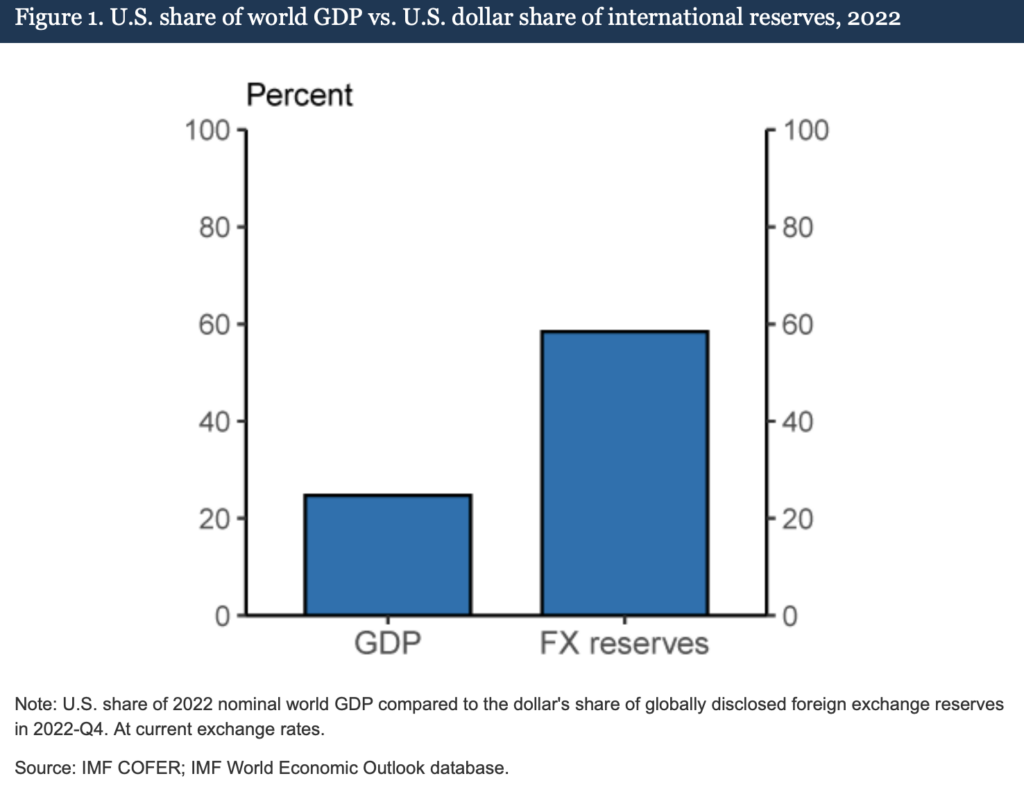

The US Dollar is still the linchpin of the global financial system. Most of the international transactions are conducted in the currency. From commodities to exports to currency reserves, the US dollar is omnipresent in the system. According to some estimates in 2022, the share of the USD among all monetary currency reserves stood at an unassailable lead of 58 percent (see below).

In other words, the dollar is still the most traded currency however much other competing economic entities wish to dethrone or replace it. There is simply no other currency that is universally accepted in all continents of the world. While the debasement of all fiat currencies happened over time, the dollar included, it is still accepted as a general store of value.

This monetary leadership is not without problems though. When the Federal Reserve adjusts its monetary policy, it may create strong headwinds in many other countries.

Source: Federal Reserve (2023)

In 2021-2022, for example, the Fed raised the policy rate multiple times to combat the soaring inflation. This puts fire under the dollar (high rates attract more capital, all things being equal). The chart below tells us in a single glance how much that dollar appreciated. From the post-pandemic low at 90, the Dollar Index rallied for 15 months to the peak at 114. The 26 percent gain was, in FX terms, a massive bull run. Many emerging markets saw their currency hit new cyclical lows against the dollar.

Remember, the dollar is like a supertanker. It takes significant buying to change and sustain a trend. Once in motion, the dollar’s prevailing trend is hard to arrest. Not to forget is that the Dollar Index is comprised of several currency pairs. On some individual FX rates (eg USDJPY), USD’s gains were much larger.

Other economic factors that attracted sustained buying of the dollar in 2022 included a rise in geopolitical tensions, a fall in risk sentiment, and the relative outperformance of the US economy.

From its overbought conditions, the dollar has corrected somewhat. Currently, it is hovering in between the range at 108-100.

What could change the dollar’s current trend?

The thing is, are we too complacent about the Dollar?

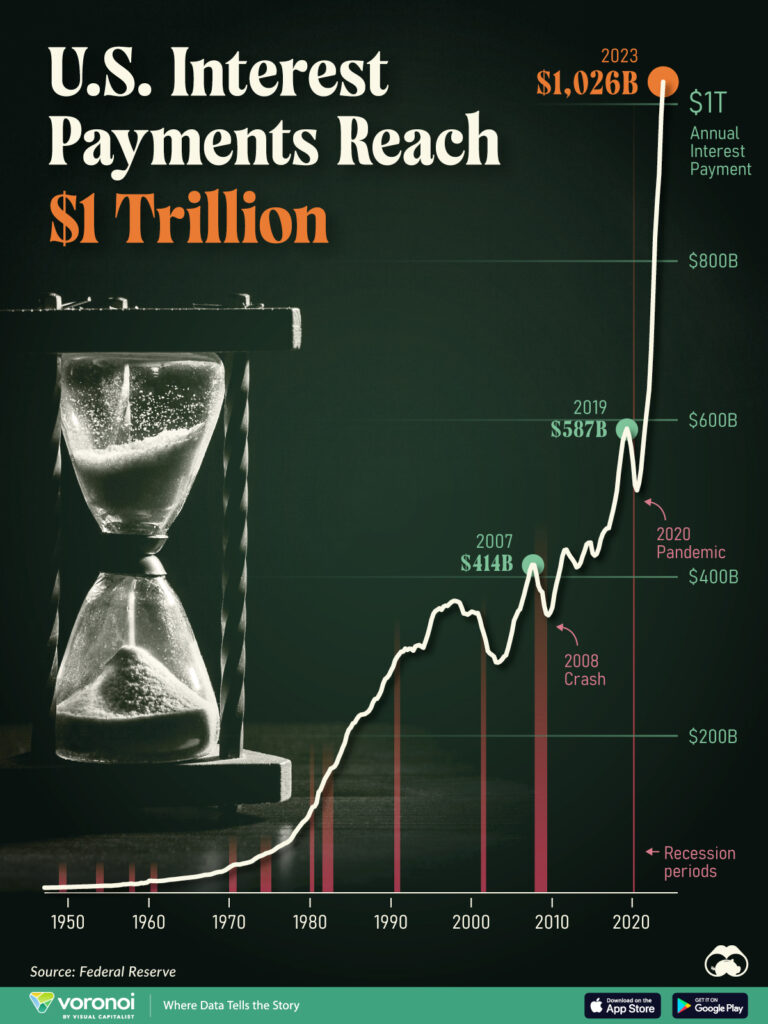

The elephant in the room, so to speak, is the ballooning US national debt. At $34.5 trillion (34 followed by 12 zeroes!) the US national debt is mounting quickly. Last year, interest payments on this pile of swelling debt reached a staggering $1 trillion dollars (see below).

The US government is simply borrowing more money to pay these interests. Eventually, the government will tap out its credit. Many experienced economists are worried about this unsustainable debt trend, from Oliver Blanchard, former chief economist of the IMF, to Philip Swagel, director of the Congressional Budget Office. Even corporate titans are anxious, including James Dimon and Ray Dalio.

“At one point,” the CEO of JP Morgan warned recently, “it will cause a problem… the problem will be caused by the market, and then you’ll be forced to deal with it and probably in a far more uncomfortable way than if you dealt with it to start.” The strategy he advised is to tackle the problem as soon as possible.

Easier said than done, though. Especially America is in an election year where the political bandwidth narrows to an election win.

Optimists, however, will argue that this debt worry is overdone. As Dick Cheney famously stated: Deficits don’t matter. As long as the US can continue paying interests, what’s the matter?

Of course, the party is nice when the music is playing. At this juncture, they are correct. The market is more concerned about near-term inflation, policy rates, and whether central banks will intervene.

Based on the macro data, there is no strong conviction on any economic thesis. Hence the rangebound dollar. Bullish this week, bearish the next. Market expectations about Fed rate cuts this year have also swung wildly. From 5-6 cuts to 3-4 to 1-2. No cuts in 2024? Maybe, who knows.

US Dollar Index is in a sideway trend

In conclusion, the US dollar is likely to stay in a sideways range until a new (but clearer) macro picture emerges. Yes, America’s national debt is frighteningly large. Until this worry is reflected in the charts, we would not bet heavily against the Dollar (yet).

Source: VisualCapitalist.com (2024)

Featured USDGBP Trading Platforms

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com