The pandemic has led to a spike in bicycle demand and a spectacular rise in investing in cycling stocks. This guide analyses the bicycle sector and some of the newer trends emerging from the bike boom, including the rise of e-bikes and bike sharing.

Boom Time For Bike Stocks

When covid-19 struck in March, cycling is probably the last activity on people’s mind. Yet, that’s what many did during the lockdown.

63% – that’s year-on-year growth in UK bicycle sales during April to June this year. Contributing to this growth are ‘work from home’, growing awareness of the need to stay fit, and the avoidance of crowded trains, tubes and gyms. Social distancing was critically needed to prevent the virus from spreading. People learned to do this on bicycles.

The sharp growth in bike sales was not limited to the UK. In Singapore, thousands more bikes were bought. The US saw bike sales double in March. Other Europeans too witnessed a spike in bicycle sales. Unsurprisingly, all these buying led to a global shortage of bicycles. This supply-demand imbalance is predicted to sustain until next year.

The background trend is clear: higher demand for bikes. But will this mean that bike stocks will go up?

Is now a good time to buy bicycle-related stocks?

Riding high on the UK cycling boom is Halfords (HFD). The company has a significant presence in the bike industry. Cyclists often turn to Halfords to service and repair their rusty bikes. In the last financial year 2020 alone, Halford carried out an impressive 125,000 bicycle repairs. Twice the company raised its profit guidance this year, citing ‘unprecedented’ demand.

Bicycle Stocks Outperform Market

Investors like Halfords’ stock so much that the firm’s share price rose by more than 400% from its pandemic lows (see below).

However, this spectacular price growth is probably behind us. Prices are unlikely to return to its March lows any time soon. So new investors looking to join the bike boom needs to ask these three questions:

- Will the cycle boom last in the post-pandemic world?

- Will health-conscious habits like cycling stay once pubs and restaurants reopen?

- What’s the risk in chasing these uptrends after a sustained period of appreciation?

Social restrictions likely to stay until early 2021

The first thing to note is that this pandemic is nine-month old already. While it is still raging, Moderna, Pfizer, and AstraZeneca are all leading the charge to provide a covid-19 vaccine.

UK will roll out Pfizer vaccine next week (December 14). Mass vaccination of the population is targeted next year. Although social restrictions are likely to stay until mass vaccination is available, the end is in sight. Bike sales may stay elevated as long as social restrictions are enforced.

However, the bike stock boom could decelerate in 2021. Vaccines will help countries to return to ‘normality’ soon. Companies may also tentatively gather workers back to the offices. This means more inter-country travelling, crowding into trains, and less cycling. New investors into the bike sector should bear this in mind.

Another point worth noting is that the number of listed bike stocks and investable bike manufacturers is small. This is because the bicycle market is fairly small. The UK market is estimated to be only about £2 billion. Globally, it is worth about US$29 billion.

Most bicycle companies have other businesses to survive. There are few ‘direct exposure’ to the bicycle market. For example, apart from selling bicycles Halfords also service cars and sell parts.

Similarly, Tandem plc (TND), another cycling-related stock, has other business lines. The AIM-listed stock has defied gravity in 2020 as its value soared by more than 400% (see below).

The US market has a few bicycle-related stocks, such as Fox Factory (FOXF) and Allegion (ALLE). But these are niche stocks that make suspension and security for bicycles respectively.

A large bicycle manufacturer is found in Taiwan, called Giant Manufacturing (9921 TW). Another is located in Japan, named Shimano Inc (7309 JP), which supplies quality bike components globally. For some other bicycle stocks, you can refer to this wonderful list.

- Related guide: How to invest in Emerging markets

What are the growing trends in the bike market?

Investing is all about anticipating future trends. After the pandemic, will cycling become part of the so-called ‘Green Recovery’?

Perhaps. There are two aspects of the bike boom to note.

- The expansion in e-bikes/e-scooters

- A return to bike sharing

First the e-bikes. Electric bikes are bikes with an integrated motor attached to the pedal that propel it forward. The motor normally uses rechargeable Li-on battery, with a range of 50-100 miles in a single charge. E-bikes is part of the rise in ‘micromobility’.

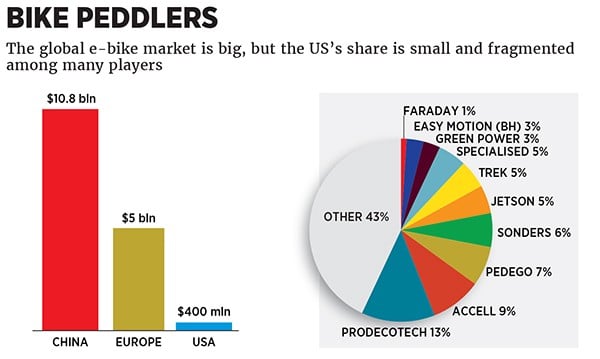

The biggest user of e-bikes now is China (see below). The market there alone is estimated to be worth $10 billion (2019 figures, see below). One of the bigger manufacturers is Accell Group (ACCEL Euronext), a company listed in Europe. Its share price has doubled from the pandemic lows.

Source: medium.com

Apart from e-bikes, e-scooter is also becoming popular. This sector was very hot a couple of years ago. Some of the bike stocks in the sector are LimeBikes (now Neutron Holdings), Bird (Scoot Network), Voi Technology (Sweden), Beam (Singapore), Uber (UBER) etc. These companies use the ‘sharing concept’ found in bicycles. Google, Uber etc are investing in these companies.

One of the best-in-class of e-scooter is Niu Technologies (NIU), a chinese startup listed in the US stock market. Prices have rocketed 5x since March, attaining a market cap of $2.2 billion (see below). A smaller competitor is Ayro (AYRO).

Note these companies are in the growth stage and only a few are profitable. Repeated funding rounds are needed to grab market share.

Will Bike Sharing boom again in 2021?

As bicycle demand soars, attention is turned to the concept of ‘bike sharing’.

A few years back, this theme was all the rage in some countries, particularly China. Billions poured into the sector. Millions of new bikes were made. Unfortunately, a sector-wide bust followed, caused by oversupply, mismanagement and over expansion. Literally ‘bike mountains’ were destroyed. Many companies went bankrupt (e.g. Ofo).

Source: TheAtlantic

With bicycles back in demand, some are returning to Bike Sharing 2.0. This time, many are expecting the trend to last.

First, companies are changing their business models and subscribing to ‘Mobility -as-a-service‘ (Maas) to profit from the boom.

Second, the leap in battery technology allows a longer travelling range. Battery swapping means customers can use products repeatedly. Third, more sophisticated AI are used to predict locational shortages, construct pricing, and deployment of vehicles.

In China, Meituan (Owner of Beijing Mobike, 3690 HK) is rolling out new e-scooters, backed by battery make CATL (300750 SZ). This is a growing trend in other parts of Asia too, such as Singapore.

In Europe, the bike sharing market market is still fragmented. Some are popular locally, and not others. A list of new startups include:

- Bleeperbike

- Rekola (https://www.rekola.cz/en/)

- Yobike (https://yobike.com)

These are early days. None of them are listed. So investors well stick to proven names like Uber (UBER) or Lyft (NASDAQ:LYFT) which are also muscling into the sector.

Conclusion: Should You Invest In Cycling Stocks?

Bicycles are one of the winners in the pandemic 2020. But as the pandemic enters in the final stages, the spike in demand may taper off. The risk in chasing the uptrends in these stocks is high. But some trends are worth nothing, such as e-bikes/e-scooters and bike sharing. These trends are likely to survive the pandemic as cities focus on winding down diesel and petrol cars.

Jackson is a core part of the editorial team at GoodMoneyGuide.com.

With over 15 years industry experience as a financial analyst, he brings a wealth of knowledge and expertise to our content and readers.

Previously Jackson was the director of Stockcube Research as Head of Investors Intelligence. This pivotal role involved providing market timing advice and research to some of the world’s largest institutions and hedge funds.

Jackson brings a huge amount of expertise in areas as diverse as global macroeconomic investment strategy, statistical backtesting, asset allocation, and cross-asset research.

Jackson has a PhD in Finance from Durham University and has authored nearly 200 articles for GoodMoneyGuide.com.