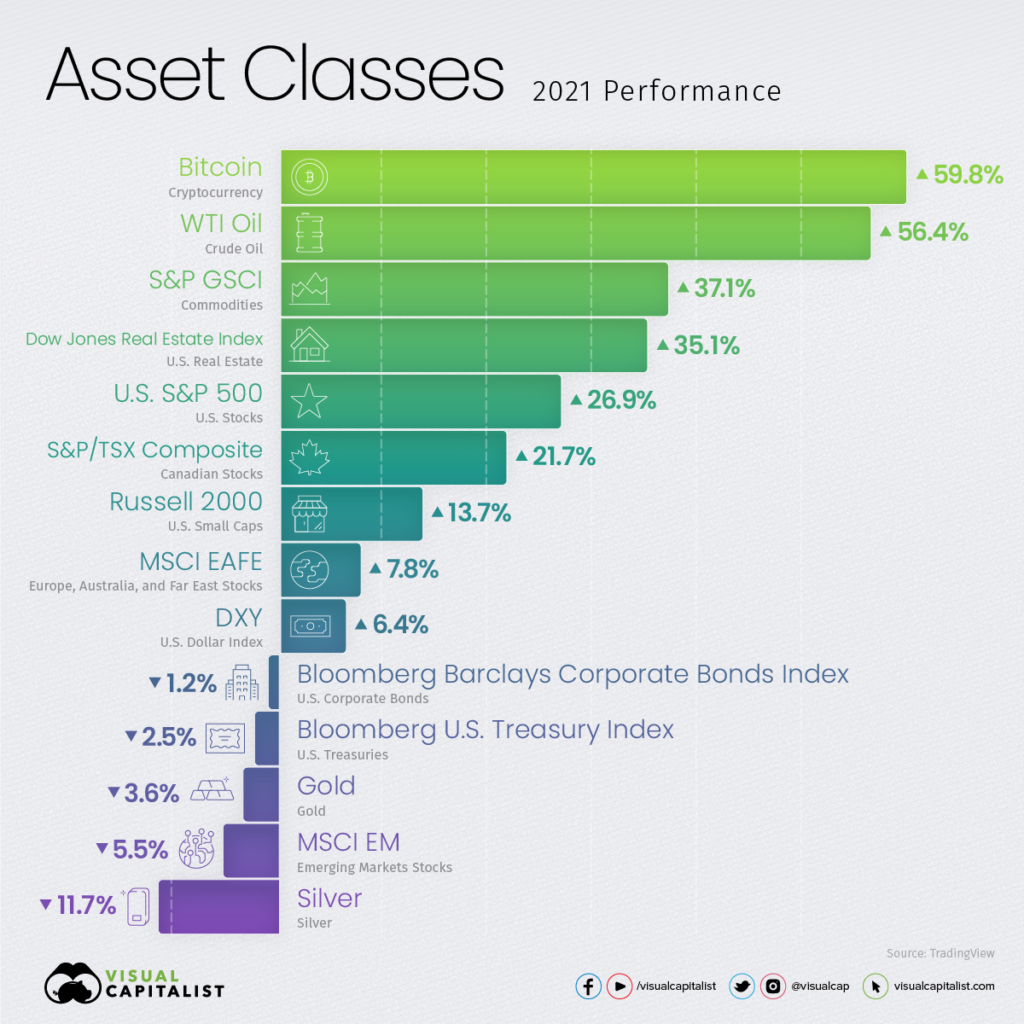

2021 was a fantastic year for many investors. Many ‘stonks’ rose to dizzying heights; while shareholders of big tech stocks made a bundle. The leader of the pack was, the ultimate risk asset: Bitcoin. Visual Capitalist has compiled an excellent summary of returns for 2021. All this, however, is now history. What lies ahead is far more treacherous.

Below are six of my predictions for the coming months…

Source: visualcapitalist.com

A quick review of my 2021 predictions

Before we read out the predictions for 2022, let’s take a step back and see how our 2021 predictions fared. You can my full analysis and 2021 predictions here.

1 . Pandemic to end by June – No. Conditions were gradually normalising before Omicron reversed the re-openings.

2. Bond prices to fall – Yes and no. Prices did slump in Q1, but they recovered in the second half.

3. Tesla to correct by 40% – Yes and no. Prices rose sharply higher before they slumped 38% from $900 to $550. The stock then rallied to new highs into the last quarter.

4. Bitcoin mania – Yes. One Bitcoin fetched $69,000 recently, up from the pandemic low of $4,000.

5. Uranium stocks to double – Yes. Uranium prices rose by nearly 50% last year. As a result, many uranium stocks doubled.

6. Space stocks to rally – Yes. Although some space stocks started to weaken into the year-end.

Overall, we did get the broad direction of the market right. Many financial instruments have performed far better than our expectations.

Three investing guidelines for 2022

Those great returns in 2021 were highly unusual in the history of financial markets. Seldom do we see a $100 billion stock rise to a $1 trillion company.

A great number of unprofitable stocks rose to unimaginable heights. Large initial public offerings were launched with great fanfare. Wealth – at least on paper and for a limited time – swelled.

However, many of these rallies have retreated considerably.

This begs the question: Are we approaching the last ‘blow off’ phase of the long bull market (2009-)?

We don’t know. Some great fund managers like Cathie Wood are already struggling these days. On the conservative side, we have to assume last year’s returns are ‘one off’. As uncertainties increase, how should we approach the market in 2022?

We draw up three general guidelines:

- Focus on protecting the returns achieved.

- Look to generate decent yields with value stocks and bonds.

- Wait patiently for bargains to emerge. Only take risk when the reward is overwhelming.

Based on these investing parameters we now go to my six market predictions for 2022.

Six market predictions for 2022

1, ‘Stonks’ to deflate

One of the defining hallmarks of a stock mania is a massive spike in share prices unjustified by fundamentals. Last year, we saw plenty of that in GameStop (GME), AMC (AMC), and Avis Budget (CAR), amongst others.

But trends like that are unsustainable in the long term. Conditions that were conducive to such a sharp rally have changed, some drastically so. This often leads to a trend reversal. What conditions are we talking about? Monetary and fiscal, for example:

- An End to QE programs – liquidity injections are removed from the financial market and this will reduce the speculative fever

- Low or no fiscal stimulus – meaning, no more free cheques to households to prop up demand

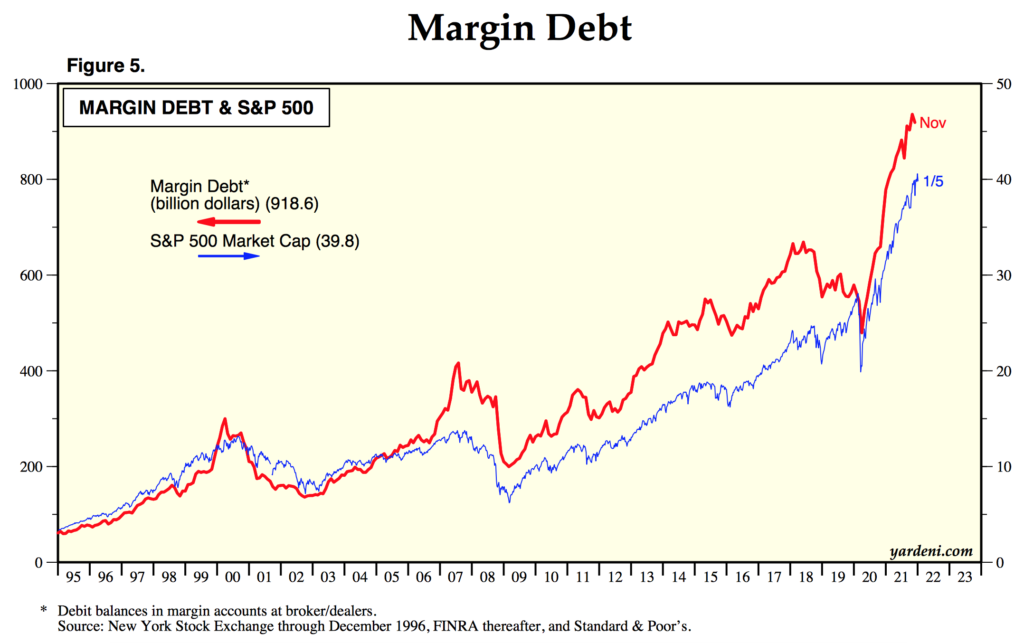

- Higher borrowing cost – due to rising interest rates. This will sap financial resources from the economic system and make servicing debt (particularly the sky-high margin debt) more expensive.

Because of these shifting macro trends, “stonks” will have a hard time repeating last year’s fabulous rally. ‘Meme’ stocks that have made outlandish gains are slowly descending back into their former (lowly) trading ranges.

2, Underperforming IPOs

Last year saw a large number of IPOs that surge initially and then go into a long decline. For example:

- Robinhood (HOOD) jumped from its IPO price to $80. It now trades at $15;

- Coupang (CPNG), the $44 billion South-Korean tech firm, skidded from the $60s all the way to $25;

- Rivian Automotive (RIVN) slumped from $170 to $80, a fall of 50%;

- Coinbase (COIN) touched $400 on its IPO day; it now trades at $235.

Scores of other IPOs have underperformed the market by a wide margin. Look at UiPath (PATH:US), Oatly (OTLY:US), or Gitlab (GTLB:US). The most infamous IPO that crashed was the ‘Chinese Uber’, Didi (DIDI:US), which collapsed from $17 to $4.50.

Now here’s food for thought: If these hotly-anticipated IPOs could not perform when the market was booming, chances of them rising in a choppier market are far slimmer.

Therefore, we would be wary buying newly-listed stocks because the pricing is too rich and the downside risk is high.

IPO related ETFs to watch: Renaissance IPO ETF (IPO:US)

3, A rollercoaster ride awaits Bitcoin

While 2021 was a banner year for the crypto sector, this year we expect crypto prices to be far more volatile.

First, crypto tokens are no longer cheap. One BTC now costs north of $40,000 even after a double-digit correction. Second, the speculative liquidity is receding as QEs fade away. Massive uncertainty looms. Third, many crypto tokens exhibited a classic boom and bust trend last year. As a result, these tokens trapped many buyers (aka ‘bag holders’) who are still waiting for the tokens to ‘go to the moon’.

Many ‘dog coins’ like Doge and Shinu Inu are trading well below their all-time peaks (see below). Metaverse coins (MANA, SAND) had a pump late last year, but these coins are developing the same big-rise-and-fall pattern. These pump and dump prices action will eventually deplete investor capital and causes sentiment to turn against the asset.

Therefore, Bitcoin may be entering into a period of volatile price action. This uncertainty will most likely wash out much of the speculative excess.

But that’s not to say the market will be dead. In fact, the crypto market may even stage a sharp rebound after a period of deep consolidation. Many players are waiting to re-enter the market when the price is low enough. Deep-pocket operators are still projecting optimism on the asset class. Goldman Sachs recently reiterated its $100,000 Bitcoin price target. Remember though, 80% of Bitcoins were never sold.

4, Emerging markets to stutter

History tells us that whenever the US central banks tighten, emerging markets tend to fall. This is due to a tightening of liquidity sloshing in the global financial market, which causes capital to flow from speculative markets back into the safer zones.

Investors are already pre-empting US rate rises by buying the US dollar. Higher dollar value makes emerging markets cheaper – and lowers the value of foreign-currency portfolios.

We already saw the currency and economic crisis in Turkey last year. The inflation in the country surged to 36%! Kazakstan is now mired in a political crisis. We anticipate the higher inflation to hit emerging economies harder than developed economies because the central banks have to increase policy rates much faster. Did you know that the Bank of Russia has raised interest 7 times in 2021?

A wild card this year could be China due to its fragile property market. Evergrande’s default is already setting out a chain of defaults in the sector. In addition, some of the best-known Chinese stocks are down sharply last year. For example, the tech giant Alibaba (BABA) lost 65% of its value in a little over thirteen months. Many other tech stocks are down heavily too due to heightened political uncertainty.

ETFs to monitor include Frontier Markets (FM:US), Emerging Market (EEM:US or VWO:US) and a few country-specific ETFs like Russia (RSX:US), Saudi (KSA:US), and Vietnam (VNM:US).

5, Financials stocks to outperform

Banks and other financial stocks look set to benefit from higher interest rates. Banks can charge higher rates on their loans and the spread between the cost of capital and interest earned will boost earnings.

As developed economies are still opening up, they should be able to weather a couple of interest rate rises. After all, we are still in the early phase of the tightening cycle.

Technically, financial stocks are already in a strong uptrend, as exhibited by the iShares Financials ETF (XLF).

The UK market, which has a large number of banks, may benefit from this trend. Barclays (BARC), Lloyds (LLOYS), Natwest (NWG) and HSBC (HSBA) certainly appear to be weathering the pandemic well. This may even cause the FTSE 100 Index to perform better relative to the growth-oriented US markets.

6, Fading Omicron to boost travel stocks

Omicron is the latest covid-variant to slam major economies. Its astonishingly high transmissibility and has prompted governments to reimpose travel and social restrictions.

But recent studies have revealed that the virus is less deadly than initially feared. A relaxation of the restrictions is on the table once countries pass ‘peak omicron’. Who knows, we may even get to travel in the summer after a long hiatus!

Ergo, there could be a trade to be made in beaten-down travel securities (airlines, cruise, travel operators etc). Watch to buy them on market-wide setbacks.

Stocks to watch: Easyjet (EZJ:UK), British Airways (IAG:UK), Wizz Air (WIZZ:UK), Carnival Cruise (CCL:UK), Airline ETF (JETS:US)

Final Remarks

It has been a remarkable 24 months. Numerous milestones were created on the way up. We saw the first $3 trillion company – Apple (APPL); the fastest asset to reach $1 trillion market cap – Bitcoin; and the first person to be worth more than $300 billion – Elon Musk).

A great number of securities and asset classes ‘mooned’ as central banks pumped oceans of liquidity into the market. But things are certainly changing, and changing fast. Perhaps we are reaching the end of the great post-pandemic speculative boom. Nobody will (or could) tell you if we have reached a bull market peak.

There is one special asset that is undervalued these days: Cash.

If we are entering a volatile period with many downside risks, cash is a good asset to own. Bonds are no longer a good place to hide as interest rates are on the cusp of a cyclical upswing. US stocks, both large and small, contain considerable risks. Even gold and silver are not necessarily a ‘store of value’.

Look at Silver’s chart; ‘toppy’ is the first word that springs to mind.

Cash could give investors plenty of options when prices swing south. Yes, inflation will erode the purchasing power of cash in 2022, but putting them in a falling asset may risk a permanent impairment of risk capital.

To wrap things up, 2022 will tell us if the party has ended. A severe hangover (inflation) is starting to emerge. Many hope there will be another party just down the road. But we doubt it.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.