To buy shares in Amazon from the UK, you need an FCA-regulated stock broker that provides access to US stocks as they are listed on the NASDAQ stock market like Interactive Investor or Hargreaves Lansdown. You can use our comparison of UK-based share dealing platforms that offer access to international markets and see what they charge for buying and selling US stocks, plus what the foreign exchange conversion costs are for converting GBP into USD.

🧑🎓Here are the steps to follow for buying Amazon shares from the UK.

- Open an account with a share dealing platform that lets you invest in US stocks

- Decide how much you want to buy and deposit fund your account

- As Amazon is a US stock and traded in USD you need to convert your funds to USD. You can either do this before trading or the share dealing platform will do it automatically for you.

- In your share dealing platform type in Amazon’s NASDAQ stock symbol (AMZN) and click “buy”. You can be given the option to buy at the currency price (market order) or set a maximin price at which you want to buy at (limit order).

🤔Note: In the US they refer to Amazon shares as stocks, but they are the same thing…

Amazon is one of the biggest companies in the world, owned by one of the richest men in the world and if you want to own a piece of it, you can do so and profit in their sucess by buying shares.

⚠️What to watch out for! Exchange Rates

When you buy a US stock like Amazon a hidden cost is often the exchange rate a share dealing platform charge for converting GBP into USD. You can compare these in our US share dealing platform comparison table.

💡Hints: Here are some of the best accounts for buying Amazon shares

- Interactive Brokers offers the cheapest FX rates for buying Amazon shares

- Hargreaves Lansdown provides an excellent service if Amazon is only going to be a small part of your portfolio.

- Dodl offers a very low account, dealing and fx cost for new and small investors.

- IG offers free US share dealing if you trade a certain amount each month.

Compare accounts for buying Amazon shares

| US Stock Buying Platform | US Commission | FX Rate | ISA | SIPP | GMG Rating | More Info |

|---|---|---|---|---|---|---|

| £11.95 | 1% - 0.25% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £3.99 | 1.5% - 0.25% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| 0.5 cents per share | 0.02% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £3.50 - £5 | 0.50% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| 20 cents per share | 0.5% | ✔️ | ✔️ | Visit Broker Capital at risk |

|

| £8 | 0.5% | ✔️ | ❌ | Visit Broker Capital at risk |

How much does it cost to buy Amazon shares (NASDAQ:AMZN)?

As of 16/04/2024 16:00 buying one Amazon share costs $183.32. However, as well as the $183.32 cost of buying the shares you will also have to pay any relevant tax, commission when you buy and sell shares, custody fees for holding your shares on your account and foreign exchange fees for converting GBP into USD. You also have to consider the difference between the bid price (the price at which you sell shares) and the offer price (the price at which you buy shares). These fees vary depending on what sort of account you open, and with what broker.

What is the live Amazon share price (NASDAQ:AMZN)

As of 16/04/2024 16:00, the current Amazon share price is $183.32 which is a change of 0.3 or 0.16% from the last closing price of 183.32 with 32,891,265 shares traded giving NASDAQ:AMZN a market capitalisation of $1,904,214,577,679. The most recent daily high has been 184.83 and daily low 182.26. The NASDAQ:AMZN share price 52 week high has been 189.77 and the 52 week low 101.15. Based on the most recent NASDAQ:AMZN share price opening of 183.32, the current NASDAQ:AMZN EPS (earnings per share) are 2.9 and the PE (price earnings ratio) is 63.22.

Is Amazon (NASDAQ:AMZN) a good investment in the long term?

This analysis was produced on the 7th of June 2023.

Here are some of the key factors that have effected Amazon’s share price recently;

- Amazon bolstered by improving macro conditions and Artificial Intelligence

- Amazon (AMZN) is the fifth-largest company in the world worth $1.2 trillion

- Regained its trillion-dollar status after investor sentiment turned favourably towards Big Tech

- First quarter earnings swing to a $3 billion profit

Improving macro conditions and the emergence of AI drive tech rally

Last year was a horrendous period – annus horribilis, perhaps – for many large tech companies. The spike in inflation and interest rates were accompanied by a dip in consumer demand. Not only revenue came under pressure, earning margin collapsed for many consumer-oriented companies.

Share prices of many big tech, Amazon included, promptly halved. In particular, shareholders of the Seattle-based group suffered a 49% loss in paper wealth. In Nov 2022, Amazon lost its ‘trillion dollar’ status – the first company to do so.

2023, however, saw a reversal of fortune for the sector. Macro headwinds are softening. The lingering impact of the pandemic have totally erased as many Asian countries opened up. China removed the last covid barriers.

Amazon, NVIDIA & Big Tech

But the most important factor that turned the corner for Big Tech is the emergence of AI, short for Artificial Intelligence.

The explosive rise in generative AI, detailed in my article here on GoodMoneyGuide, has sparked a mad rush into AI stocks.

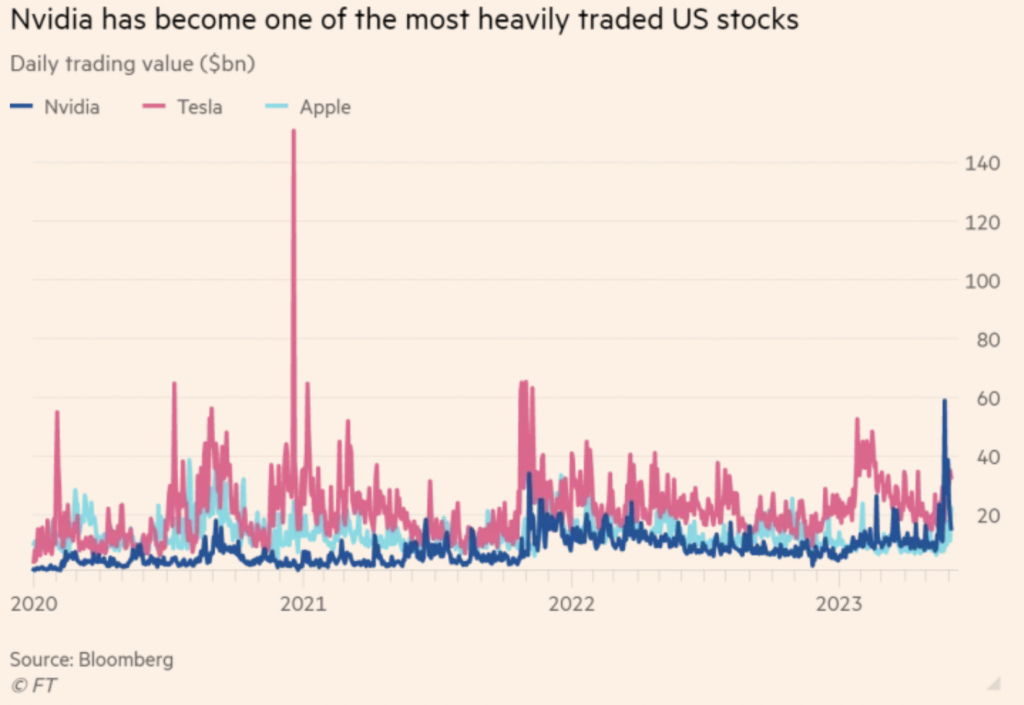

Leading the charge in this sector is Nvidia (US:NVDA). At the end of May, the stock joined the elite Trillion Dollar Club (companies sporting more than $1 trillion in market capitalisation). The California-based company was the ninth company to reach that trillion dollar milestone. The key reason for Nvidia’s sharp rally was its bullishness on future revenue. So high is the demand for AI computing that Nvidia’s quarterly income rose 44%.

Suddenly, investors and fund managers missed the rally, as most of them have been ‘derisking’ from the tech sector in the last few quarters. As a result, there is a mad rush back into Big Tech companies who are heavy users and developers of AI. Trading in Nvidia shares sky-rocketed as retail and institutional investors piled into the stock. Fear of Missing Out (FOMO) is a powerful emotion indeed.

But what has this got to do with Amazon? More than you think.

In the latest earnings call, the CEO of Amazon has stressed the importance of AI in improving its underlying business:

while our AWS business navigates companies spending more cautiously in this macro environment, we continue to prioritize building long-term customer relationships both by helping customers save money and enabling them to more easily leverage technologies like Large Language Models and Generative AI with our uniquely cost-effective machine learning chips (“Trainium” and “Inferentia”), managed Large Language Models (“Bedrock”), and AI code companion CodeWhisperer. We like the fundamentals we’re seeing in AWS, and believe there’s much growth ahead.

AI is very important for many tech companies since it can improve productivity and improve profit margins. Generative AI, for instance, can do plenty of coding. This is slowly revolutionising how million of lines of codes are produced and maintained. Large language models are used to contextualise problems and produced answers efficiently.

Would I Buy Amazon Shares Now?

Technically the stock is in a clear multi-week uptrend, as defined by the pattern of rising lows and rising highs (see below). And this uptrend was supported by a 6-month churn (Oct-Mar).

Should we chase? Looking at Amazon’s accelerative uptrend, I would be wary of doing so. For one, while the macro conditions have improved, they are by no means over. The Fed is still eyeing to raise interest rates. China, the second largest economy in the world, is reporting sluggish export data. Inflation remains sticky in many countries. Meanwhile, interest rates are still high; mortgage rates are slowing rising, too. All these factors erode the buying power of consumers.

Moreover, as late as mid-March, Amazon was still trading in the low 90s. The recent uptrend may have came as a surprise to many. Many traders are still watching where the macro winds blow. A retracement back to the 50-day moving average at around $110-115 is not to be ruled out.

Therefore, having some spare buying power is critical in case investor sentiment sours again in the coming weeks. Watch to buy on modest weakness with clear stop loss levels to protect capital. Risk a modest portion of the overall portfolio.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.