Macro winds are blowing cold

Is the market fretting about an economic slowdown?

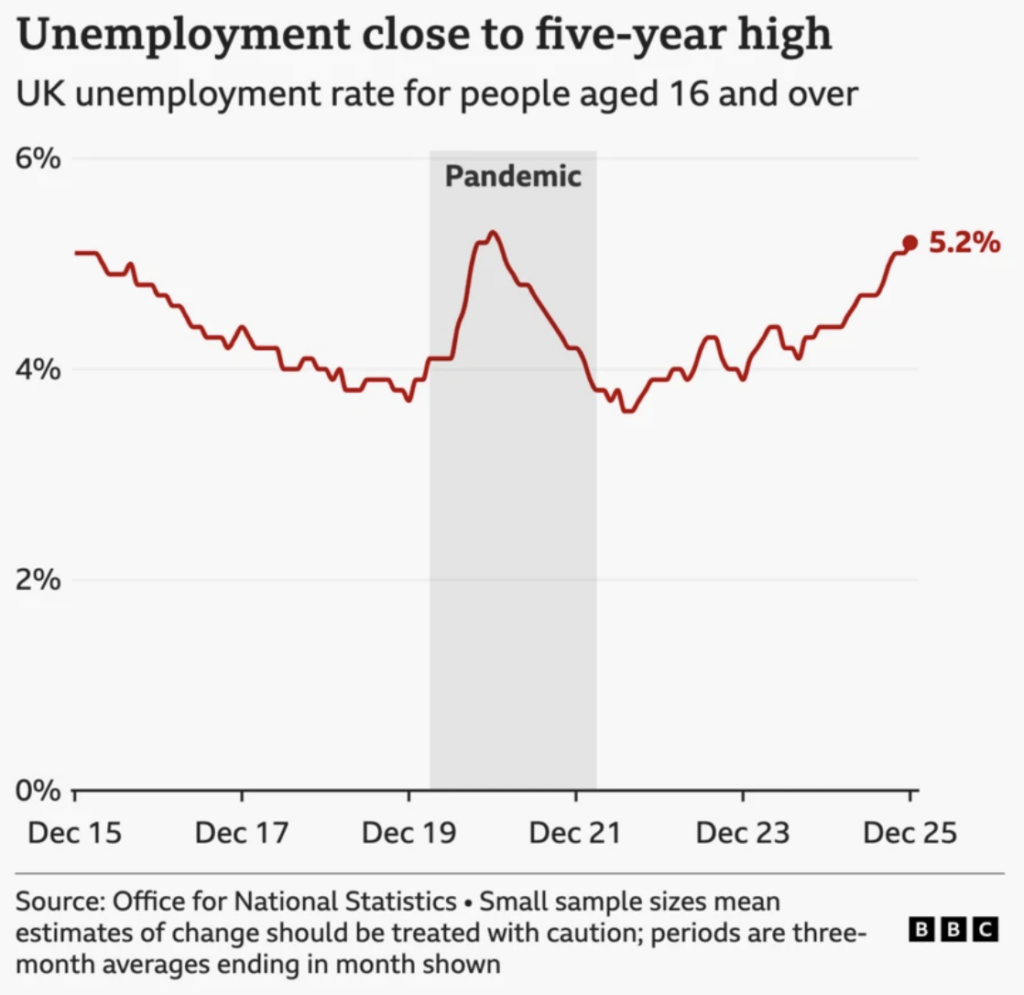

This week, the closely-watched UK unemployment rate rose to 5.2 percent, the highest level in 60 months. Wage growth is also slowing.

Source: BBC (Feb 2026)

In America, however, non-farm payrolls added 130k jobs in January, far surpassing market expectations. Still, many are voicing caution about this unexpected data jump.

Mohamed El-Erian, chief economic advisor at Allianz, cautioned about this in the Financial Times (entitled: “This time really could be different on jobs“, 16-Feb-2026, paywall)

Don’t be fooled. Last week’s better than expected US jobs report is likely to prove a head fake when assessing the divergence in the US between a cooling labour market and the country’s strong GDP growth.

And remember, many large corporations are cutting thousands of jobs.

UPS, the international delivery firm, will cut 30,000 jobs this year. Amazon confirmed a 16,000 job cut last month. Artificial Intelligence (AI) is now becoming the go-to excuse to trim labour costs (so-called ‘AI Washing’).

Tech layoffs year-to-date already exceeding 30,000. Some estimates suggest that the total layoffs from the sector will reach a quarter of a million by the end of 2026.

Another bearish employment point comes from the stock market itself.

History suggests that a steep decline in the share prices of Adobe, Salesforce, Netflix, etc. would have profound real-world consequences, albeit with a delay. First, share prices tank, then profits slip under expectations. As headline revenue slows, the urgent need to pivot to other fields may result in significantly lower labour count.

In other words, a surge in joblessness may hit statistical tables in the months ahead.

Investors turning to defensive assets

Perhaps spooked by this worrying macro trend, investors have been rotating into defensive assets in recent weeks.

First, notice the still-$5,000 gold price. It seems gold investors are undeterred by this price level and are ‘buying the dips’ here. And while silver has declined sharply from its recent highs, it continues to trade at 150 percent above its 2025 levels.

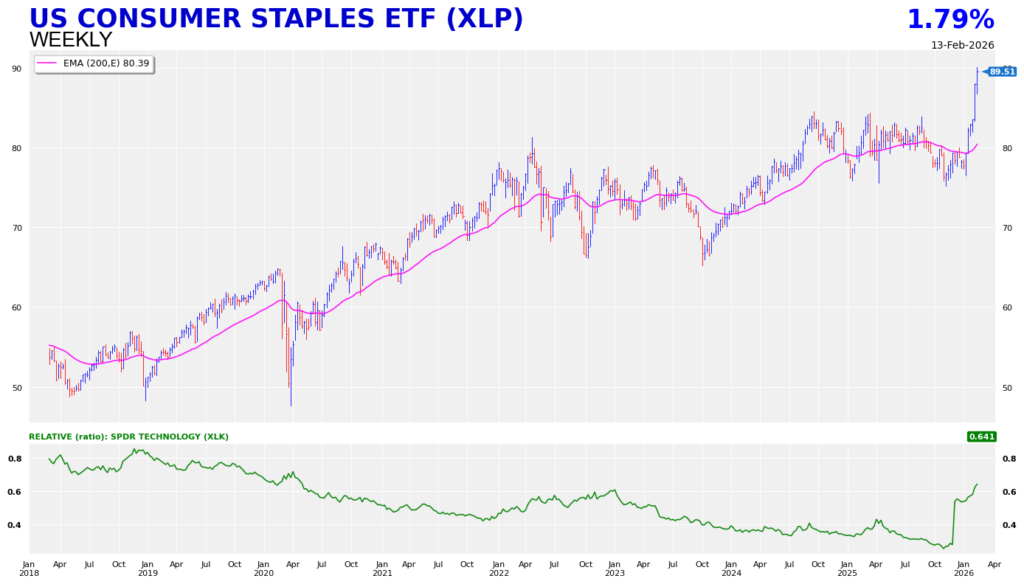

Next, look at the sudden out-performance of the Consumer Staples ETF (XLP) versus the Technology fund (XLK).

The former broke out to new all-time highs recently, while the latter traded sideways. This led to the soaring relative ratio in favour of the Staples industry (the ratio is obtained by dividing XLP against XLK).

Furthermore, even utility stocks have been appreciating sharply. Have a quick glance at the recent performance of the US Utility ETF (XLU).

The latest bounce is pushing the ETF to the cusp of a bullish breakout. Level aside, the sector is rising at the fastest rate in years (strong momentum).

UK utility stocks, too, are exhibiting strong upward momentum, as I have indicated last week on Invesdaq.com.

Lastly, the price trend in US treasuries is offering a glimpse of this defensive trade. Market prices of the long-maturity Treasuries (ticker:TLT) have rebounded in recent days despite the 130k non-farm payroll data.

Treasuries’ bullish reaction to the release of new labour data suggests more near-term upside here.

Are investors preparing for a mid-year slowdown?

Market bulls, however, would point out that many global equity indices are trading at elevated levels. This suggests that the cyclical equity bull market is continuing apace.

Didn’t the Dow Jones Industrials recently touch the magnificent 50,000 level? Is this not enough to validate the bulls’ thesis?

Indeed. Equity indices at all-time highs are always encouraging.

But that’s not to say market risks have been eliminated completely. There are always ‘stealth trends’ developing under the headline market index. The collapse of the software industry is one; the rotation into defensive assets another.

Even those red-hot cyclical industries are pausing their rallies.

As an example, have a look at copper’s price chart (based on LME) below. Last year, I flagged the bullish momentum on the metal (aka ‘Dr Copper’) as prices broke the 11,000 resistance to the upside. Now, it appears copper’s bullish price momentum is slowing. The spike to 14,000 suggests the potential of a retracement back to 12,000.

And the fact that BHP – one of the largest miners in the world – failed to rally after reporting strong results this week tells you that much of the good corporate numbers are already priced in. Antofagasta (ANTO), the £36-billion copper miner, dropped 6 percent along with BHP’s results. When cyclical sectors like mining start to reverse their uptrends, it seems that risk sentiment may be receding.

Therefore, I’d be wary of chasing the equity uptrend aggressively at this point. It appears that the macro current is becoming more complicated, and the risk for stocks is that they no longer offer a low-risk, one-way bet.

The rotation into defensive assets happens because the market is expecting potential market turbulence ahead.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years of industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously, Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored over 200 guides for GoodMoneyGuide.com.

To contact Jackson, please see his Invesdaq profile.