Capital.com is no longer taking on customers from the UK (at the moment), but you can trade with them if you are based internationally. If you are in the UK a list of alternative brokers is below.

Customer Reviews

Leave a review

- Tell us what you think of this company and help others make more informed financial decisions.

Unclaimed review: Is this your business?

Alternatives

| Trading Platform | Markets Available | Minimum Deposit | GMG Rating | More Info | Risk Warning |

|---|---|---|---|---|---|

| 13,500 | £100 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 1,200 | £1 | See Platform | 75.3% of retail investor accounts lose money when trading CFDs with this provider | |

| 17,000 | £250 | See Platform | 70% of retail investor accounts lose money when trading CFDs and spread bets with this provider. | |

| 10,000 | £1 | See Platform | 64% of retail investor accounts lose money when trading CFDs with this provider | |

| 12,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider | |

| 9,000 | £1 | See Platform | 65% of retail investor accounts lose money when trading CFDs with this provider | |

| 7,000 | £1 | See Platform | 62.5% of retail investor accounts lose money when trading CFDs with this provider | |

| 2,976 | $50 | See Platform | 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money | |

| 578 | £100 | See Platform | 71% of retail investor accounts lose money when trading CFDs and spread bets with this provider | |

| 5,000 | £1 | See Platform | 69% of retail investor accounts lose money when trading CFDs with this provider. |

Expert Capital.com Review

Capital.com Review

Name: Capital.com

Description: Capital.com was founded in 2016 and is a CFD trading platform and spread betting broker with offices in the UK and around the world. Since then, they have grown to offer over 3,700 tradable assets to 300,000 active monthly traders. Capital.com won “Best Trading App” in our 2023 Awards.

Why we like them:

Capital.com has an easy-to-use and intuitive trading platform and app, that gives access to the most popular financial markets with competitive spreads with the ability to reduce risk by decreasing your leverage.

Pros

- Innovative and intuitive app

- Set your own leverage

- Proprietary technology

Cons

- Trading only, no ISA or SIPP

- No options markets

-

Pricing & Spreads

(4)

-

Market Access

(3.5)

-

Apps & Trading Platform

(4.5)

-

Customer Service

(4.5)

-

Research & Analysis

(3.5)

Overall

4Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Thumbs up, literally

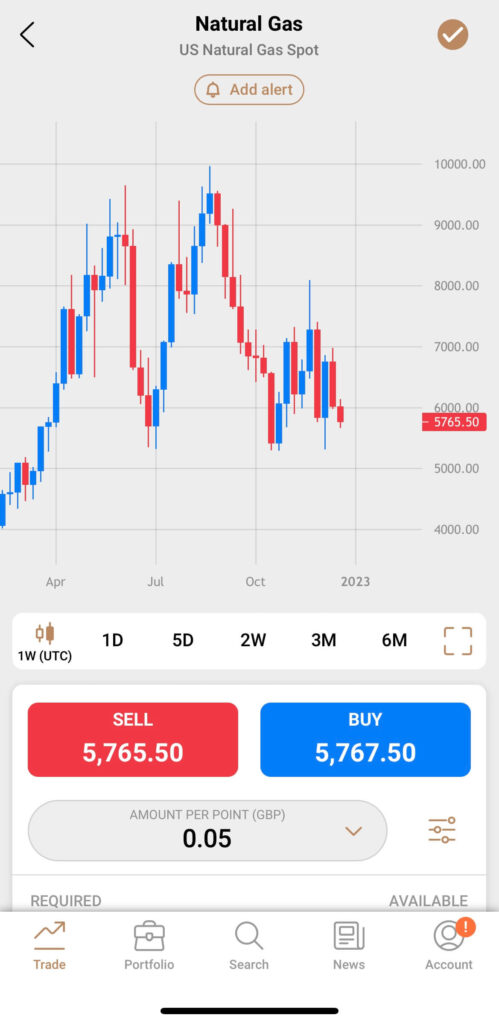

Do you know what the most impressive thing about Capital.com is? They put the buy and sell buttons at the bottom of the app.

I don’t mean that in a facetious way, it’s genuinely a brilliant feature.

This may not sound like much but it’s a good example of how Capital.com has integrated decades of analytics, experience, feedback and customer data into creating a very easy-to-use intuitive trading app from scratch.

When Capital.com first became authorised by the FCA back in 2018, I visited their offices in London to have a chat about what they offer. The two main things we discussed were button placement and AI.

Rapid Growth

Of course, since then Capital.com has grown rapidly and now has over 7 million registered users, with 75,000 active monthly clients across Europe who have traded positions valued at over $700 billion. They have also significantly boosted their UK management team by making a series of high-level executive hires. This includes Peter Hetherington as UK CEO, the former CEO of IG Group and Schroders Wealth Management.

Trading App

But anyway, if you’ve updated your iPhone to the latest iOS you’ll notice that Apple has started moving things to the bottom of the screen, the search bar for instance. This is because, phones are getting bigger, and your thumb can’t reach the top of the screen if you are holding it with one hand. This is something that Capital.com figured out would make trading easier 5 years ago. I’ve just been through a bunch of other trading apps on my phone and still, amazingly enough, none of the other brokers have done this yet.

Capital.com was also the first to integrate artificial intelligence to help you improve your trading, they say, based on the Martingale theory. When I spoke to Chris Demetriou, the head of sales in the UK, he said that the system should give you prompts based on your previous trades. So for example, if you are about to do a trade that is similar to ones you have constantly lost on before, you should get a “are you sure you want to do this” notification.

There have also been some significant improvements recently including:

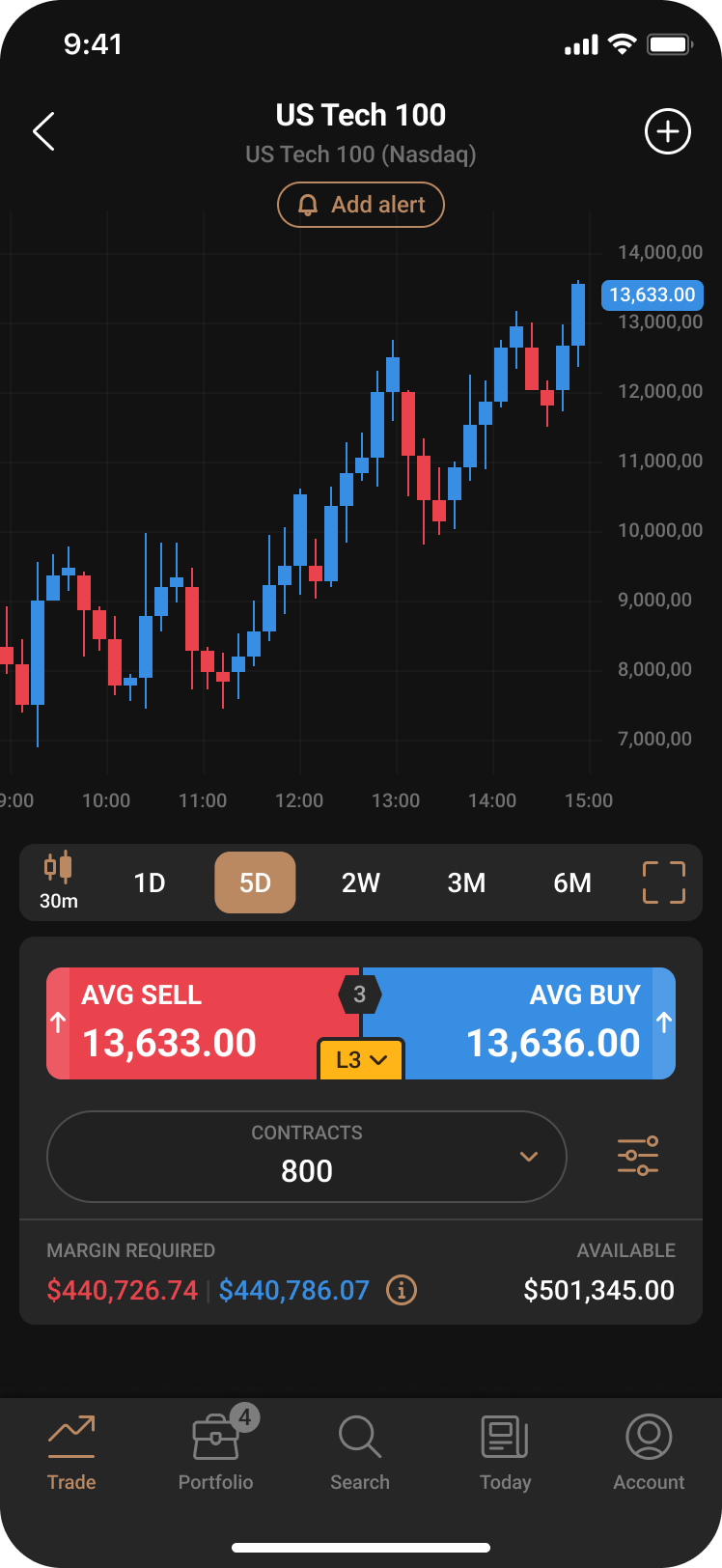

- adding average price execution data for larger orders

- improving the visibility of overnight funding fees

- the ability to add dynamic widgets to individual home screens

Leverage Control

Everybody knows, that one of the main reasons people lose money when trading is overleverage. This could be either from not having enough free cash on account to give your position breathing space, or simply putting on trades that are too risky. One really good feature is that you can change your leverage based on asset class. The default leverage is the max that retail traders in the UK are permitted, but you can change this to 1:1 so you need to fully pay up for positions. A sensible thing to do if you are just getting started, which can help reduce excessive losses. As your experience grows you can increase your leverage accordingly.

Hedging

You can also set the platform to put on hedging positions, so you can be long and short the same thing at the same time. Why you ask? Well, it can help you run longer-term positions and short-term hedges. This in fact is the very point of CFDs and spread bets. They were originally hedging tools, and still a good way to protect your long-term investment portfolio against short-term market corrections without having to close off your positions.

Customer Support

Customer support is pretty good too, you can get in touch via the chat widget on the platform, whatsapp or telegram. When I tested it I got a response within a minute and the issue I had was dealt with quickly (uploading ID to verify my account if you must know).

TradingView

You can’t trade from the charts, but when you have open positions they are overlayed along with your stops and limits, which you can move by dragging and dropping. But, if charting is your thing, you can join the other 78,000 Capital.com customers using and trading from TradingView.

Proprietory Tech

One thing I quite like though is that instead of relying on third-party software, the Capital.com trading platform is built in-house, and if you want something you can ask for it. For example, previously on the app you could see where an asset is as a percentage relative to the daily range. But, a customer asked, if you could see it in points too. So, that was quickly integrated so that you can now toggle between percentages and points. A small thing, but indicative of a broker that can do things and does do things, rather than just logging a helpdesk ticket.

Refinitiv

There are no trading signals on the platform or app, but you do get access to Refinitiv reports on US stocks, which give you a good overview of historic and potential future financial health. A good feature for those looking at slightly longer-term positions.

Overnight funding

Talking of long positions, or longer long positions, Capital.com also display quite clearly what your overnight financing rates are going to be on a daily basis. I’m sure this is a regulatory obligation anyway, but it’s done in a way that you can actually see what the price is, rather than an opaque formula. It gives a bit more transparency about how much a position is going to cost you.

Investmate

If you are new to trading, they have a stand-alone app called Investmate, which puts you through a series of bitesize courses that explain the financial markets. Capital.com also own currency.com if you fancy a punt on crypto, and shares.com so we can expect to see more comprehensive physical investing options soon.

Average Execution Pricing

The new feature is part of a wider upgrade to Capital.com’s trading platform. As well as average execution prices traders will now be able to view dynamic bid-offer prices that react to changes in order size. Clients will also be able to view market depth in a security.

This means that a customer can see the amount of liquidity, or interest at a given price point, in an instrument, on both sides of the order book, and the changes to that market depth, as they occur.

The average execution price that customers see will be the Volume-Weighted Average Price or VWAP.

A tool that institutional and pro traders have had access to for many years, but which is only now being made available to retail traders in an order book setting.

Having visibility over this type of level-two data should allow Capital.com clients to make more informed trading decisions, and to get a better handle on how the market is feeling about a specific security at a given point in time.

Examining its trader’s behaviour and performance

Capital.com has analysed the behaviour and performance of 100,000 active traders in a study that ran between May 2022 and April 2023.

The results are quite eye-opening, for example, traders who traded across five separate asset classes, closed 60% of their trades with a profit, on average.

Whilst those that traded just one asset class closed just 48% of their trades profitably.

The majority of Capital.com’s traders are multi-asset traders, though only 15% of them, trade in five or more asset classes. Whilst some 65% trade between two to four different assets, 20% of the customers studied, traded just one asset class.

The research also revealed a correlation between the length of time that traders held their positions open, and profitability, with 44% of trades held open between 30 minutes and 6 hours being closed for a profit.

Traders who held positions open for less than 30 minutes experienced an average of 41% profitability.

And those holding positions open for 24 hours or longer closed just 39% of their positions with a profit. Interestingly more than 50% of traders, who held their position for 24 hours or more, did not use a stop loss.

First-time traders fared better in FX Indices and Commodities on average, Capital.com’s first-time traders made a profit on 58% of their trades when they traded commodities, compared to 56% in FX, 54% in index trades and just 46% in equity trades.

The new features introduced by Capital.com are a further sign that it’s listening to what its clients want from their trading tools, however, the firm is also feeding back useful information to its clients, both of these initiatives should help those same clients, to improve their trading outcomes.

Cheaper Guaranteed Stop Loss Premiums

Ini June 2023 Capital.com reduced the fees it charges for using guaranteed stop losses (GSL), giving clients a cheaper way to protect their positions from large market gaps. GSL spreads have been narrowed across four separate asset classes, Forex, Equity Indices, Commodities and individual stocks and shares.

The fees or premiums charged for GSLs at Capital.com have been reduced as follows:

- Forex: the GSL charge is reduced from 0.10% to as low as 0.01% on major FX pairs

- Indices: GSL charges come down from 0.1% to as low as 0.02% on major equity indices.

- Commodities: GSL charges are reduced from 0.05% to 0.03%

- Shares: GSL charges on the top 10 most traded equities are cut from 1.0% to 0.5%.

Traders will now also be able to view GSL charges within their deal ticket before committing to a trade.

Stop distance minimums

Capital.com has also looked at the minimum distances that GSLs can be placed away from the current market.

Minimum distances have been decreased for most commodities, indices, minor FX pairs and the top ten traded stocks.

However, they have been extended for major FX pairs and less popular stocks.

The firm has also increased the maximum distance a GSL can be placed away from the current market price, this level has now been set to 75% of that value.

What are guaranteed stop losses, and why use one?

Guaranteed stop losses are a form of trade insurance which fix the maximum loss a trader can incur on a trade.

A standard stop loss order is executed at the next best available price, once triggered.

However, in fast-moving markets or markets that don’t trade 24 hours a day and which can therefore gap overnight, standard stop loss orders can be subject to slippage.

A guaranteed stop loss is not subject to slippage, because the price at which the trade will be closed has been specified in advance, clients pay a premium or fee for that facility.

Using GSL means a trader can quantify their risk at the outset of the trade which could allow them to take on a larger trade size than they might normally trade or to limit their risk to a fixed sum of money.

Guaranteed stop losses are a useful backstop for traders in volatile or fast-moving markets or for those occasions when you can’t monitor a position but still want to be in the market.

They can be helpful for newbies and novice traders who want to tread carefully and limit their risk in each trade they make.

The cheaper GSLs they are to deploy the better.

They are not a total panacea, however, because there will still be debates about whether they should or shouldn’t have been triggered.

Capital.com overnight financing charge transparency

Capital.com said back in March 2023 that it would publish the rates of how overnight funding was charged. Capital.com is, in fact, one of the growing trading platforms that show overnight funding charges on trading tickets.

Funding charges are an integral part of CFDs, rolling spot Forex, and certain Spread Betting contracts that are not priced as futures, such as rolling bets.

The charges represent the cost of carry on margined positions.

Traders that hold long positions pay funding charges to the broker to cover their cost of carry on the underlying instrument, whilst those traders that hold short positions receive funding in lieu of their settlement proceeds.

Funding charges are only applicable to margin trades that are held open for longer than a business day.

- Want more info? Read our expert guide to overnight financing rates

The new funding charges are to be calculated based on a known premium or discount, to the relevant overnight funding rates.

So for example, a long CFD position on a US equity index that is dollar-denominated will attract funding charges based on the following calculation:

(Position size * index value) *the US Secured Overnight Financing Rate (SOFR) +/-4%

Whilst for commodities and Forex contacts Capital.com will reference rates used in the underlying markets.

That’s the Tomnext or tomorrow next-day funding rates in FX, and the appropriate futures contracts in the case of commodities.

- See which brokers charge the lowest overnight financing rates in our trading platform comparison table

This a notoriously opaque area in the margin trading business, and in my experience many firms are unable, or unwilling, to explain how they calculate their overnight swaps rates.

Meaning that they amount to a hidden charge on a trader’s account.

Capital.com has come out from behind its website to explain the funding schedules and though +/- 4% premium sounds steep to me, clients can now make an informed choice about whether they want to pay those rates on their overnight trades.

- Find out more about this broker by reading our expert Capital.com review

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com Video Review

Watch as we trade live on the Capital.com app and web platform and demonstrate some of the key features including, user experience, leverage and overnight funding.

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com Facts & Figures

Capital.com Total Markets | Over 3700 |

| ➡️ Forex Pairs | 122 |

| ➡️ Commodities | 19 |

| ➡️ Indices | 21 |

| ➡️ UK Stocks | 328 |

| ➡️ US Stocks | 1432 |

| ➡️ ETFs | 120 |

Capital.com Key Info | |

| 👉 Number Active Clients | 75,000 (monthly) |

| 💰 Minimum Deposit | £20 |

| ❔ Inactivity Fee | ❌ |

| 📅 Founded | 2016 |

| ⬜ Public Company | ❌ |

Capital.com Account Types | |

| ➡️ CFD Trading | ✔️ |

| ➡️ Forex Trading | ✔️ |

| ➡️ Spread Betting | ✔️ |

| ➡️ DMA (Direct Market Access) | ✔️ |

| ➡️ Futures Trading | ❌ |

| ➡️ Options Trading | ❌ |

| ➡️ Investing Account | ❌ |

Capital.com Average Fees | |

| ➡️ FTSE 100 | 1 |

| ➡️ DAX 30 | 1.5 |

| ➡️ DJIA | 2 |

| ➡️ NASDAQ | 1.8 |

| ➡️ S&P 500 | 0.7 |

| ➡️ EURUSD | 0.6 |

| ➡️ GBPUSD | 1.3 |

| ➡️ USDJPY | 0.8 |

| ➡️ Gold | 0.18 |

| ➡️ Crude Oil | 0.03 |

| ➡️ UK Stocks | 0.1% |

| ➡️ US Stocks | 0.1% |

79% of retail investor accounts lose money when trading CFDs with this provider

Capital.com FAQs

Yes, if you a UK trader Capital.com is authorised and regulated by the FCA (Financial Conduct Authority) and your funds are protected up to a certain point by the FSCS.

Capital.com offers financial spread betting and CFDs (contracts for difference) on forex, indices, commodities and shares. They also have a Zero commission investing feature on the app.

No, Capital.com is not regulated in the US. However, you can trade US stocks and shares, indices and USD denominated currencies.

The two main revenue streams from Capital.com are spreads (comission) and funding (overnight financing charges) which is charged when you hold positions over night.

No, Capital.com does not charge for deposits or withdrawals.

Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading spread bets and/or CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

79% of retail investor accounts lose money when trading CFDs with this provider

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.