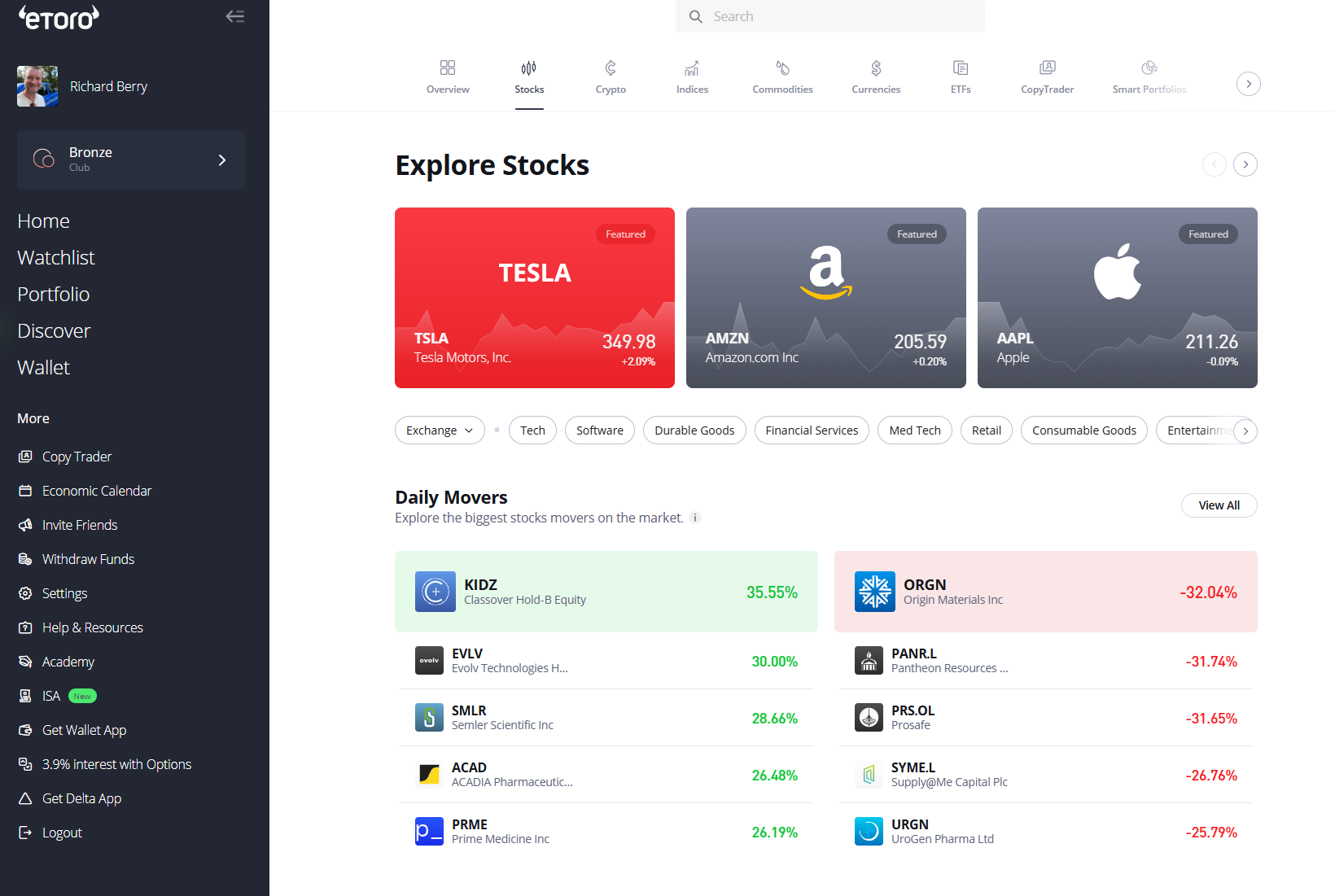

eToro lets you go long or short on global markets with CFDs

Account: eToro CFD Trading

Description: eToro lets you trade CFDs on major indices, forex pairs and stocks. One advantage of trading CFDs with eToro is that you can set your own leverage and reduce the amount of risk you take on per trade. A good option for new traders who want to see what other investors are trading through their social trading feature.

61% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Does eToro have CFD trading?

Yes, you can trade CFDs on eToro (but not if you are in America). As a CFD broker, eToro has a fairly basic offering, but that’s fine because I’d say that eToro is mainly geared towards beginner investors whose CFD trading is not really suitable, as it’s a leverage product and you can lose money quickly. But, having said that, it’s really easy to use for new CFD traders who want to take on some risk, but not too much, you can reduce leverage on CFD positions.

One of key benefits of CFD trading on eToro is that you can short the market if you think it is going to go down in the short term. However, eToro is not that great for longer-term CFD positions as their overnight financing charges are quite high compared to other brokers.

However, by trading CFDs on eToro you don’t have to pay stamp duty, which is currently 0.5% of the value of any shares you buy. So if you are just speculating in the short term it can be more cost-effective than buying fully paid-up shares.

Interestingly, last time I interviewed the UK MD of eToro he told me that less that 5% of revenue came from CFD trading. However, that was during the crypto boom and as investors have settled down and are taking longer-term equity positions, I think eToro’s CFD trading volume will increase in the future.

This is especially relevant as when you trade out-of-hours US stocks with eToro, your positions is classed as a CFD instead of a stock investment. 24 hours on exchange trading is definitely on the horizon so it may become cheaper to trade 24 hours with eToro soon.

Pros

- Social and copy CFD trading

- Easy-to-use CFD platform

- Can change your CFD leverage

Cons

- Accounts must be in USD

- High FX conversion charges

- Limited market range

-

Pricing

(4)

-

Market Access

(4.5)

-

Online Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4.5)

Overall

4.361% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.