The original question was: DO YOU KNOW WITH WICH BROKER I CAN TRADE VIX FUTURES (APART INTERACTIVE ) THANKS

If you’re not keen on Interactive Brokers, there are a plethora of futures brokers that offer access to VIX futures. However, I wouldn’t discount IBKR, they have a good reputation, low fees and provide access to a wide variety of markets. You can read our interview with Thomas Peterffy, the CEO & founder here.

Firstly, you will need a futures broker, you can either visit our page on Futures Brokers or take a look at any of the below futures brokers:

- Saxo Capital Markets

- Interactive Brokers

You can compare the best futures brokers here

Alternatives to VIX futures:

Trading futures is generally only for professional or experienced traders. As such minimum deposits for futures brokers tend to be around £10,000 or higher. You will also have to pay commission on a per trader basis. Futures commission are generally volume-based, so the more you trade the lower they are.

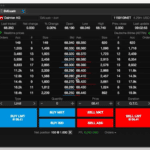

However, with futures trading, you will be using a DMA broker who should provide direct access to the exchange order book, in this case, the CBOE. Which means you can work bid/offers, and get inside the price.

If you are looking for a broker that offers access to the VIX market but with slightly smaller trade sizes you can go with a spread betting or CFD broker like:

- IG – good allrounder

- Spreadex – good personal service

- CMC Markets – very innovative platform

Further reading: Our comparison table of VIX brokers and guide to VIX trading

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.