Another good day for Plus500 shareholders as UK broker Cavendish rate the stock a buy, following upgraded guidance from the business. Which pointed to increasing revenues from its non-OTC activities. Which Plus500 called ” a key growth driver”. And which is said was “supported by positive momentum across global financial markets, as well as with strong operational results including launching prediction markets products for B2C customers and completing the acquisition of Mehta Equities in India.”

Cavendish maybe buyers of the stock but their price target is well below the current price. at £43.45 versus the £47.78 they are printing at as I type.

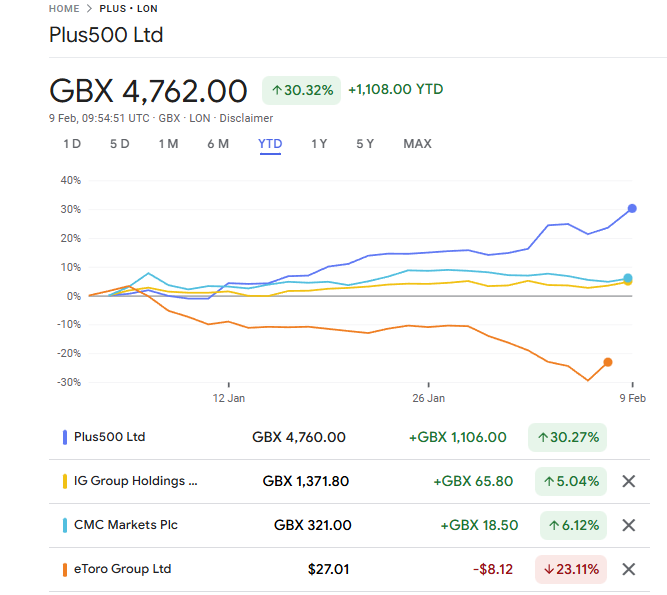

And with the stock up +30.0% year to date and plenty of volatility in the markets I fancy that the Cavendish target will prove to be too low.

The chart below shows Plus500 versus the IG Group, CMC Markets and eToro share prices. YTD.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please see his Invesdaq profile.