Buying gilts has become more popular among investors as the economy and interest rates have seen increased volatility. In this guide, we explain how to buy Government Gilts, what they are, where to buy them and the potential risks and rewards of buying “gilt-edge” government bonds.

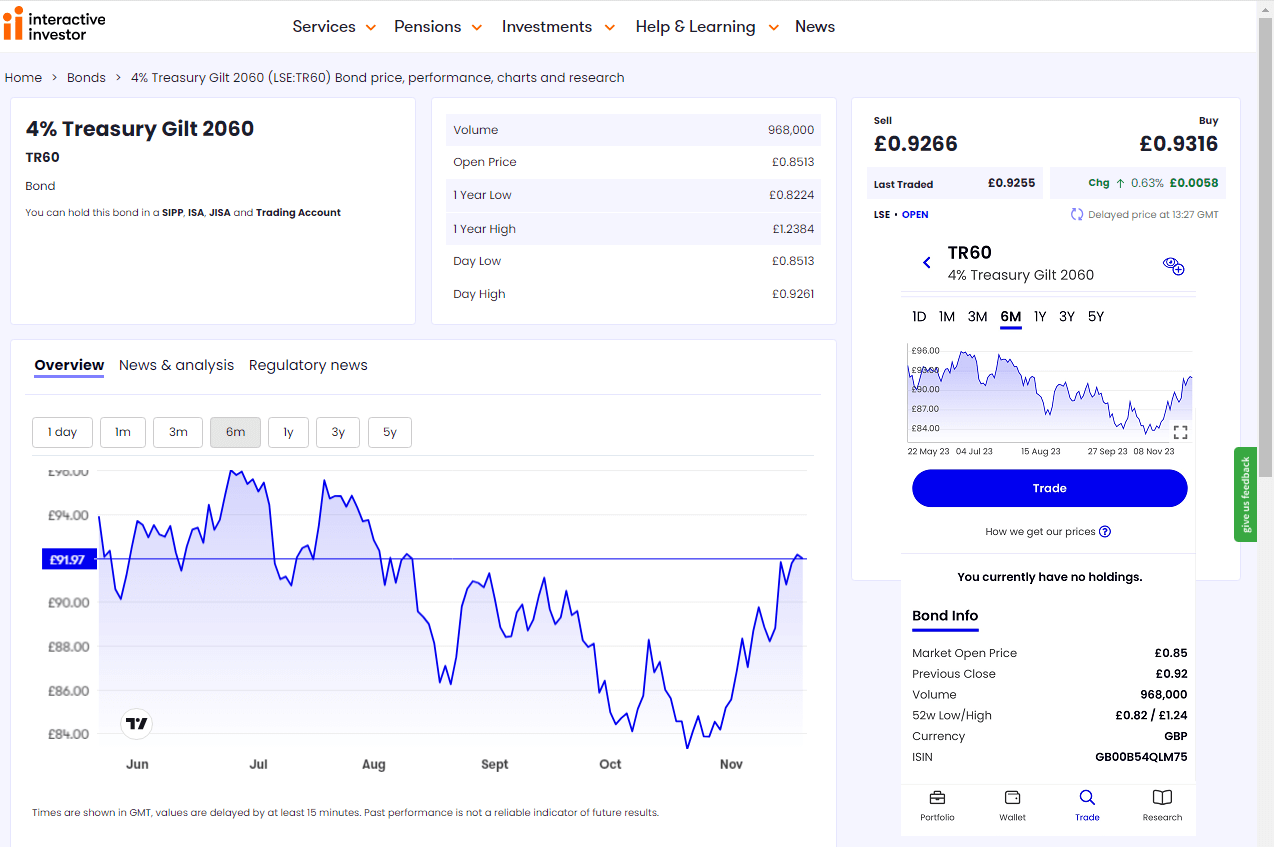

Interactive Investor: Fixed Fee Gilt Investing

- Gilt dealing commission: £7.99

- Gilt account fee: £4.99 a month.

Interactive Investor charges a low flat monthly fee for all their investing accounts.

Interactive Investor’s website will also show you a small list of gilts available to trade on the platform.

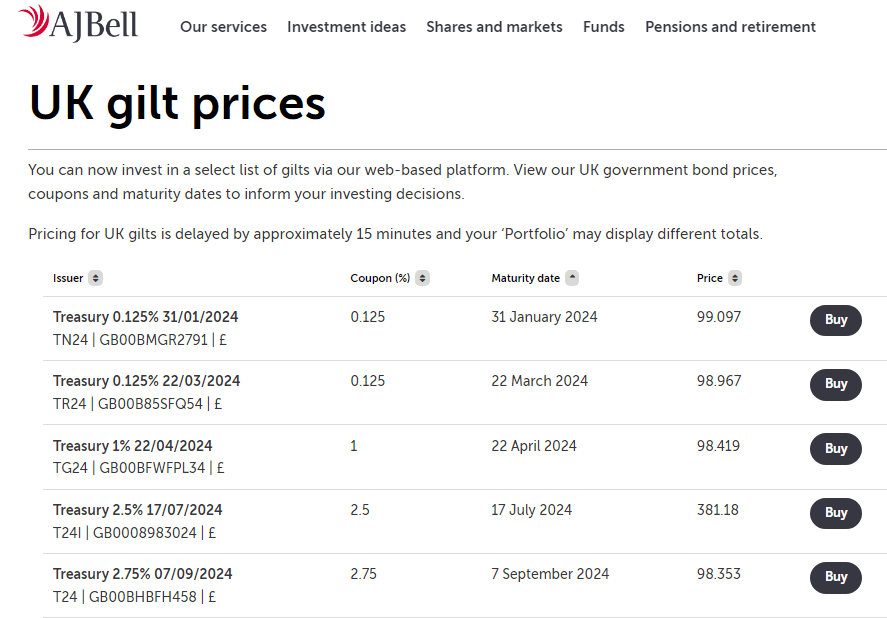

AJ Bell: Best Platform For Low-Cost DIY Gilt Investing

- Gilt dealing commission: £9.95

- Gilt account fee: 0.25%.

Capital at risk

AJ Bell is a well-established low-cost investment platform for buying Gilts.

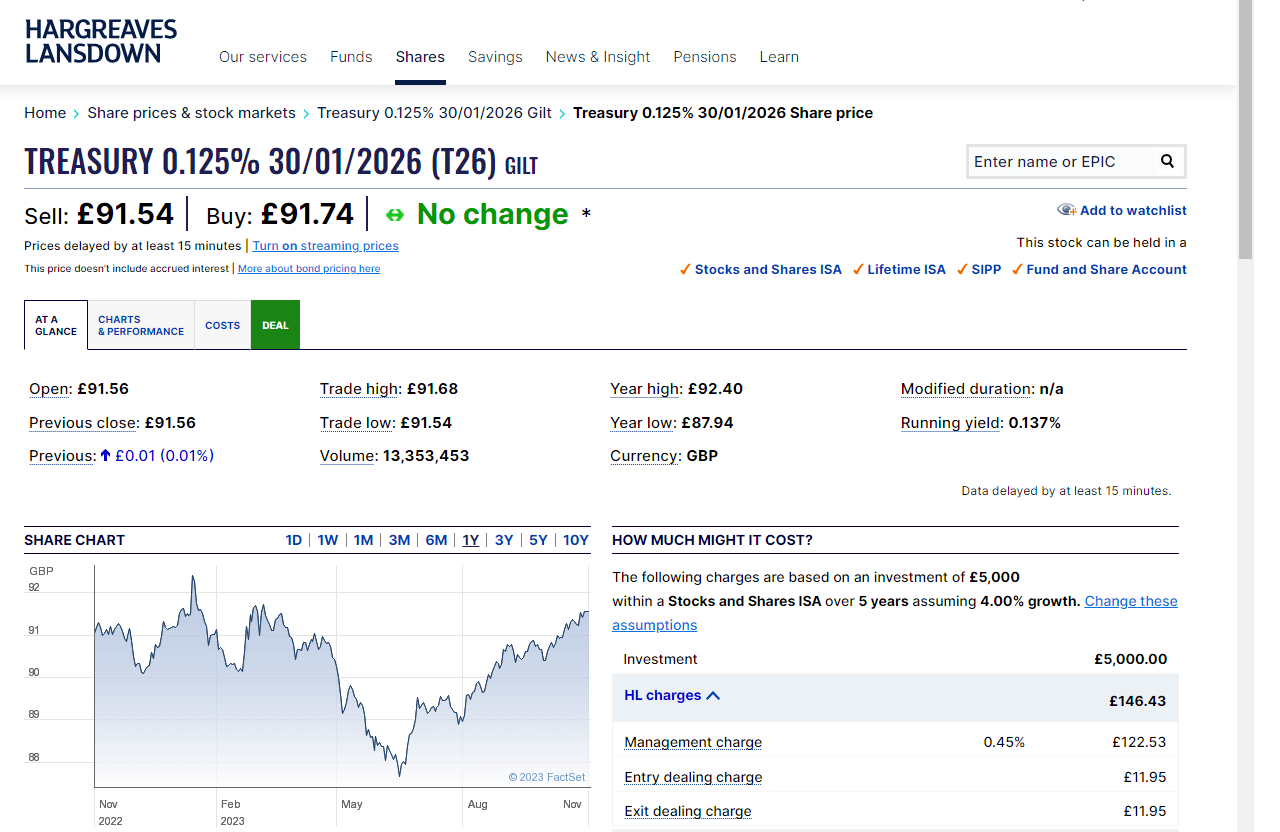

Hargreaves Lansdown: Excellent Added Value Investment Platform For Gilts

- Gilt dealing commission: £11.95

- Gilt account fees are 0.45%

Capital at risk

Hargreaves Lansdown has an excellent free-to-view market data portal where you can view bond and gilt prices.

How To Buy UK Government Gilts

You can buy UK Government bonds either directly from the DMO or through various bond brokers (see here for US ones) and investment platforms.

The process for buying gilts is:

- Search for a Gilt that fits your investment criteria and look up the symbol for that instrument (for example TR60 for the 4% Treasury Gilt 2060) .

- Be careful to note the coupon payment (normally in percentage), maturity date, and current prices.

- The price you purchase will determine your overall return. Gilts are issued at £1, but go up and down based on the Bank of England interest rates and how risky they are considered.

- Gilts are redeemed by the Treasury at £100 (known as “par”). Gilt investors make money via a combination of coupons and capital gains at maturity.

Alternative ways to buy Gilts:

If you are only interested in speculating on the price of gilts, then Saxo or IBKR offer Gilt derivatives.

- Saxo – Saxo is for advanced and professional investing. Bond dealing commission: 0.2% to 0.05%. You can only trade Gilt, futures or ETFs on Saxo Trader GO.

- Interactive Brokers – You can’t trade individual UK gilts on the IBKR portal, but you can buy Gilt ETFs, which give you access to a range of Gilts.

Alternatively, you can also buy and sell leveraged gilt funds. For example, the Wisdomtree Leverage 3x 10-year Gilt ETF (3GIL) is a high-octane vehicle for traders. The fund moves three times the daily movement of the Long Gilt Rolling Future Index. For obvious reasons, this ETF is not really suitable for every trader, especially investors with conservative financial objectives.

Important factors to consider when buying gilts

When we talk about buying government bonds like gilts, we focus on a few important factors, like:

- Current yields – how much is the bond offering investors now?

- Maturity – how many more years do the debt instrument last?

- Credit ratings of the borrowing entity – is the organisation financially viable?

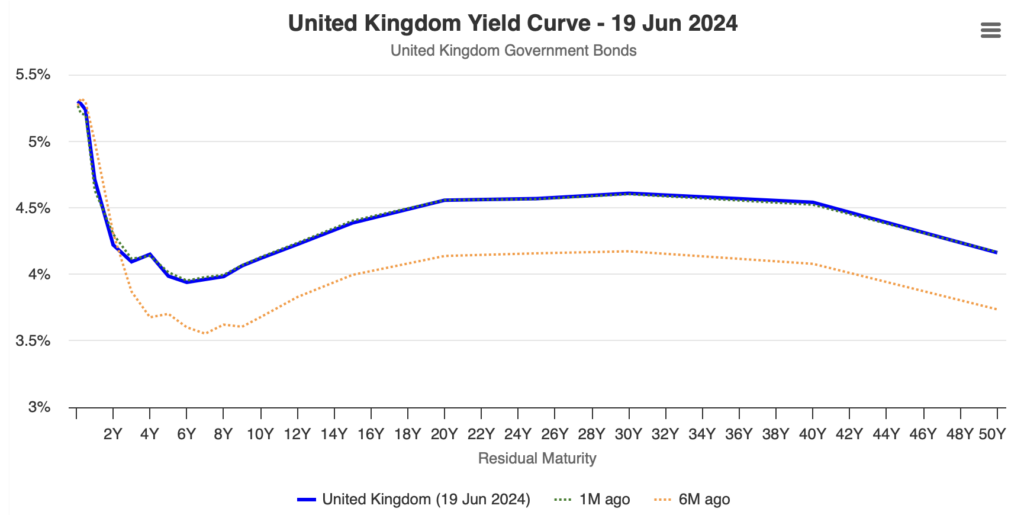

As you can see above, gilts of different maturities offer different yields.

Assuming the credit rating of the UK government remains strong for the time being (AA-stable by Standard & Poor’s in 2023), the two important factors are yield and maturity. How long do you intend to hold the debt for? Is the yield compensating investors sufficiently for the risk?

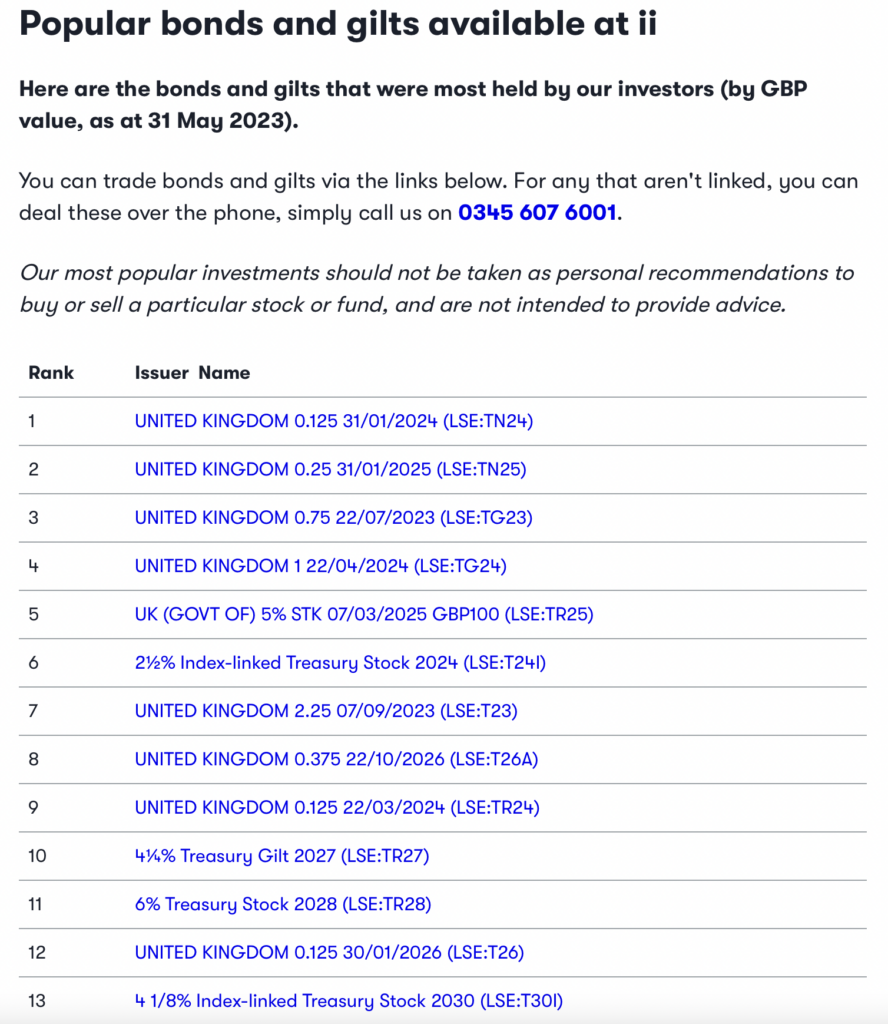

Recent data from bond brokers like Interactive Investor show that investors are picking up the near-term gilts (those maturing within 24 months). Yields are high; holding period short. A good parking place for surplus capital.

More crucially, during these hectic days there are two additional factors to consider:

- Trend of rates – Will interest rates start dropping in the coming months? If yes, it tends to buoy gilt prices.

- Real interest rates – Will nominal rates compensate investors enough for the inflation?

In 2023, gilts weren’t yield high enough (inflation at 8%, yield at 5%). Now, inflation has fallen to about 2-3 percent (2% in May 2024). So UK’s real interest rate has started to move into positive territory. When this happens, gilts prices tend to move up, or at the minimum, stop going down.

Gilt ETFs for your portfolio

Average investors need to diversify. In doing so, it reduces the overall portfolio risk. Asset diversification balances the risk.

With near-term gilt yields (3-6 months) now floating above 5 percent, interest in the sector is high. However, instead of buying individual gilts, a portfolio of gilts may be more appropriate for some investors.

For example, the iShares 0-5 year Gilt (IGLS) is an exchange-traded fund (ETF) that holds a portfolio of gilts with maturities ranging from 0 to five years. According to its factsheet, more than two-fifth of IGLS’s £3.1 billion gilt portfolio matures within 24 months. A bond ETF, like many equity ETFs, may track a bond index. Here IGLS tracks the “FTSE UK Conventional Gilts – Up To 5 Years Index“.

From a high of 135, the ETF plunged to 122 due to the surging interest rates before staging a recovery rally. Recent price action is modestly bullish as interest rates are expected to fall. Right now, the ETF’s yield-to-maturity fetches about 4.5 percent.

Another ETF that may interest readers is the iShares Gilt ETF (IGLT). This £2.5 billion bond fund (factsheet here) follows the “FTSE Actuaries UK Conventional Gilts All Stocks Index (link)”.

There is another sector that may be worth a look – index linked gilts. These bonds are linked to the price index Retail Price Index (PRI). Coupons and principal of the bonds are adjusted according to a set formula using the RPI index. These adjustments help to offset the erosion of buying power of capital. You can find out more about index linked gilts from the Debt Management Office (DMO).

There is a bond ETF that holds just indexed linked gilts. This is the £689 million iShares index-linked Gilt ETF (INXG, factsheet here). Due to the long-maturity of its gilt holdings (one-third in 20+ year maturity), the bond fund is particularly volatile. In 2022, the ETF’s total return was a shocking -34 percent. In the US, the equivalent is the TIPS Bond ETF (TIP).

How do government gilts work?

Gilts are government bonds, which is a financial instrument with a promise – a promise to pay certain sums periodically (‘interest’) and the original capital in the future. In this case, the debtor is the UK government.

It works like this. The UK government borrows money from the market to spend; it then raises revenue from the economy via taxes; and uses the tax revenue to repay interest and capital to the creditors.

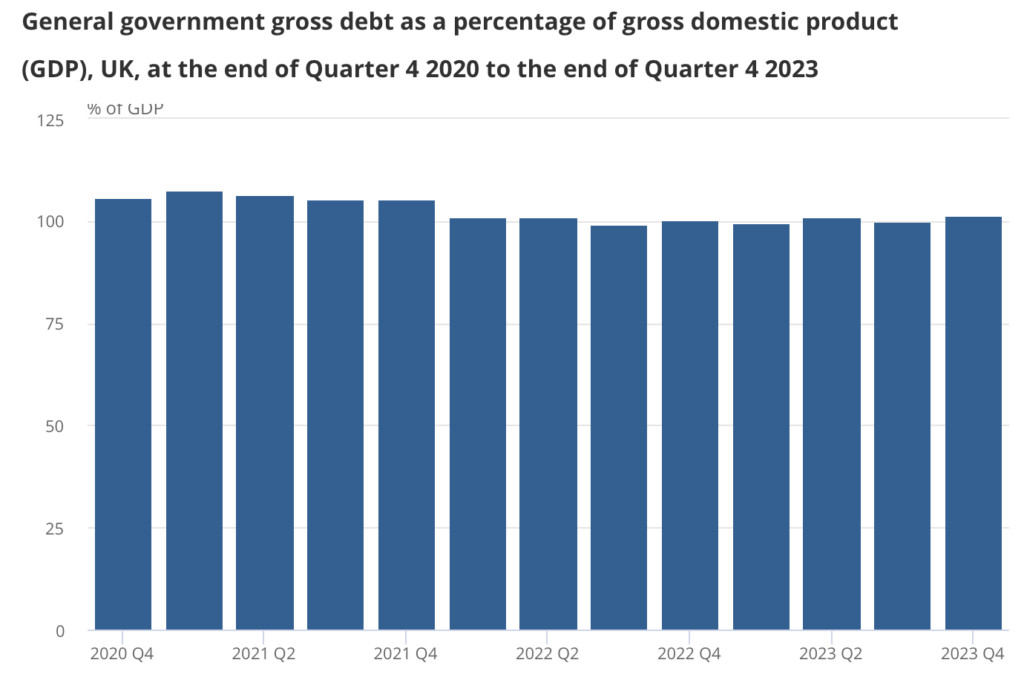

Sometimes, the government will use new borrowings to retire old borrowings when it is cheaper to do so. The most recent statistics (April 2024) show the total UK debt borrowings at the end of 2023 to be £2.7 trillion. As a percentage of UK’s GDP, this ratio is about 101 percent (see below). Fiscally-prudent investors will think this is too high. Germany, they point out, has the debt-to-GDP ratio of about 64 percent. But as long as the market thinks the UK government has the ability to re-finance these debt instruments, there is no reason to panic now.

Source: ONS (Apr 2024)

How safe are government gilts?

Not all sovereign debtors are equal. What differentiates sovereign bonds are the rate of interest, collateral, duration, sums to borrow, and the credibility of borrowers.

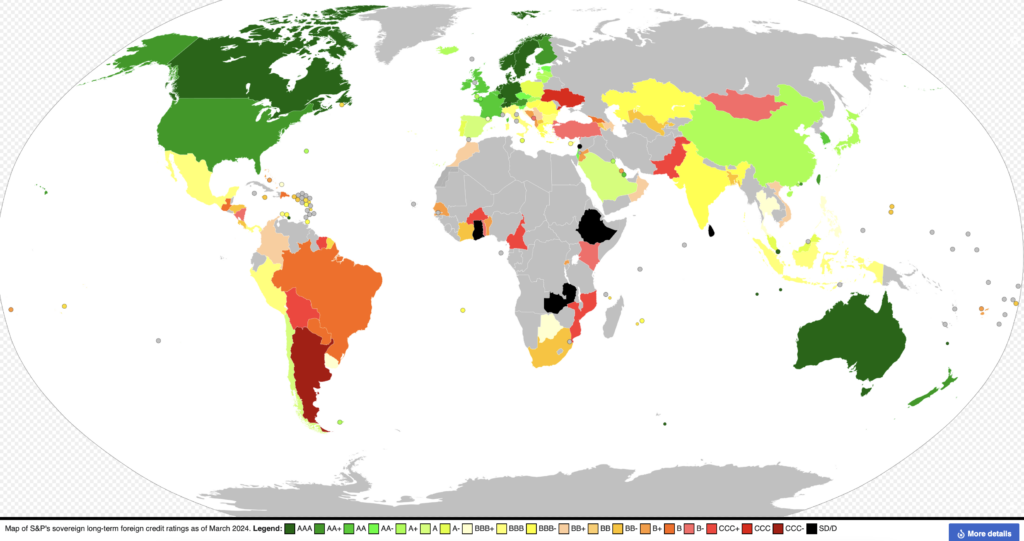

Creditors certainly want to borrow from sovereign governments that can repay. This ability to repay is measured crudely by sovereign credit ratings. Third-party professional firms called rating agencies (Standard & Poor’s, Fitch, and Moody’s) assigned these ratings to nearly all governments that issue bonds. The UK has enjoyed good ratings in recent years. The chart below compares the S&P sovereign ratings across the world. The UK is currently double A investment grade (2023)

Source: S&P/Wikipedia (March 2024)

What is the relationship between gilt yields and price?

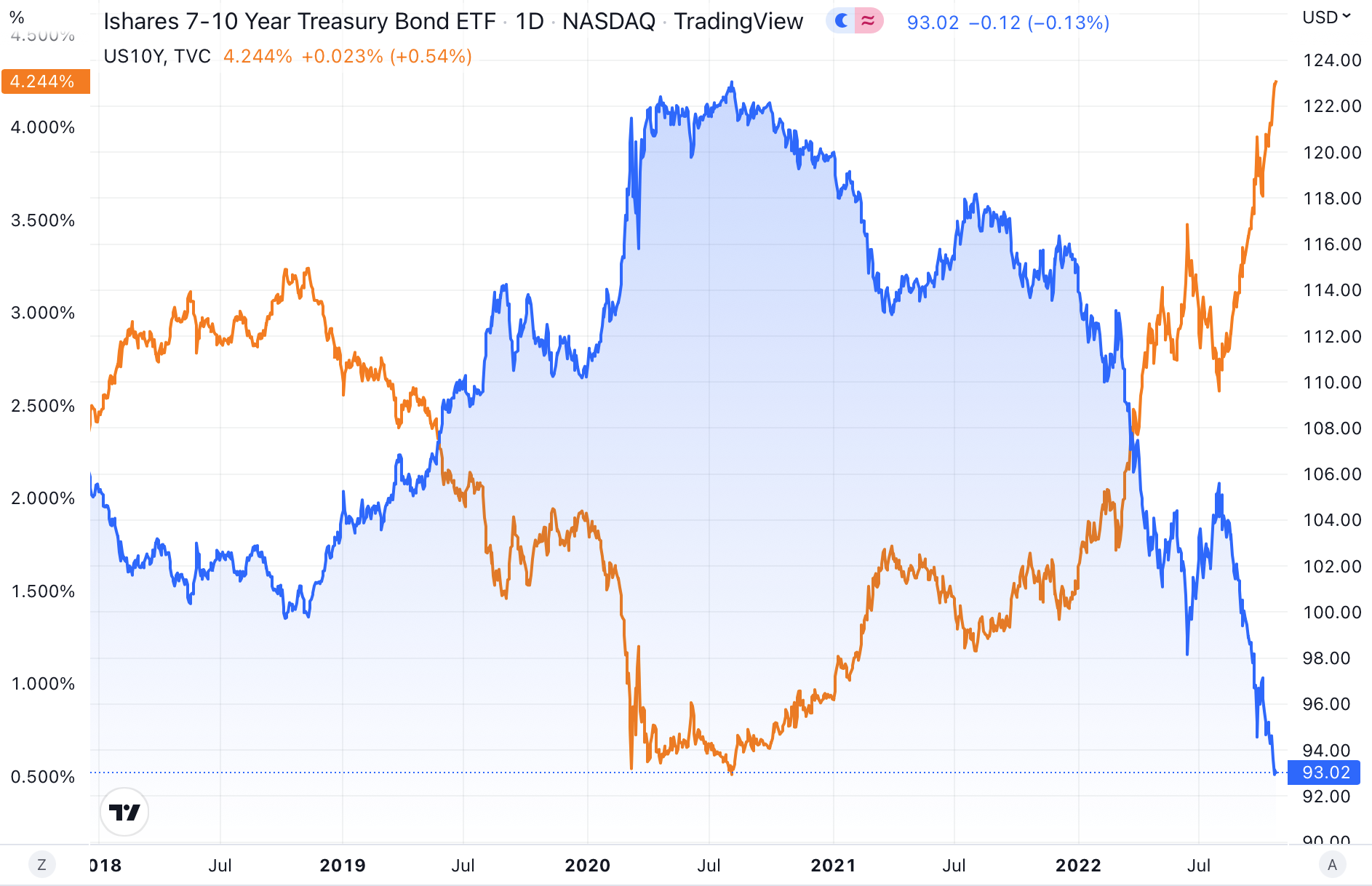

The relationship between bond yield and price is simple: They move in the opposite direction. Look at the chart below. Here I use a US bond ETF (IEF) as an example.

As US bond prices dropped (blue line), the 10-year bond yield rose (orange line). In other words, the higher the bond yield, the lower the price.

Generally speaking, shorter-maturity government bond yields (maturities of less than two years) track the central bank policy rate closely.

This means that as central bank raises the policy rate, these 0-2 year yields rise too. Longer maturity bonds, however, may not track the policy rate that closely for a variety of reasons, including inflation expectations.

- Further reading: You can read more about how bonds work here in our bond guide.

Are UK Government Bonds (Gilts) a Good Investment?

- Near-term gilts yielding in excess of 5%

- Higher-than-expected gilts yield attracting investor interest

- Falling inflation rates may boost bond prices further

The best savings accounts now offer decent interest rates, but people cannot be blamed for wanting to take on a little more risk in the hopes of better returns and buy gilts.

However, whereas savings accounts are generally safe (although there is never a 100% guarantee other than the FSCS protection) there is a big difference between a savings account and investing in bonds.

Unlike savings accounts, the price of a bond can go down as well as up, so it is possible that you will get less than what you put into the investment.

Inflation peaked and hit target (2024): Is now a good time to buy UK Government Gilts?

UK government gilts are issued by the UK Government to finance public spending and are therefore relatively safe, generally rated AA by the major credit agencies.

(For more information about UK Government Gilts and how they compare to other types of bond investing read our guide on how to invest in bonds. In it, we cover the pros and cons of most types of bonds as well as have a video discussion about the risks and rewards. Or, for the more ethically minded, take a look at our guide to Green Gilts.)

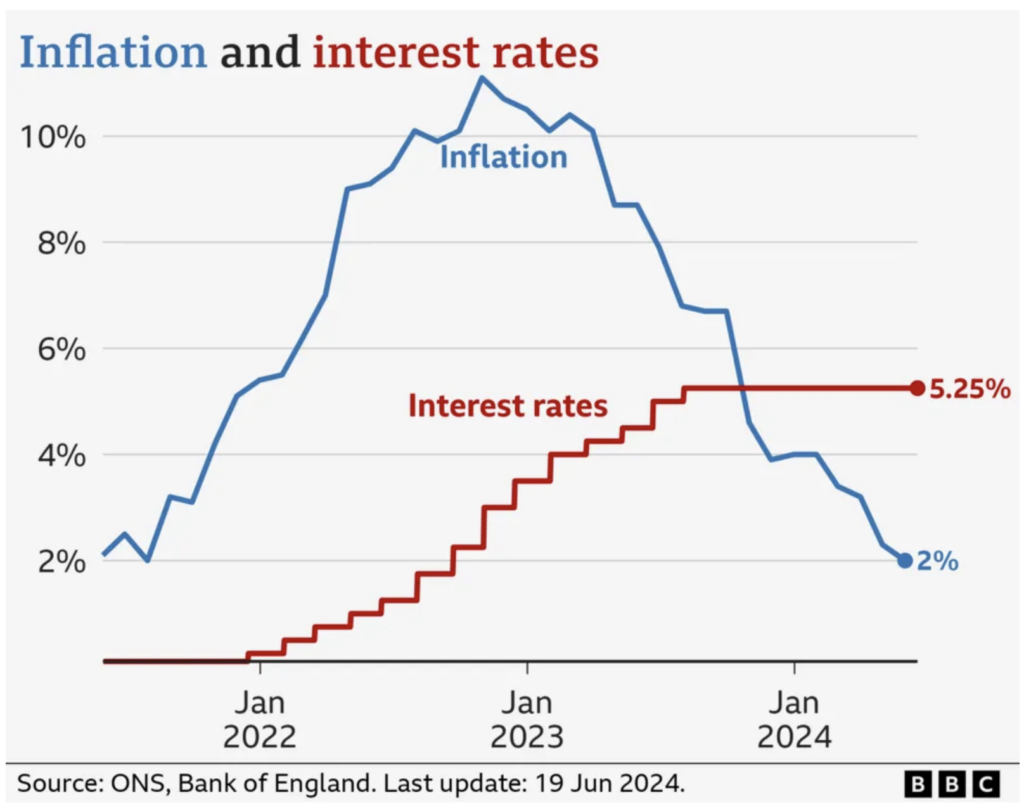

Over the past year or so, inflation rates have been rolling down steadily from the double-digit peaks recorded in 2022/23. By May this year, inflation have dropped to the 2 percent BoE target (see below). This is a major positive macro-economic trend since: a) household spending power are slowly stabilising and b) consumers may be spending again. A virtuous economic cycle may be at hand.

However, this is not a guaranteed economic trend since many are ascertaining if the lower inflation rate is here to stay. Having been stung by higher-than-expected inflation rates, people are naturally cautious. Wait-and-see is the preferred attitude.

As inflation rate slows to a crawl, is now a good time to buy gilts?

Source: ONS/BBC

This strategy is now ringing at the back of many astute investors. The reason is this. If inflation is hitting the 2 percent target, the UK central bank, more likely than not, is able to lower interest rates. This will boost bond prices generally.

The question is how dovish will the British central bank be. Across the the Atlantic, the Fed signals that it will drop the Fed Funds Rate once or twice this year. No more. The Old Lady of Threadneedle Street may move along the same line.

Based on these observations, which segment (or maturity) of gilts should we buy? The near-maturity gilts (3-6 months) may benefit from these cuts. The real kicker, however, are the long-term gilts since these bonds are much more volatile. A quick look at the gilt yield curve (plotting different yields according to the maturity) tells you the current market pricing:

Source: Worldgovernmentbonds.com

The cheapest yield at the moment is the 5-year maturity yield, around the 4 percent mark. In other words, once we move out of the near-term gilts, yields start to drop sharply. This is because the market is anticipating a fall in interest rates in the next couple of years. But as we move out of the 7-year maturity, yields start to pick up again.

This ‘inverted’ yield curve tells us the the short-term rates may be too restrictive and there are room for it to fall.

However, short-term gilts have rallied a fair bit since the end of 2023 because investors raced to price in the possibility of rate cuts. Right now, you can still buy near-term gilts at 5 percent. But these instruments mature fast. Once redeemed, you’ll then have to re-deploy capital at lower yields.

As such, I prefer to stick to a portfolio of gilts (like iShares 0-5 year Gilts ETF, ticker: IGLS). It currently yields around 4.5 percent and you can always buy more when prices correct in the future.

Compare Brokers & Platforms For Buying Gilts

| Gilt Broker | Bonds Available | Gilt Dealing Commission | Gilt Account Fee | Our Rating | More Info |

|---|---|---|---|---|---|

| 10,000+ | £11.95 (or £5.95 if more than 20 deals done in previous month) | 0.45% capped at £45 per annum | See Bonds Capital at Risk |

|

| 10,000+ | £7.99 or £3.99 for “Super Investors” | £4.99 a month | See Bonds Capital at Risk |

|

| 5,000+ | £9.95 (or £4.95, if you do 10 or more online deals in the previous month) | 0.25% capped at £3.50 per month | See Bonds Capital at Risk |

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.