The pound-to-Swiss Franc forecast is an indication of where technical and fundamental analysts think the GBPCHF price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy the Swiss Franc, or if you should wait until the price improves.

| GBPCHF Price | 1 Day Change | 1 Week Change | 1 Month Change | 1 Year Change |

| 1.116135 | -0.18% | -0.18% | -0.66% | 0.73% |

👉If you have a large upcoming Swiss Franc money transfer, we can recommend Currencies Direct as a secure FCA-regulated currency broker that can offer bank-beating exchange rates. Get a quote now.

GBPCHF Forecast Highlights

- GBPCHF abruptly reversed its uptrend in July; trading sideways since

- Rising market uncertainties underpin CHF strength

- GBPCHF to trade sideways until macro and monetary issues settle

How has the Pound performed against the Swiss Franc recently?

The Swiss Franc continues to act as an international ‘safe haven’ currency. Whenever investors felt uncertainties are increasing in the financial market, they seek safety in the Swiss Franc. This has always been the case since the seventies. During some episodes of extreme buying, the Swiss National Bank even had to intervene in the FX market to weaken the currency.

In 2022, GBPCHF crashed to near parity due to the chancellor’s budget debacle. While the rate had recovered speedily from that accelerated fall, it remains broadly – technically speaking – in a ‘base building’ mode.

Since my last update in the summer, the rate did a speed crash from 1.16 to 1.07 (see below). This correction neutralises the positive upside breakout at 1.150 and lengthens the sideways price action. I can’t say this correction was totally unexpected since there was a failed test of the resistance at 1.165 in mid-July. A failed breakout should always be viewed with a degree of caution. It signifies weakening price momentum.

Why did GBP do so badly against the Swiss Franc? Perhaps investors think Britain’s economy will continue to underperform Switzerland’s for the time being, even though there is a new administration in Downing Street. Or perhaps the Swiss currency is in greater demand due to macro uncertainties on the horizon (eg, US election). Whatever the reason, the summer crash showed us was that a sudden fall in the GBP is still possible, especially investors become overly optimistic. Economic reality still bites (the GBP).

Chartwise, the rate looks set for some sideways short-term trading between 1.100 and 1.150. A break on either side may lead to short-term trading activity.

Is it a good time to buy Swiss Francs with Pounds?

Based on the above analyses, it is a good time to buy Swiss Francs now?

The answer is yes if you need some CHFs in the coming months. The rate has rebounded above 1.10 and is on a slow rise towards 1.150. You can to secure these Francs with a currency forward.

Of course, you may wish to wait further to bet on renewed GBP strength. The next upside target is at 1.150. The risk is that Sterling may trade sideways with a modest downward drift. Buying on the spot when you need the Franc always carries some risks.

Will the pound get stronger against the Swiss Francs in 2025?

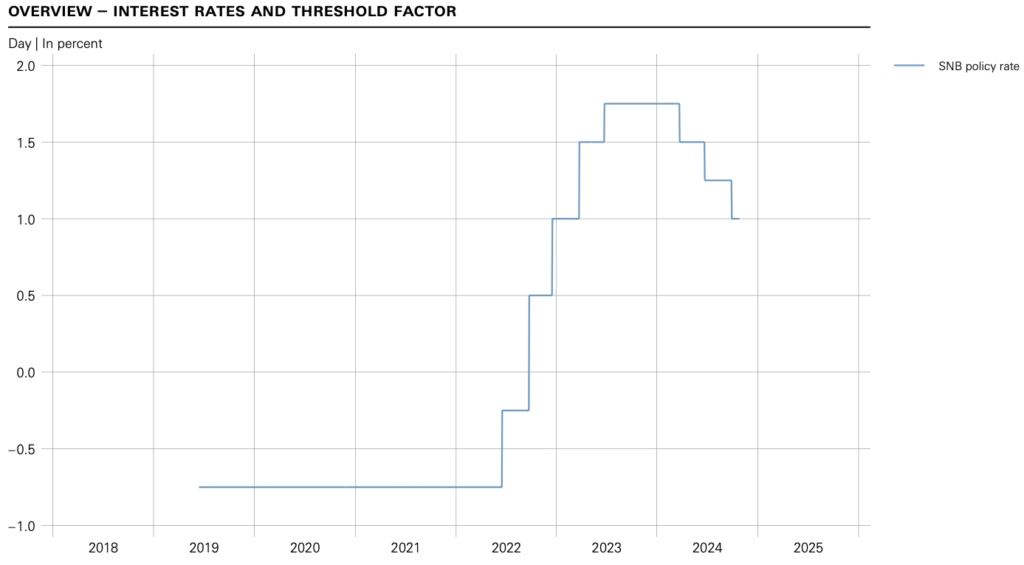

A turning point in global monetary policy is firmly on the table. After two years to rapid tightening, the trend is for set some monetary loosening. The Swiss National Bank is leading the way in this.

Over the past few months, the Swiss central bank has cut interest rates thrice. The reason for the string of rate cuts is clear: tumbling inflation. In the last monetary meeting back in September, the bank observed that:

Inflationary pressure in Switzerland has again decreased significantly compared to the previous quarter…..Inflation in the period since the last monetary policy assessment was lower than expected, standing at 1.1% in August compared to 1.4% in May. Imported goods and services in particular contributed to the decline……The new conditional inflation forecast is significantly lower than that of June. The stronger Swiss franc, the lower oil price and electricity price cuts announced for next January have contributed to the downward revision.

As a result, the SNB was able to lower the policy rate to 1.0 percent. This is the lowest level since late 2022 (see below). In comparison, the UK policy rate is still five times higher – at 5 percent. You may argue that the UK policy rate is too high and rate cuts are on the horizon. I concur. Inflation in September (as measured by the CPI) came in at a lowly 1.7 percent, which is below the BoE’s target rate. The scope for to lower the borrowing costs has increased.

With monetary policies now moving rapidly on both sides, investors aren’t sure where interest rates will land. Hence choppy trading could be the default price scenario going forward.

To gauge CHF’s strength, perhaps a more revealing rate to look at is EURCHF. EU member states, after all, are Switzerland’s largest trading partners. The rate is showing continuing CHF strength. The rate sunk beneath parity in 2022 and has been trading below that threshold since. In the summer, it even touched new long-term lows (weaker EUR) of 0.921.

Therefore, GBP will need to show further strength in order to reverse the medium-term downtrend against the Swiss Franc. Not easy, given the backdrop of sluggish British economic growth. GBPCHF’s default scenario is thus broad sideways movements in between 1.18 and 1.05.

Source: Swiss National Bank

What is the GBPCHF forecast in weeks, months, years?

Broadly speaking the market is not expecting GBP to strengthen significantly against the CHF in the coming weeks.

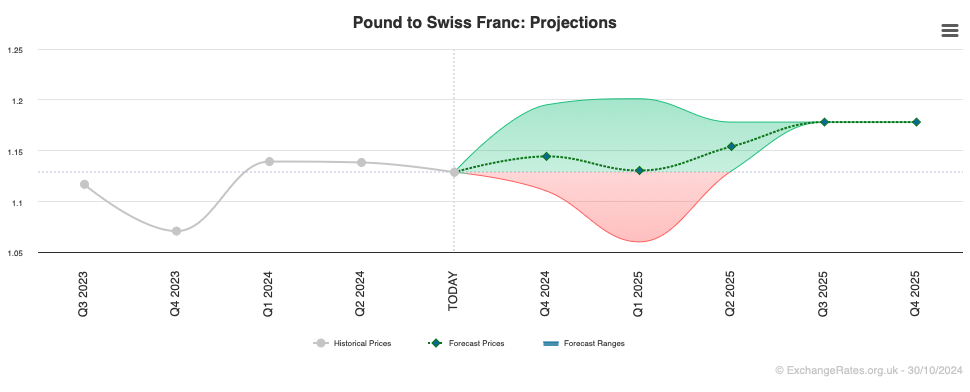

If we look at the aggregate forecasts of GPBCHF, the generate consensus is that the rates will gradually trend lower in the next few months. The projection chart below is taken from Exchangerateforecast.org.uk.

But the market is very dynamical at the moment and the rate may move quickly, up or down. Right now, the rate is steadying at 1.12. A 200bps move on either side does not change the technical picture much.

Source: Exchangerates.org.uk (Oct 2024)

Where is the best place for buying large amounts of Swiss Francs from Pounds

There are two different ways people buy Swiss Francs from Pounds

- Through a currency broker like Currencies Direct, OFX or Corpay– when transferring money abroad

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of currency

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum CHF transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPCHF, you can compare forex brokers here.

What is the live GBPCHF exchange rate?

The current GBPCHF exchange rate is 1.116135 which is a change of -0.18% from the previous days closing price. Over a week GBPCHF is -0.18%, compared to it’s change over a month of -0.66% and one year of 0.73%.

GBPCHF exchange rate data is updated every 15 minutes.

Other Forecasts:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com