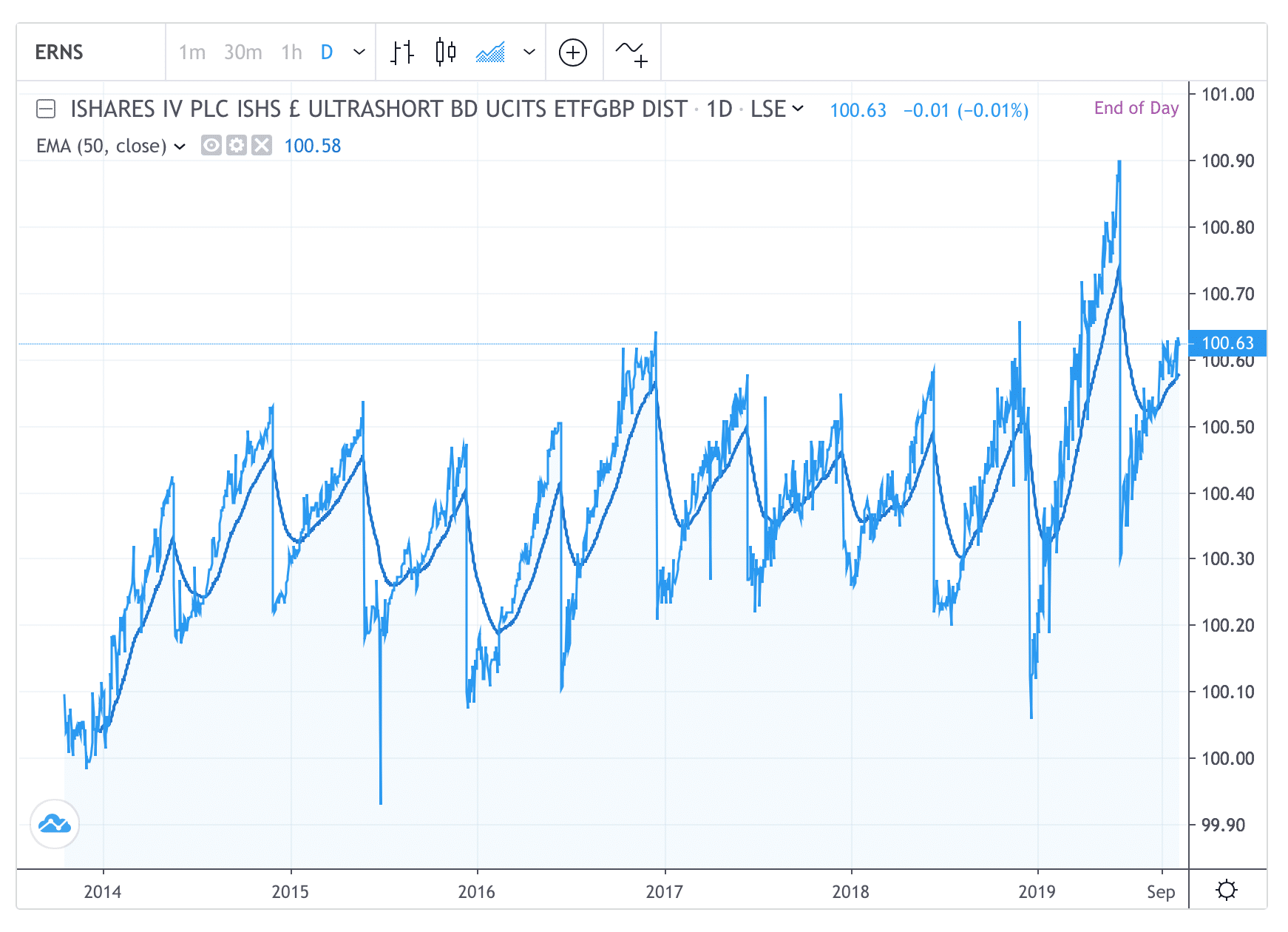

One possibility is the iShares GBP Ultrashort ETF (ERNS). It is Sterling denominated and has £950 millions AUM. (Factsheet) The fund invests primarily in investment grade corporate bonds in the UK.

Another alternative is the Royal London Short Term Money Market fund, with about £3 billion AUM. So this is a fund with a decent size. Its objective is to provide income in line with SONIA. Some funds also aim to replicate the returns from SONIA with synthetic swaps. So you do need to check out the fund’s prospectus.

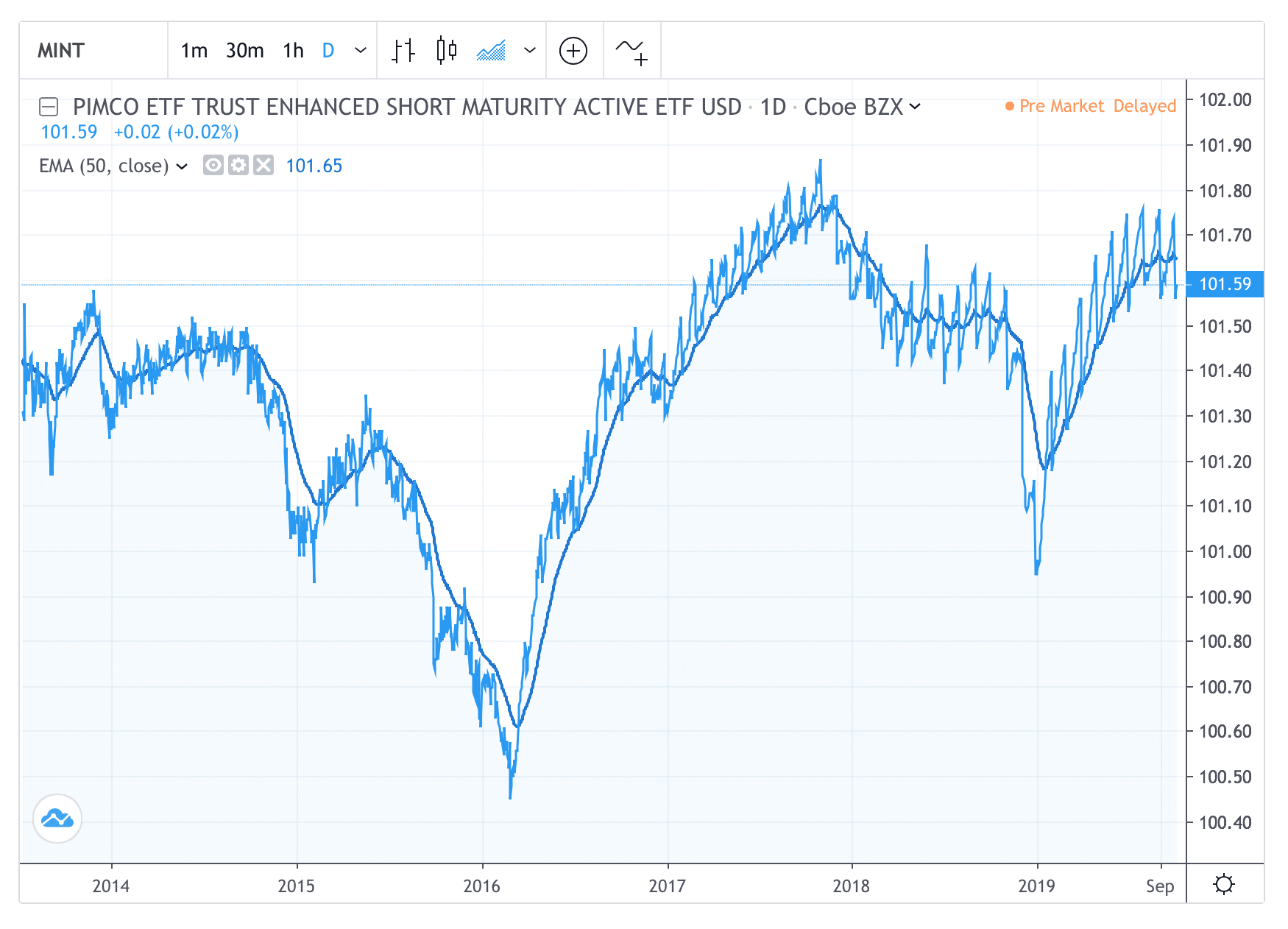

If you think the Sterling may be about to be torpedoed by Brexit, some short maturity bond in the US may be desired. One example is the Pimco Enhanced Maturity Active Bond ETF (MINT). However, bear in mind that this is an actively managed instrument (factsheet), meaning that its price volatility will be greater than that of money market funds. Note its price swing in the chart below.

In this world of low interest rates, these money market funds don’t yield much. Their paltry returns are forcing many investors into higher-yielding debt instruments, such as infrastructure funds. In the mid-cap space, III Infrastructure (31N) has benefitted enormously from this stampede.

Other real assets, such as gold, are also back in favour. But these instruments carry large market risks.

Over the long term, the goal of negative rates is to force consumers to spend more (not a good idea) and companies to borrow even more (not a good idea, too). Savers are being penalised greatly. Sewing, the head of Deutsche Bank, recently estimated that savers are losing 160 billion euro a year due to negative rates.

Funny enough, creditors are not doing well either in this environment, as they can’t make too much money with negative rates. Look at the performance of the Europe’s Banks Index.

How will this gigantic monetary experiment end? Nobody knows. For investors, the options are stark: Take more market risk, however small, or pay to hold cash.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.