One of the stock darlings during the pandemic was the online computer game company Roblox (NAS: RBLX).

Roblox shares breakthrough support

During those months-long lockdown, youngsters all tuned into the internet-based gaming website to relieve of their boredom. User growth rocketed; sales surged. RBLX was listed with much fanfare back in 2021 and on its debut gained a market capitalisation of $38 billion. At its peak, Roblox was worth more than $70 billion.

Alas, that bull market didn’t last, especially as household started travelling again. Roblox share price plunged by 80 percent from its $140 peak. And for the last 18 months, prices were stuck in the range of $25-$50. All good, except prices have started to break down again.

Monday saw the loss-making company slump 7 percent to its lowest level this year (see below). Given a lack of support until $30, the risk of a further slide is high.

Election factor looms large in the US

Rates aside, there is another factor flashing at the back of investors’ minds: Elections.

In 2024, the United States will elect a president. Contenders in the ring are the 45th (Donald Trump, in red) and 46th presidents (Joe Biden, in blue) respectively.

According to a popular political website (www.realclearpolitics.com), the polling data says that Donald Trump has a slight edge in the 2024 presidential election, particularly after securing the republican nomination by a massive lead (see below). But the election is still months ahead and the outlook will only be clearer towards the end of a potentially contentious summer.

Source: realclearpolling

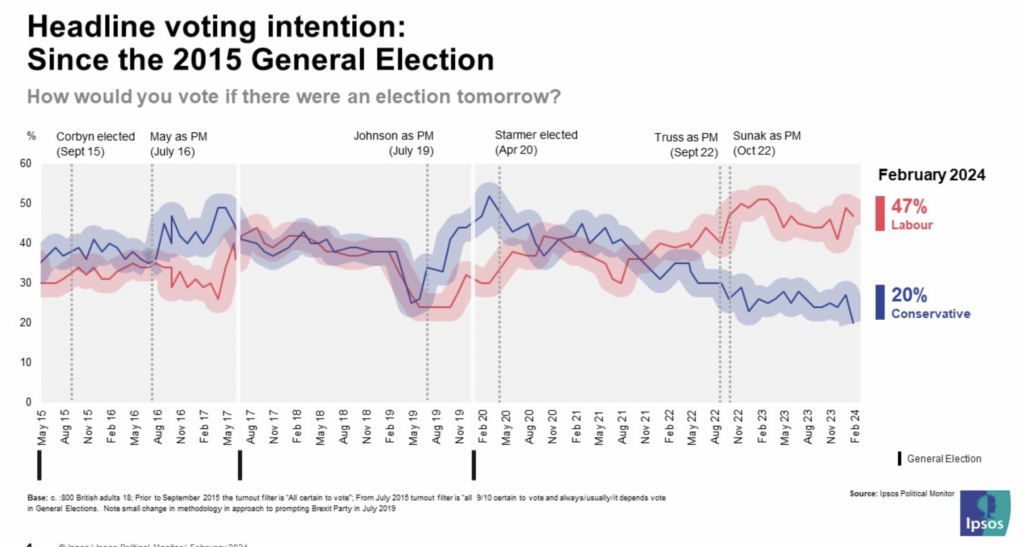

In the UK, the country is also gearing up for a general election, the first since the covid pandemic. Unlike the US, the polling data on the street favours a big win for the opposition (Labour). The current conservative administration, led by Rishi Sunak, has been in power since 2010. Voters are clearly agitating for a change.

India, now the fifth largest economy in the world, is also preparing for another election this year. Narendra Modi is the favourite to win a third five-year term as prime minister.

The question for investors is how will all these elections impact the market? Very difficult to say. Trump mark two is probably less of a shock to the market than his first win back in 2016. Still, a new administration means new policies and this will create significant uncertainties for some sectors.

Currently stock markets are cruising higher but as the election looms we expect investors to start taking some chips off the table.

Source: ipsos.com

How to buy shares in Roblox (NYSE:RBLX) from the UK

Buying one NYSE:RBLX share costs $62.51. However, as well as the $62.51 cost of buying each share you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. To buy shares in Roblox (NYSE:RBLX), you need a trading or share dealing account. Follow these three steps if you want to buy shares in Roblox:

- Decide if you want to buy Roblox shares in the short-term or invest in the long-term

- Compare share dealing and trading fees in our comparison tables

- Choose which broker is right for you and open an account

It’s also important to remember that share prices can move quickly, for example, the current NYSE:RBLX share price is $62.51 which is a change of 0.31 or 0.49% from the last closing price of 62.51 with 6,810,514 shares traded giving NYSE:RBLX a market capitalisation of $41,020,573,640. The most recent daily high has been 63 and daily low 62.04. The NYSE:RBLX share price 52 week high has been 75.74 and the 52 week low 29.55. Based on the most recent NYSE:RBLX share price opening of 62.51, the current NYSE:RBLX EPS (earnings per share) are -1.44 and the PE (price earnings ratio) is n/a.

Pricing data automatically updates every 15 minutes

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.

You can contact Jackson at jackson@goodmoneyguide.com