Beanstalk Customer Reviews

Tell us what you think of this provider.

Simplicity

Simple and reliable app

Reassuring

Keep Me informed

Trusted

Care and fair

Easy

Straight forward platform with easy to use app.

Reliable

Keep the customer fully informed

Simplicity

Easy investing for family members

Easy to manage

Very easy to manage your child investment product. The return, so far, seems ok

Excellent

Excellent customer service

Straightforward

Beanstalk simplifies the investment process by allowing customers to choose their investor risk profile.

Exciting

I love saving for my kid & watching the £ grow. Beanstalk is great & very user friendly for someone like me who is not a financial expert at all – they’re better than the rest!

Comprehensive

Beanstalk products are easily accessible and offer fully comprehensive investments.

Amazing

Way to use, helpful and informative.

Easy

Knowledge sharing

Fantastic

Easy app. Understandable language for beginners.

Good

Easy to use

Easy

They make thins simples

Efficient

Keeps everything simple and easy to understand and interface with in the app.

Simple

No over complicated decisions needed about my child’s investments. Easy to send links to relatives to put gift money in

Easy to use

Keeps me up to date with my investments via app notifications.

Easy

So easy to use, informative and a breeze to navigate – I have and check regularly two junior ISAs

Beanstalk Expert Review

Beanstalk Investing App Expert Review: Voted Best Junior ISA 2026

Provider: Beanstalk Investing App

Verdict: Beanstalk is an investment app that helps you invest for your children through a Junior ISA. It was founded by the team behind Kidstart (a cashback site for children’s shopping) and won “best Investing Account” in 2025 and in 2022, 2023, 2024 & 2026 the award for Best Junior Stocks & Shares ISA as they make setting up an account to invest for your children’s future cheap, easy, flexible and accessible for you and for others to contribute to.

Is Beanstalk a good investing app?

Yes, Beanstalk won best investing account (as voted for by customers) in the 2025 Good Money Guide Awards. Beanstalk is a super simple way to start investing in an ISA. You can either invest as an adult of in a Junior ISA for your children, which you can split between cash savings and the stock market.

Beanstalk Junior Stocks and Shares ISA

Beanstalk has won “Best Junior Stocks and Shares ISA” in our 2024, 2023 and 2022 awards. They offer one of the easiest ways to invest for your children and you can quickly move money between cash and the stock market to manage the amount of risk/reward you want to take.

Julian Robson, founder and CEO of Beanstalk said after winning the award: We’re thrilled to have won the Best Junior ISA Award from the Good Money Guide Awards for the third consecutive year. It’s a fantastic recognition, reflecting our unique and valuable proposition for parents and grandparents who want to invest in their children’s future. Our focus is on encouraging long-term investment over cash savings, as that tends to yield better returns. We aim to support first-time retail investors with a simple solution to put money away for 18 years, and it’s great to see the UK retail investment market thriving.

Beanstalk provides a simple yet effective way to invest for your children’s future. Friends and family can also make deposits directly into your child’s account via the app. The investment options are split between cash and the stock market enabling parents to adjust the level of risk they are prepared to take. It’s a good option for parents who want to investment for their children, but don’t want to pick individual investments.

Why is Beanstalk so good? Well…

We quite often go to the ponies as a family, and if there is more than a single page of horses on the card for a race we always let the children have a little bet to cover more of the field. A while ago we were at Sandown, it was the last race of the day, and Hugo, my youngest, chose a horse based on the only sensible strategy available to a two-year-old, he picked one at random. As luck would have it, it was a rank outsider, a 13-year-old with an exceptional track record that was now a little bit long in the tooth. But, he wished and he hoped and Wishing and Hoping romped home to win at 50-1, after leading the pack the entire race.

ITV Racing caught us trackside on the TV as the owner burst into floods of tears and the trainers were whooping away. That’s us on the left clapping the trainers…

We didn’t get 50-1, we got 34-1 because we only bet with the bookies at the track, in particular, we like a chap called Barry, who wears a Fedora.

A tidy return nonetheless, but what to do with it? Usually, we’d all go out to dinner to celebrate, but because it was Dry January, we just went home. And because we’re trying to be more responsible parents, we thought we’d invest his winnings. Let it ride as it were, on the biggest bet out there, the stock market.

Previously, we invested one of my other children’s birthday money through GoHenry, but as Hugo is too young to get pocket money, I chose Beanstalk for him.

But was it a good time to be investing in your children’s future? I hear you ask. The stock market was coming off five-year highs, we may have been in a recession, the world is nearly at war and the tech giants who have historically created massive shareholder returns are laying people off left right and centre.

Well, here’s the thing, there is always a disaster around the corner, and actually now is the best time to start investing, because it is in fact, now. When it comes to long-term returns (Hugo can’t access money in his JISA until he is 18), the best time to invest is as soon as possible.

When I interviewed Julian Robson, the co-founder of Beanstalk, he told me that one of the inspirations for setting up the Beanstalk JISA was a chart that was on the wall in his old boss’s office. It was a chart of the stock market going back to the 1900s. His point was that if you look at a long-term chart of the stock market, you can’t see 1987’s Black Monday, The 1930’s Great Depression, or any other major stock market crash. In general, it just goes up.

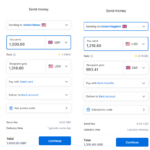

Here is a good example of the Covid market crash that Cem Eyi (Beanstalks other co-founder highlighted on LinkedIn recently (the fund is Fidelity World Index).

What does Beanstalk invest in?

When you invest in a Junior stocks and shares ISA with Beanstalk, you are essentially making two investments (three if you want to include your child’s future), the Legal & General Cash Trust fund and the Fidelity Global Index fund. The first tracks interest rates and keeps your money as cash, the second tracks the stock market, and holds big profitable companies like Apple, Microsoft and Johnson & Johnson (you can see the full portfolio breakdown here). It’s a standard diversified portfolio.

How much does Beanstalk cost?

It costs 0.5% of the balance of your portfolio for a Beanstalk JISA, but if cost is your only concern, you can buy these funds individually with a DIY platform like AJ Bell (0.25%) and interactive investor (JISA is free with a £9.99 per month trading account). Regardless of who you invest with, you will still have to pay the 0.12-0.15%. charges levied by L&G and Fidelity for managing the fund. It’s worth noting that Hargreaves Lansdown Junior ISA is now free, so much cheaper.

Why invest in a Beanstalk ISA?

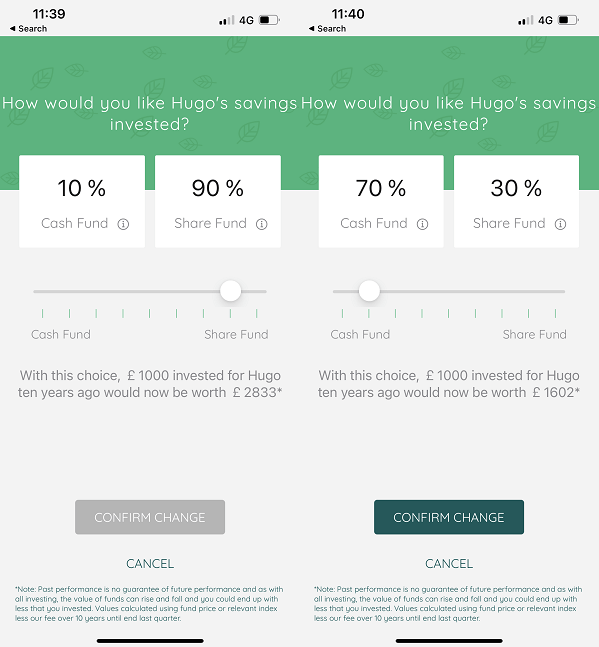

Where Beanstalk earns its money is that you can very easily switch between what percentage of cash and stocks are in your child’s portfolio. There is a handy slider, which also shows what the historic returns would have been depending on the allocation.

So, if you think the market is going to crash, you can switch to more cash and interest, rather than stock market investments. But remember, a general rule of thumb when it comes to investing is that the younger you are, the more risk you should take. If you are old, the closer to retirement you are the lower risk your investments should be. So, when your child comes close to 18, you can tune down the risk so that you don’t get bitten by a shock stock market crash the week before they get their money.

I’m not suggesting for a second that you bet on horses to kickstart your children’s financial literacy, that would be idiocy. But, if you have a few pounds sitting around, pick up your phone, download the app, and start investing for your children’s future. If you’re looking to bet on a winner, that’s a sure thing.

Pros

- Switch between stocks and cash

- Low cost & tax efficient

- Easy to use & contribute

Cons

- JISA funds can only be accessed when your child turns 18

- App only, no website access

-

Pricing

(4.5)

-

Market Access

(4)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(4)

Overall

4.3

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.