Rio Tinto (RIO) slashed payout to shareholders

Rio Tinto (RIO), the world’s second largest miner with a market value of £100 billion, has recently slashed its dividend as revenue and cash from its mining operations dropped.

Before we proceed, a short summary of Rio Tinto’s activities is in order. The company is a major seller of iron ore ($30 billion in revenue), aluminium ($14b), copper ($6.7b) and other minerals ($6.8b). It is a huge company with thousands of employees engaging in mining, exploration and refineries. A major part of its operations is in the resource-rich Australia.

What caused Rio Tinto to reduce shareholders payout? Shrinking cash flow from its base metal shipments, down $5.7 billion year-on-year, prompted the management to reduce the overall returns.

Despite this, Chief executive Jakob Stausholm is optimistic, commenting:

“Despite challenging market conditions, we remain resilient because of the quality of our assets, our great people and the strength of our balance sheet. That is why we delivered strong financial results with underlying EBITDA of $26.3 billion, free cash flow of $9.0 billion and underlying earnings of $13.3 billion, after taxes and government royalties of $8.4 billion. This enables us to continue to invest in strengthening the business while also paying a total dividend of $8.0 billion, a 60% payout”

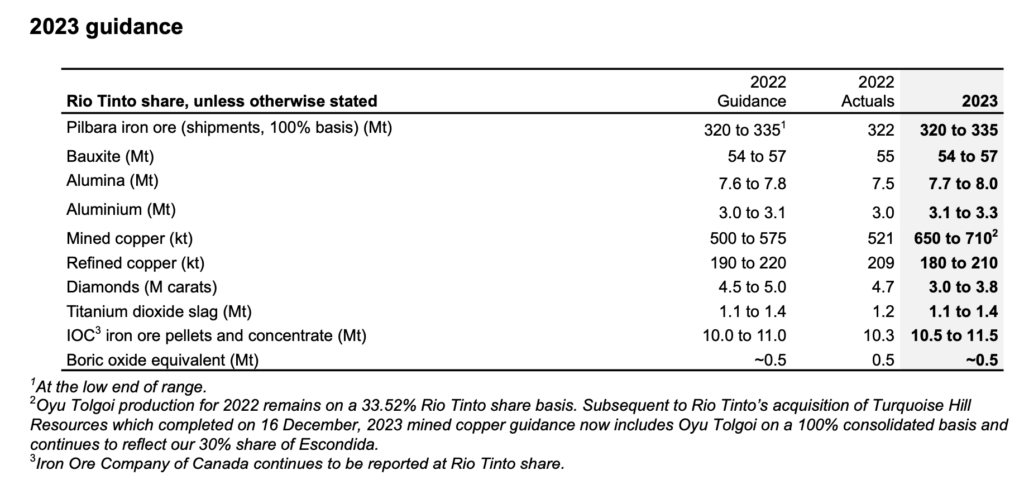

However, it is the future guidance that investors are unsure about. According to the company, operations this year will stay (roughly) at 2022’s level. This means that its revenue, cash flow and dividends will remain similar; ergo, cash returns to shareholder will level out.

As a result, Rio Tinto’s share price dropped following the 2022 FY results. Rio Tinto’s share prices are now trading below £60, slowly retracing its earlier rally from £40.

With strong overhead resistance at £60, a further correction into last year’s lows (mid-forties) is not to be ruled out.

However, should you take advantage of its weakness to buy? To answer that, I first take a look at the commodity market.

What does it mean for the ‘commodity supercycle’?

In fact, many are wondering: Are we still in a commodity supercycle?

That term was coined nearly two decades ago at the start of the BRIC boom (short for Brazil, Russia, India, China). Alas, those heady days from emerging markets are gone. China’s strong growth has tumbled; Russia is at war; while Brazil is struggling to resuscitate an economic revival. Only India is still doing reasonably ok, but its currency weakness is a concern.

All in all, many suspect that the commodity market is unlikely to soar like it did before.

True, but remember that in a commodity market a price rally can be driven by supply concerns too. Last year, we saw a massive spike in Natural Gas, Oil, Nickel, Wheat, Lithium, Soybean et cetera. The surge in commodity prices caused inflation to skyrocket.

Therefore, even though we may not be in supercycle driven by demand, the supply crunch is worrying, at least for some commodities. The ongoing war in Ukraine means that geopolitical concerns are mounting and which leads to supply restrictions on energy and food.

Take oil. Many companies are raking in, like Shell (SHEL) and BP (SHEL). Profits are surging.

But Rio Tinto’s businesses are iron, aluminium and copper. That sector is cyclical and heavily dependant on China. Because of this, I would wait further until that region returns solidly to growth before buying Rio’s shares.

Downside support noted at £40.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.