Plus500: Global CFD Options Trading Platform for Major Markets

Account: Plus500 Options Trading

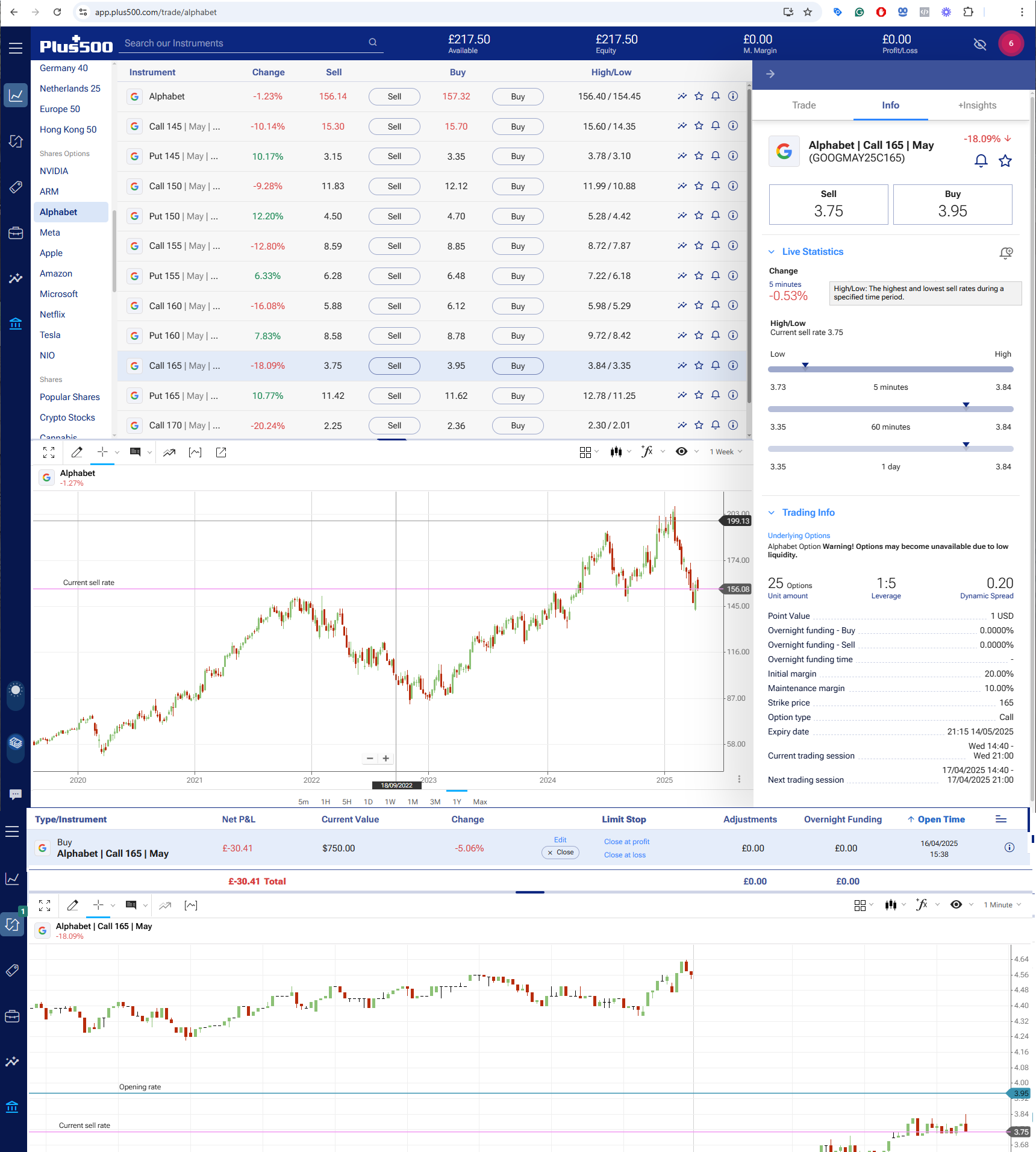

Description: Plus500 lets you trade options in the UK as a CFD on US stocks, EURUSD international indices, volatility and commodities.

76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Is Plus500 good for options trading?

When I was trying out options trading on Plus500, I was going to try and make up for the horrible luck I had when shorting Reddit CFD trading on Plus500. Basically, I went short on Reddit as I assume that our grand master Google will at some point turn on them and stop ranking them for every query possible with hopeless, outdated answers. But alas, literally, 30 minutes after I’d opened the position, Trump announced his 90-day tariff delay, and the market shot up, and my stop was hit.

I still think I’m right about Reddit and will put the position on again, but in the meantime, I thought I’d take the other side of the position and go long Google. Now, you can do this as a CFD, but one of the great things about options trading is that when you only have a little bit left in your account, you can put on a fixed risk/high reward position by buying out-of-the-money call options.

I think Google (Alphabet) is going to go higher, and as the market, they are a survivo,r and no matter what people think about their AI overviews, I like them.

I’m not the only one who likes Google, either. Looking at Plus500’s Insights tool, 99% are buyers, and is also has the 4th highest buy ratio of all instruments in the last 7 days. I take sentiment with a pinch of salt, but nevertheless, it’s quite nice to be part of the majority sometimes.

So I bought some May 165 Calls for $3.95 each and will leave them sitting there for the next few weeks to see if they bounce of the support levels.

Pricing: Options spreads are dynamic, and commission is built in. For the Alphabet calls, I bought the spread, which was only 0.25, which is good enough for taking a speculative medium-term position.

Market Access: You can trade options on all the major indices, including the VIX (for volatilty), natural gas is very popular and the major US stocks. Only one FX pair (EURUSD) though. But lots of indices and commodities.

Apps & Platform: Very easy to use for beginners,

Customer Service: I got through to an agent in about two minutes when asking about overnight charges on options positions on the live chat, no phone number though in case of emergencies.

Research & Analysis: There is not much options trading educational material, but the insights tab is good for seeing what other Plus500 traders are doing. Social channels are very quiet as well.

Pros

- Major markets options

- Simple interface

Cons

- Limited market range

- Basic order types

-

Pricing

(4)

-

Market Access

(4)

-

App & Platform

(4.5)

-

Customer Service

(4)

-

Research & Analysis

(4)

Overall

4.176% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

If you are a beginner options trader it is worth starting with a demo account and utilizing a brokers trading academy, webinars, and insights for learning and to understand the risks involved.