Can you trade FTSE 100 futures on IG?

No, you cannot trade on-exchange FTSE 100 futures contracts on IG. Many traders searching for FTSE futures on IG are surprised to learn that you can’t trade FTSE futures contracts directly through an IG spread betting or CFD account, especially as they now offer access to futures through TastyTrade.

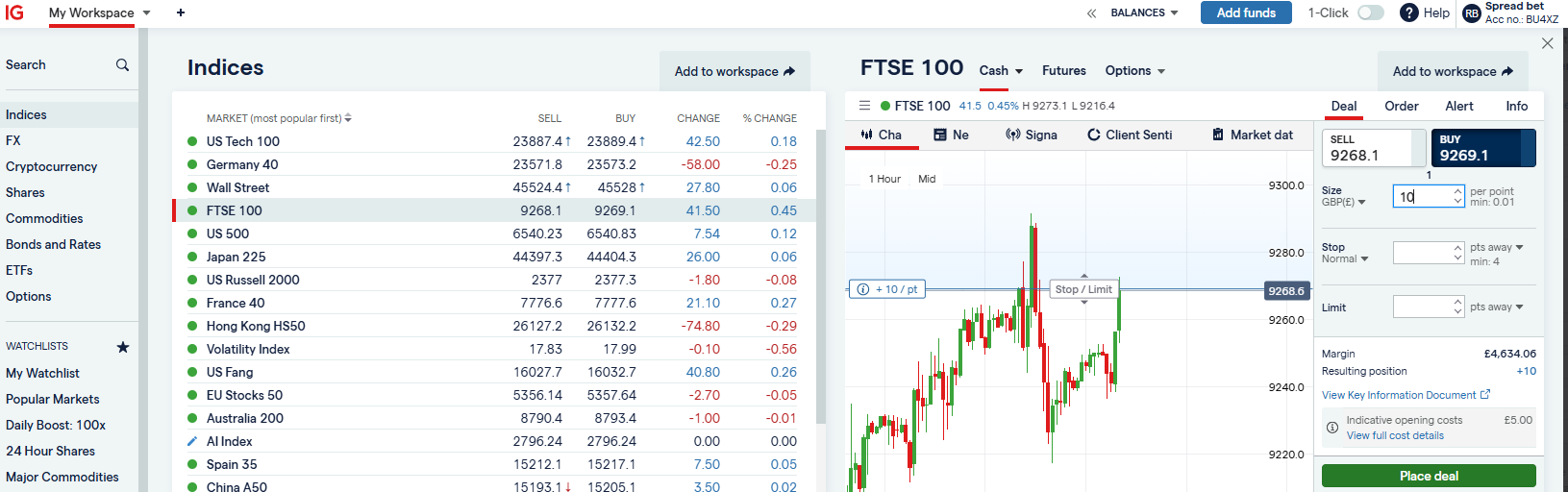

While IG offers pricing derived from the underlying FTSE 100 futures listed on ICE (the Intercontinental Exchange), what you actually trade on IG are CFDs (contracts for difference) and financial spread bets, not listed futures themselves.

IG OTC FTSE Trading Versus On-Exchange ICE Futures

This distinction between OTC derivatives and on-exchange futures matters. Listed futures are standardised exchange-traded contracts, while CFDs and spread bets are over-the-counter (OTC) derivatives that mirror the underlying futures price but don’t involve central clearing or physical delivery.

Because of this, you won’t see fixed expiry dates or contract sizes on IG’s platform the way you would on a futures exchange. Instead, you choose your stake per point, and your profit or loss is calculated based on price movements of the underlying market.

For example, the notional value of 10 FTSE IG index CFD contracts (or spread betting position) is 10x the current price.

So, if the FTSE 100 is trading at 9271.1 (as it is today) and you’re trading £10 per point, your notional exposure is £92,710 (the £10 per point relates to the 0.1)

As you are trading on leverage, you will need to deposit an initial deposit of 5%, which is £4633. But, because you only post a fraction of this as margin, losses can exceed your deposit, making risk management critical.

But if you were trading 10 FTSE 100 Futures contracts on the exchange, you would have notional exposure of £927,100 as futures contracts are much larger contracts based on the whole number as opposed to the decimal. (ICE FTSE contract specs).

So, whilst you can’t trade, on exchange FTSE 100 futures with IG, being able to trade the FTSE as a spread bet or CFD does give you the advantage of being able to take smaller or fractional positions.

Plus, as an added bonus if you are trading the FTSE as a spread bet, your profits are tax free.

Why does IG.com not include FTSE 350?

You can trade FTSE 350 sectors like Banks, Chemicals and Mining, but IG does not offer the FTSE 350 index as a market. The reason is that the FTSE 350 is essentially a composite of the FTSE 100 and FTSE 250. Because IG already offers both of those indices as separate markets, the demand and liquidity for a combined FTSE 350 product is too limited to justify listing it. Also, not that many people want to trade it from my experience as a broker.

If you want to trade actual listed futures contracts (rather than CFDs), IG enables this through its separate US options and futures account powered by Tastytrade.

TastyTrade platform gives access to a wide range of US futures and futures options, including equity indices, interest rates, commodities and currencies—but these are all denominated in US dollars. UK and European futures such as FTSE 100 are not available there.

Where can you trade the FTSE 100 futures?

In short, while you can’t directly trade FTSE futures through IG, you can gain similar exposure via their spread betting and CFD products, which track the futures price while offering flexible sizing and leverage.

Want to trade FTSE futures?

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.