Currency trading relies heavily on models and performance. Currency strength is one such tools that traders used to identify suitable FX pairs to profit from. This guide summarises what currency strength is and how you can use it in your Forex trading.

What is currency strength?

Currency strength measures how strong it is relative to other currencies (the exchange rate).

When a currency is strong it buys more of a foreign currency. When it is weak, it buys less. A country with a strong currency imports goods at a cheaper price.

Factors that may affect the strength of a currency includes:

- Market psychology

- Fundamentals

- Expectations of future fundamentals (eg future inflation or interest rates)

- Technicals

Due to these factors, a currency will sometimes trend persistently for weeks. At other times, it can crab sideways in a frustrating manner for many months.

The most direct way to measure the strength of a currency is via performance. We look at the historical movements of a currency and determine its strength over a fixed time frame. Once we have a suitable way to measure currency strength, it can be used as a tool in trading and investing.

Using currency strength as a trading tool is not a new concept. In fact, a popular measure of the US Dollar is the Dollar Index called the ‘Dixie‘.

The Dollar Index is made up of six currency pairs (USD-EUR, GBP, JPY, SEK, CHF, CAD) and is weighted according to the underlying trade flow pattern. At 57%, the largest weighting is the USD-EUR pair, followed by USD-JPY at 13%.

Apart from price-based currency strength measures, The Economist has devised a simple FX model based on McDonald’s Big Mac, called the Big Mac Index. (GMG Big Mac link?) By using the sale price of the ubiquitous burger around the world, the Economist charts which currency is over- or undervalued. Of course, this is just based on a single good (the Big Mac) and is therefore a rudimentary index.

When to use currency strength in FX trading

Currency strength is frequently used in trading as a broad selective mechanism. It filters the strong and weak currencies.

Currency strength measurement may not tell you the exact time and place to place a trade, but it lays the groundwork for fruitful trading. Currency strength gauges often help to identify a suitable currency pair to trade.

For example, if you note that the Japanese Yen is weakening in recent days. But which pair do you sell it against? Recall that initiating an FX position means that you are simultaneously buying and selling two currencies – the base currency and another.

Using currency strength meters you can pick out stronger currencies easily – in this case, the US Dollar. You will not want to sell Yen and buy another weak currency because their movements will not be as pronounced.

You may even use currency strength as a contrarian signal.

For example, when a currency is extremely bullish over an extended period of time (weeks), chances are it could be near a tipping point. Perhaps it is to time reassess and see if we could sell into strength.

How to read a currency strength meter

To accurately measure the performance of a currency, a FX aggregate index is usually constructed. Why? Remember that currency strength is derived from multiple pairs of exchange rates.

There are 164 national currencies in the world. So when we measure the strength of a currency (say A), we need to take its performance from the following rates: A-B, A-C, A-D,…etc.

Such strength can be captured in several ways. The simplest method is to average the returns of the currency against all other currencies and construct a simple index. For example,

- Take a base currency – eg USD

- Track its performance against a basket of currencies over a specific time period – eg EUR, GBP, JPY over 1 day

- Average the performance of each currency pair

Further adjustments can be made to the above process. For instance, the raw performance data may be modified into an oscillator. An oscillator is a time series that has an upper and lower range.

Another adjustment is to include some fundamental data, such as interest rate differential or inflation expectations, into the calculations.

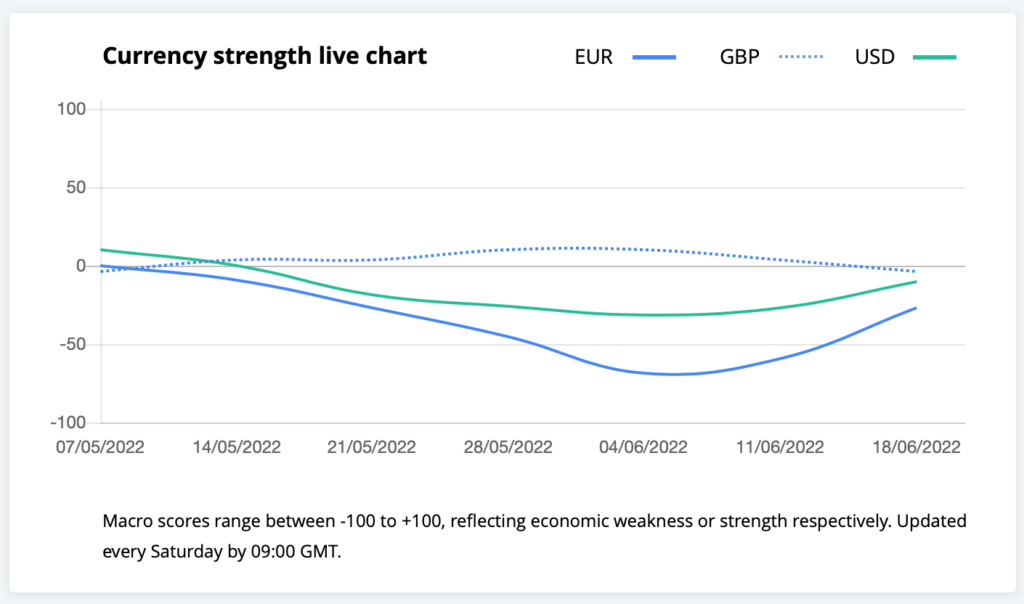

For example, logikfx.com has a macro currency strength measurement that goes from -100 to 100. When the currency strength index rises, it signals bullishness. When it falls, it suggests a weakening currency.

Source: logikfx.com

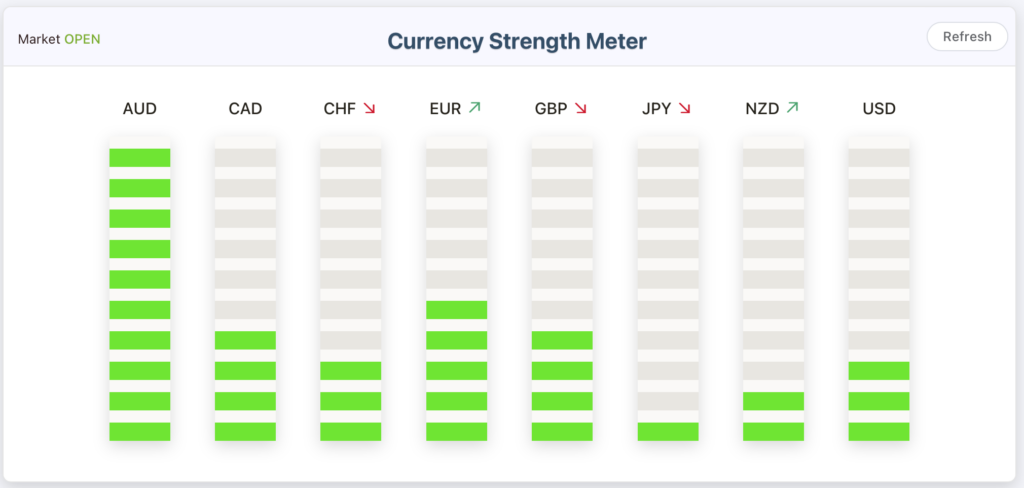

Another currency strength meter, displayed by currencystrengthmeter.org, shows a series of bars. The higher the bars, the more positive is the currency. Its calculation differs to that of the above.

Source: currencystrengthmeter.org

Turning currency meters into trading buy/sell signals

The most straightforward use of currency strength meters is to generate buy/sell signals.

For example, when a currency is strong and another is weak, there is a potential trade to be made. You buy the currency that is expected to appreciate the most and sell the currency predicted to decline.

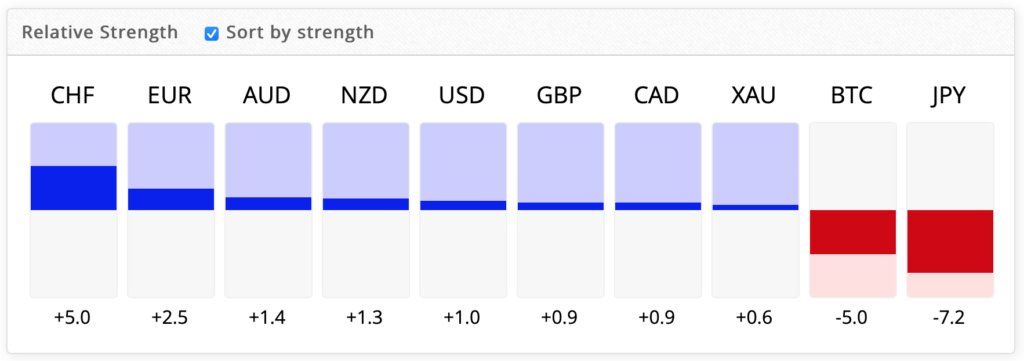

Take the currency strength meter from fxblue.com. From the table below, you note that CHF is the strongest currency and JPY is the weakest.

Source: fxblue.com

The pair to trade is therefore CHFJPY. As their long-term chart shows, the rate has indeed trended significantly higher over the last few weeks (CHF strong; JPY weak). In fact, the trend here is so powerful that prices soared to new all-time highs several times in recent sessions.

Source: tradingview.com

However, not all currency strength meters are constructed in the same way. Incorporating them into your FX trading system is not a straightforward exercise because you will need to study how these signals behave over time.

What should you look for when employing these currency meters?

- Consistency of the currency strength meters

- Predictability of the signals

- Time emphasis of the currency strength measurement, ie long or short-term

Some currency strength meters are not necessarily suitable for long-term trading, ie with positions held over weeks, because the signals are short-term oriented.

Moreover, some currency meters behave like a macro model due to macro data inputs. Do you really understand how it will behave over an economic cycle? Economic data are usually updated less frequently while high-frequency trading like FX heavily relies on prices.

Lastly, do these meters just rely on past performance? Do they weight all past performance equally? There are several ways to average historical prices. Different options will impact the performance of the currency strength meters.

Therefore, before you start using currency strength meters, make a detailed study of these tools and determine if they are suited for your trading style. Paper trade for a while to ascertain its usefulness.

An example of using currency strength in a trade

One of the earliest examples of a currency strength indicator is the US Dollar Index.

As mentioned above, the Dixie is made up of several currencies to measure strength of the US Dollar and was devised back in the seventies after the demise of the Bretton Woods system. Due to its popularity, derivatives are layered on top of this index to facilitate trading, called ICE Dollar Futures (USDX, link to futures contracts).

We use the currency strength to layer on this instrument.

Take fxblue’s currency meter (www.fxblue.com/market-data/currency-strength). Using the “long-term” option found on the website, the USD is the strongest currency right now.

Next, using this information we look at the US Dollar Index to determine a trade.

There are two approaches to use currency meter:

- Long-term positional view – still bullish due to DXX’s rising trend, as evidenced by higher reaction highs and lows. In this case, you may want to use DXY’s recent weakness to go long (say, around 101)

- Medium-term – upside fatigue, as noted from a) failed breakout at 105 and b) overbought momentum. In this case, a short-term contrary sell position may be activated with the stoploss at recent highs (105.5).

Last words

One fundamental principle of trading is that the tools used to trade must result in profits over time. The currency strength meter is no different. Too many investor ignore the risk side when using a new ‘fancy to tool’. In this guide, we introduce the fx strength comparison tool so that you can delve deeper and check if it improves your FX trading performance.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.