One of the big advantages of eToro is that the platform allows you to trade stocks in both directions. Not only can you take ‘long’ positions in order to profit from rising share prices, but you can also take ‘short’ positions in order to capitalise on falling share prices. If you are interested in shorting stocks on eToro? This guide covers everything you need to know.

How to short stocks on eToro

Shorting stocks on eToro is a relatively straightforward process. Here are the steps involved.

- Login to the platform and fund your account.

- Search for the stock you wish to short and then select ‘Trade’.

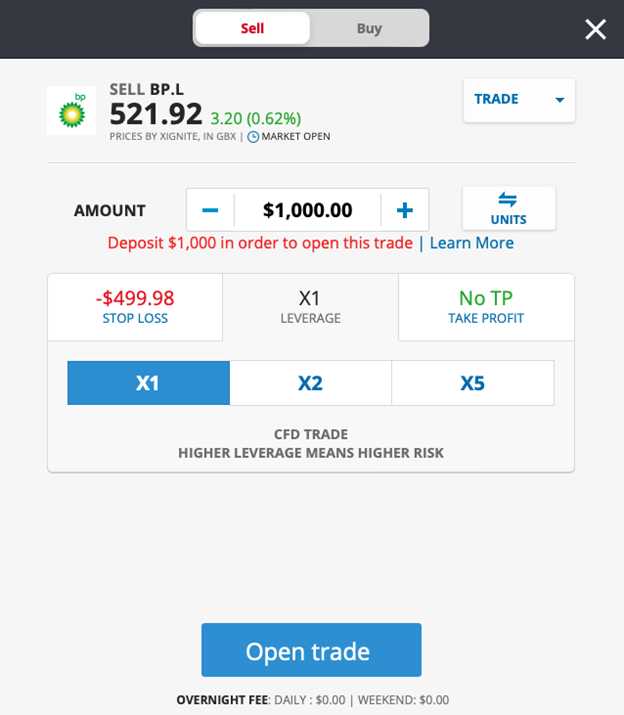

- Select SELL.

- Enter the amount of money you wish to trade on the stock or the number of units of stock you wish to trade.

- Set the stop loss and take profit parameters.

- Select the amount of leverage you wish to use (1X, 2X, etc.)

- Select ‘Open Trade’.

What is shorting?

Shorting (also known as ‘short selling’ or ‘going short’) is a trading strategy that aims to profit from a decline in a security’s price. An advanced strategy that’s typically undertaken by sophisticated investors (e.g. hedge funds), it involves betting against stocks and other securities in the hope that their prices will fall.

You can think of short selling as the opposite of regular investing. Whereas regular ‘long’ investors profit from rising share prices, those going short profit from falling share prices.

- Related Guide: Best Brokers For Shorting Stocks

How shorting stocks works on eToro

Traditionally, in order to short a stock, you had to borrow it from a broker and then sell it on the open market. The idea was that if the stock’s price fell, you could buy it back at the lower price, return it to the broker, and pocket the difference between the price it was sold for and the price it was bought back for.

This is not how shorting on eToro works, however. With eToro, the main way to go short is via Contracts for Difference (CFDs). CFDs are financial instruments that enable you to profit from a security’s price movements without owning the security itself. With these financial instruments, you can trade securities in both directions and use leverage to increase your exposure.

It’s worth noting, however, that there are a few other ways you can go short on eToro. One way is through ‘inverse’ exchange-traded funds (ETFs) such as the ProShares Short QQQ ETF. This aims to profit from a decline in the QQQ ETF, which tracks the Nasdaq 100 index. eToro also offers the ‘Short-ETFs’ Smart Portfolio. This comprises short positions on major global ETFs meaning its value is likely to rise if the prices of the ETFs fall.

What securities can you short on eToro?

It’s possible to short a wide range of securities on eToro including:

- Stocks (Apple, Lloyds, Tesla, BP, etc.)

- Indices (FTSE 100, S&P 500, Nasdaq 100, etc.)

- Commodities (oil, gold, copper, etc.)

- Exchange-traded funds (Vanguard S&P 500 ETF, iShares Core MSCI World UCITS ETF, etc.)

- Currencies (GBP/USD, AUD/USD, etc.)

What are the benefits of shorting stocks on eToro?

The ability to go short can be valuable at times.

For a start, shorting allows you to benefit from a decline in a security’s price. This can be valuable if you believe the security is overvalued or its fundamentals are deteriorating.

Shorting can also allow you to hedge against market weakness. For example, if you believe the market is set to fall, you could open some short positions to protect your portfolio.

What are the risks of shorting stocks on eToro?

Investors need to be careful when shorting stocks as it’s a risky strategy.

If you short a stock and its price rises, you are going to generate a loss. And losses can be significant. While a stock can only fall to zero, there is no theoretical limit to how high it can go.

One big risk short sellers face is short squeezes. A short squeeze occurs when sentiment towards a heavily-shorted stock improves, and short sellers rush to close their positions. This can push the stock’s price up substantially, resulting in large losses for those with short positions.

What are the costs of shorting stocks on eToro?

eToro offers commission-free trading. However, there are several hidden fees to be aware of when shorting stocks on the platform. These include:

- Trading spreads (the difference between the cost to buy and the cost to sell a security).

- Overnight or ‘rollover’ fees. These may apply if you hold a CFD position overnight.

- FX conversion fees. On eToro, all trades have to be made in USD.

eToro also charges a $5 withdrawal fee.

Shorting on eToro summary

- Shorting is a trading strategy that aims to profit from a decline in a security’s price.

- You can short a range of securities on eToro including stocks, indices, ETFs, and commodities.

- Traders should be aware of the risks involved in shorting.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com