Robinhood Customer Reviews

Customer Reviews

4/5

Pros:

accessibility, fees

2/5

3/5

Pros:

Forex

1/5

Pros:

jsp

Cons:

jsp

4/5

Pros:

EASY INTERACTION.

Cons:

MORE INVESTMENT TOOLS.

5/5

3/5

Pros:

Stocks

Cons:

nothing

3/5

3/5

Pros:

commission-free stock trades

Cons:

work on user friendly navigation

5/5

4/5

1/5

Pros:

Easy to use app

Cons:

Get regulated

2/5

3/5

Pros:

low cost

3/5

5/5

Pros:

User Interface

Cons:

Add more details to their user interface

3/5

Pros:

it’s free

2/5

Pros:

Nothing

Cons:

Not sure

3/5

4/5

GMG View

Robinhood UK Review

Name: Robinhood

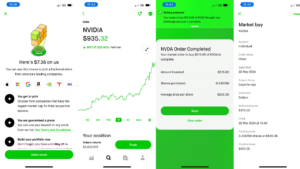

Description: Robinhood is a zero-commission trading app launched in 2013 that lets UK investors buy and sell around 6,000 US shares 24 hours a day with as little as $1 through fractional shares.

Is Robinhood good for UK investors?

If you just want to invest a little bit of money in US shares then Robinhood is a good choice to get started. It’s very simple to use and you can trade 24 hours with zero commission and custody fees. However, it’s not really up to scratch for more advanced or active investors.

Pros

- Zero commission trading

- Very good exchange rates

- Slick app

- 24 hours investing

Cons

- Only US stocks

- No SIPPs or ISA

- No options trading

-

Pricing

(4.5)

-

Market Access

(2)

-

App & Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(3)

Overall

3.5Ratings Explained

- Pricing: Cheap GBPUSD fx rates of 0.03% and no commission.

- Market Access: US stocks only and no pension or ISA accounts.

- Platform & Apps: Very slick app, but basic execution orders.

- Customer Service: App only, no phone number or chat online.

- Research & Analysis: Limited to some technical indicators and news.

Robinhood Alternatives

| US Stock Buying Platform | US Commission | FX Rate | Account Fee | ISA | GMG Rating | More Info |

|---|---|---|---|---|---|---|

| £0 – £10 | 0.5% | $0 – $96 per year | ✔️ | Visit Broker Capital at risk |

|

| 0.5 cents per share | 0.02% | $0 | ✔️ | Visit Broker Capital at risk |

|

| 0.015 USD/Share (min. 1 USD) | 0.25% | 0.12% – 0.08% | ✔️ | Visit Broker Capital at risk |

|

| $0 | 0%-1.5% | $0 | ❌ | Visit Broker Capital at risk |

|

| £3.50 – £5 | 0.75% – 0.25% | 0.25% (max £3.50 per month) | ✔️ | Visit Broker Capital at risk |

|

| £5.95 – £11.95 | 1% – 0.25% | $0 | ✔️ | Visit Broker Capital at risk |

|

| £3.99 | 1.5% – 0.25% | £4.99 – £19.99 per month | ✔️ | Visit Broker Capital at risk |

Robinhood moves into wealth management with $300m acquisition of TradePMR

US Investing app Robinhood has targeted the wealth management sector in America with the acquisition of TradePMR. Robinhood’s move to buy a custodial and portfolio management firm for $300 million deal will enable it to market its services to registered investment advisers (RIAs), which are akin to regulated financial advisers in the UK. In the

Robinhood launches margin trading to UK customers

UK users of Robinhood will be able to borrow money from the platform to trade on margin, following an update today. Lending money to customers to trade on margin is one of the most common forms of revenue for brokers. This is another move from Robinhood, which recently launched a share lending program to try

Commission-free UK stock trading set to come to Robinhood UK

Robinhood Markets is mulling bringing commission-free UK stock trading to British users of the trading app, according to a report by Bloomberg last week. The speculation comes around six months after the California-based company launched for a second time in the UK, when it rolled out commission-free trading for more than 6,000 US-listed stocks. “We

Robinhood acquires crypto exchange Bitstamp for $200m

Robinhood, the US-headquartered commission-free brokerage has expanded its footprint with a $200 million cryptocurrency acquisition in Europe. Robinhood has acquired Bitstamp a European cryptocurrency exchange that was founded in Slovenia in 2011. The exchange offers markets in 101 instruments, that range across Cryptocurrencies, NFTs, Stablecoins and Defi Protocols. Why would Robinhood aquire Bitstamp? Bitstamp is

Robinhood UK First Look: Absolute Gold or the Sheriff of Nottingham’s Silver?

My original Robinhood review back in 2020 was titled ‘Robinhood Gold: More Like The Sheriff of Nottingham’s Silver‘. Because a) you couldn’t get Robinhood in the UK and b) because, whilst I think the name is great for marketing, it’s fairly disingenuous. But, Robinhood launched today in the UK and as I just watched ‘Dumb

Robinhood launches in the UK for a second time

Commission-free investing app Robinhood has launched in the UK for the second time, having failed to gain traction in 2020. Robinhood in the UK UK investors can only buy US shares through a general investment account at the moment. Robinhood, a US-based commission-free share trading platform has a UK operation and the firm is in

Can you write naked puts/calls (sell uncovered options) at Robinhood?

No, Robinhood does not allow you to sell options on stocks you down not own as naked short put/call positions can result in significant loss. If you want to write naked option puts or calls you need a more professional options brokerage like Interactive Brokers. However, keep in mind there are significant risks that you

Robinhood to introduce 24-hour stock and ETF trading

Online broker Robinhood is set to allow its clients to trade a range of ETFs and stocks around the clock, with the introduction of 24-hour trading at the firm. The new service will be introduced later in May and will make Robinhood the first US broker to offer this facility. 24-hour trading Twenty-four-hour trading will

Robinhood gets pulled up by the Sherrif of FINRA

US-based commission-free stock broker Robinhood has had a tough time lately, over the last three months the company’s share price has fallen by almost -62% and year to date the stock is down by-12.00%. Robinhood is due to report earnings on January 27th and investors will be eager to hear about trading volumes and active

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com