Yes, you can buy corporate bonds and Treasury bonds online with Interactive Brokers. However, as the majority of IBKR’s dealing services are online, there are better options for buying illiquid retail bonds. For example, Saxo has a dedicated bond desk for high-value bond investors and traders. You can see how Interactive Brokers compare in our bond broker comparison here.

Is Interactive Brokers Good For Bond Trading?

Yes, Interactive Brokers offers access to the most bonds out of all the brokers we compare. You can trade over one million bonds, with commissions as low as 0.1%. These include UK, US, and international government bonds, over 26,000 US corporate bonds and thousands of UK corporate retail bonds. There is no custody or account fee for holding bonds in a general investment account, stocks and shares ISA or SIPP.

Fees: Minimum dealing commissions are £1 in the UK or 0.05% of the deal size.

How To Buy US Treasury Bonds On Interactive Brokers

To buy US T-Bills on IBKR follow these steps:

- Login to the IBKR portal or app

- Click on ‘Research’ on the main menu

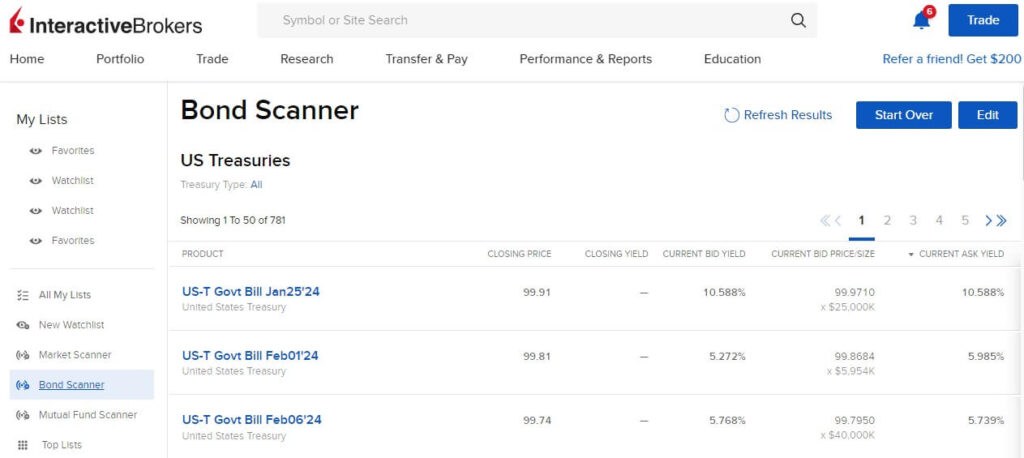

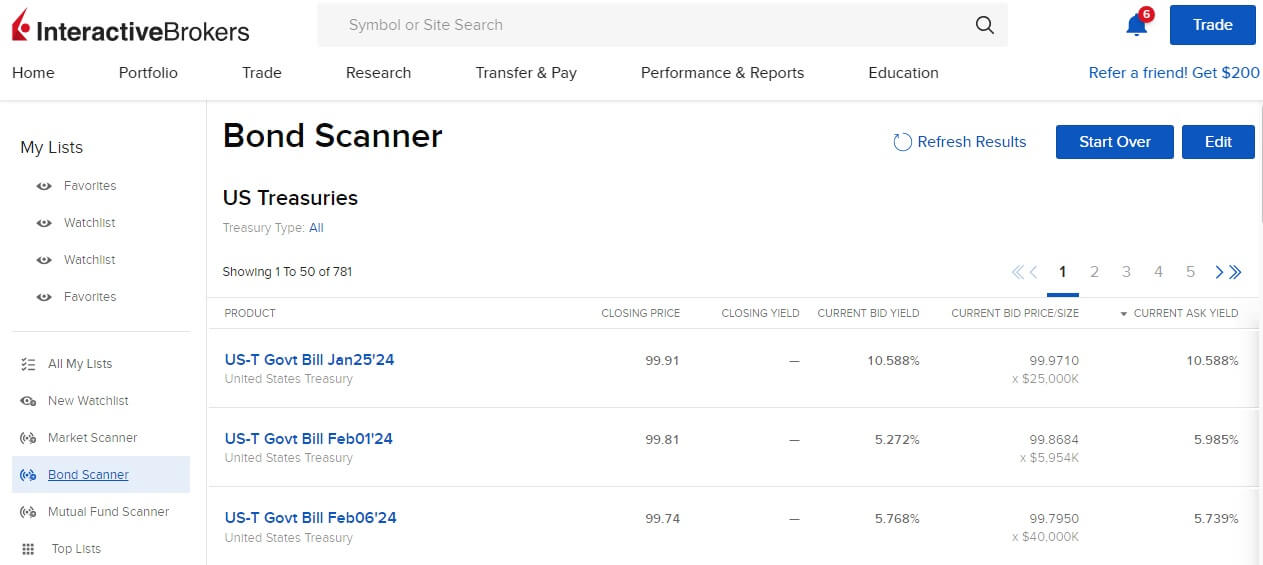

- Click on ‘US Treasuries’ (there are currency 781 bonds listed)

- Click ‘View Results’ at the bottom of the page

- You will then see a list of US Treasuries that you can buy on Interactive Brokers (shown below)

- Click on the bond you are interested in and then ‘Buy’ to add to your portfolio.

Expanded Trading Hours For US Treasury Bonds

In a move that provides greater flexibility for its clients, Interactive Brokers has announced a major expansion of its trading hours, for US Treasury Bonds on its platform.

Clients can now trade these securities for up to 22 hours per day.

The new trading extended trading session opens at 8pm Eastern Daylight Time (EDT) each evening and continues until 5 pm EDT the following day.

When Eastern Standard Time (EST) is in effect, the trading hours will be 7 pm to 5 pm EST the following day.

This is a significant increase from the previous nine-hour-per-day trading window.

The new, extended trading hours, are designed to cater to Interactive Brokers’ worldwide client base, who hail from over 200 countries.

In facilitating trading during local market hours ever, Interactive Brokers will allow its clients to react swiftly to news and events that impact global markets around the clock.

Treasury bonds are a “safe haven investment”, and a “go-to” instrument when geopolitical and macro themes are in play in the markets.

There are trillions of dollars worth of US treasury bonds in issue, making it one of the deepest most liquid markets in the world.

Thomas Frank, Interactive Brokers Executive VP, said of the extended trading hours:

“With clients globally, it’s essential we accommodate their needs and provide trading schedules suited to their locations, especially for a crucial market like US Treasuries,”

He added that

“This expansion represents a significant enhancement aligning with our aim to offer the most flexible and comprehensive trading environment possible.”

US Treasury bonds are among the world’s most sought-after assets due to their stability and perceived security, and the new 22-hour trading model gives Interactive Brokers’ clients the ability to manage their positions and take advantage of market conditions and newsflow twenty-two hours per day.

In addition to Treasuries, Interactive Brokers provides access to thousands of global bond issues spanning corporate, municipal, and sovereign debt.

These Instruments can be traded without markups, or built-in spreads, and analysed using the firms’s powerful search/filtering tools to match bonds to investment objectives.

The expansion of Treasury bond trading exemplifies Interactive Brokers’ client-first philosophy and its drive to deliver innovative solutions meeting the needs of investors worldwide.

Compare IBKR to other bond brokers below:

| Bond Broker | Bonds Available | Bond Dealing Commission | Bond Account Fee | GMG Rating | More Info |

|---|---|---|---|---|---|

| 1m+ | 0.1% to 0.015% depending on volume | £0 | Visit Broker Capital at Risk |

|

| 4,500 | 0.2% to 0.05% on Government bonds depending on account type | 0.12% or 0.08% for VIP accounts | Visit Broker Capital at Risk |

|

| 10,000+ | £11.95 (or £5.95 if more than 20 deals done in previous month) | 0.45% capped at £45 per annum | Visit Broker Capital at Risk |

|

| 10,000+ | £7.99 or £3.99 for "Super Investors" | £4.99 a month | Visit Broker Capital at Risk |

|

| 5,000+ | £9.95 (or £4.95, if you do 10 or more online deals in the previous month) | 0.25% capped at £3.50 per month | Visit Broker Capital at Risk |

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com