Saudi Arabian Oil Group, or ‘Aramco’ for short, is the national oil company of Saudi Arabia. One of the largest companies in the world, it is known for its ability to generate enormous revenues and profits.

Looking to buy shares in Aramco from the UK? Here’s what you need to know.

Can you buy shares in Aramco?

Buying shares in Aramco from the UK is not easy. In fact, it’s pretty much impossible.

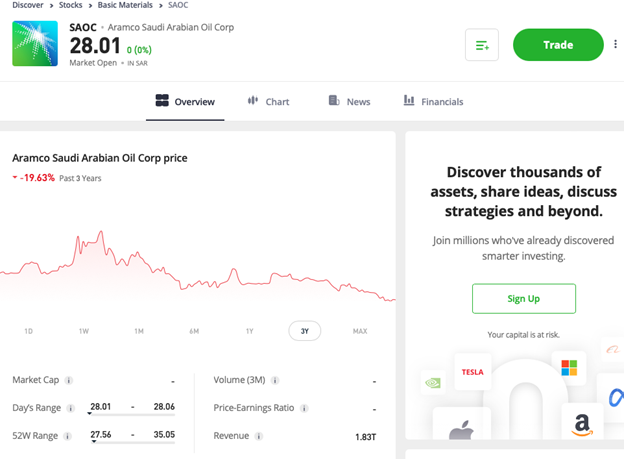

Unlike other large-cap international stocks, such as Apple and Amazon, Aramco – which is listed on Saudi’s Tadawul stock exchange under ticker ‘2222’ – is not available on investment platforms such as Hargreaves Lansdown and Interactive Investor.

This is due to the fact that the only people eligible to buy shares in Aramco are Saudi nationals, Gulf Cooperation Council (GCC) nationals, and certain foreign nationals who live in Saudi Arabia and have a bank account or investment portfolio with a registered bank (there are exceptions for billionaires).

How to invest in Aramco

There are ways that UK investors can get exposure to Aramco shares though. One way is via eToro.

With eToro, you can trade the shares with Contracts for Difference (CFDs). These are financial instruments that allow you to profit from the price movements of a security without actually owning the underlying security itself.

With CFD trading, you can trade the stock in both directions. You can also use leverage to increase your position size. The downside of these instruments is that you don’t own the underlying stock directly. And if you use leverage, even small price movements can result in substantial losses.

Investing in Aramco via funds and ETFs

Another way to get exposure to Aramco shares is through investment funds and exchange-traded funds (ETFs). One example of a fund that provides exposure to the oil company is the iShares MSCI Saudi Arabia Capped UCITS ETF (LON:IKSA), which tracks the performance of an index composed of Saudi Arabian equities. Currently, Aramco is one of the largest positions here, at nearly 10% of the index.

Another example is eToro’s OilWorldWide Smart Portfolio. This is a managed portfolio that provides access to oil derivatives, oil ETFs, and oil stocks. Currently, Aramco is in the portfolio.

Could Aramco come to the London Stock Exchange?

It’s worth noting that in the past there has been talk that Aramco could one day have a secondary listing on the London Stock Exchange.

A secondary listing is where a company lists on a separate exchange from their home stock exchange, in order to enable foreign investors to invest more easily.

However, there are no guarantees that this will ever happen. I wouldn’t expect to see Aramco trading on the LSE any time soon.

Based in London, Edward is a distinguished investment writer with an extensive client portfolio comprising a diverse array of prominent financial services firms across the globe. With over 15 years of hands-on experience in private wealth management and institutional asset management, both in the UK and Australia, he possesses a profound understanding of the finance industry.

Before establishing himself as a writer, Edward earned a Commerce degree from the prestigious University of Melbourne. Complementing his academic background, he holds the esteemed Investment Management Certificate (IMC) and is a proud holder of the Chartered Financial Analyst (CFA) qualification.

Widely recognised as a sought-after investment expert, Edward’s insightful perspectives and analyses have been featured on sites such as BlackRock, Credit Suisse, WisdomTree, Motley Fool, eToro, and CMC Markets, among others.

To contact Ed, please see his Invesdaq profile.