XTB Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

XTB Expert Review

I once tweeted about asking who would win in a fight, XTB’s Conor McGregor or Plus500’s Jack Bauer. I don’t know why brokers choose the celebrities they do to endorse them, but they must have their reasons. But this isn’t about UFC vs 24. It’s about whether or not XTB is a decent broker. I’ve been trading on their platform for years now and here I highlight what features I like, what they are lacking and what sort of trader XTB is suitable for.

XTB Ratings

Name: XTB

Description: XTB is a CFD and forex broker headquartered in Poland and listed on the Warsaw Stock Exchange (WSE:XTB) valued at over $1bn. XTB was founded in 2003 and offers forex, indices, commodities, ETF and stock CFD trading. XTB has historically used celebrity endorsements to promote it’s brand including Jose Mourinho, Conor McGregor, Joanna Jędrzejczyk and Jiří Procházka.

77% of retail investor accounts lose money when trading CFDs with this provider

Summary

XTB, are a decent all-round trading platform and a good choice for most small-to-medium sized CFD traders. They are publically listed in Poland and offer, competitive spreads on a fairly wide range of markets.

Pros

- Publically listed

- Mulitple platform choices

- Innovative order types

Cons

- Not UK based

- No DMA

-

Pricing

(4)

-

Market Access

(4)

-

Online Platform

(4)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4Ratings Explained

- Pricing: Industry standard and inline with tight spreads.

- Market Access: Getting better all the time as XTB embrace pong-term investing.

- Platform & Apps: Very good, with some really innovative features and integrations.

- Customer Service: Industry standard.

- Research & Analysis: Lots of educational “masterclasses” built in.

I’ve used XTB on and off now for around 5 years, and one thing to note is that they are a reactionary broker. In that, they keep adding and removing features based heavily on client demand. One feature they used to have which I thought was brilliant, was the option to build your own baskets of assets. Which is essentially building your own ETF to trade multiple currency pairs, stocks of indices in one go. You could even assign your own custom weighting to which assets were included. Unfortunately, no-one used it so they discontinued the feature. Which is a shame, but on the plus side, they do keep adding features to the platform as and when customers need them.

When we do CFD broker reviews, we talk to the people at the brokerages themselves, trade live with real money and highlight some key features that make them stand-out. So we also spoke to Josh Raymond, one of the directors who over the course of a 15-minute video chat took us through some of the key features on the platform. I would have suggested we meet in person for an update on what’s new but, last time I was due to meet Josh for a coffee in Canary Wharf, he forgot and didn’t turn up. I can, however, recommend Notes for a bit of people watching.

Highlights

The key things to focus on when considering trading with XTB are:

- They have their own proprietary trading platform. When I interviewed Omar Arnaout, the XTB CEO Omar Arnout he said “I’m really proud of our platform and honestly believe it’s one of the best in the market.” Rightly so.

- They really push client education, XTB won “Best Trading Platform Education” in our 2023 awards (although they didn’t show up to collect the trophy, they never do). You can read their Q&A on forex education here.

- Customer service is paramount. Omar said that “first and foremost is the customer service”. I really agree with this as I think it’s important to have a few different trading accounts (diversify, diversify, diversify) and you’ll trade more with the broker that treats you best.

Awards

In our annual awards, XTB has won:

- Best Trading Platform Education – 2023

- Best Forex Broker – 2021

- Best Crypto Broker – 2019 & 2018

However, they never bother to show up to our awards ceremony to collect them.

XTB Facts & Figures

| Total Markets | 2,100 |

| ➡️Forex Pairs | 57 |

| ➡️Commodities | 22 |

| ➡️Indices | 25 |

| ➡️UK Stocks | 230 |

| ➡️US Stocks | 1080 |

| ➡️ETFs | 138 |

| Broker specifics | |

| 👉Active Clients | Over 447,000 |

| 💰Minimum Deposit | 0 |

| ❔Inactivity Fee | 10EUR per month |

| 📅Founded | 2002 |

| ℹ️Public Company | ✔️ |

| Account Types | |

| ➡️CFD Trading | ✔️ |

| ➡️Forex Trading | ✔️ |

| ➡️Spread Betting | ❌ |

| ➡️DMA (Direct Market Access) | ❌ |

| ➡️Futures Trading | ❌ |

| ➡️Options Trading | ❌ |

| ➡️Investing Account | ❌ |

| Average Costs | |

| ➡️FTSE 100 | 1.7 |

| ➡️DAX 30 | 1 |

| ➡️DJIA | 3 |

| ➡️NASDAQ | 1 |

| ➡️S&P 500 | 0.5 |

| ➡️EURUSD | 0.9 |

| ➡️GBPUSD | 1.4 |

| ➡️USDJPY | 1.4 |

| ➡️Gold | 0.35 |

| ➡️Crude Oil | 3 |

| ➡️UK Stocks | 0.08% |

| ➡️US Stocks | 0.08% |

XTB News, analysis and trading ideas

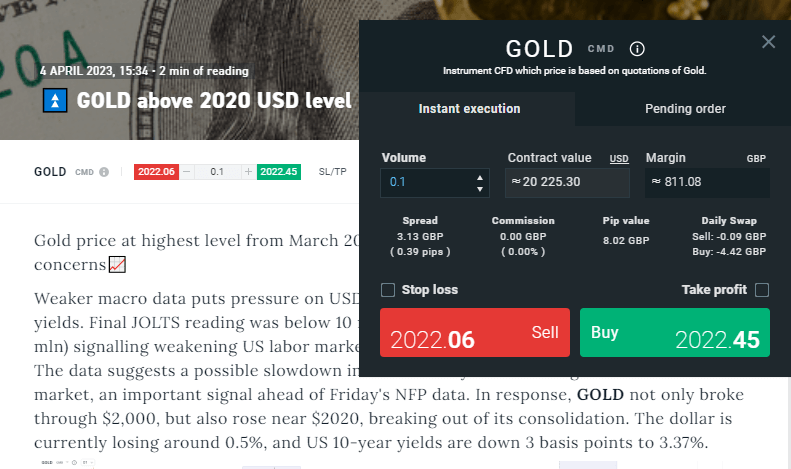

All brokers have news, technical analysis, economic announcements and fundamental data. Most even have RanSquark (where your computer shouts at you every time there is a market figure), but XTB also has an integrated dealing ticket so you can trade quickly from the analysis. You can see below in their recent Gold analysis. You can either place a market order to go long or short at your saved standard lot size or bring up a dealing ticket to work a limit.

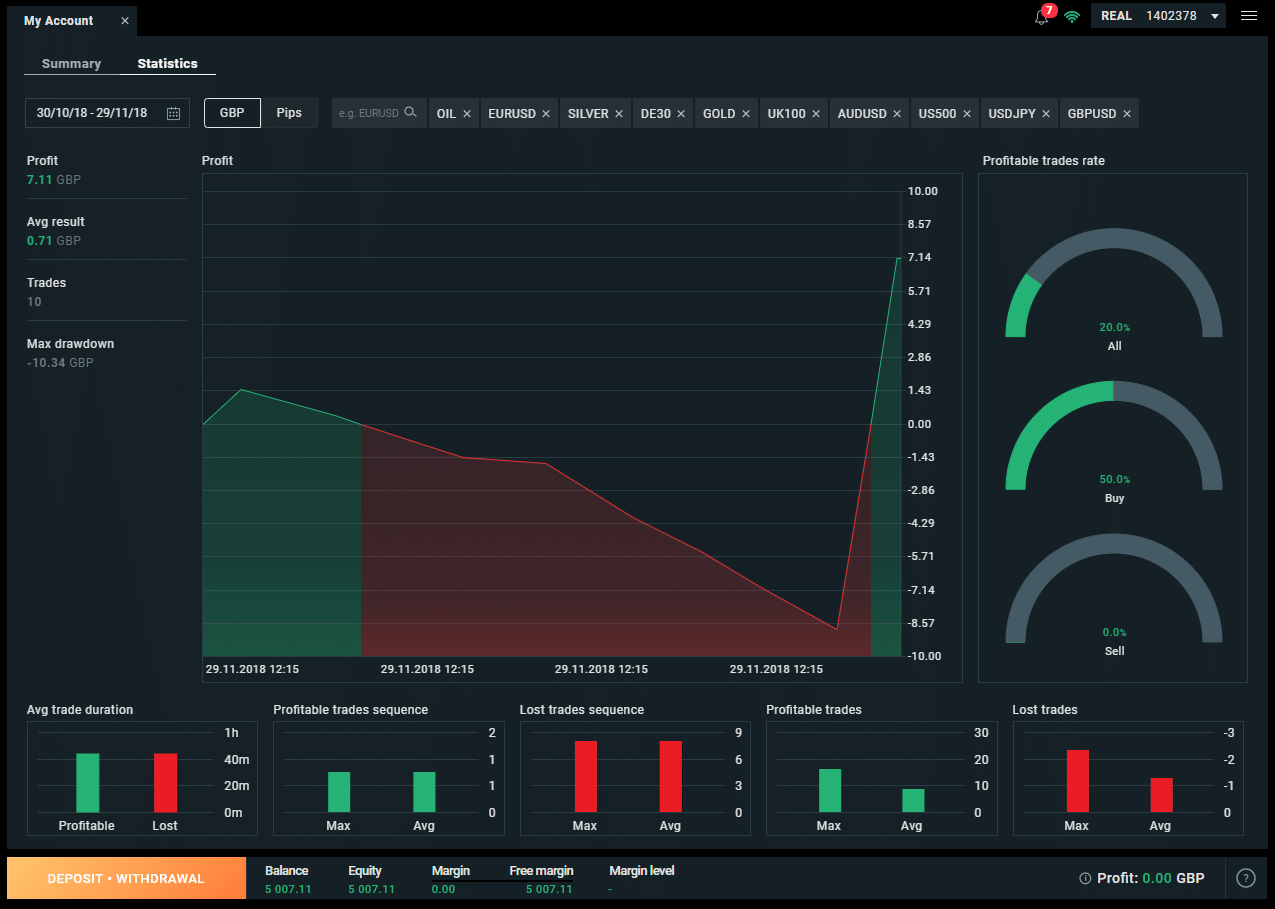

Post-trade analysis

See a breakdown of what markets and trades you make or lose money.

XTB was one of the first brokers to introduce post-trade analysis, and this sits nicely alongside their ethos of trading to educate their clients rather than churn and burn them. You can see a recap of your previous trades in your account settings. This gives a very visual representation of which trades you make and lose money on. This is a really interesting feature because, as we all know, it’s hard to make money trading. But oddly enough it’s not that hard to pick winners.

Picking on Josh again, we highlighted an article he wrote (The truth about whether trading is actually winnable) way back in 2014, showing that the profitable trades were around 60%. It’s just that the losses were larger than the profits. This suggests that it is a post-trading strategy that is the issue. Not picking trades. So, by using this section to evaluate which trades you most frequently win on you should be able to improve your overall trading strategy.

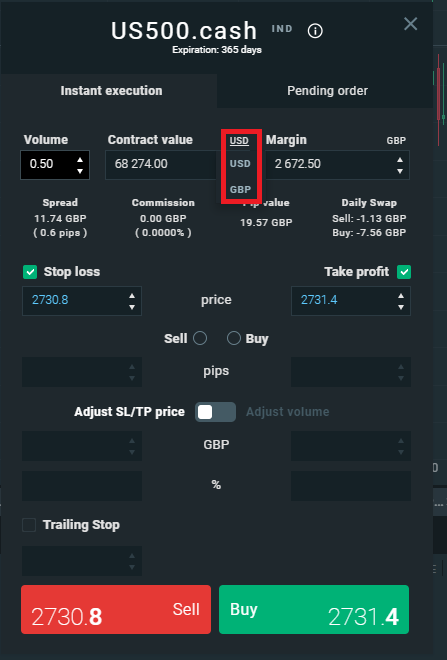

Account base currencies

You can change your base currency by setting up different sub accounts.

This may not seem like a big deal on the surface, but it’s actually a really nice feature. One thing traders never really take into account when trading international markets is currency exposure.

Even when trading Forex, traders tend to just look at what is happening on the chart and not the overall economic climate. Trading profits are hugely affected by currency exposure and in some cases can wipe out profits. Also, as tight as deliverable foreign exchange rates are becoming they are still always never below 0.5%.

So if you are in the UK with GBP on account and trading US products your P&L will be in USD. This will then have to be converted into GBP before you can withdraw (unless you want to be at the mercy of your banks tourists rates (which you don’t)). But, if you go to your “My Accounts” page you can open up sub accounts in GBP, USD, or EUR. So, if you have a strategy that mainly relies on non-local currencies you can reduce your FX fees and currency exposure.

You can also change the currency in the dealing ticket, between local and base currency, which can give you more control over your position exposure. This is particularly helpful, when fx markets are volatile.

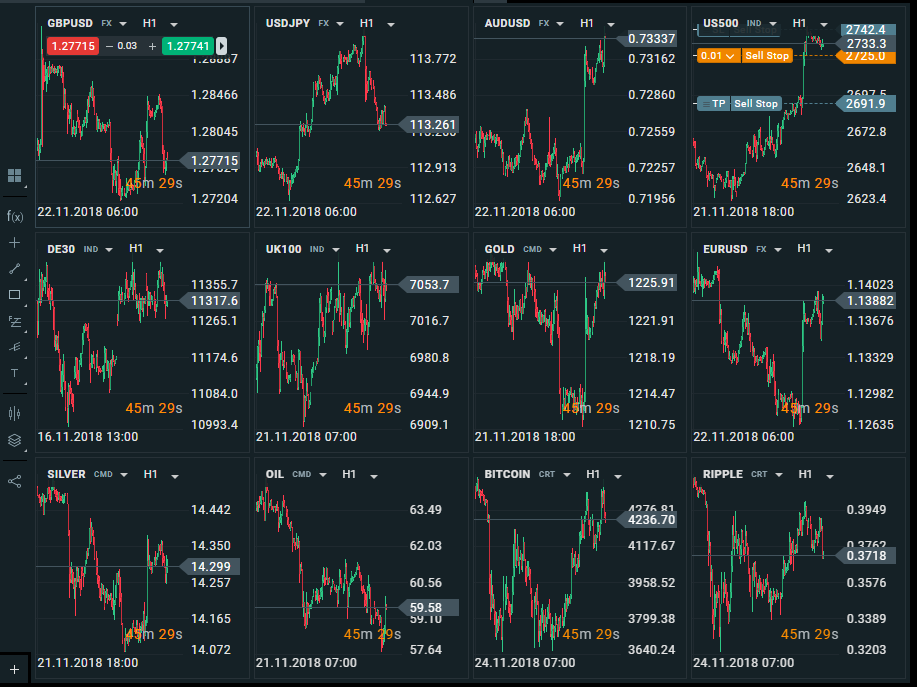

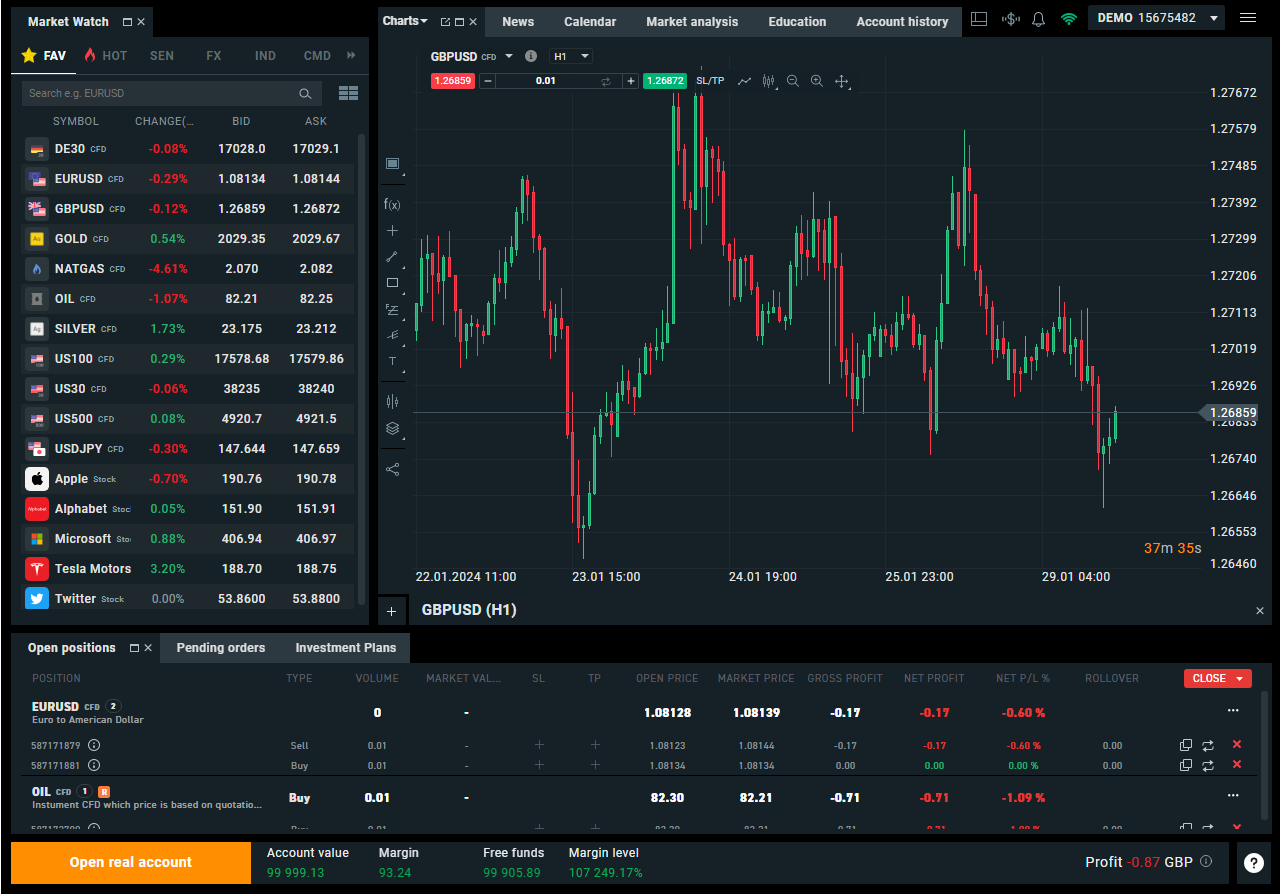

Chart grids

You can get an instant macro market overview with grid charts.

When I first started off as a stockbroker many decades ago we used this pricing system called QTS. It’s long gone now, but it had this great feature where you could get a grid view of a market with a single click. It was a great default view so you can instantly see what was going up or down without having to have multiple screens up.

I know you can set this up manually on most other brokers, but other than CMC, I don’t think it’s that easy anywhere else. XTB, have a really nice feature where you can see all your open charts as a grid. A very handy visual overview of what is going on.

Plus, if you’ve got a pending order you can see the levels on the chart. When I took the below screenshot I had a working stop entry in US500 (top right).

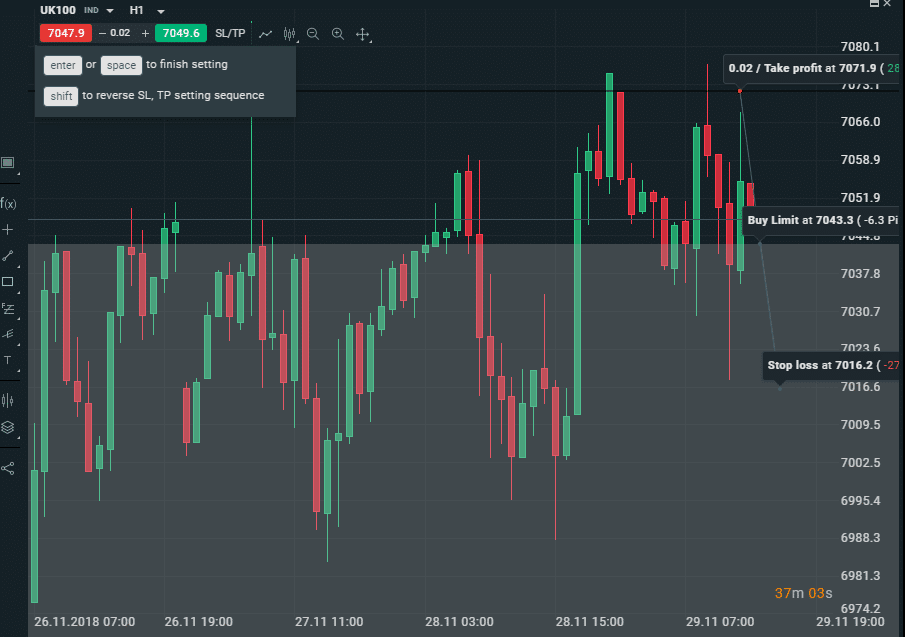

Trade from the charts

Add market orders, stops entries, limits and stop losses by clicking directly on the charts.

A lot of other brokers let you trade from the charts. In fact, last week when we did a video demo of Spreadex’s platform where we highlighted that you can move your stops from the chart.

Which is an almost essential feature. Because let’s face it you either place stops at support and resistance levels or base them on how much you want to win or lose. So it’s quite nice to set your P&L limits then move your orders based on what the chart looks like.

However, what is unique to XTB (as far as I know) is the ability to place stop entries, stop losses and limits straight onto the chart.

The first click is where you want to buy, second your stop loss and third your limit. You basically draw your trade on the chart and it is created in the dealing ticket.

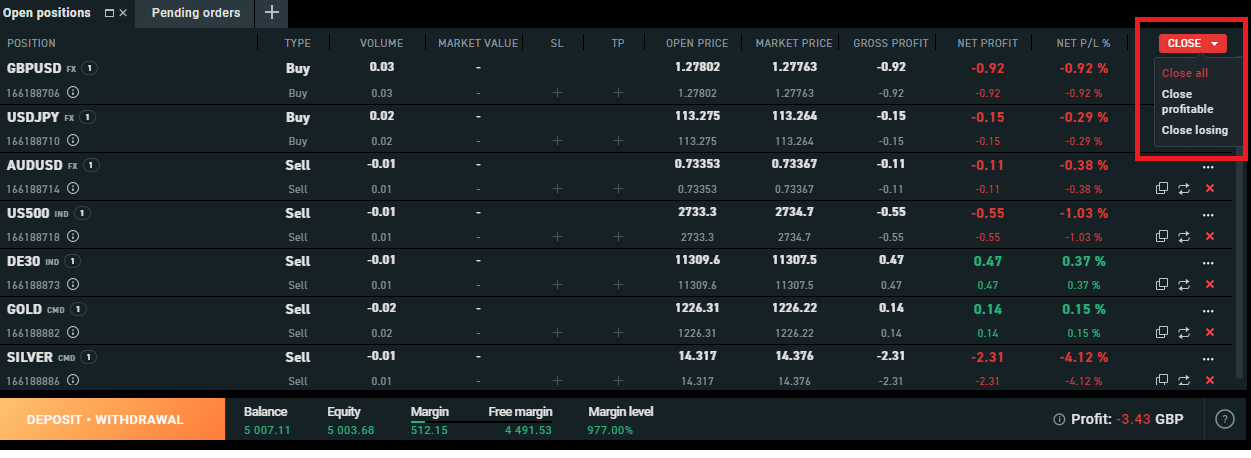

Closing off positions

You can close all, profitable or losing trades in one go

This is a nice feature to end off our XTB review. When you are done for the day, or popping off to the shops, you can select what trades you want to close.

It’s really annoying when you have to click on twenty different trades to close them out when you want to be flat. So on the XTB “Open Positions” tab you can choose to close either all your trades or just the duds that are losing. Or, you can bank your profits by closing all the winners and leave your losers to either get stopped or reverse. But I shall leave it to you to decide if that is a sensible trading strategy.

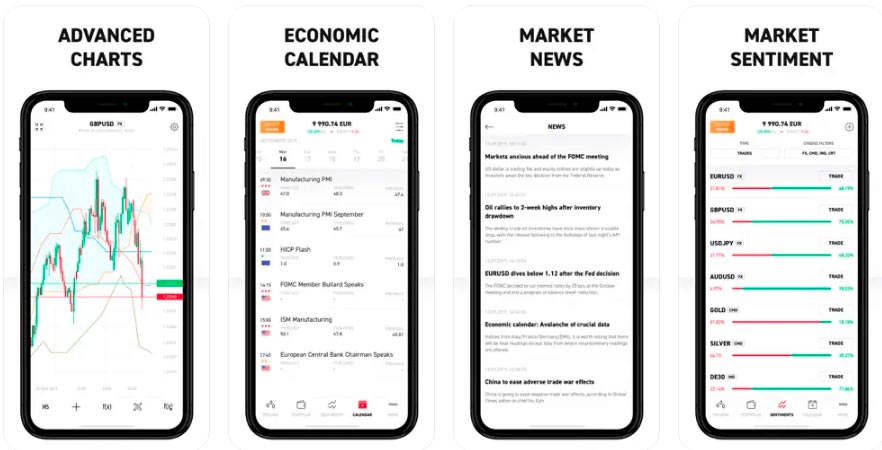

Is XTB’s trading app any good?

XTB has some pretty good trading apps. They offer MT4, MT5 and xStation Mobile, for traders to trade on the move. Of those, I would say that XTB’s xStation mobile is very good, especially compared to basic CFD mobile trading apps like eToro.

XTB’s trading app provides access to about 2,100 markets through CFDs and does provide some added value over the more basic apps from other brokers.

Specifically, the app highlights your favourite markets, and what is “hot” at the moment so you can see what traders are trading as well as sentiment indicators for those most popular markets. You can filter XTBs client trader sentiment by buyers and sellers, and also by asset class, so you can see where order flow has been going and decided if you want to follow or take a contrarian position.

Charting is nicely layed out, but you cannot trade from the charts on the app (you can on desktop), but the crosshairs feature, does give you a visual of where your orders are relative to support and resistance on the same screen, which is a nice touch.

I did find when trading on the app though there is a good “Discover” section where you can view popular markets such as stocks that have exposure to “inflation protection”, environmental assets, top ETFs that are being traded and also a tab for stocks and markets that are being talked about on Reddit.

You can get access, via the app, to XTBs educational videos, such as their Masterclass, and interviews with people like Jamie Rogozinksi from WallStreetBets.

Overall, the app has some good features and is a good complement to the main trading platform.

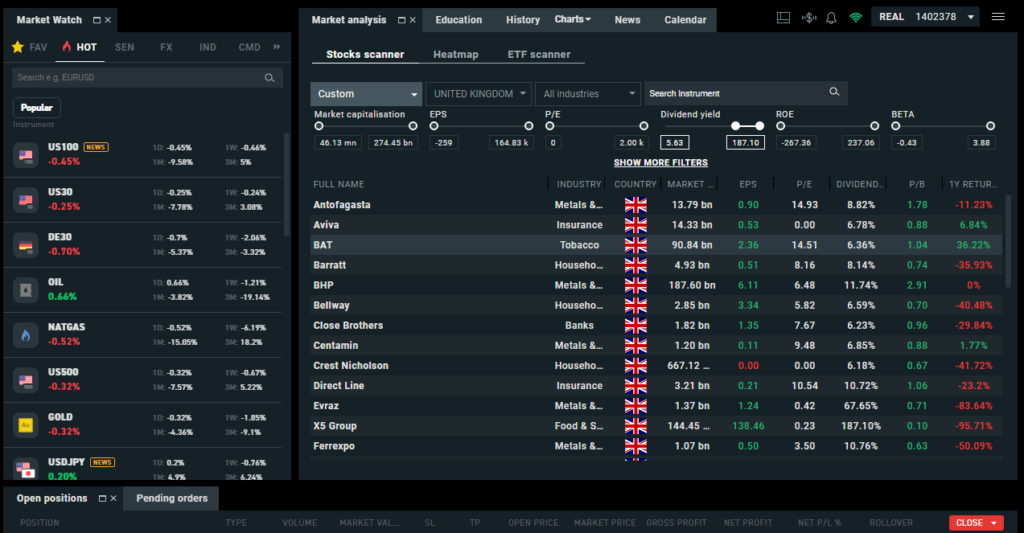

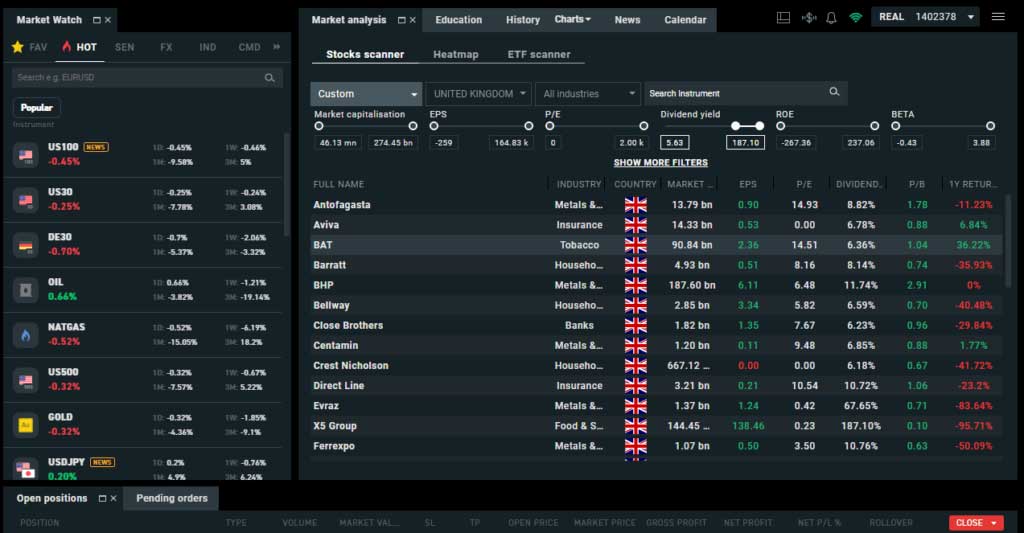

Is XTB’s trading platform any good?

Yes, as a broker XTB offers access to some very good trading platforms, including their own xStation 5, Metaquotes 5 and MT4. All a safe to use from a compliance point of view as XTB is regulated by the FCA in the UK.

XTB’s Xstation5 trading platform is highly customisable and it was clear from when I tested the platform that it is going to appeal to traders needing a little bit more than point-and-click trading.

XTB’s trading platform offers access to the usual markets and pricing is fairly standard, but what sets it apart from other brokers is some of the trading platform’s unique functionality.

Most brokers offer it now but XTB was actually one of the first brokers to offer post-trade analysis, where the trading platform will show you where you are profitable and where you lose money.

One nice feature is the ability to close all of your positions in one go. A time saver if you are a day trader and want to be flat at the end of the day, or if you want out of the market in a hurry.

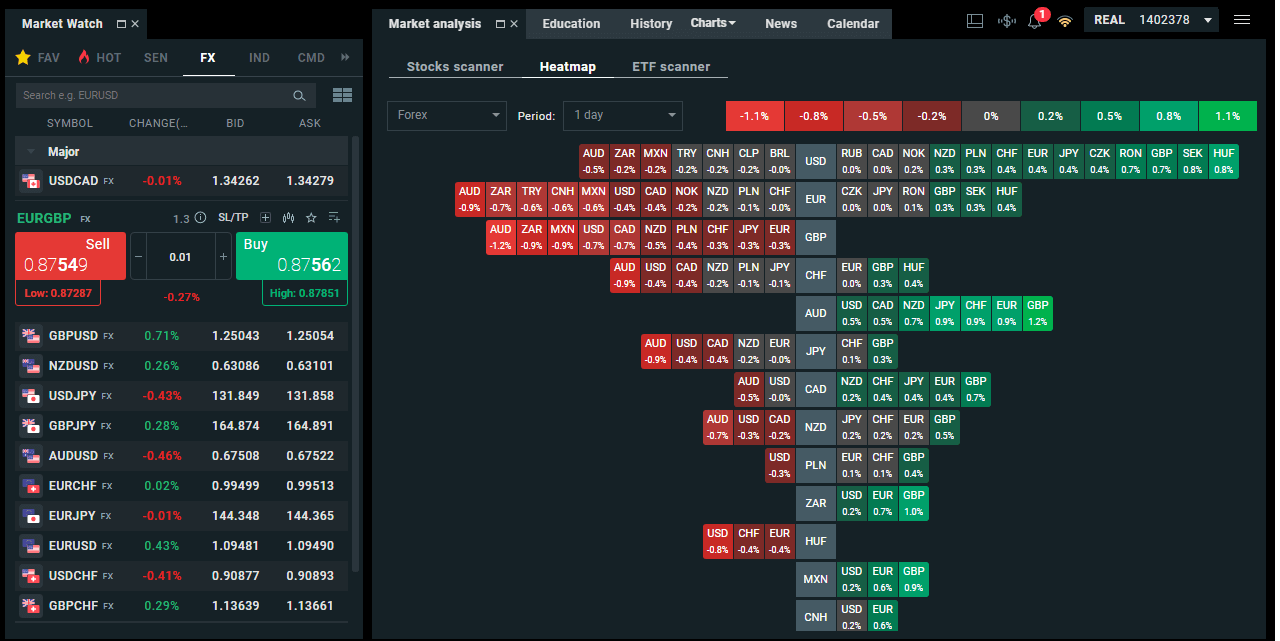

XTB produce their own market news, which is constantly updated throughout the day, which you can filter by asset class. If you combine this with the heatmap feature, stock scanner, sentiment indicators and automatically updated “hot” watchlist that shows where the order flow is going you can hunt out trading ideas

Overall, XTB is a very good trading platform that offers a lot more than just vanilla trading, suitable for new traders or more experienced investors wanting to create and hedge their own markets.

Is an XTB ISA on the cards?

The ISA market in the UK is about to get a new entrant.

XTB, the Polish fintech and CFD broker is now authorized to offer Individual Savings Accounts (ISAs) to UK investors.

This marks a major expansion for the company and one that goes beyond its core CFD and forex trading roots.

Opening the door to the potentially lucrative UK ISA market, which has more than £700 billion in AUM

After announcing plans to move into ISAs earlier this year, XTB has now secured the necessary regulatory approval from the UK authorities.

It aims to launch its inaugural ISA products to UK clients during the third quarter of 2024 or early autumn.

What are ISAs?

ISAs allow UK private clients to invest up to £25,000 annually in tax-efficient savings vehicles via stocks and shares, funds and ETFs or cash deposits, without incurring taxes on any gains or income generated by those investments.

ISAs are a popular way for retail investors to build long-term wealth, and as of June 2023 11.80 million people in the UK had ISA accounts.

What asset classes will XTB offer to its ISA clients?

XTB’s initial ISA product suite will focus on investing in stocks and shares alongside passive exposure through ETFs, according to the firm.

This is in line with XTBs strategic vision of expanding their business through the roll-out of new investment products, beyond CFDs and forex trading.

Joshua Raymond, the CEO of XTB’s UK entity, said:

“Our entry into the ISA market would mark yet another milestone for our product rollout in the UK…to complement what is already a broad offering including ETFs, stocks, Investment Plans, and CFD products.”

With over 300,000 active traders globally and an aggressive growth strategy, XTB’s foray into ISAs should offer the firm the chance to compete for a bigger slice of the UK’s retail investor market.

We are seeing more margin trading brokers expanding their product ranges, as they try to cross-sell services to their existing client base, as well as attracting new customers, in a bid to defray the high cost of client acquisition, in the increasingly competitive UK market.

Does XTB have a demo account?

XTB has a great demo account that, it’s easy to set up and easy to use. I tried the XTB demo after a long day of testing other (more annoying demos) and it was quite frankly a breath of fresh air.

XTB’s demo account lets you around 2,000 markets with £100,000 virtual funds for 30 days.

I’ve always liked XTB, everything about them just works. Yes they may have removed my favourite feature ever (the ability to create your own basket of stocks to trade in one go), but I like the demo too, it just works. It doesn’t do anything fancy, the XTB demo just gives you a good look inside the platform and lets you know what trading with them would be like.

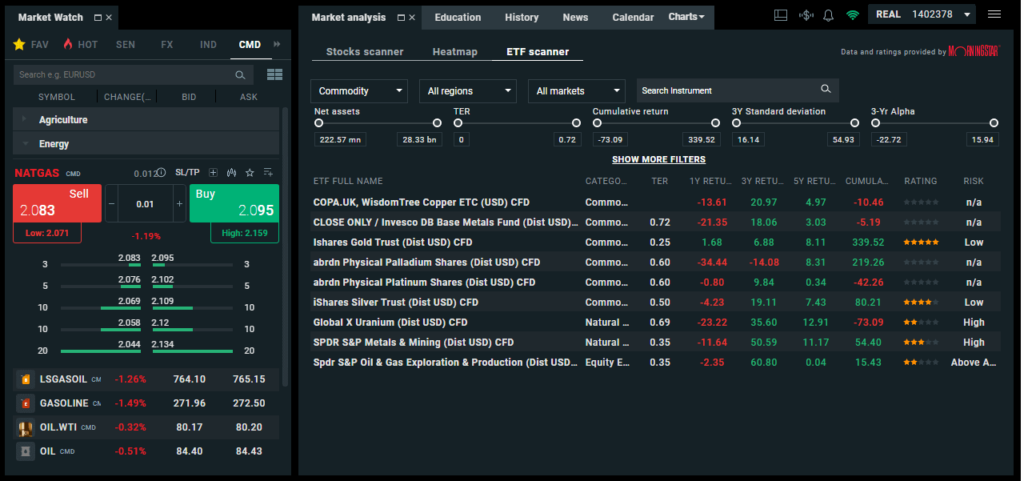

Can you trade commodity futures on XTB?

No, XTB does not offer DMA futures trading, but you can trade commodities as a CFD or invest in physical commodity ETFs.

There are two ways to trade commodities with XTB, CFDs on the commodities, or commodity ETF CFDs. The ETF scanner provides quite a handy way to see what ratings Morningstar gives them, which can give you an indicate of how well they perform as investments.

- Commodities markets available: 22

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Gold 0.35, Oil 0.3

XTB also produce their own news and analysis, which features commodities that are approaching or have broken through key trading levels. It’s quite a nice touch that you can trade direct from the news article as well as place corresponding stops and limits.

If you would rather speculate on the outright price of the underlying commodities XTB groups commodity CFDs together by markets such as agriculture, energy, industrial metals, precious metals and livestock.

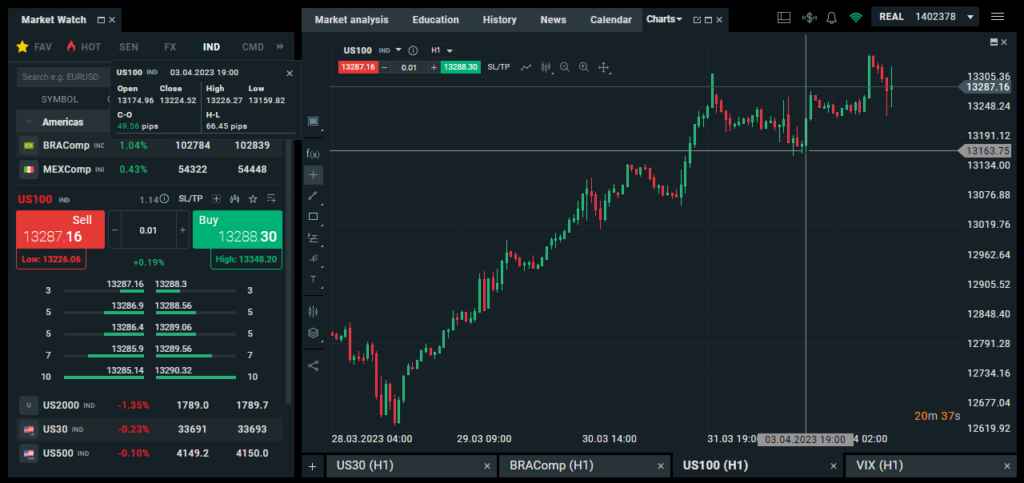

Is it legal to use XTB for indices trading?

Yes, XTB is regulated by the FCA (Financial Conduct Authority) in the UK, so it is safe to trade indices as a CFD with them.

One of the good things about index trading with XTB, is that you can see market depth on the sidebar when trading indices. I’ve included that as a screenshot in the index trading platform tab below. This may not be such an issue if you are a smaller trader, but if you are dealing in size then people able to see what volume you will get filled in is very handy. You can also deal direct from the charts, so if you use the crosshairs function, you can quickly place orders around key support and resistance levels.

- Indices available: 25

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: FTSE 1.7, DAX 1, Dow 3, NASDAQ 1, S&P 0.5

Is XTB CFD trading real DMA or OTC?

When you trade CFDs with XTB you are not buying or selling real shares, instead, you are entering into a contract for the difference between the opening and closing prices of your position with the broker. However, if you would rather not trade on fake prices you can buy real shares with XTB’s investing plans.

XTB’s CFD trading platform offers access to a well voer 2,000 CFD markets including 57 forex pairs, 22 commodities and 25 indices as well as UK, US and international stocks.

Overall, XTB, is a well-established CFD trading platform with some nice added value that is suitable for most traders.

- CFD markets available: 2,100

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: Shares 0.3%, FTSE 1.7, GBPUSD 1.4

When I tested XTBs CFD brokerage I found what sets them apart is some of the platform features.

There are also some nice close-off features, so you can close all your CFD positions in one go, or if you want to cut your losses, just close the losers, or if you want to lock in profits you can just close your winning trades.

There is a lot of educational content on how to trade from various independent “experts” such as Tom Hougaard, Lee Stanford. As well as different courses on how to understand specific aspects of trading like technical analysis and trading psychology.

You also have a comprehensive suite of CFD trader tools like constantly updating market analysis including stock screeners, heatmaps and ETF scanners to help you pick out new trades. There is also an integrated news feed and economic calendar so you can check for upcoming events or news flow that may affect your open positions.

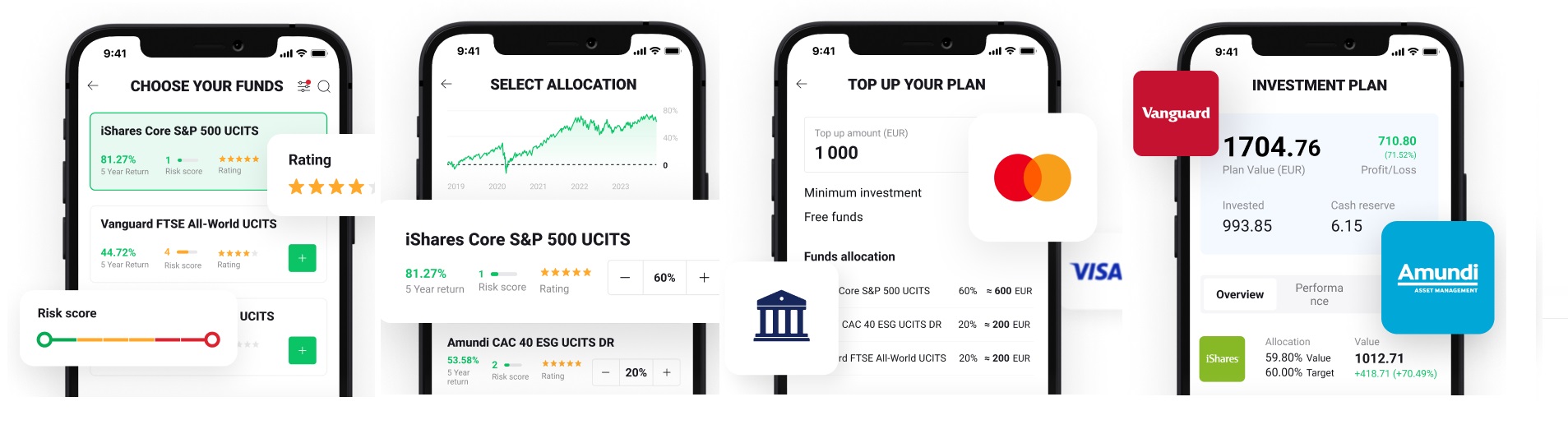

XTB investing plans

Investment Plans allow users to build a personalised portfolio of ETFs that are specifically aligned with their attitudes towards risk and their asset allocation choices.

Investors can choose the ETFs that they want to invest in and the amount of capital they want to allocate to each one.

As the portfolio grows and develops the allocation can be adjusted to keep it in line with the original investment objectives and XTB will alert clients as and when this becomes necessary.

Investment plan fees

Investment plans can only be created via the XTB app clients simply need to log in to their app and go to the save tab to start constructing an investment plan.

XTB is offering zero commission investing for those who invest less than €100,000 or equivalent per month.

Those clients that invest more than €100,000o will pay a commission of 0.20% subject to a minimum ticket charge of £10.00.

There are also FX fees of 0.50% to pay if you trade in ETF that’s not denominated in your account’s base currency. For example, a sterling-based investor buying a US-listed ETF priced in dollars.

XTB clients will be able to make regular monthly deposits into their Investment Plans, and those funds will be allocated among the ETFs they have selected, in the weightings they have chosen.

Clients looking for long-term investments

XTB recently expanded access to fractional share trading for its UK clients, in the face of growing demand for trading in physical stocks and ETFs.

XTB UK’s Joshua Raymond said that 61% of the firm’s clients were now investing in real stocks and ETFs and not just leveraged products.

As part of that process, XTB now offers more than 3000 stocks from across 16 major exchanges alongside 300 ETFs all of which can be traded fractionally.

XTB had previously rolled out fractional share trading in European markets including Poland, Spain and Portugal.

XTBs recent initiatives show that brokers are listening to their client bases and are introducing the services they want access to expanding beyond traditional margin trading and investing and physical share trading.

There has been no mention of it as yet but might we see an XTB ISA for UK customers in the not-too-distant future I wonder?

Is XTB on MT4 or MT5?

XTB offer both MT4 and MT5 for their clients (you can’t trade via MetaQuotes without a broker), but the own xStation 5 platform is much better for the majority of beginner traders. To see how XTB’s MT4 offering compares to other brokers read our review below or see our best MT4 broker guide.

xStation is XTB’s main trading platform, but they also provide access to MT4. You do get access to a wide range of markets and pricing is tight. The key advantage of trading on MT4 through XTB, is that yo are trading MT4 through XTB, who are a well-established, regulated and publicly listed company

Auto invest in ETFs with XTB

XTB investment plans allows UK clients to save and invest regular amounts via a range of ETF-based strategies.

Using the service, UK investors will now be able to set up regular payments or contributions to their existing portfolios.

Or, for more confident investors, they build new portfolios from scratch, and top them up using a pre-defined asset allocation plan.

XTB’s investment plans allow users to create a bespoke portfolio(s) from more than 350 ETFs.

The plans are aimed at long-term savers, or those looking to create an investment portfolio for their retirement.

- Want to invest in ETFs? Our picks of the best ETF investing platforms.

What is an ETF?

ETFs or Exchange Traded Funds are open-ended funds similar to mutual funds.

However, unlike mutual funds, ETFs are listed and traded on a stock exchange just like shares in a limited company.

An ETF typically an tracks equity index, a sector, an industry or a country, but it can also aim to capture the price movements of commodities and bonds.

Or even specific investment themes and factors, such as growth, value, equity income, low volatility etc.

Typically an ETF is a passive investment vehicle, which holds a basket of stocks, shares or other instruments that allow it to track and capture the returns of the underlying investment.

For example, the iShares Core FTSE 100 UCITS ETF (ISF LN) seeks to track the performance of an index composed of the 100 largest UK companies.

To do this it holds a basket of UK equities, in various weights, drawn from across 11 sectors.

Its biggest holdings are in the largest FTSE 100 stocks, such as Shell, AstraZeneca HSBC and Unilever.

Unlike shares in an investment trust or other closed-end fund, the value of units in the ETF primarily depends on changes in the value of the underlying investment and not on the supply and demand around the ETF units themselves.

- Related Guide: How to invest in ETFs.

Commission-free investing for smaller accounts

XTB’s investment plans are commission-free as long as you don’t turn over €100,000 or more per month if you do then you will pay a 0.2% commission subject to a minimum ticket charge of £10.00.

Note that if you buy or sell a foreign ETF i.e. one not priced in sterling, then your transaction will be subject to a 0.50% FX conversion fee.

The ability to make regular contributions to a predefined savings and investment plan (or plans) is a very powerful tool.

Saving over the long term allows the investor to benefit from the effects of compounding, through the reinvestment of dividends.

And to be able to ride out shorter-term fluctuations in the market.

The fact that you can now do that through XTB, with minimal or no dealing charges is another plus point for retail investors.

Fractional Share Trading & Investing

in September 2023 XTB is introduced fractional share trading where clients cane to trade in fractions of a wide range of stocks and ETFs from the UK, European and US markets.

Fractional shares are a product which allows investors and traders to own a fraction of an existing stock or ETF.

So for example using fractional share trading you could buy a tenth of a share in chip maker Broadcom (AVGO) which trades at around $816.00 per share and which might otherwise be too expensive for many retail traders.

Fractional share trading also allows clients to get more of their money working for them as they can fully invest their cash. By for example putting $1000.00 into Broadcom by buying 1.22 shares in the stock.

Fractional share trading is commission-free at XTB unless that is your turnover is more than €100,000 per month. In which case your trading will be subject to a commission of 0.2% and a minimum ticket charge of €10.00.

How are fractional shareholders be treated at XTB?

Under fractional share trading at XTB clients who hold fractional holdings in stocks and ETFs wil be treated in the same way as full shareholders and will receive their fiduciary rights such as access to dividends and corporate actions, though fractional shareholders will not enjoy voting rights, as there is currently no mechanism through which holders of less than one share can vote.

How does XTB hold and administer fractional shares?

XTB will hold the underlying stocks that represent the fractional share holdings in a dedicated custody account, for example holding a share of Tesla that might be divided into three fractional holdings, of say, a holding of one-half of a share and two holdings of a quarter of a share each.

How can you access fractional share trading at XTB?

Once fractional share trading commences at XTB clients can access the service by logging on to their XTB account navigating to the stocks tab in the market watch area on the platform and selecting the stock or ETF that they wish to trade. Fractional shares will trade at the same bid-offer prices as the underlying stocks or ETFs.

Be aware

Fractional share trading is a tool that can help democratise investing and bring the benefits of long-term investments to a wider audience. XTB has chosen to mirror the treatment of full shareholders for its new fractional share trading service and it’s not going to treat those holdings as a derivative or CFD.

However, the regulatory and tax treatment of fractional share trading is still something of a grey area, with European regulator ESMA suggesting earlier this year that fractional share trading should be considered as a form of derivatives trading.

HMRC was said to be investigating UK brokers who offered fractional share trading, and whether those fractional shares were ISA eligible. HMRC’s view at the time was that fractional shares were not eligible for XTB ISA inclusion.

Is XTB any good for forex trading?

Yes, we rate XTB as a good forex broker due to their FCA regulation, competitive pricing, robust xStation 5 trading platform and FX education material.

You get a little bit more than just point and click when trading forex with XTB. Specifically, XTB produce their own currency news, have an excellent FX heat map function and simple dealing ticket. Some brokers I feel overcomplicate their forex layout, but XTB, has all the pertinent information where you need it.

- Forex pairs available: 57

- Minimum deposit: £1

- Account types: CFDs

- Equity overnight financing: -0.02341% / -0.00159% DAILY

- Pricing: EURUSD 0.9, GBPUSD 1.4, USDJPY 1.4

Forex Trading Platform:

One feature I particularly like on the dealing ticket is that the spread is shown as both a spread and pip, with pip value and daily swap (overnight funding) costs clearly displayed. Plus you can see the performance of where a currency pair sits within the one day range compared to the other major forex pairs.

Investing as an add-on to trading

XTB UK customers can now trade physical stocks alongside CFDs and margin FX products.

As of today, UK clients can deal in any of more than 3000 equities and 300 ETFs drawn from 16 major exchanges, including those from UK, US and European markets.

The new trading instruments can be accessed via the firm’s X-station trading platform on both demo and live accounts.

Traders can intuitively look up an equity or ETF ticker, and drag that instrument onto the charting panel to immediately call up a price chart of that stock.

Clicking on the instrument in the watchlist brings up a deal ticket which can be quickly configured for execution.

- Related guide – our views on the best stock brokers for investing in shares

XTB investing charges

Physical equity and ETF trading with XTB is commission free up to a point.

I say that because rather unusually, XTB will charge a commission of 0.2%, with a €10.00 minimum ticket, if you turnover more than €100,000 or £86,000 per month.

Whether that charging structure is designed to appeal to smaller equity traders and deter larger players, or is just for differentiation is not immediately clear.

There are no minimum deposits required to open an XTB share trading account.

Custody arrangements

XTB will hold all client assets in a segregated custody account held with KBC Securities. Clients will receive dividends as cash credits into their accounts and they will be able to participate in corporate actions in the usual way.

How does XTB’s share trading service compare to the competition?

IG the market leading margin trading broker also offers a share trading service covering more than 13000 shares, ETFs and investment trusts.

IG offers commission fee trading on US stocks, just as long as you’ve traded three times or more in the previous month.

If you didnt, then you pay £10 per trade.

It’s a similar scenario for those who trade UK stocks if traded less than three times in teh prior month you will pay £8.00 per trade, but only £3.00 per trade if you meet or beat the prior month’s trading hurdle.

It’s also worth noting that these rates only apply for trades with a consideration of £25000 or less. If you are trading in sizes that are larger than that, you will need to negotiate your rates with IG.

Denmark’s Saxo Markets also offers physical share trading with commissions from $0.01 per share, depending upon which account tier you qualify for.

The 1 cent per share commission is available to VIP accounts trading in stocks listed on Nasdaq, the NYSE, and the NYSE MKT exchange (formerly the ASE).

Saxo’s classic clients pay 2 cents per share on US stocks with a minimum $5.0 ticket charge. Whilst platinum account holders will pay 0.15 cents per share, subject to a minimum $4.0 ticket charge.

Saxo’s charges vary by exchange in European trading.

Dealing in Dax constituents on Deutsche Bourse’s XETRA platform, costs VIP customers 0.05% with €3.0 minimum, while classic clients pay 0.1% and or a €6.0 minimum.

On LSE-listed UK equities, classic clients pay 0.1% with a £6.00 minimum charge. Platinum clients pay 0.07% subject to a £5.0 minimum.

The broker’s VIP customers pay just 0.05% with a £3.0 minimum ticket fee.

CMC Markets offers physical share trading through its recently launched CMC Invest division.

Clients can trade in more than 3250 UK and US shares commission free, alongside more than 400 UK-listed ETFs and investment trusts.

If you are trading US-listed stocks with CMC Invest with a sterling-denominated account you will pay 0.5% FX conversions fees.

Social Trading platform eToro offers its clients access to just over 3170 international stocks which can be traded on a commission-free basis, and there are no minimum ticket charges or volume related restrictions when trading stocks with the broker.

77% of retail investor accounts lose money when trading CFDs with this provider

XTB FAQs:

Yes, we rate XTB as a good broker and can recommend it based on their pricing, reputation, customer service, regulator status and platform features.

Yes. If you are trading through the FCA regulated entity of XTB your funds are protected by the FSCS. However, it’s important to note that XTB offers CFDs which are a high-risk and volatile way to invest and trade the market.

There is no minimum deposit required to open an account. However, you will need enough funds on account to cover the initial and variation margin of the positions you open.

XTB say it takes one business day to withdraw funds from your account. However, this process may be delayed if you use a different withdrawal/deposit method due to AML regulations.

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.