To invest in oil stocks, you need a stockbroker like interactive investor, where you can buy oil companies like Exxon, Chevron, Shell and BP. You can also invest in oil through an ETF like the WisdomTree WTI Crude Oil, for your ISA or SIPP. In this guide we will look at the best oil stocks to buy and if they are good investments.

Is Now A Good Time To Invest In Oil?

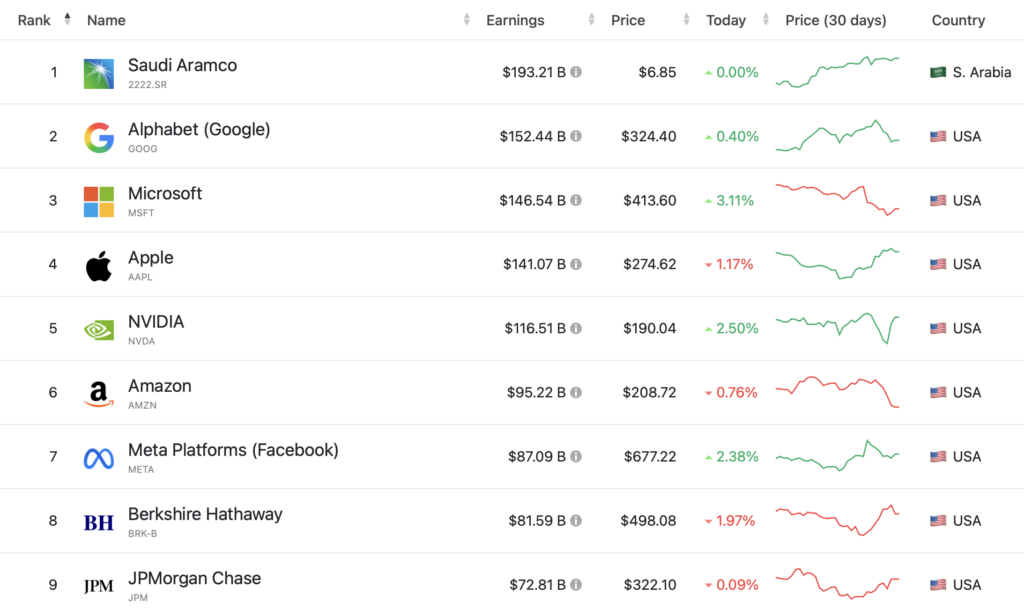

The world’s most profitable company in recent quarters was the national oil group Saudi Aramco.

Its total earnings over the last four quarters almost reached $200 billion, a sum that is $40-50 billion ahead of the elite tech groups like Google, Apple, or Microsoft.

ExxonMobil (XOM) is the next oil company on the list, with yearly earnings reaching $43 billion. PetroChina comes next, with annual earnings at $35 billion. This is then followed by Equinor, TotalEnergies, and Shell (SHEL), each making about $27 billion.

Other oil companies that are amongst the top 100 most profitable companies included: Chevron (CVX), BP (BP), ConocoPhillips (COP) and Petrobas.

Source: Companiesmarketcap.com

The point that I’m making by showing this list is this: Crude oil still matters. These energy companies are continuing to make up a significant chunk of global corporate earnings despite the secular rise of the ‘Green Economy’.

While many tech platform firms (particularly US-based) have superseded the profitability of numerous monopolistic oil groups, these boring old companies continued to fund a big chunk of government expenditures and pensions, and provide jobs in the thousands.

In other words, the oil sector is not the ‘sunset industry’ that many are expecting. On the contrary, the sector still has plenty of life in it.

Oil demand remains robust

One reason why the crude economy is continuing to perform better than anticipated is that crude oil usage has remained robust.

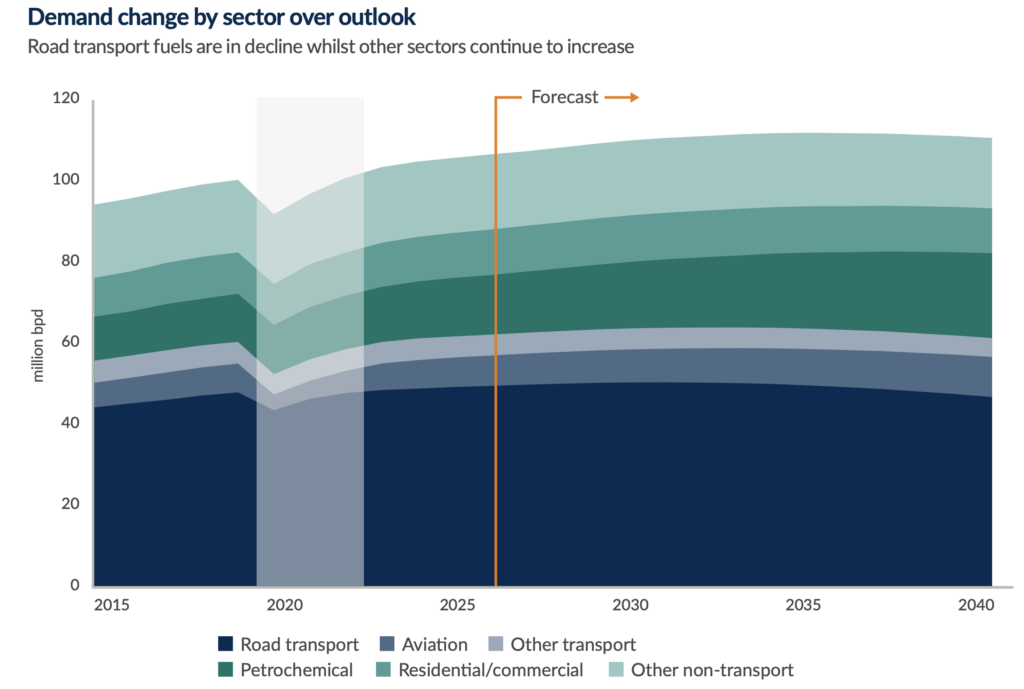

According to global commodity group Vitol, its latest oil outlook (Feb 2026) shows that ‘Peak Oil Demand’ may only arrive in a decade’s time:

At its height – expected in the mid-2030s – demand could reach around 112 million bpd, and is likely to remain close to this level with only minimal decline by the end of the forecast – expected to be 5 million bpd higher than today.

The chart below encapsulates Vitol’s oil demand prediction from various sectors. While Road Transport may shrink gradually, other usages like Petrochemical are making up for this shortfall:

Source: Vitol (Feb 2026)

Even for this year, the International Energy Agency is anticipating higher oil demand, as it concluded in its January (2026) report :

Global oil demand growth is forecast to average 930 kb/d in 2026, up from 850 kb/d in 2025, reflecting a normalisation of economic conditions after last year’s tariff turmoil and lower oil prices than a year ago.

Petrol cars are making an unexpected comeback.

Did you know that General Motors (GM), Ford (F), and Stellantis have recently written off $52 billion from their EV departments?

This is not some small change. EV adoption is happening at a pace far slower than expected. Auto customers are baulking at switching, while current EV owners are troubled by steep drops in second-hand EV car prices and charges for new batteries. This is prolonging the demand for gasoline automobiles.

Meanwhile, global demand for plastics and chemicals is highly positive. DarrenWoods, the CEO of ExxonMobil, recently affirmed this trend in XOM’s 2026 earnings conference:

From a demand standpoint, I would say continue to see very robust strong demand across the world for the chemical products.

In sum, chances of the oil sector collapsing overnight like 2020 are low.

Oil equities back in vogue?

As a result of these bullish demand revisions, crude oil prices are finding firm support at the fifties.

WTI Crude Oil attempted to break the 2025 lows but are finding this downside breakout difficult. As a result, prices rebounded back above $60. A further rally from here will challenge the multi-year downtrend resistance (at around $70).

But bearish investors may point out that crude’s long-term trend is still negative. See the entrenched pattern of falling highs. That’s true. But perhaps crude is attempting to construct a base at these levels. As crude’s current sentiment is negative, any upside revision may send prices higher quickly.

Against this backdrop, investors have piled into energy stocks.

Look at this $33-billion State Street Energy Sector Equity ETF (XLE). Since the start of this year, this fund has been rising non-stop. It’s rally powered through the massive resistance at $48-50 decisively.

This upside breakout takes out the peak registered back in 2014 almost 12 years ago! When a long-term breakout happens a) out of the blue and b) above a massive congestion zone, I expect a further upward drift over the medium term.

A partial sample of energy oil stocks that recently made new 52-week highs:

- ExxonMobil (US:XOM)

- Chevron (US:CVX)

- ConocoPhillips (US:COP)

- Shell (US:SHEL) – not on UK-listed LSE

- Valero Energy (US:VLO)

- PetroChina (HK:857)

- TotalEnergies (US:TTE)

- Enbridge (US:ENB)

It is a well-known empirical fact that when a stock hit 52-week highs, its bullish momentum persists for some time.

At a fund level, apart from XLE (which is highly US-centered) this iShares Global Energy ETF (ticker: IXC, factsheet) also looks promising. Prices are gearing up for a multi-decade breakout.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.