The pound-to-Japanese Yen forecast is an indication of where technical and fundamental analysts think the GBPJPY price may be in the future. You can use these exchange rate forecasts to help you decide if now is the right time to buy Japanese Yen, or if you should wait until the price improves further.

| GBPJPY Price | 1 Day Change | 1 Week Change | 1 Month Change | 1 Year Change |

| 210.05 | -0.82% | -0.82% | -0.49% | 11.29% |

👉If you have a large upcoming Japanese Yen money transfer, we can recommend Currencies Direct as a secure FCA-regulated currency broker that can offer bank-beating exchange rates. Get a quote now.

GBPJPY Forecast Highlights

- GPBJPY’s uptrend faltering at psychological 200

- Higher UK interest rates recently dampening GBP sentiment

- GBPJPY may re-test 190-188 as macro trends cast doubts on UK growth prospects

How has the Pound performed against the Japanese Yen recently?

While the Japanese Yen is well-known for its persistent weakness, largely due to Bank of Japan’s never-ending accommodative monetary policy, Pound Sterling is not doing great either.

Since my last update on GBPJPY in last October, the rate had corrected, briefly, into 190s before staging a sharp rebound back to the psychological round number level at 200 (see below).

So the key question here is this: Will the 200 barrier give way or reaffirm as resistance?

After GBP exhibited a broad decline this week (Jan 8), it appears that the resistance at 200 is here to stay for a little while longer. But if you asked the same question a few days ago, the answer would be different, 50-50 would be my guess. What caused this sudden downshift in GBP’s trend?

The macro catalyst that spark a sentiment change on GBP is the same factor that cause a market carnage back in 2022: fast-rising UK interest rates. This week, for example, saw the UK 30-year Gilt Yield hitting the highest level in decades. The 10-year Gilt Yield is following suit, trading at 17-year high on Wednesday. When the UK suffered from a rate spike in 2022, Sterling weakened sharply. As that episode is still raw in everyone’s memory, investors are frantically scaling back GBP exposure in case the situation gets worse. If a cat sits on a hot stove, observed Mark Twain, that cat wouldn’t sit on a hot stove again. Investors learned.

GBPJPY’s near-term support is noted at 188.0.

Is it a good time to buy Japanese Yen in pounds?

Sterling has weakened against the Japanese Yen this week as prices declined from the 200 mark.

Should we, then, buy Yen now before GBP weakens further?

If you do need the Yen in the near future, selling GBPs for some Japanese Yen may not be a bad idea since the rate is still sitting at the upper half of its trading range. Of course, you may wait further to see if the exchange rate breaks north of 200. But this strategy is only applicable if you can afford to wait in buying the Yen.

Will the pound get stronger against the JPY in 2025?

For years, the Japanese Yen has been providing the funding leg of the famous ‘Yen Carry Trade‘. Low interest rate in that country makes it the ideal capital source. And despite two hikes in 2024, the Japanese policy rate is still at a remarkable 0.25 percent!

Will anything change this year?

Interest rates are going up fast in the US and UK. This means the bond bear market is reasserting itself in an emphatic way. This makes the Yen Carry even more attractive since the rates differential between US-Japan are widening.

The real issue is whether Japanese interest rates may start going up, too. In the last Bank of Japan monetary meeting (Dec 2024), the bank did not spell out any plan to raise interest rates further. This is why USDJPY rose from 151 to 158 over the past month. Traders took that meeting as the financial green light to short more Yen.

As you can see below, this rate, unlike GBPJPY, is trading at multi-week highs. It looks like USDJPY is reasserting the long-term uptrend (USD stronger) with the near-term objective of taking out the 2024 highs at 162 (see below).

The weak Yen is also a factor propelling the Japanese stock market to new all-time highs. Mind you, it took the Nikkei 225 Index only a quarter of a century to surpass the 1989 highs! (see below) The stock index ended 2024 near the top of its bull run.

Thus, it is worth reminding ourselves that big macro trends tend to last. With the Japanese inflation rates and interest rate outlook staying dovish, JPY may remain in a weak state in the foreseeable future.

Of course, JPY will not stay weak all the time. Occasionally, it will exhibit burst of extreme strength (like last July-August) when traders scramble to unwind part of the Yen carry trade.

If GBP can’t make headway against JPY under these economic circumstances, then it must that GBP is weaker. This means the macro conditions are not favourable to GBP in early weeks of 2025.

This may change, of course. But until Sterling borrowing costs stop ascending, investors would refrain from taking a favourable position on GBP assets. A more neutral pattern in GBPJPY over the near term.

What is the GBPJPY forecast in weeks, months, and years?

The major pullback in GBPJPY last year (August 2024), where it slumped by 26 points, ended the smooth multi-quarter uptrend. Since then, the rate has not been the same. Prices bounced up and down vigorously, but along a horizontal band.

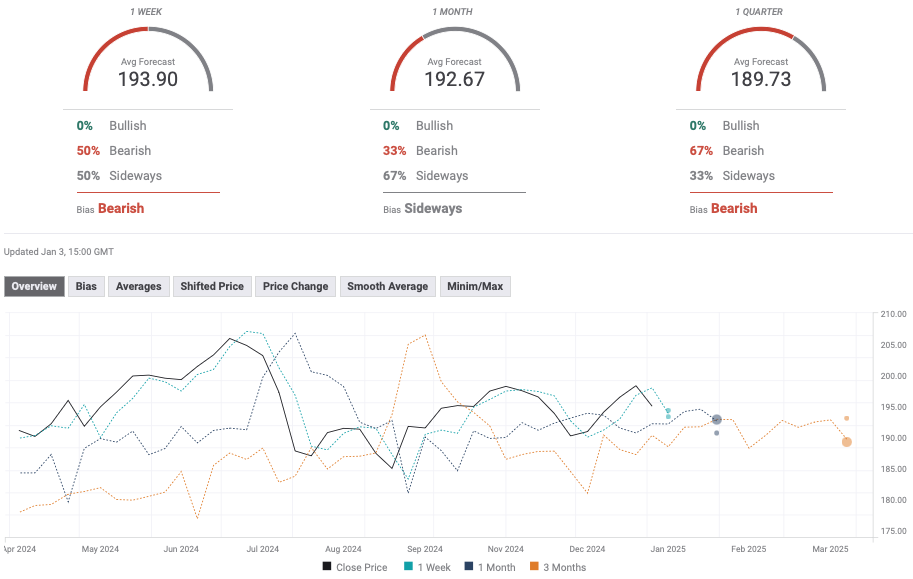

As such, analysts are not sure if GBPJPY can resume the consistent uptrend any time soon. With the resistance at 200 intact, a few brokers are penciling a gradual decline down to 190s again (see below).

But I suspect these are not high-conviction calls since the Yen remains weak and vulnerable to a further decline.

Source: fxstreet.com (Jan 2025)

Where is the best place for buying large amounts of Japanese Yen from Pounds

There are two different ways people buy JPY from Pounds

- Through a currency broker like Currencies Direct, OFX or Global Reach– when transferring money abroad.

- Through a forex broker like CMC Markets, City Index or IG – when speculating on the price of a currency.

You can use our comparison table of currency brokers to see how many currencies they offer, what the minimum JPY transfer is and if they offer forwards and currency options as well as when they were established. You can either visit each currency broker individually or use our currency quote comparison tool to request multiple exchange rates.

Or, if you are more interested in trading GBPJPY, you can compare forex brokers here.

What is the live GBPJPY exchange rate?

The current GBPJPY exchange rate is 210.05 which is a change of -0.82% from the previous days closing price. Over a week GBPJPY is -0.82%, compared to it’s change over a month of -0.49% and one year of 11.29%.

GBPJPY exchange rate data is updated every 15 minutes.

Other Forecasts:

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.