Today’s DJ30 index price is 49,625.97 (as of 16:41 20-Feb-2026) which is a change of 230.81 or 0.47% from the last closing price of 49,395.16 with a constituent traded volume of 574,812,034. The most recent daily high has been 49,712.56 and daily low 49,158.28. The DJ30 index price 52 week high has been 50,512.79 and the 52 week low 36,611.78.

Compare Brokers For Trading INDEXDJX: .DJI

| Name | Logo | Futures Commission | Minimum deposit | GMG Rating | Customer Reviews | CTA | Feature | Expand |

|---|---|---|---|---|---|---|---|---|

|

Futures Commission $0.25 to $0.89 |

Minimum deposit $2,000 |

GMG Rating |

Customer Reviews 4.5

(Based on 1,330 reviews)

|

Account Types:

|

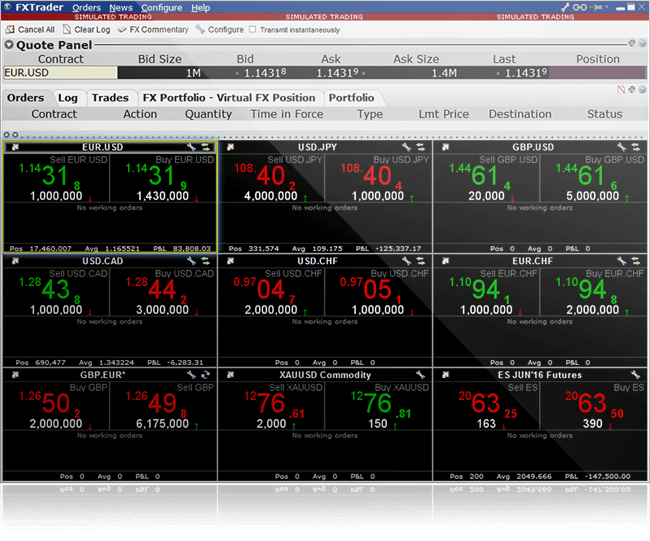

Interactive Brokers US Forex Trading Review: Seriously advanced trader tools for professionals Account: Interactive Brokers US Forex Trading Description: Interactive Brokers has been offering forex trading services in the US since their inception in 1978. As a pioneer in the industry, Interactive Brokers has established itself as a reputable and reliable broker for forex trading, offering competitive spreads, advanced trading platforms, and a wide range of currency pairs to trade. Over the years, Interactive Brokers has continued to enhance its forex trading offerings, incorporating advanced technology and features to meet the evolving needs of traders. Can you trade forex with Interactive Brokers in the US? Yes, you can trade currency futures with direct market access and currency options on the Interactive Brokers trading platforms. Interactive Brokers is a great forex broker for those who want to trade on exchange currency contracts rather than spot FX. Through IBKRs FXTrader you get interbank quality FX spreads, the ability to trade spot alongside on-exchange futures and over 20 forex order types like trailing stops to lock in profits if a position is going your way, OCO and scaled execution for large orders. IBKR US Address: Interactive Brokers LLC, One Pickwick Plaza, Greenwich, CT 06830, United

Pros

Cons

Overall4.8 |

|||

|

Futures Commission $0.49 to $0.89 |

Minimum deposit $100 |

GMG Rating |

Customer Reviews 3.7

(Based on 146 reviews)

|

Visit Platform Trading in futures involves the risk of loss. |

Account Types:

|

Plus500 US Futures Trading Review: DMA access to US futures Account: Plus500 US Futures Trading Description: In 2023, Plus500 launched its online trading platform in the US. Through the platform, those in the US can trade futures on a range of instruments including equity indexes, crypto-assets, currencies (forex), and commodities. Is Plus500 a good futures broker? Yes, Plus500 is an online trading company that operates in over 50 countries worldwide and in the US, its platform allows you to trade futures on a range of assets. Plus500 also offers a range of features designed to help traders capitalize on opportunities in the markets including charting tools and real-time news feeds. There is a demo account for those looking to learn how to trade futures before committing real money, but one downside is that there are some platforms that offer more futures markets than Plus500. Pros

Cons

Overall4.5 |

List of companies in the Dow Jones Industrial Average (DJIA/US30/Wall Street) Index

The table below lists the constituents of the Dow Jones Industrial Average Index (DJIA). You can rank the top US30 companies in the index by name, market cap, price-earnings ratio and earnings per share. We also provide a buy-sell rating, analysis and the pros and cons of each stock.

| US30 Company | Price ($) | Market Cap | P/E Ratio | EPS | 1m Change | 6m Change | 1y Change |

|---|---|---|---|---|---|---|---|

| 3M Co (MMM) | 167.06 | $88.0 bn | 27.82 | 6 | 4.7% | 8.5% | 9.1% |

| American Express Co (AXP) | 346.18 | $237.7 bn | 22.52 | 15.38 | -4.7% | 6.4% | 24.6% |

| Amgen Inc (AMGN) | 374.75 | $202.0 bn | 26.34 | 14.23 | 7.2% | 33.7% | 19.2% |

| Apple Inc (AAPL) | 264.58 | $3,890.0 bn | #N/A | #N/A | 3.6% | 11.2% | 19.9% |

| Boeing Co (BA) | 232.03 | $182.2 bn | 93.59 | 2.48 | -6.6% | 0.5% | 28.3% |

| Caterpillar Inc (CAT) | 759.74 | $353.5 bn | 40.39 | 18.81 | 19.5% | 79.7% | 122.4% |

| Chevron Corp (CVX) | 183.93 | $364.2 bn | 27.75 | 6.63 | 9.8% | 19.4% | 11.5% |

| Cisco Systems Inc (CSCO) | 79.2 | $312.8 bn | 28.53 | 2.78 | 2.8% | 18.4% | 29.9% |

| Coca Cola Co (KO) | 79.84 | $343.4 bn | 26.27 | 3.04 | 10.0% | 18.4% | 15.8% |

| Dow Inc (DOW) | 30.52 | $21.9 bn | #N/A | -3.7 | 8.3% | 27.3% | -15.9% |

| Goldman Sachs Group Inc (GS) | 922.24 | $276.6 bn | 17.97 | 51.32 | -1.0% | 24.3% | 59.0% |

| Home Depot Inc (HD) | 382.25 | $380.5 bn | 26.07 | 14.66 | -1.1% | -9.0% | 5.1% |

| Honeywell International Inc (HON) | 243.97 | $155.1 bn | 35.44 | 6.88 | 10.3% | 20.6% | 22.2% |

| Intel Corp (INTC) | 44.11 | $220.3 bn | #N/A | -0.06 | 3.8% | 80.2% | 82.1% |

| International Business Machines Corp (IBM) | 257.16 | $240.4 bn | 20.8 | 12.37 | -13.2% | 0.4% | 3.5% |

| Johnson & Johnson (JNJ) | 242.49 | $584.4 bn | 21.19 | 11.44 | 9.5% | 36.1% | 48.5% |

| JPMorgan Chase & Co (JPM) | 310.79 | $838.2 bn | 15.53 | 20.02 | 3.2% | 6.1% | 25.3% |

| McDonald's Corp (MCD) | 329.23 | $234.5 bn | 27.54 | 11.95 | 5.2% | 5.3% | 7.7% |

| Merck & Co Inc (MRK) | 122.26 | $303.5 bn | 16.79 | 7.28 | 13.8% | 45.4% | 32.4% |

| Microsoft Corp (MSFT) | 397.23 | $2,949.7 bn | 24.85 | 15.98 | -15.5% | -20.3% | 1.1% |

| Nike Inc Cl B (NKE) | 65.4 | $96.8 bn | 38.35 | 1.71 | 0.6% | -11.8% | -3.0% |

| Procter & Gamble Co (PG) | 160.78 | $373.7 bn | 23.82 | 6.75 | 7.6% | 1.1% | -2.9% |

| Salesforce Inc (CRM) | 185.16 | $173.5 bn | 24.69 | 7.5 | -19.3% | -26.6% | -35.2% |

| Travelers Companies Inc (TRV) | 304.93 | $65.9 bn | 11.12 | 27.43 | 8.2% | 11.1% | 17.5% |

| UnitedHealth Group Inc (UNH) | 290 | $262.7 bn | 21.91 | 13.23 | -17.5% | -9.4% | -43.9% |

| Verizon Communications Inc (VZ) | 49.25 | $207.7 bn | 12.13 | 4.06 | 24.3% | 13.7% | 13.1% |

| Visa Inc Class A (V) | 320.95 | $611.7 bn | 30.12 | 10.65 | -2.3% | -6.2% | -6.7% |

| Walgreens Boots Alliance Inc (WBA)1. | 222 | $10.4 bn | #N/A | #N/A | #N/A | #N/A | #N/A |

| Walmart Inc (WMT) | 122.99 | $980.3 bn | #N/A | #N/A | 4.5% | 20.2% | 40.6% |

| Walt Disney Co (DIS) | 105.58 | $187.0 bn | 15.56 | 6.79 | -5.1% | -11.2% | 5.4% |

What is a constituent of the Dow Jones?

Dow Jones Industrial Average (DJIA) constituents are the 30 American companies whose stocks are included in the Wall Street index. US30 constituents are typically the biggest publically listed companies in a broad range of sectors and industries and are chosen by the S&P Dow Jones Indices committee to reflect the health of the U.S. economy.

What is the Dow Jones 30?

The Dow Jones Industrial Average (DJIA/DJ30/Dow/Wall Street), is one of the oldest and most widely recognized stock market indices. It is named after Charles Dow, who created the index with his business partner Edward Jones in 1896.

The DJIA is one of the most heavily traded financial instruments in the world as it tracks the performance of the 30 largest, most established and most profitable companies listed on the NASDAQ and New York Stock Exchange. Because of the way the index is weighted and size of the companies in the DJIA, there is always plenty of liquidity for larger traders, news flow and company results to reduce volatility.

How can you trade and invest in the Dow Jones 30?

Here are the most common ways to trade and invest in the Dow Jones Industrial Average (DJIA), and who they are appropriate for:

- Exchange-Traded Funds (ETFs): DJ30 ETF lets you buy all the stocks in the DJIA in one go. It is the simplest way for beginner investors to invest in Wall Street, as exchange-traded funds like DIA SPDR Dow Jones Industrial Average ETF Trust (DIA) track the price movements of the index and accumulate or pay out company dividends. Suitable for all investors.

- Individual Stocks: You can buy shares of the US30 constituents of the DJIA. This is a good way to speculate on the performance of specific companies. It is particularly useful if you think that certain stocks will outperform others as you can go long and short and remain neutral to the underlying index moves. Suitable for advanced investors.

- Index Futures: Let you speculate through the CME with margin whether the price of the DJIA will go up or down in the short to medium term. Suitable for advanced investors

- Options: DJIA options are a good tool for hedging portfolios against significant market moves. However, in recent years they have become more popular as a tool for speculating on the short-term intra-day price movements of the DJIA.

DJIA Analysis & Guides

Best Dow Jones Trading Platforms (DJIA/US30) Compared & Reviewed

Dow Jones trading platforms let you trade the DJ Industrials Index (the ‘Dow’, ticker: INDU), one of the oldest stock market indices in the world. You can use our comparison of the best brokers for trading the Dow Jones Industrial Average (DJIA/US 30) to see the key features offered by US30 trading platforms, including costs,

Best Index Trading Platforms Compared & Reviewed

Index brokers provide access to indices markets such as the FTSE, DAX, and S&P for the purposes of trading, speculation, and hedging. These indices are made up of individual shares traded on stock exchanges. For example, the FTSE 100 is an index of the 100 biggest publicly listed shares traded on the London Stock Exchange.

Best Indices To Trade

In this guide, we look at the best indices for trading & investing. We explain what they are, the risks involved and also how you can invest in and trade stock market indices. Plus, what are the best indices to trade for beginners and experienced investors. What is a stock market index? A stock market