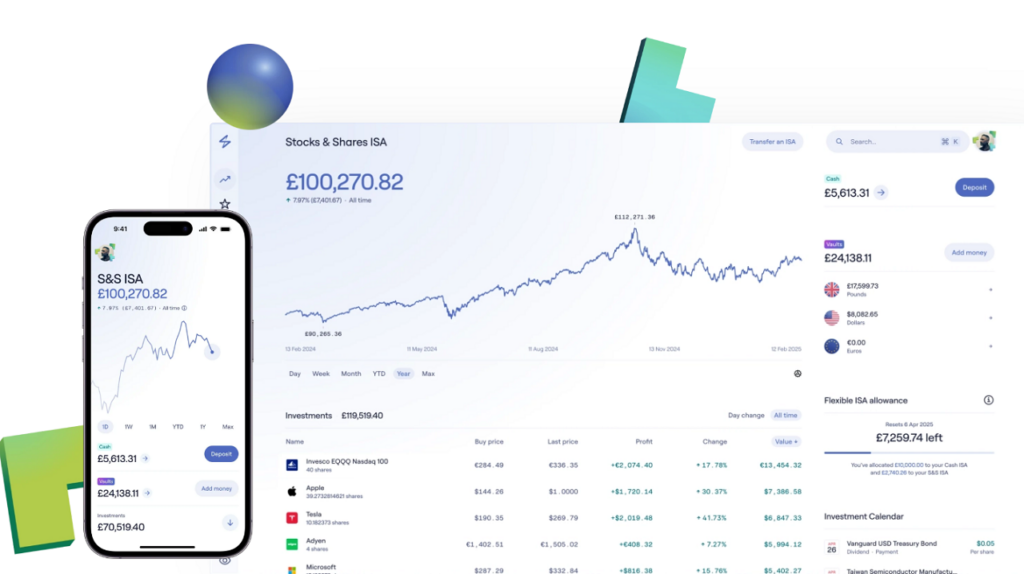

Lightyear has introduced fractional investing inside its Stocks & Shares ISA ahead of ISA season. Investors can now buy fractions of popular US stocks, GBP and EUR ETFs, and major EU stocks. More fractional options are coming next, with UK stocks set to be added soon.

What is the Lightyear Stocks & Shares ISA?

Lightyear, the investment platform founded in 2020 by former Wise executives Martin Sokk and Mihkel Aamer, now offers both a Stocks & Shares Individual Savings Account (ISA) and a Cash ISA.

ISAs allow you to put aside savings of up to £20,000 each UK tax year (the tax year runs from 6 April to 5 April the following year) and enjoy the returns without paying tax.

Lightyear Stocks & Shares ISA Has 0% Commission On Shares

Stocks & shares ISAs allow people to invest their money in the stock market with zero commission, either directly or through a managed service, rather than hold it as cash. Investing in stocks and funds generally offers the potential for better returns, alongside a higher risk of losses.

As part of Lightyear’s plans to to reduce excessive fees charged on £100bn of UK ISA savings and investments, chief operating officer Wander Rutgers and former president of trading app Robinhood UK became Lightyear’s first UK chief executive, stating, “Unlike others who’ve tried to enter the UK with no experience, we’ve been live here since the start, so we’ve had years of experience in the UK, combined with years of experience building a ‘global-local’ tailored product in each of our other 21 markets,” Rutgers said.

Is the Lightyear Stocks and Shares ISA Any Good?

We’ve reviewed the Lightyear Stocks & Shares ISA, launched in early 2025, and compared it with the stocks & shares ISAs offered by other providers.

Lightyear Stocks & Shares ISA Review: Zero commission and low FX fees keep US stock investing cheap

Account: Lightyear Stocks & Shares ISA

Description: Lightyear’s stocks and shares ISAs are flexible, meaning you can move money freely in and out without losing any of your annual allowance. They also have no minimum deposit, and zero commission fees. Overall, Lightyear’s Stocks & Shares ISA remains one of the best value options for cost-conscious investors who want simple, flexible and low-fee global investing. Capital at risk. The value of your investments can go down or up.

Is the Lightyear Stocks & Shares ISA Any Good?

Lightyear won our 2025 Award for Best Stocks & Shares ISA because it offers a genuinely low-cost, no-nonsense investing experience. Its ETFs are commission-free, the app has excellent built-in research, and the platform remains highly competitive for international investing. Lightyear has now fully removed commission fees for US, UK and EU stocks, strengthening its position as one of the cheapest ISA providers in the UK.

In most respects, the Lightyear Stocks & Shares ISA compares very well with longer-established competitors thanks to its transparent pricing. There are no platform fees, no custody fees, no transfer fees and no hidden charges. Trading US, UK and EU shares and ETFs is commission-free, with only stamp duty and fund manager fees applying where relevant.

This makes the Lightyear Stocks & Shares ISA one of the cheapest options available. By comparison, the UK’s most widely used investment platform, Hargreaves Lansdown, charges up to 0.45% per year on assets. Vanguard, a lower-cost alternative, charges a £4 monthly account fee for portfolios under £32,000 (equivalent to £48 per year) and 0.15% annually above that level.

Lightyear’s pricing advantage is reinforced by research commissioned from Capital Economics, which estimates ISA investors lose more than £850 million per year to account fees. The study found Lightyear’s ISA could be around 10 times cheaper than the average provider over 10 years and up to 16 times cheaper over 25 years.

While buying and selling stocks and ETFs and is commission free, investors should remember that ETFs and funds still have their own underlying fund charges. Currency conversion costs 0.35% when converting between GBP and other currencies.

Lightyear is still a newer entrant to the investment platform market, which may make some investors more comfortable with longer-established providers. However, it now offers a broad range of investments, including more than 4,000 US stocks, UK and EU shares, ETFs, money market funds and fractional shares.

One area that has improved significantly is cash returns. Investors can now hold money in Lightyear Vaults within the ISA, which invest in BlackRock money market funds and currently offer around 3.77% AER with easy access and no minimum or maximum deposit limits. These variable-rate vaults follow Bank of England overnight rates and provide a competitive way to earn interest on uninvested cash inside the ISA.

Pros

- Among the lowest fees

- Zero commission

- High-interest Vaults product (QMMFs) within the ISA

Cons

- Relatively new platform

- Fewer instruments than some

- Middling uninvested cash rate

-

Pricing

(5)

-

Market Access

(4.5)

-

App & Platform

(5)

-

Customer Service

(4.5)

-

Research & Analysis

(4.5)

Overall

4.7

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.