Please note that since this article was written the FCA has banned retail traders from trading cryptocurrency derivatives. If you would like to speculate on Bitcoin and cryptocurrencies you need to use a cryptocurrency exchange or professional trading account.

The rise of Bitcoin has led to a wave of new crypto-based products, such as the Cryptocurrency Index. Here is a quick guide to these interesting indices…

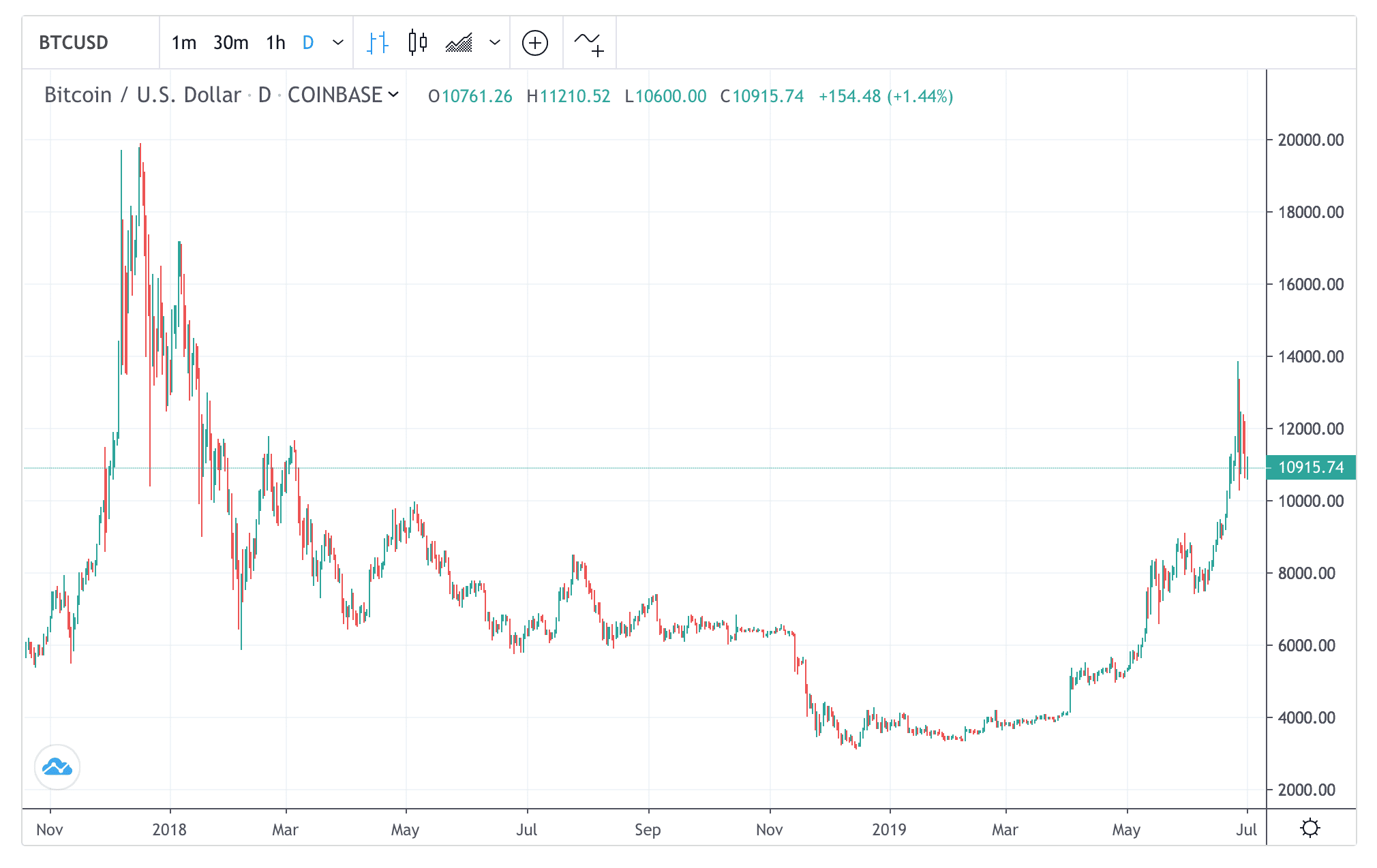

The hibernation of Bitcoin (BTC) – and the wider cryptocurrency market – is over. From its late-March lows to recent highs, Bitcoin has soared over 250%! Ethereum (ETH), the second-largest crypto, jumped by 100%.

Why trade cryptocurrency indices now?

Compare to the wider equity market, the S&P 500 Index advanced by just 4% over the same period. The Nasdaq 100 Index added only 6%.

When an asset class exhibits impressive relative strength, it attracts attention and interest. Capital swiftly follows. Bitcoin’s rather large rally further whip up bullish sentiment. Those who missed the previous Bitcoin boom are keen to participate in the next one.

Advantages and disadvantages of the Crypto Index

With interest growing, Crypto-based indices could be a good way to gain exposure to the market. Lately, several spread-betting firms have been getting on the act on this aspect.

A crypto index is based on a basket of coins. Depending on the weighting of each coin, the index will fluctuate according to the underlying constituents. For many traders, gaining exposure to a basket of coins is more preferable to buying just one single coin – simply because not all coins will move at the same rate.

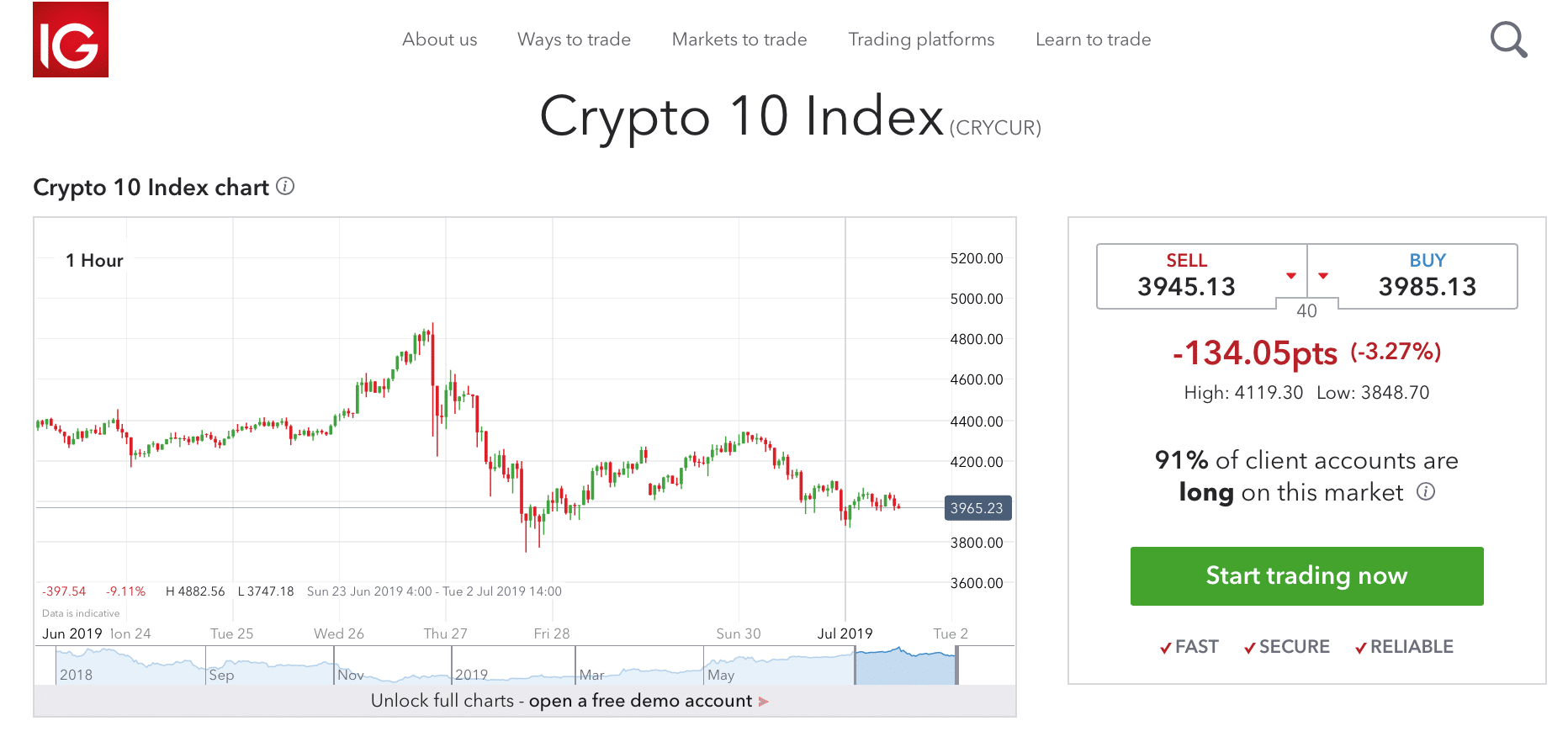

IG Cryptocurrency Index

IG Index, for example, provided a Crypto 10 Index to help its customers to bet on a diversified array of crypto coins. According to its website, IG’s Crypto 10 Index is based on the largest ten cryptocurrencies. The index is calculated and maintained by BITA GmbH.

Below, you can see a snapshot of the Index on IG’s website. The buy-sell spread is around 40 points, and margin around 50% (retail).

According to BITA’s website, Bitcoin and Ethereum made up around 50% of this Crypto 10 Index.

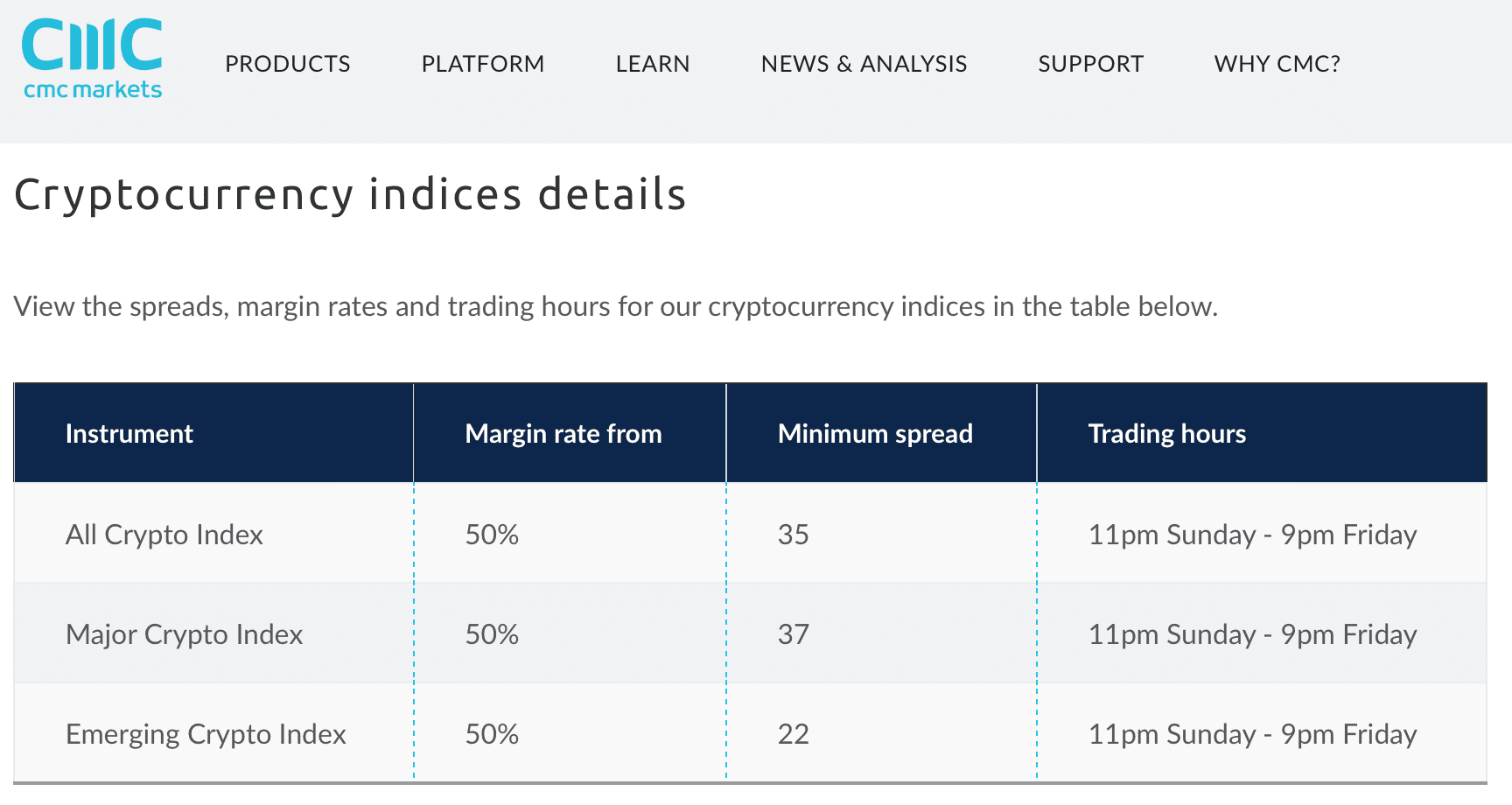

CMC Markets Cryptocurrency Index

CMC markets, another big spread-betting company, has recently offered three proprietary crypto indices:

- All Crypto Index

- Major Crypto Index – bitcoin, ethereal, ripple, bitcoin cash, litecoin,

- Emerging Crypto Index – cardamon, dash, EOS, monero, NEO, stellar lumens, tron

The margin rates of these indices can be seen below:

Again, margin is around 50%.

According to CMC’s description of the index, Bitcoin will constitute around 12% of the All Crypto Index and 40% of the Major Crypto Index at rebalancing dates. The calculation of these indices appears to be done internally and the calculation methods can be accessed publicly via this document.

The main disadvantage, of course, is that crypto even with 50% margin is extremely volatile and sometimes illiquid. So expect P&L swings to be huge and hard to trade out of in some circumstances.

So depending on your risk appetite, there are now an array of interesting crypto-based indices to be traded on. Again, stop losses are recommended in all positions.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com