IG Group, one of the UK’s largest CFD trding platforms and Spread Betting brokers, is to start offering single stock options on its MyIG dealing platform.

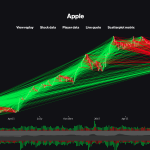

The broker will initially offer options with weekly and monthly expires, over a range of 12 US equities, that includes Apple, Amazon, Netflix, Tesla and Nvidia.

IG has a long history of equity options trading, however, until now these contracts were traded over the phone, rather than online.

IG say they are making the transition to improve the end-user experience and to make the options contracts more accessible.

Clients can choose to trade the new online options as either a financial spread bet or a CFD, the prices for which will be based on the underlying exchange-traded options.

However, as either bets or margin trades, the IG options will be cash-settled rather than deliverable.

Interestingly IG will internalise the order flow generated by online equity options trading and will be aiming to match off trades and exposures against opposing client flows, and or, the firm’s overall risk positions.

The initial list of stocks that can be traded as online options is not cast in stone, and it’s likely that the list will change over time. With new stocks being added and in some cases, removed and replaced, if, interest in particular names disappears.

If there is demand for online options trading then IG will extend the list of stocks available (indeed we understand that two additional stocks will shortly be added to the list)

In the meantime, IG’s phone-based options dealing service will continue as normal.

Are there any risks in options trading? Yes, options are considered to be complex instruments by the FCA.

However, simply buying puts or calls, that is, the right to sell or the right to buy, a fixed amount of the underlying asset, at a known strike price, over a given period of time, of say, a week, a month, or a quarter, into the future, could be considered as a limited risk trade.

Because the buyer of an option is only on risk for the initial premium or purchase price.

Selling or going short of options, has a very different risk profile, however, and it would be sensible to have a thorough understanding of the risks involved, in options trading and its various strategies, before you start dealing in them.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

You can contact Darren at darrensinden@goodmoneyguide.com