-

Reviews By

Richard Berry

Reviews By

Richard Berry

- Updated

| Name | Logo | GMG Rating | Customer Reviews | SIPP Annual Fees | Dealing Fees | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

GMG Rating |

Customer Reviews 4.2

(Based on 1,105 reviews)

|

SIPP Annual Fees 0% – 0.25% |

Dealing Fees £3.50 – £5 |

See Offer Capital at risk |

Features:

|

AJ Bell's SIPP & pension is one of the cheapest around for retirement investing Account: AJ Bell SIPP & Pension Description: AJ Bell offers the cheapest SIPP account when you compare them against providers that charge a percentage of your portfolio value. You can invest in a wide range of investments, including stocks in more than 20 markets, over 4,000 funds, ETFs, and bonds.

Is AJ Bell's pension any good? AJ Bell won “best SIPP provider” in our 2023 and 2022 awards. They offer a huge range of UK and international markets to invest in (with low FX fees). AJ Bell also scored very well in our survey for customer support and has an easy-to-use and low-cost SIPP account platform. AJ Bell SIPP Special Offers: Up to £500 cashback: Switch your SIPP to AJ Bell and they will pay up to £35 per investment and £100 in exit fees as cash back to cover your costs up to £500. AJ Bell SIPP Fees: Annual account charges are 0.25% for shares (capped at £10/month) and tiered for funds (0.25% up to £250,000, 0.10% up to £500,000, and free beyond), with dealing charges of £5 for shares (£3.50 for frequent traders) and £1.50 for funds. Pros

Cons

Overall5 |

||

|

GMG Rating |

Customer Reviews 3.8

(Based on 1,774 reviews)

|

SIPP Annual Fees 0% – 0.45% |

Dealing Fees £5.95 – £11.95 |

See Offer Capital at risk |

Features:

|

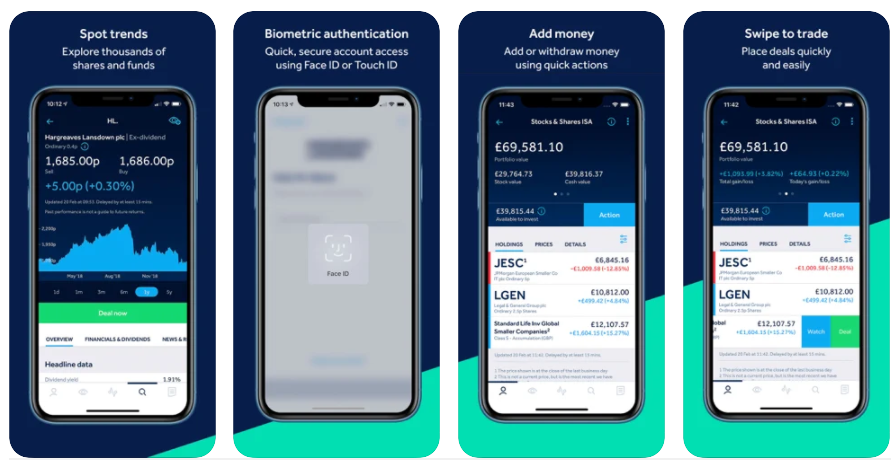

Hargreaves Lansdown SIPP & Pension Is Great For Those That Want Excellent Service & Research Account: Hargreaves Lansdown SIPP & Pension Description: We do however, consistantly rank Hargreaves Lansdown as one of the best SIPP providers in the UK (HL won best SIPP in our 2022 Awards). The main advantage of Hargreaves Lansdown’s SIPP is that it offers access to a vast range of investments. Investors have access to domestic and international equities, over 3,000 funds, bonds, as well as plenty of research and investment tools. Customer service is also top notch, with really helpful and knowledgable staff that can provide guidence if needed. Is Hargreaves Lansdown SIPP (Pension) Any Good? Yes, Hargreaves Lansdown SIPP costs start at 0.45% of your portfolio value. The account charge for shares is capped at £200 per year. Funds are charged at 0.45% for the first £250,000, then 0.25% between £250k and £1m, then 0.1% between £1-£2m. There is no charge above £2m. There is no charge for buying funds, but shares are charged at £11.95 per deal or £5.95 if you do over 20 deals per month. But, if you open a SIPP with HL before the 30th June with £10k or more you’ll get a discount of 40% on account fees. As HL is generally quite expensive, this is a great deal, and could save you £180 in fees. But keep in mind that when this discount ends in 2026, if you have £100,000 in your SIPP with HL it will cost £450 a year, versus £155.88 with interactive investor. For beginners and smaller accounts Hargreaves Lansdown, is a great choice, as HL offer one of the best apps on the market and provide stock research and analysis on the most heavily traded stocks in the UK and US. Hargreaves Lansdown is also good for beginners because they are quite simple to use and have an excellent reputation for customer support from their Bristol based offices. They may be a little more expensive that some of the other platforms, but you certainly get what you pay for. Some SIPP accounts are better suited to beginners than others. Generally speaking, beginner investors require a SIPP that is easy to use, cost-effective, and offers access to products that are well suited to beginners such as ready-made portfolios. So, if you are a complete beginner to SIPP investing and are not confident enough to choose what individual stocks and shares you want to own in the long term. A private pension may be more appropriate. One private pension account (which is not actually a SIPP because you can’t buy individual shares) that is well suited to beginners is Wealthify. Wealthify is a robo advisor (or digital wealth manager) that offers a managed pension product. With Wealthify, you choose an investment style based on your risk tolerance. One advantage of Wealthify is that the minimum investment is just £50. One downside, however, is that there are only a few investment options to choose from. Pros

Cons

Overall4.8 |

||

|

GMG Rating |

Customer Reviews 4.3

(Based on 1,123 reviews)

|

SIPP Annual Fees £59.88 – £143.88 |

Dealing Fees £3.99 |

See Offer Capital at risk |

Features:

|

Interactive Investor SIPP won best self-invested personal pension 2025 Account: Interactive Investor SIPP Description: Interactive Investor offers the most investment options in the UK SIPP markets. With II you can invest more than 40,000 domestic and international shares, ETFs, bonds and over 3,000 funds (AJ Bell has 2,000 and HL offers 2,500 funds). Is Interactive Investors' SIPP (pension) any good? Yes, interactive investor won “Best SIPP Provider” in the 2025 Good Money Guide Awards. ii has a really good pre-selected fund section, which makes crucial SIPP asset allocation decisions much easier. It’s very low cost too, with excellent education and research, and a huge range of investments to choose from. The key advantage of interactive investor’s SIPP is that it has a flat-fee structure. This means that annual account charges do not increase as your pension pot grows in size. This structure can help those with larger SIPP portfolios save on fees, however it can be a little expensive for small pensions if you are just starting to invest for your retirement. For smaller pension pots, those that just want to invest in ETFs, InvestEngine offer a free SIPP, but it is limited to just UK-listed ETFs, so you can’t buy individual shares. One of the good things about ii’s SIPP is that you can buy bonds, gilts, and shares in small and large UK and international companies. Even though ii charges £3.99 for buying funds. If you compare this to Hargreaves Lansdown, which does not charge for buying and selling funds, but HL SIPP fees are higher. If you have £100,000 in your SIPP with ii you’d pay £71.88 a year, versus HL where your fees would be £450. So, if you have a big pension, is it worth moving it to ii? Well, yes at the moment, as interactive investor claim their SIPP pricing can give you an additional £68,467 towards your pension after 30 years compared to HL. Plus, if you transfer your SIPP to ii before 31st August, you can claim up to £2,000 in cash back.

Of course, you’ll need to add cash or start a transfer of a minimum value of £10,000 to qualify for your cashback reward. Terms apply. Pros

Cons

Overall5 |

||

|

GMG Rating |

Customer Reviews 4.1

(Based on 15 reviews)

|

SIPP Annual Fees £120 |

Dealing Fees £0 |

See Offer Capital at risk |

Features:

|

CMC Invest’s SIPP is Great for Active Investors Account: CMC Invest SIPP Description: CMC Invest’s SIPP is great for active investors and you can buy mid and small-cap UK shares, AIM shares and 1,000+ mutual funds as well as 3,000+ US shares, large-cap UK shares, 400+ ETFs, investment trusts and REITs with zero commission. What is a CMC Invest SIPP? The SIPP is available to CMC Invest Premium account holders. SIPP holders will be able to trade at zero commission (other charges may apply), within their Premium plan, which is £25 a month. A self-invested personal pension or SIPP is a class of personal pension plan in the United Kingdom. A SIPP allows you to make your own investment decisions about your retirement savings. With a SIPP, you have a wide range of investment options, including stocks, bonds, mutual funds, exchange-traded funds (ETFs) and more. This flexibility allows you to tailor your investments according to your risk tolerance and investment goals. As with other personal pension schemes, contributions to a SIPP are eligible for tax relief, reducing your overall tax liability and boosting your investments. The money within the SIPP grows tax-free, and you can access your pension savings from the age of 55 under current legislation. SIPPs are portable, meaning you can transfer them from one provider to another if you are unhappy with the service or want to consolidate multiple pensions. With a SIPP, you have greater control over your retirement savings and investment decisions, as opposed to traditional personal pension plans where investment decisions are made by the provider. Though, of course, that puts the onus of performance firmly on you. Overall, SIPPs are designed for self-determined individuals who want to take an active role in managing their retirement savings and who have a good understanding of investment principles. Pros

Cons

Overall4.4 |

||

|

GMG Rating |

Customer Reviews 3.9

(Based on 695 reviews)

|

SIPP Annual Fees £210 |

Dealing Fees £0 |

See Offer Capital at risk |

Features:

|

IG SIPP & Pension Review: Great for active SIPP investors & Smart portfolios Account: IG SIPP & Pension Description: IG’s SIPP account lets you invest in over 13,000 UK and US shares, funds and investment trusts. Or if you can buy into an IG Smart Portfolios are expertly managed, broadly diversified portfolios with exposure to many global markets, such as fixed income and equity, along with alternative investments like gold and property. Is IG's SIPP (pension) any good? IG SIPP clients will be able to invest in a wide range of individual stocks, ETFs, and investment trusts, as well as placings and IPOs, through IG’s relationship with Primary Bid. IG Smart Portfolios are also available to its SIPP Customers. To start investing in a SIPP through IG you will first need to open an IG share dealing or Smart Portfolio account, and then add a SIPP account, using the MY IG dashboard. You can then set up your SIPP with Options UK, from whom you will receive an email invite. Options UK will let IG know when the SIPP is set up and they will activate it. IG SIPP Fees: A SIPP with IG costs £210 per year and dealing commission for UK shares have just been removed to £0, you can buy and sell UK and US shares for free (excluding the FX fees of 0.7%). IG Smart Portfolio fees are 0.5% – capped at £250 per year. Fund management charges are 0.13% and transaction costs are 0.09%. Can you transfer an existing SIPP into IG? Yes. Alternatively, you can transfer an existing SIPP to Options UK from any UK-registered pension scheme, or a recognised overseas pension scheme. IG SIPP clients can invest up to £40,000 in the current tax year (under existing legislation) and they will pay zero commission on US stock trades, and just £3.0 per trade on UK trades, if, they have traded at least three times, in the previous month. Options UK charges £210.00 per annum as a SIPP management fee. How does IG’s SIPP compare to Interactive Brokers and Saxo Markets? Many of IG’s competitors offer SIPP trading facilities, for example, Interactive Brokers has its own SIPP trading account, which allows investors to trade in stocks, bonds, funds and ETFs, in 150 markets, spread across 33 different countries. Interactive Brokers offers its customary low commissions to its SIPP customers. However, its SIPP account also has some additional perks, such as interest on uninvested cash balances, fractional share trading, and a stock yield enhancement program. Under which, qualifying SIPP holders can elect to lend the shares held in their SIPP on the stock loan market, via Interactive brokers, and they will receive 50% of the fees generated by way of return. It’s also possible to trade derivatives such as futures, options, and currencies within the Interactive Brokers SIPP. Saxo Markets also has its own SIPP account, however, the bank does not act as a pension administrator or trustee. Rather it facilitates the trading of securities within a SIPP, that is managed and administered elsewhere. Opening a SIPP account at Saxo is free of charge and Saxo supports two SIPP providers, to whom clients can transfer their SIPPs. Saxo’s charging structure is tiered, so you pay a commission thats applicable to either the Classic, Platinum or VIP tiers, depending on your activity levels. Clients in the classic tier pay 2 cents per share commission on US equity trades, and 0.10% of the consideration on UK and European equity deals. Whilst VIP clients pay 1 cent per share on US trades, and just 0.05% on UK and European equity deals. However, not every trading platform offers SIPP trading, for example, SIPP trading is not available at eToro or CMC Markets, though the recently launched CMC Invest platform will be introducing SIPP trading in the near future. Pros

Cons

Overall5 |

Our experts hand-picked the best SIPP providers based on:

- User feedback. We analysed over 30,000 votes and reviews in the prestigious Good Money Guide annual awards.

- Unbiased, real-world testing. Our team tests each SIPP provider with real money to ensure you have a seamless and user-friendly experience.

- In-depth feature comparison. We conduct a thorough comparison of SIPP features, highlighting those that make each provider stand out from the competition.

- Exclusive insights from the top: Our exclusive interviews with SIPP provider CEOs provide insider perspectives and valuable information to help you make informed decisions.

What is a SIPP?

SIPPs are a type of pension that lets you invest in individual shares & ETFs, which gives you more control over your retirement pension pot. They are great if you want to take more risk, or invest in brands and companies you use and love.

A self-invested personal pension (SIPP) lets you take control of your retirement investments. Unlike a traditional private pension managed by professionals, a SIPP allows you to choose individual shares, bonds, funds, and exchange-traded funds (ETFs), giving you more flexibility over your investments.

SIPPs are ideal if you’re confident in managing your pension savings. They can grow your retirement fund faster if you invest wisely. SIPPs typically cost less than managed pensions and provide a wider range of investment options compared to personal pensions.

What Investments Can be Held in a SIPP?

The range of investment options will vary across SIPP providers, but typically you can choose from:

- Individual stocks. These are company shares registered on a stock exchange

- Bonds. These are loans made to companies or the government

- Unit trusts. These are open-ended funds which pool your investments with others’

- Investment trusts. This means a closed-ended investment vehicle where your money is pooled with other investors’

- Exchange-traded funds (ETFs). An ETF is a basket of stocks that trades on an exchange

- Deposit accounts with banks and building societies. These provide fixed returns on savings accounts

- Commercial property. This means investments in office buildings, shops and factories (full SIPPs).

How to Choose a SIPP Provider

These are the main aspects to consider:

- Account fee – the annual charges of having a SIPP account

- Minimum deposit – the smallest amount of money you can deposit initially to open a SIPP account

- Share dealing fee – the standard fee for buying and selling UK shares (this may reduce for frequent traders)

- Fund dealing fee – the cost of buying and selling funds (this may reduce for multiple monthly deals)

- International shares – does the SIPP account give you access to US and other international stock markets?

- Junior SIPPs – can you also open an account for your children to help them invest for their retirement?

How Much Can You Pay into Your SIPP?

You can pay 100% of your earnings into a pension in a year and receive tax relief of up to 40% on the first £60,000 paid in per year. This is known as your annual allowance; there is no longer a lifetime allowance.

This standard annual allowance is reduced by £1 for every £2 of “adjusted income” you have above £260,000. That applies if your income minus the amount you paid into a pension was above £200,000, and your total, including payments to your pension, was above £260,000.

SIPP Returns Calculator

Find out how much your contributions will be worth when you retire with our free online SIPP returns calculator. A good return on a SIPP would be 7% – 10% but this depends on how the overall stock market is performing.

What Is The Best SIPP?

interactive investor won “Best SIPP Provider” in the 2025 Good Money Guide Awards becuase of its fixed fee structure and wide range of market available.

Other highly rated SIPP accounts in the UK are:

- IG for Smart Portfolios

- Hargreaves Lansdown for customer service

- AJ Bell for low costs

What Is The Cheapest SIPP Account?

InvestEngine has zero account fee for it’s pension product.

But as you can only invest in ETFs, you cannot buy individual shares, so do not have complete control.

However, of the full-service SIPPs we compare from full-service stock brokers, AJ Bell is the cheapest SIPP as their account fee starts at 0.25% compared to Hargreaves Lansdown’s 0.45%.

However, Bestinvest charges the lowest SIPP account fee (0.2%) if you are investing in ready-made portfolios. But, for other investments like shares, ETFs and investment trusts, the basic account fee starts at 0.4%.

So in actual fact, if you treat a SIPP as it is intended where you choose exactly the shares and funds you buy and sell in it, AJ Bell has the cheapest annual charges which are capped at £10 a month for shares.

Best SIPP For Large Pensions

For those with large pension accounts, Interactive Investor’s SIPP can be very cost-effective. This SIPP offers a flat-fee structure meaning that annual account charges do not get bigger as your SIPP grows in size. Fees for pensions above £50k are only £12.99 a month.

If you have a £1 million pension, choosing interactive investors flat-fee platform at £12.99 a month would save you a huge amount compared to a provider charging 0.25% annually.

The flat fee works out at just £155.88 per year, versus £2,500 a year on the percentage-based model.

Over a decade, that’s £1,558.80 in flat fees compared with £25,000 in percentage charges, a total saving of £23,441.20 simply by opting for the cheaper structure.

Best SIPP For UK Shares

We rank AJ Bell as the best SIPP account for holding shares, because of their low fees and excellent research.

Holding shares in a SIPP with AJ Bell costs 0.25% of your pension value which is capped at £10 per month.

This is lower than interactive investor’s £12.99 per month, and significantly lower than Hargraves Lansdown’s 0.45% annual fee

If you buy and sell shares for your SIPP on a regular basis with AJ Bell UK dealing commission is reduced from £5 to £3.50 per share.

Plus, as a full service stock broker, AJ Bell gives investors access to smaller cap shares which have greater growth potential.

Best SIPP For US Stocks & International Stocks

We rank Hargreaves Lansdown as the best SIPP for buying US stocks as they offer an excellent research platform for choosing which US stocks to buy.

International investing also falls under their standard dealing fees which are £11.95 per trade, which reduces to £8.95 if you do over ten deals, or £5.95 if you are buying and selling shares more than 20 times a month.

Technically Interactive Brokers has the lowest fees for buying international shares in a SIPP, as the minimum charge per trade is £1 and the FX conversion rate is as low as 0.2%, but, they are online only and do not have the customer service in the UK or the research portal that Hargreaves Lansdown clients have access to.

Best SIPP Apps

We rate Hargreaves Lansdown as having the best SIPP platform if you want to use your SIPP account to make investing decisions. Interactive Investor, Bestinvest and AJ Bell may be cheaper, but they don’t offer anywhere near as comprehensive data, research and analysis as Hargreaves Lansdown.

Hargreaves Lansdown enables you to see risers and fallers, get an overview of world markets, drill down in a company’s fundamentals and compare charts. You can also see what the most popular traded shares are from its 1.7 million customers and rank bonds by yield and coupons.

Hargreaves Lansdown also produces a list of shortlisted funds and sector reviews, should you wish to use them for market timing technical analysis on the charting software.

What are the best SIPP transfer offers?

SIPP providers are constantly battling for the best clients, and many will be willing to offer attractive cashback options for people who transfer their SIPPs.

If you are thinking of moving your self-invested personal pension, we’ve put together a list of which SIPP providers are offering the best transfer cashback offers and deals that could cover exit costs or give you a top-up bonus when you move your SIPP to a different provider.

We have ranked the top SIPP transfer offers below:

- interactive investor: Get £200 cashback when you open a SIPP and deposit or transfer a minimum of £15,000.

- AJ Bell: £500 to cover exit fees, free shares magazine worth £220 a year, Addidas gift card worth £200

- Hargreaves Lansdown: No SIPP transfer offer

- CMC Invest: No SIPP transfer offer

- IG: No SIPP transfer offer

- InvestEngine: No SIPP transfer offer

Note: The FCA only allows affiliates to feature a single offer by a provider so it’s worth checking their websites directly for the most up-to-date information.

Each of these looks attractive, but it is important to understand the detail before you commit to a switch. You should consider cashback offers against the overall price of the pension carefully. For example, providers have historically masked higher annual fees when compared to competitors with attractive cashback offers. In other words, they are using your money from high fees to pay for their special offer. Suddenly things don’t look so rosy.

Others place limits. Cashback may rise and fall depending on how much you’re putting in. You might have to transfer quite a large amount to get the full value of the cashback offer. Others will only cover a certain amount.

Special offers on SIPPs, therefore, can be great, but they don’t tell the whole story. When choosing a SIPP always look at all the features and their fees before you decide whether to take the plunge.

When making the decision, you need to make sure you understand all the cost implications. Some of these deals are not actually cashbacks but come with higher-than-normal fees. In other words, they are using your money to fund your own cashback and hoping you won’t notice. The fact that they feel the need to pay you to make a transfer may also say something about the underlying quality of their SIPP. Sometimes it’s worth looking at SIPP provider that do not offer special offers, as the service and quality of the product are the only incentive customers need to sign up.

Self-invested pension transfers can take a long time. Fortunately, plenty of providers offer cashback and special incentives to those who want to switch.

This is because maximising your pension pot can often be improved with a switch to a new, better performing provider. According to a recent study from Which, switching to a self-invested pension could save more than £20,000 in the run-up to retirement.

The idea of switching becomes even more attractive when you consider how many special offers leading providers have put in place to attract switches. From cashback to temporary discounts, switching your pension could offer all sorts of benefits.

However, you should be very careful before moving your pension to a SIPP as private or corporate pensions come with benefits that self-invested personal pensions cannot match. If you are considering transferring a pension into a SIPP you must talk to an independent financial advisor beforehand.

You should also not just switch because of a cashback offer, you should see the cashback offer as a bonus for switching, not the only reason. Specifically, if you actively manage your SIPP, as you may find the new provider does not offer the same market access as your existing one.

Also, all providers charge differently for SIPP. For example, Interactive Investors, charge a flat fee, so no matter the value of your SIPP, your fees will be the same. If you were to switch from ii, to Hargreaves Lansdown, where charges are scaled all the way up to £2m for funds, you could end up paying more over time.

The other thing to consider is if you want to give your children a head start on their retirement with a Junior SIPP. Interactive Investor for example, does not offer Junior self-invested personal pensions, where as HL does, so if you were considering moving from HL to II, it would mean managing accounts at two separate providers.

- Related guide: How to start a private pension

New providers will often say they will cover you for ‘up to’ a certain amount, so you need to look beyond the headline figure and see how much they will really give you. Check this carefully, if the cashback offer isn’t enough to cover any costs associated with moving your account away from your existing provider you will need to consider if this provider still offers the best deal for you.

It’s a balancing act. On the one hand you must calculate the full extent of the exit fees you could be facing and on the other you should make sure you read the small print of any SIPP transfer offer. Make sure you understand all the features of the SIPP and its fees. Only then will you be able to decide whether it really is worth making the change.

Ultimately, you will be better off in the long term paying low annual fees for SIPP management and earning the best returns, over a gaining a £250 cashback offer now but paying more for your SIPP for the next 20 years.

SIPP transfers can be difficult, expensive and time-consuming but our comparison can make it easier to choose the best SIPP provider for your account.

I’d say generally no. You shouldn’t switch your SIPP from one provider to another just to get the cashback as overall pricing structures and the time and effort can eat into any reward. However, if you are going to switch your SIPP anyway, it’s always worth ensuring you do it in a way that qualifies you for the cashback to make more of your money.

FCA Regulation Gives You Peace of Mind

All UK SIPP providers must be regulated by the Financial Conduct Authority (FCA), which ensures they are financially secure, treat customers fairly, and maintain proper compliance systems.

Good Money Guide lists only FCA-regulated SIPP accounts, offering the added protection of the Financial Services Compensation Scheme (FSCS) for your funds, which means your deposits are protected up to £85,000 if your provider were to go bust.

Is a SIPP Right for You?

Compared with a normal or private pension, the main advantage of a SIPP is you get more investment options; the main disadvantage is that you are responsible for managing your own money.

Pros of SIPPs

- Contributions come with tax relief

- Investment gains and income are tax-free

- There’s a generous annual allowance

- You have control over your retirement savings

- You generally have a wide range of investment options to choose from

- You can transfer old pensions into your account

Cons of SIPPs

- You can’t access your money before the age of 55

- When you turn 55, you can withdraw only 25% of your SIPP tax-free

- There’s a limit to the amount of tax relief you can get

- You’re responsible for managing your retirement savings

SIPPs vs Personal Pensions

SIPPs work much like personal pensions, which you set up and manage yourself. The key difference is that SIPPs usually provide a wider range of investment options.

With a SIPP, you can invest in UK and international shares, funds, investment trusts, ETFs, bonds, and more. In contrast, personal pensions typically restrict your choices to managed funds and ready-made portfolios.

If you want to transfer a private pension to a SIPP, most SIPPs will help you transfer pensions free of charge and in some cases may cover some of your exit fees.

However, not all plans let you take your money out and even if you can transfer, you will likely pay charges. The rules and fees vary across providers, but the regulator is clamping down on exit fees.

If you have a final salary (defined benefit) scheme with your employer with a pot of £30,000 or more, you will need the transfer approved by a regulated adviser, to ensure you don’t lose significant pension benefits.

Different Types of SIPP

There are two types of SIPP – which you choose depends on how you want to invest for your retirement. Below we explain the difference between low-cost and full SIPPs.

Low-Cost SIPPs

The low-cost SIPP (also known as SIPP lite or DIY SIPP) normally has lower fees than a full SIPP. This is because it is “execution-only”, which means the provider offers a platform for you to choose and manage your investments. There are generally fewer investment choices and typically no investment advice.

Low-cost SIPPs offer fewer asset classes than their full-cost counterparts and typically include listed equities, ETFs and bonds, but not unlisted equity or commercial property.

Some may just offer a limited number of ready-made funds. Providers don’t offer advice, leaving the investor to make their choices on their own.

Full SIPPs

Full SIPPs offer the widest range of investment choices, including unlisted stocks and commercial property. Some full SIPP providers also give you access to an investment adviser.

The advice – and the broader investment options – mean that full SIPP fees are generally higher than lite SIPPs’ fees. When thinking about what to include in your SIPP, remember that you will need to maintain and manage your portfolio, so your financial circumstances and expectations are important.

Think about your level of investment experience, financial knowledge and confidence. Consider whether the provider offers a smaller fixed range of investments or a wider, more flexible portfolio.

Fees: How Much Do SIPPs Cost?

SIPPs are generally cheaper than private pensions because you are making the investment decisions yourself; however, they are not free.

Here are the main costs of investing in a SIPP for your retirement:

-

Account Costs (Custody Fees)

This is the annual charge to cover running the SIPP. Typically this will be charged as a percentage of the value of your pension portfolio or as a flat fee. If a provider charges a percentage there will often be a cap on how much is charged monthly. interactive investor for instance charges a flat fee of £9.99 for pensions below £50,000.

-

Dealing Charges

These apply to the buying and selling of share, funds and ETFs. The more active an investor you are, the lower these will be. Hargreaves Lansdown for instance will reduce share dealing commission from £11.95 to £5.95 if you had 20 or more share deals in the previous month.

-

Exit Fees

These are the fees a SIPP platform will charge when you transfer out your pension. They are not as common as they used to be and some brokers may cover the cost of the fines if you transfer into them. For example, AJ Bell will pay up to £35 per investment moved and up to £100 to cover general exit fees, up to an overall maximum of £500 per person.

Tips to reduce your SIPP charges

You can reduce your SIPP charges by following these tips:

It’s worth noting that on some platforms, some investments attract lower custody fees than others. For example, Hargreaves Lansdown SIPP fees start at 0.45% compared with AJ Bell’s 0.25%.

ETFs, for example, generally have much lower fees than actively managed funds. It’s much cheaper to buy an ETF that follows gold, than to invest in a selection of gold stocks that perform relative to the gold price.

If you set your SIPP account to automatically invest in funds and shares for you each month, it is cheaper than doing it manually as commission is reduced. You can also save money by dealing once a month, rather than by doing lots of small deals.

SIPP Provider FAQs:

Yes. Investing with a regulated SIPP provider is generally safe as UK regulators require SIPP providers to keep clients’ assets separate from their own money. This means that the assets cannot be taken by creditors if the firm goes bust. A SIPP trustee is an organisation that holds assets in a trust for the beneficiaries of the account. The trustees are responsible for ensuring that the account holder’s investments are secure. A SIPP administrator is an entity responsible for ensuring that a SIPP is run properly.

If a regulated SIPP provider fails, you will be covered by the Financial Services Compensation Scheme (FSCS). This protects up to £85,000 of your investment deposit per person per provider.

It’s important to understand, however, that investments within a SIPP come with risk. The FSCS won’t protect you if your SIPP investments fall in value.

To open and pay into a SIPP, you must be aged between 18 and 75 and either a UK resident or a Crown employee (or married to or in a civil partnership with a Crown employee). Those under the age of 18 are eligible for a junior SIPP.

You can have a SIPP alongside other pension accounts such as workplace pension schemes as well as other investment accounts such as ISAs. You’re allowed to have multiple SIPP accounts if you wish to.

Yes, with a Junior SIPP. SIPPs are available to those aged between 18 and 75. For those under the age of 18, junior SIPPs are available. With a junior SIPP, you can contribute up to £2,880 per year and contributions get 20% tax relief. The money is tied up until retirement age.

Another investment option for those under the age of 18 is the junior stocks and shares ISA. In this account, all investment gains and income are tax-free. The junior ISA has an annual allowance of £9,000.

Comparing the performance of different SIPP accounts is difficult because most SIPPs offer a wide range of investments and you’re in charge of investing your money. Additionally, the returns from investments within a SIPP such as shares, funds, and ETFs are uncertain and past performance doesn’t indicate future performance.

If your goal is to generate high returns from your SIPP, the key is to focus on the range of investments offered by the SIPP, as well as the fee structure, as these factors are the main determinants of a SIPP’s return potential.

Compared with a Lifetime ISA, the main advantages of a SIPP are that contributions come with tax relief, you can potentially contribute more than the £4,000 lifetime ISA allowance, and you can access your money at age 55 (versus age 60 or when you buy your first property for a lifetime ISA). The main disadvantages of a SIPP versus a lifetime ISA are that at age 55, you can withdraw only 25% tax-free. With a lifetime ISA, you can withdraw all your money tax-free at 60 or when you buy your first property.

When you put your SIPP into drawdown, you keep most of your pension invested, while making flexible withdrawals for income.

You can move your SIPP into drawdown when you turn 55. Once in drawdown, you can take up to 25% of your SIPP as a tax-free lump sum. You can then make withdrawals from the remainder of your pension balance that can be used for retirement income. These will be taxed at your normal rate.

With pension drawdown, you generally have a lot of flexibility. You have flexibility over the amounts you withdraw and the timing of the withdrawals. Also, you’re not locked into drawdown for life. At any time, you can use your pension savings to buy an alternative retirement income product such as an annuity.

To set up SIPP drawdown, you need to ask your SIPP provider to move your pension into drawdown mode. Normally, you have to complete a pension drawdown application form.

Some SIPP providers charge annual drawdown fees. Providers that currently charge for drawdowns include Aegon, AJ Bell, Halifax Share Dealing, interactive investor, and the Share Centre. SIPP providers that don’t currently charge annual fees for drawdown include Hargreaves Lansdown, Vanguard, and Fidelity.

Toggle Content

Because a SIPP is a retirement account, you can’t access money from it until you’re aged 55. In 2028, this will rise to 57. Once you turn 55, you can make withdrawals from your SIPP, but you can only withdraw 25% of your savings tax-free. Anything above this will count as income and be taxed at your normal rate.

Most SIPP providers don’t allow you to withdraw money before the age of 55. If they do, they will likely charge you a large fee for doing so. And HMRC will tax the funds withdrawn at a hefty 55%.

No, it was reported in November 2025 that the FCA blocked Trading212 from launching SIPP accounts.