Bitpanda, one of Europe’s leading brokers in the cryptocurrency and digital assets space has secured approval from the UK FCA.

This development comes after Bitpanda recently obtained a European MiCAR license (Markets in Crypto-Assets Regulation), and helps to put the business in a strong position across both EU and UK jurisdictions.

Why has the move into the UK taken more than 10 years?

Cryptocurrency exchange, Bitpanda, which was founded in 2014, has its HQ in Vienna Austria.

The firm had previously tried to enter the UK market, before Covid, but at that time London’s banks weren’t receptive to the idea of opening client money accounts, for crypto businesses and they had to “row back” on their ambitions.

The UK FCA also moved to make the marketing and provision of crypto derivatives to UK retail clients illegal.

A move that at the time, drew a fair degree of criticism from the industry. Who quite rightly suggested that the prohibition would simply drive crypto-traders offshore and towards totally unregulated venues and firms.

Though the ban on crypto derivatives remains in place, it does seem as though attitudes towards crypto investment services, among service providers, and the regulators in the UK, have now softened considerably.

With HMRC going on record, earlier in the year, to say, that crypto staking was now not considered as a collective investment scheme.

That clarification has meant that established brokers like eToro, are once again able to offer staking to their UK retail clients.

What is Bitpanda offering to UK clients?

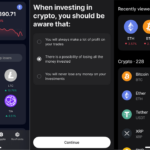

Bitpanda’s offering to UK clients includes over 500 cryptocurrencies. Investors will also be able to earn rewards through staking, automate their purchases with customizable savings plans, and diversify their exposure through the use of crypto-indices.

Bitpanda acts for both retail and institutional clients. And, through their Bitpanda Technology Solutions division, BTS, they’re enabling banks and fintech companies to integrate crypto services into their existing platforms. This B2B approach could help to facilitate the mainstream adoption of digital assets in the wider UK financial sector.

What prompted Bitpandas UK expansion?

Bitpanda’s growth has been impressive, with the firm growing from 1.0 million users in 2019 to 6.0 million by December 2024. The firm has plans in place to “re-open” their UK office and expand its local team. CEO Eric Demuth said that the UK was “the last missing piece” that enabled the firm to serve all Europeans.

The company’s focus on regulatory compliance sets a precedent in an industry that has often faced scrutiny about its levels of security and trustworthiness.

Looking ahead, Bitpanda’s combination of regulatory approvals, product range, and established user base suggests they’re well-positioned to capitalize on the growing interest in digital assets.

Their focus on developing products specifically for British investors indicates a nuanced understanding of the local market rather than a one-size-fits-all approach.

Though in truth, this a pragmatic approach, brought about by UK regulations, as much as anything else.

How big is the UK crypto market?

Revenue from the UK cryptocurrency market is forecast at just over £1.30 billion for 2025, and though that’s down modestly from the 2024 figure, it’s still a significant number.

However, from the retail perspective at least it remains a volume business, with the average revenue per user, in the UK digital assets space, said to be circa £55.50 per annum.

So it will be interesting to see if, and how quickly Bitpanda can gain traction in the UK market.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.