What is Slippage?

Slippage is the difference between the intended executed price and the actual executive price. For example, you put in an order to buy a stock at £10.50 and it was executed at £10.55. The difference of £0.05 (£10.55-10.50) is the slippage. A ‘bad fill’.

Of course, slippage can sometimes work in your favour. This is called positive slippage. If slippage worsens your intended price, if is called negative slippage.

Slippage can be caused by many things. One of which is price volatility. This means that prices are moving at such a speed that few are able to trade at intended prices during that particular period.

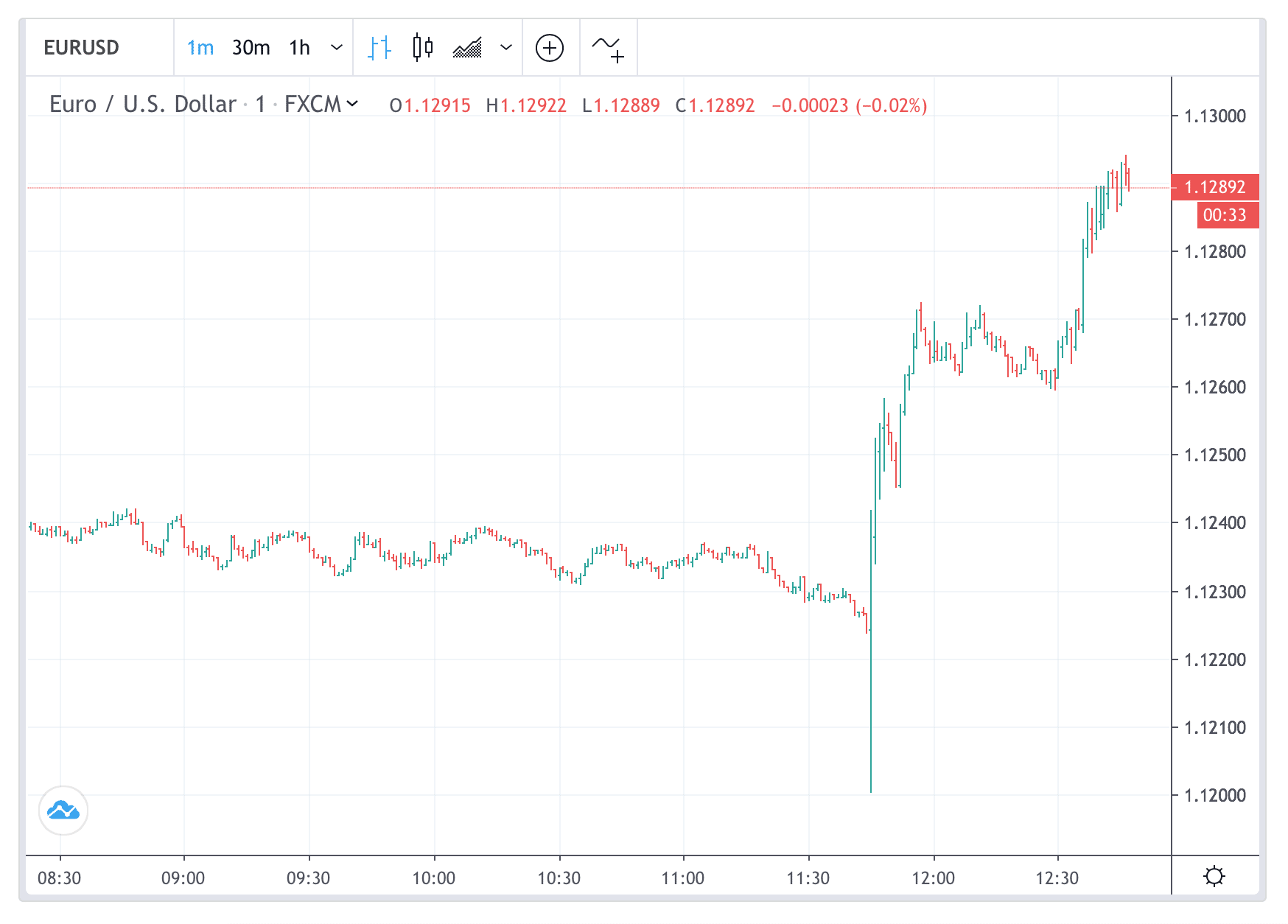

Look at this EURUSD chart (1 minute interval), produced today (June 6). The rate was largely rangebound until 11.45am, when prices surged dramatically during a press conference hosted by the European Central Bank (ECB) president Mario Draghi. If you were entering buy/sell (at market) orders during that particular 60-second interval, slippage may occur.

How to Reduce Slippage

Slippage is part and parcel of trading activities. You will experience slippage in all asset classes, including stocks, FX, commodities or futures. Slippage itself is dynamic and time varying.

During periods of extreme price volatility, slippage can be high. That’s why many trading houses have algorithms to protect themselves during these abnormal periods, such as ‘kill switches’ to pause/reduce trading activities.

For traders, there are several ways to reduce slippage.

- Avoid trading the instrument periods of high volatility. This is because prices will experience jumps in any directions, thus causing bad execution all around. Predictable events that will elevate market volatility include:

- Central bank meetings and rate decisions

- Release of key economic data, e.g. US non-farm payroll

- Political events, e.g. elections

- Expiry date of derivatives, e.g. triple witching

- Earnings/corp results

- Use limit orders (if possible). If buying actual shares, use limit orders where possible to lock in better prices. If spread betting, use guaranteed stops whenever possible.

- Focus on liquid instruments. With more market makers, the bid-ask spread is likely to be more competitive. This also means that there are more liquidity and, possibly, lower slippage. For example, slippage on Vodafone shares is likely to be lower than that of some small-cap miners.

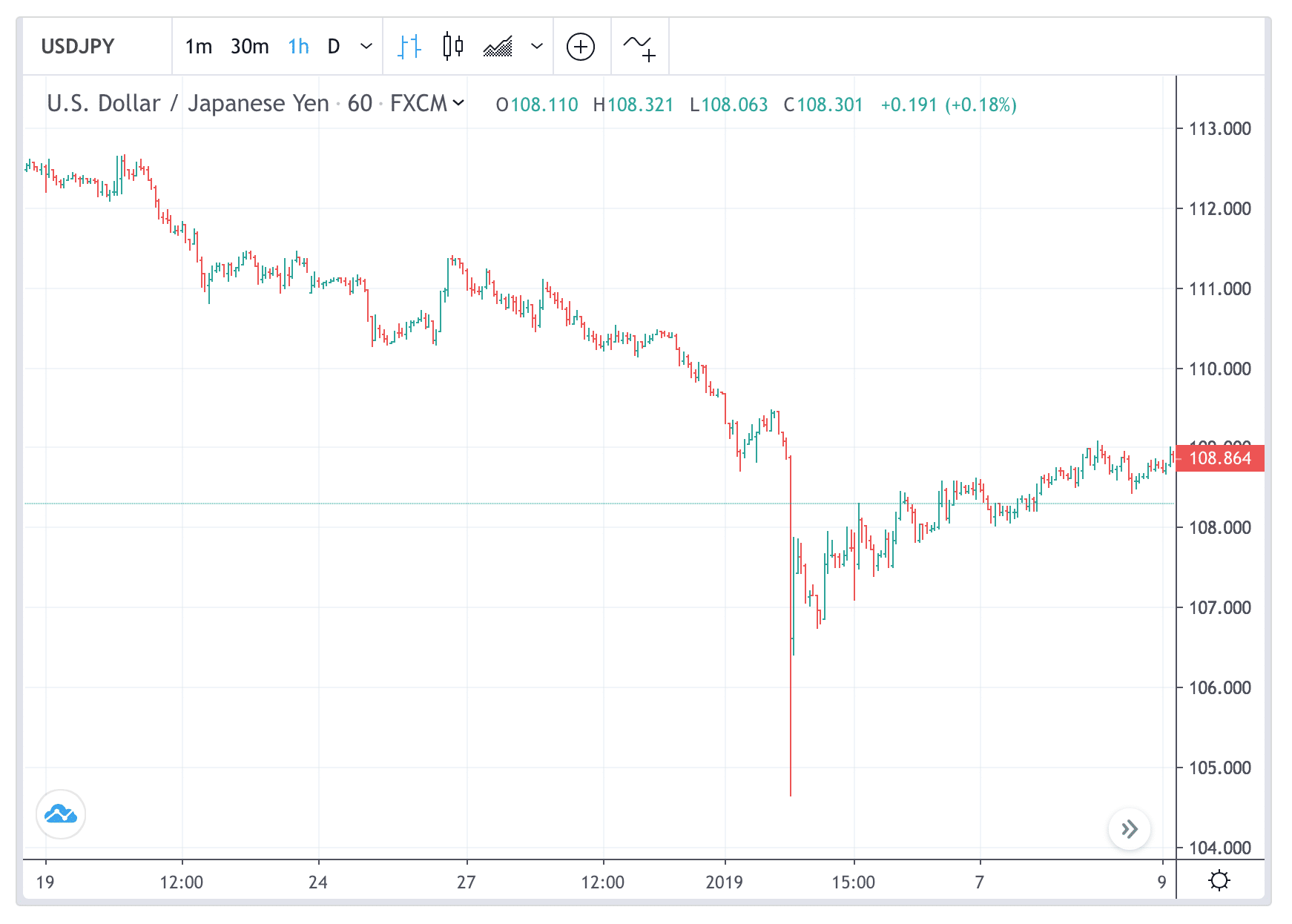

- Reduce trading activities outside peak hours. In the FX market, it is a well-known fact that during the time between the close of New York and the opening of Tokyo hours FX liquidity is lower. This subdue period is known as the ‘witching hours’ of Asian trading. On January 3 this year, the Japanese Yen experienced a mini ‘flash crash’ during this period. Many Yen-related rates soared in a matter of minutes before these moves reversed (see below).

To recap, slippage is always a possibility when you enter an order to buy or sell. There is an element of unpredictability associated with this issue. But with the above steps you may reduce trading slippage to a tolerable level.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.