Why invest in Asia? In a word: Growth.

The region provides one of the best long term structural growth opportunities for investors. Strategically important and fast growing, Asian corporations could offer good long-term returns for astute shareholders. More importantly, Asian stock markets could provide a safe harbour from weak European economies and Brexit-hit UK.

Compare stock brokers to invest in stocks

This starter guide summarises what you need to know investing in the region – and which stocks to look at.

Asia 101

Asia is a large region. The geographical definition of Asia stretches from Iran/India in the west and Japan to the east. It contains both developed and developing countries; first world and frontier economies. Some areas, like North Korea, remained impenetrable to investors and outsiders.

Asia is also heavily populated. Four out of the top five most populous countries in the world are in Asia. Sitting atop is China, followed by India (1.3 billion), Indonesia (264 million) and Pakistan (210 million). Other significantly populated countries include Philippines (103 million) and Vietnam (94 million). All these countries are still developing. Growth rates are inevitably higher than developed economies.

The biggest economy in Asia is China, which stands at US$14 trillion. So big is the Chinese economy that whenever it sneezes, the world catches a cold. The Chinese ‘leash effect’. By per-capita GDP, however, Singapore, Hong Kong, Japan and South Korea are some of the highest in the world.

So you can easily imagine the bustling vitality of the region as resources from richer countries pour into poorer ones. Labour and financial arbitrage activities promote economic growth and trade. Infrastructure building growing apace; intra-Asian trade surging. The swelling of the middle class provides significant buying power of consumer goods. Just ask LVMH where their best sales regions are.

The question is: How can you take advantage of all these wonderful opportunities?

In this week’s guide, I show you seven Asian profitable stocks to watch and buy. These stocks are carefully selected to provide stability and growth.

Here are potentially the top 7 Stocks to watch and buy in Asia

Tencent (700 HK)

AIA (1299.HK)

BYD (1211 HK)

China Tower (788 HK)

DBS Group (DO5 SG)

Macquerie Group (MQG.AU)

Fortescue Metals Group (FMG AU)

Here are the best seven Asian stocks to watch and buy.

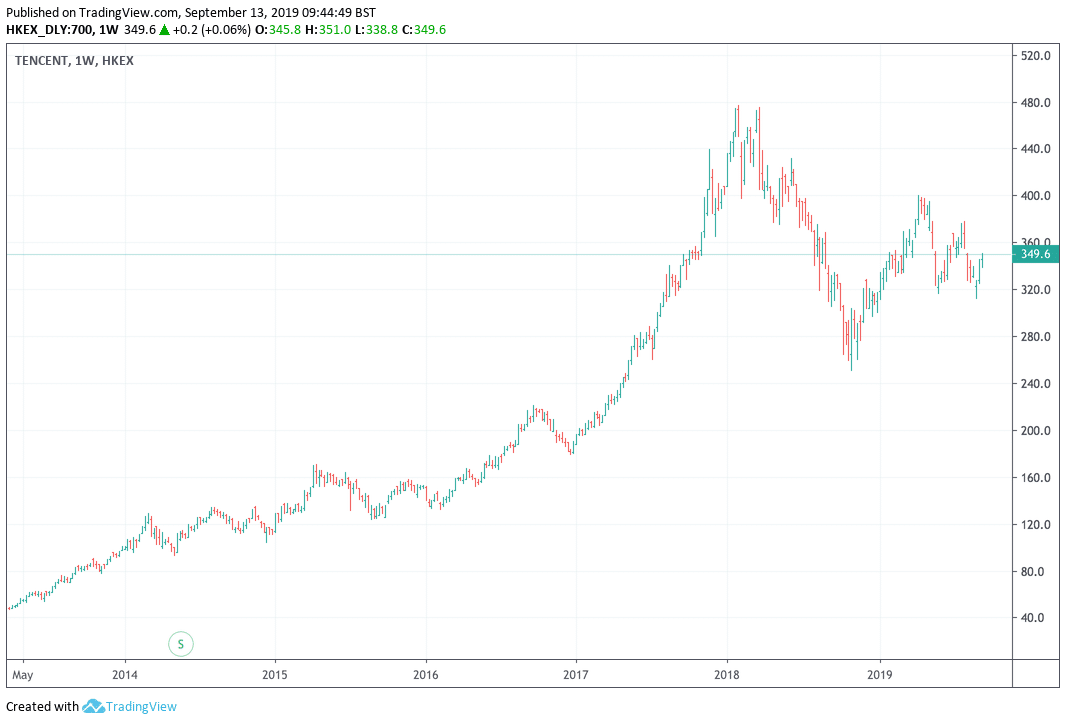

Tencent (700 HK)

If you have been to China, you will know the pervasiveness of the the social app ‘WeChat’. The company that owns this valuable social media tech is Tencent (700.HK). The firm is listed in Hong Kong and headquartered in Shenzhen. At US$428 billion, Tencent is among the top ten largest stocks in the world by market capitalisation.

While prices have been choppy of late, the stock remains on a long-term bull trend. Remember that the technology sector in China is growing rapidly, so deep setbacks here may present buying opportunities.

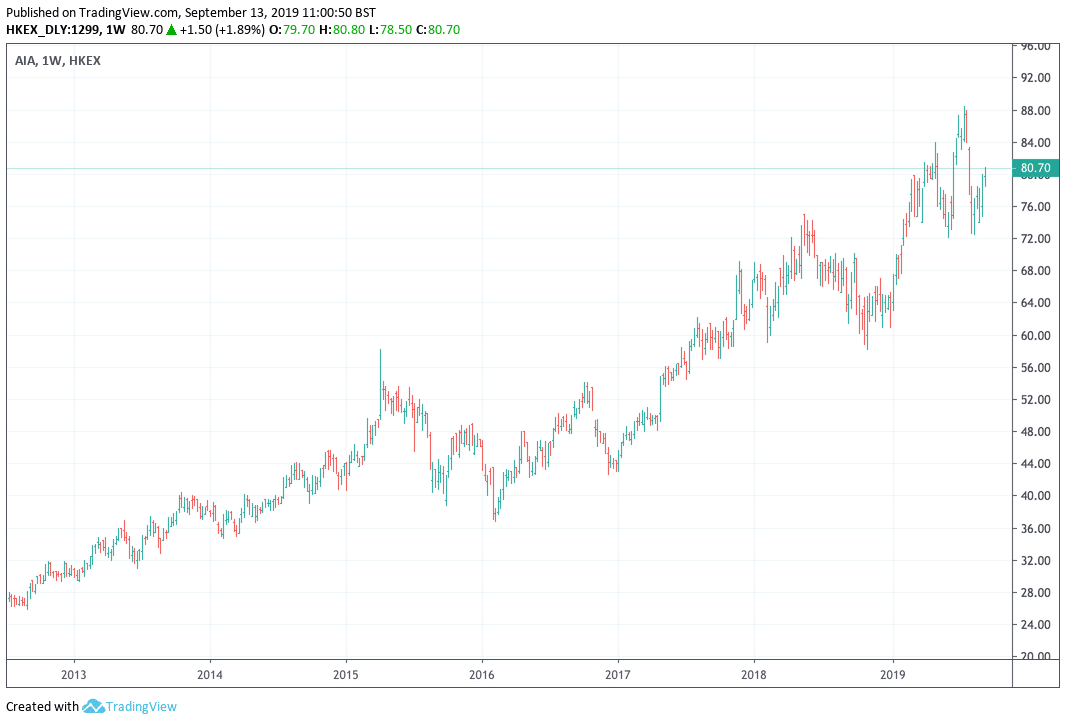

AIA (1299.HK)

Whenever a country develops, so will its financial sector. AIA (1299.HK), the insurance giant, is taking advantage of the secular expansion of the Asian middle class and the growing demand for life insurance. The company operates in many countries, such as Singapore, HK, China etc. Hence, it is well positioned to take advantage of the economic growth. It is well-recognised brand.

If you look at AIA’s long-term chart, the trend here is unmistakably bullish. Watch for new highs in the coming year.

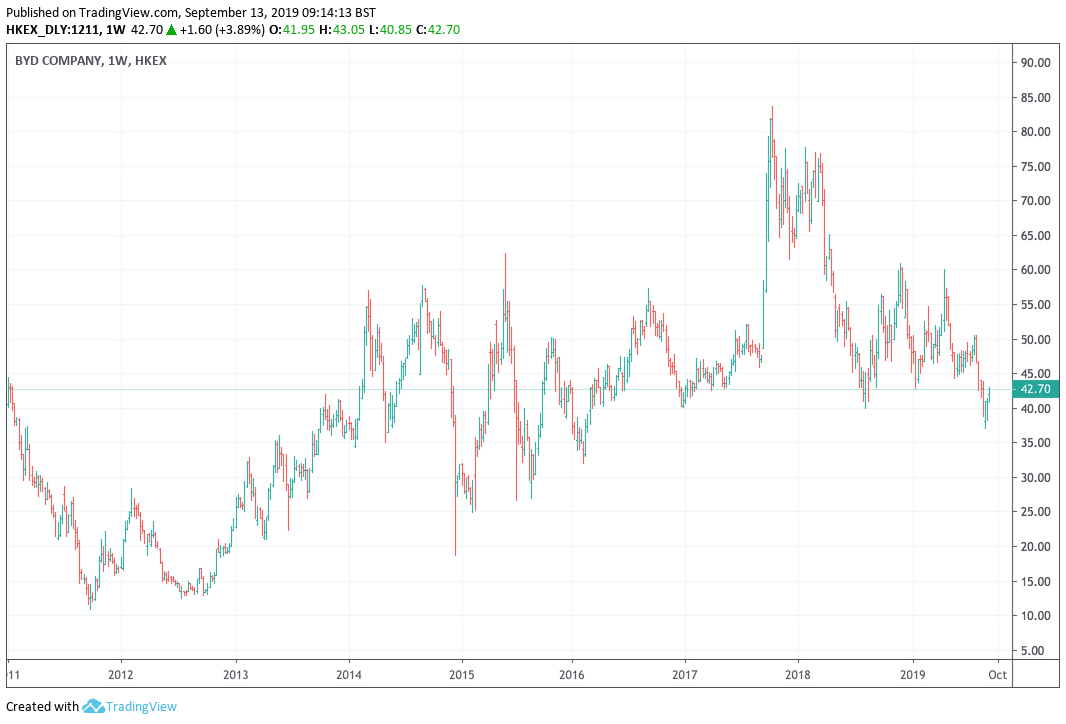

BYD (1211 HK)

Away from the traditional financial, electric car is one of the most exciting subsectors to invest in. One of the first movers in this sector in Asia was BYD (1211.HK). Warren Buffett famously bought a stake in this firm a decade ago and has been sitting on massive paper profits since. If it is good enough for Berkshire to hold over the long term, you should at least watch to buy some of BYD on setbacks. Technically, $25-35 may be good entry zones (see below).

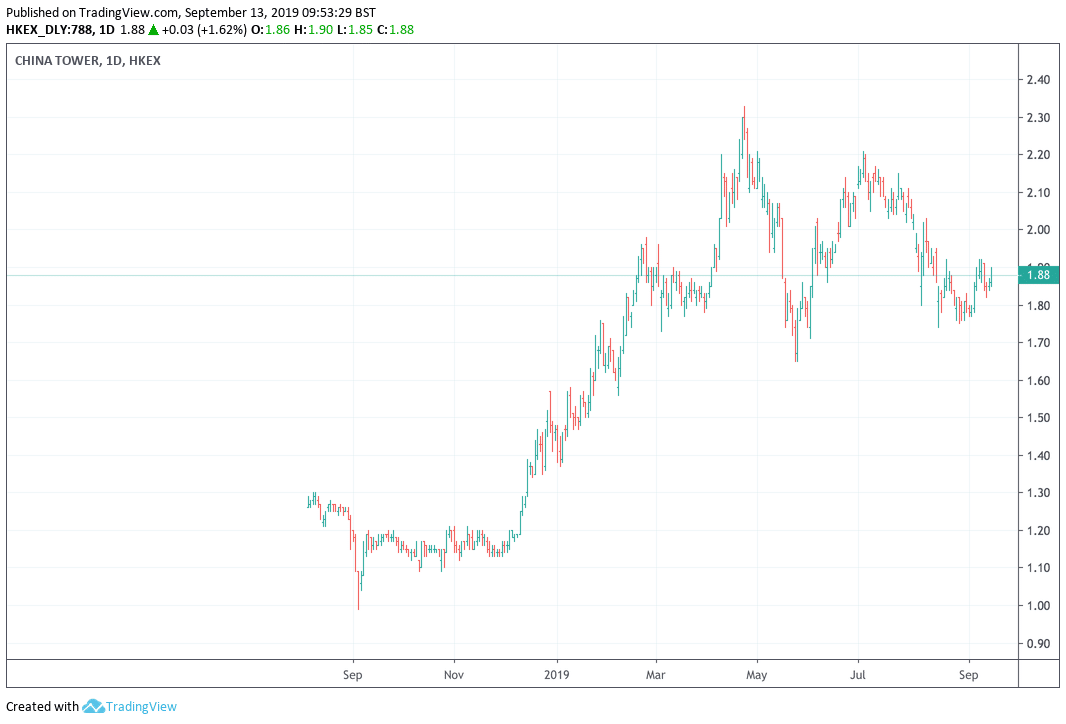

China Tower (788 HK)

At US$6.9 billion, China Tower’s floatation last year was one of the biggest in the world. China Tower operates the telecommunications towers for the world’s biggest cellular phone networks, which is upgrading into the 5G space as we speak. The stock offers a huge opportunity to buy into a slice of that critical infrastructure.

Investors concur with this thesis. China Tower’s stock price has more than doubled from its post-IPO lows. Support is noted at $1.70.

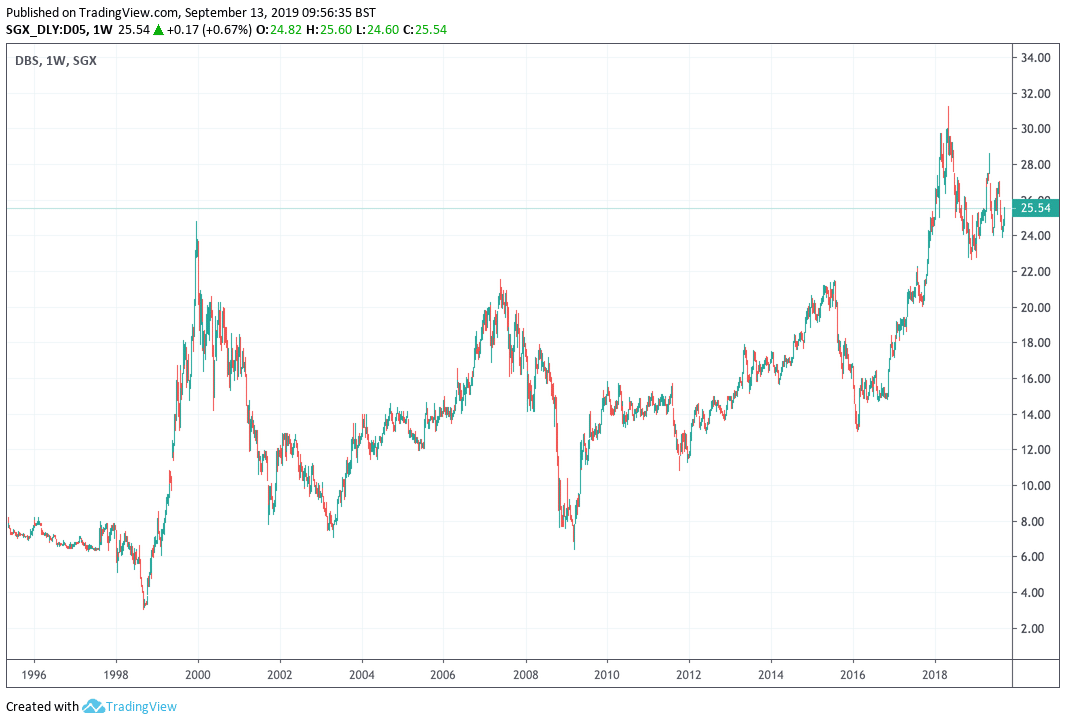

DBS Group (DO5 SG)

The political turmoil in HK may provide some opportunities for Singapore-based financial stocks. Asset holders from HK may seek safe harbour in Singapore-based banks like DBS Bank (DO5).

DBS Group is one of the largest banks in South East Asia and has operations in Indonesia, a fast-growing economy, India, among others. DBS’s controlling shareholder is Temasek, a Wealth Fund controlled by the Singapore Ministry of Finance. Technically, the stock is sitting atop the former resistance, now support at $22. A re-test of the highs is possible.

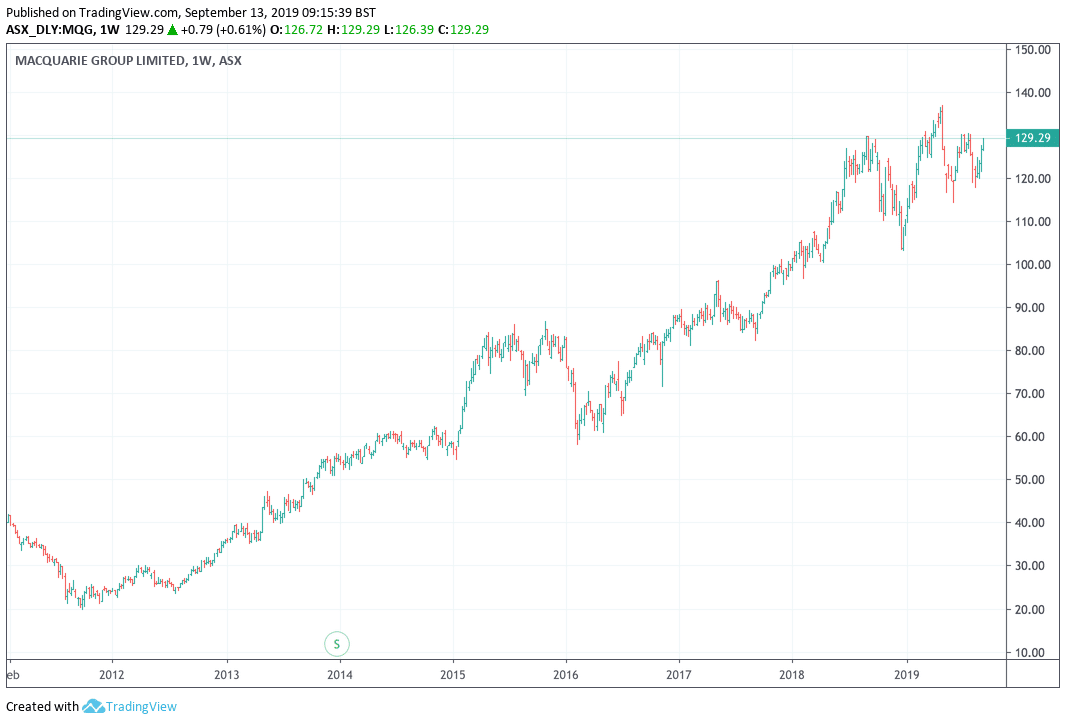

Macquerie Group (MQG.AU)

Macquerie is one of the most profitable companies in Australia. It is a diversified financial company with operations in asset management, corporate banking, and infrastructure investment etc. Investors like the stability of its earnings and have been bidding the stock up since 2012. According to the Financial Times, the stock yields about 5.3%, which is significantly higher than many sovereign bonds.

Technically, Macquerie remains on a cyclical bull trend with support levels just north of $100.

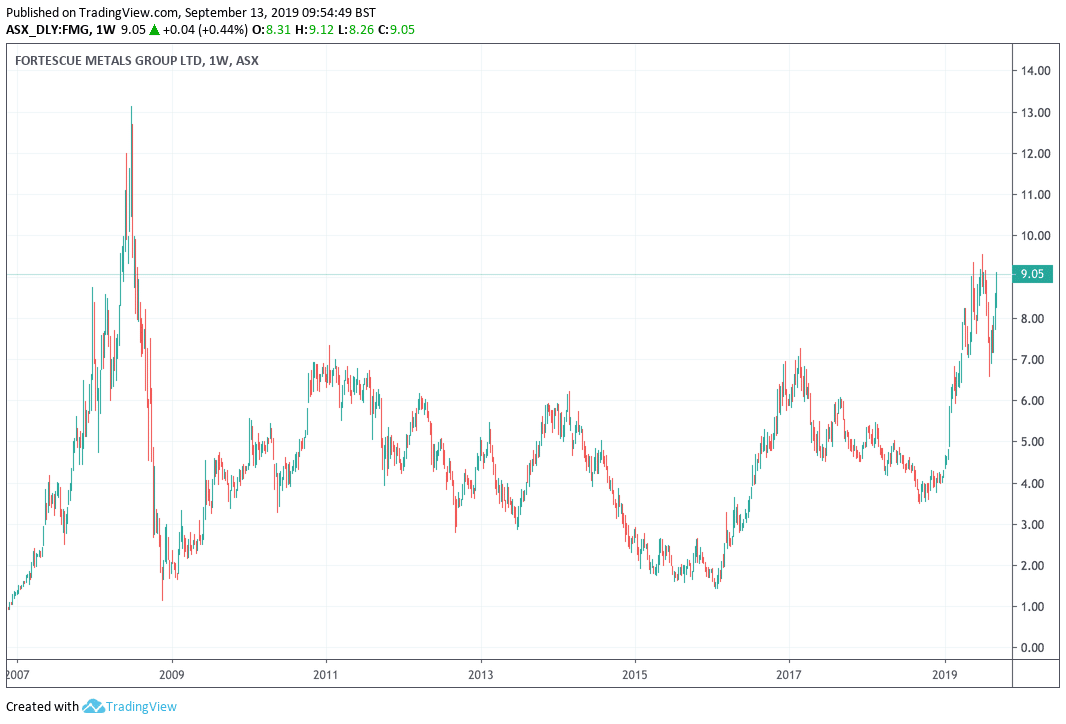

Fortescue Metals Group (FMG AU)

Fortescue Metals is the fourth largest iron ore company in the world. The firm struggled when the iron ore market was very subdue back in 2010-2016. But a recovery is now underway as iron ore prices rebound. Interestingly, the stock recently broke out above its decade-long base resistance at $7 and appears on the cusp of further rallies (see below).

Mining companies are always speculative. Fortescue is no different. Therefore, I expect high price volatility here. If you are keen on the stock, position size wisely.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.