We rate Beanstalk as a very good investing app for junior stocks and shares ISAs. In fact, it’s so good that it won our best JISA award two years in a row and I use it to invest for my son. Beanstalk also received very good feed back in our provider surveys with a customer rating of 4.9 from over 200 reviews.

Beanstalk Customer Reviews

Leave a review and tell us what you think to help others make more informed financial decisions.

Our annual “Stocks In Your Stockings” competition 🎅 is open so any verified review you leave will enter you into the prize draw to win a £500 JISA.

Great service and easy to…

Great service and easy to use app

Simple the best

Simple the best

Easy to use and setup

Easy to use and setup

I love it so easy…

I love it so easy to apply for and keep track of.

Easy to use and good…

Easy to use and good rates

5/5

Very easy to use. Good…

Very easy to use. Good tools and educational sections.

.

.

Easy to use and good…

Easy to use and good features like cashback. Takes a little too long for cash to appear as cleared

Very clear and user friendly…

Very clear and user friendly platform

A company with good values

A company with good values

Very good and future saving…

Very good and future saving for my children

Fantastic

Fantastic

My first stocks isa and…

My first stocks isa and I love it

Always very helpful

Always very helpful

Very good

Very good

Good investment for grandchildren

Good investment for grandchildren

I’ve been using Beanstalk for…

I’ve been using Beanstalk for more than 3 years. I transferred my son’s CTF and I like knowing his money is growing and that it will be available to him when he is ready for it. The friends and relatives can also donate into it for him. I can also save through their sister company Kidstart.

Really pleased with Beanstalk they…

Really pleased with Beanstalk they have my daughter and myself with all my child investments and they are very quick to get back to you to help when needed, not a bad word to say about them

5/5

Pros:

It’s easy to understand, upfront and allows us to save for our child.

Cons:

Not sure, but I think they are doing really well as it is.

- Beanstalk Overview

- Richard's Review

- Beanstalk Awards

- Video Demo

- Facts & Figures

Beanstalk JISA Review

Name: Beanstalk

Description: Beanstalk is an investment app that helps you invest for your children through a Junior ISA. It was founded by the team behind Kidstart (a cashback site for children’s shopping) and won our 2022 & 2023 award for Best Junior Stocks & Shares ISA as they make setting up an account to invest for your children’s future cheap, easy, flexible and accessible for you and for others to contribute to.

Summary

Beanstalk’s Junior ISA won our award for the best JISA in 2023 and 2022 as they provide a simple yet effective way to invest for your children’s future. Friends and family can also make deposits directly into your child’s account via the app. The investment options are split between cash and the stock market enabling parents to adjust the level of risk they are prepared to take. It’s a good option for parents who want to investment for their children, but don’t want to pick individual invesments.

Pros

- Switch between stocks and cash

- Low cost & tax efficient

- Easy to use & contribute

Cons

- JISA funds can only be accessed when your child turns 18

- App only, no website access

-

Pricing

(4)

-

Market Access

(3.5)

-

Online Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(3.5)

Overall

4Beanstalk JISA Expert Review

We quite often go to the ponies as a family, and if there is more than a single page of horses on the card for a race we always let the children have a little bet to cover more of the field. The other day we were at Sandown, it was the last race of the day, and Hugo, my youngest chose a horse based on the only sensible strategy available to a two-year-old, he picked one at random. As luck would have it, it was a rank outsider, a 13-year-old with an exceptional track record that was now a little bit long in the tooth. But, he wished and he hoped and Wishing and Hoping romped home to win at 50-1, after leading the pack the entire race.

ITV Racing caught us trackside on the TV as the owner burst into floods of tears and the trainers were whooping away. That’s us on the left…

We didn’t get 50-1, we got 34-1 because we only bet with the bookies at the track, in particular, we like a chap called Barry, who wears a Fedora.

A tidy return nonetheless, but what to do with it? Usually, we’d all go out to dinner to celebrate, but because it’s Dry January, we just went home. And because we’re trying to be more responsible parents, we thought we’d invest his winnings. Let it ride as it were, on the biggest bet out there, the stock market.

Last week, we invested one of my other children’s birthday money through GoHenry, but as Hugo is too young to get pocket money, I chose Beanstalk for him.

But is now a good time to be investing for your children’s future? I hear you ask. The stock market is coming off five-year highs, we are in a recession, the world is nearly at war and the tech giants who have historically created massive shareholder returns are laying people off left right and centre.

- Related guide – How to invest in a recession

Well, here’s the thing, there is always a disaster around the corner, and actually now is the best time to start investing, because it is in fact, now. When it comes to long-term returns (Hugo can’t access money in his JISA until he is 18), the best time to invest is as soon as possible.

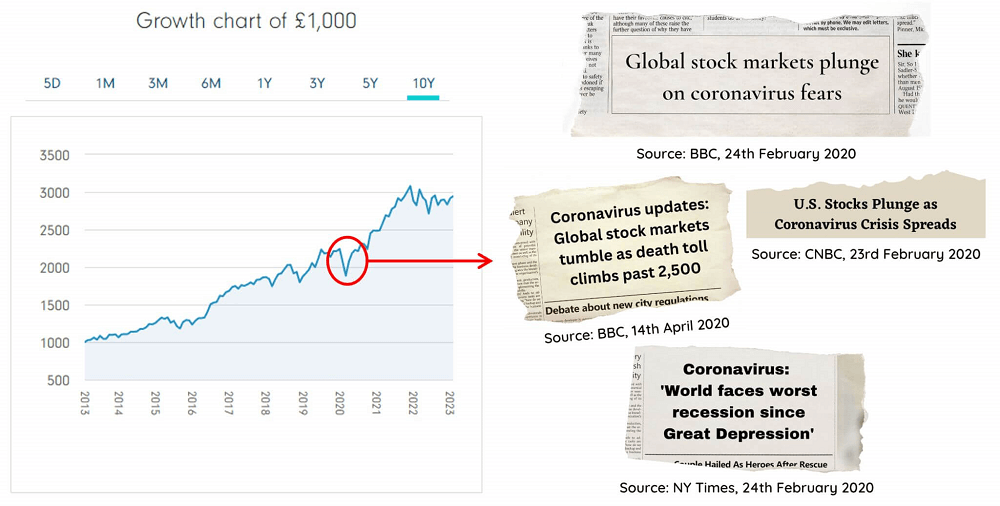

When I interviewed Julian Robson, the co-founder of Beanstalk last year, he told me that one of the inspirations for setting up the Beanstalk JISA was a chart that was on the wall in his old boss’s office. It was a chart of the stock market going back to the 1900s. His point was that if you look at a long-term chart of the stock market, you can’t see 1987’s Black Monday, The 1930’s Great Depression, or any other major stock market crash. In general, it just goes up.

Here is a good example of the Covid market crash that Cem Eyi (Beanstalks other co-founder highlighted on LinkedIn recently (the fund is Fidelity World Index).

What does the Beanstalk JISA invest in?

When you invest in a Junior stocks and shares ISA with Beanstalk, you are essentially making two investments (three if you want to include your child’s future), the Legal & General Cash Trust fund and Fidelity Global Index fund. The first tracks interest rates and keeps your money as cash, the second tracks the stock market, and holds big profitable companies like Apple, Microsoft and Johnson & Johnson (you can see the full portfolio breakdown here). It’s a standard diversified portfolio.

How much does the Beanstalk JISA cost?

It costs, 0.5% of the balance of your portfolio for a Beanstalk JISA, but if cost is your only concern, you can buy these funds individually with a DIY platform like AJ Bell (0.25%), Hargreaves Lansdown (0.45%) and Interactive Investor (JISA is free with a £9.99 per month trading account). Regardless of who you invest with you will still have to pay the 0.12-0.15%. charges levied by L&G and Fidelity for managing the fund.

Why invest with a Beanstalk JISA then?

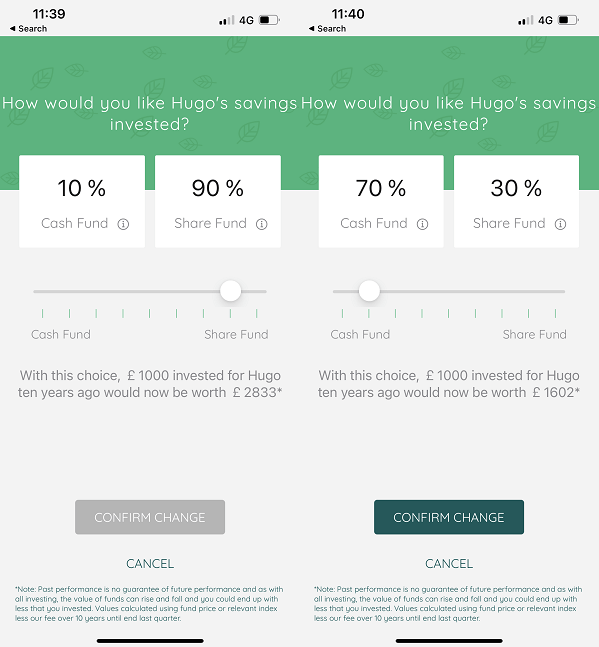

Where Beanstalk earns its money is that you can very easily switch between what percentage of cash and stocks are in your child’s portfolio. There is a handy slider, which also shows what the historic returns would have been depending on the allocation.

So, if you think the market is going to crash you can switch to more cash and interest, rather than stock market investments. But remember, a general rule of thumb when it comes to investing is that the younger you are, the more risk you should take. If you are old, the closer to retirement you are the lower risk your investments should be. So, when your child comes close to 18, you can tune down the risk so that you don’t get bitten by a shock stock market crash the week before they get their money.

I’m not suggesting for a second that you bet on horses to kickstart your children’s financial literacy, that would be idiocy. But, if you have a few pounds sitting around, pick up your phone, download the app, and start investing for your children’s future. If you’re looking to bet on a winner, that’s a sure thing.

Beanstalk Awards

Beanstalk has won the best junior stocks and shares ISA in our 2023 and 2024 awards.Beanstalk Junior ISA Video Review

Watch as we invest live in a Beanstalk JISA and explain the pros and cons of the app versus traditional investment platforms.

Beanstalk Facts & Figures

| ⬜ Public Company | ❌ |

| 👉 Number Active Clients | na |

| 💰 Minimum Deposit | £10 |

| 💸 Client Funds | na |

| 📅 Founded | 2020 |

Account Costs | |

| ➡️ Investment Account | ❌ |

| ➡️ SIPP | ❌ |

| ➡️ Stocks & Shares ISA | 0.5% |

| ➡️ Junior ISA | 0.5% |

| ➡️ Lifetime ISA | ❌ |

Dealing Costs | |

| ➡️ UK Shares | ❌ |

| ➡️ US Stocks | ❌ |

| ➡️ ETFs | ❌ |

| ➡️ Bonds | ❌ |

| ➡️ Funds | £0 |

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com