- Lightyear is rated positively on Good Money Guide as a modern investing platform focused on low-cost access to US and global shares, ETFs and interest on uninvested cash.

- Experts highlight its simple app design, competitive pricing and beginner-friendly approach, making it a strong option for newer investors wanting international exposure.

- Customer reviews on Good Money Guide are generally favourable, with users praising the ease of use, low fees and smooth onboarding, though some mention occasional platform limitations compared with larger brokers.

Lightyear Customer Reviews

Tell us what you think of this provider.

Fair

The app is amazing and it has fees that make sense.

Perfect

Omogočanje investiranja vsem, ne glede na prihodke posameznika.

Simple

At Lightyear, even a novice investor can build a profitable investment portfolio.

Ease

Easy to use interface

Simple and smart

Makes good and informed investment available to everyone

Simplicity

It’s the simplicity of the app and also how fast the funds can be transferred

Easy

Branding, user experience, educational content

Smooth

The app combines smooth UI with enough customisation when making trades, analysing and etc.

Easy

Simple clear information

Innovative

The simplicity is their ultimate sophistication

lean

The application is straightforard, menu structure is clear, no visual clutter. The transaction fees are perfectly balanced, some providers make little investments unfeasible due to high constant costs in each and every transaction, which in the end burns all the money.

Accessible

Lightyear provides a user-friendly app for ordinary people to invest in the stock market. From an array of ETFs, to thousands of stocks, Lightyear enables an affordable investment opportunity, multiple informations to guide its users (through its AI information provider), round the clock global information of the stock market, interest on uninvested cash, and many others. I’ve been using it since Dec 2023, and I have been fortunate in finding such platform to help me in my medium to long term plan to invest and be financially free (as much as possible really).

Usable

It offers transparent and cheap way to invest. Also, it integrates seamlessly with local investing vehicles (investing account in Estonia) which allows to postpone income tax from gains as long as they haven’t been withdrawn from the account), enabling users to postpone paying 22% tax.

Slick

Beautiful design, excellent tools, great service

Informative

Lightyear delivers timely updates on market-moving events, making it easier to invest efficiently and keep track of stocks in your portfolio.

Often used to describe their interest rates on uninvested cash (they pass the central bank rates directly to you). Modern: Referring to their multi-currency accounts that let you hold USD, GBP, and EUR in one place lightyear is the best

Lightyear is efficient. Low fees, great FX rates (0.35%), and an interface that doesn’t waste your time. It’s the first ‘fintech’ broker that actually feels like it’s on the user’s side. Highly recommended for both beginners and seasoned stock pickers, that’s so great 👍

intuitive, customer friendly

trustful

Best designed

They’ve got the best overall app and experience. Super low fees and great UX.

Modern

Making it really easy to invest with low fees.

Superb

It super easy to use, makes investing easy, makes stock performance understandable, very modern app. Super localised.

Lightyear Expert Review

Affiliate disclaimer: We will be paid a referral fee if you open an account and deposit funds through some of the links on this page

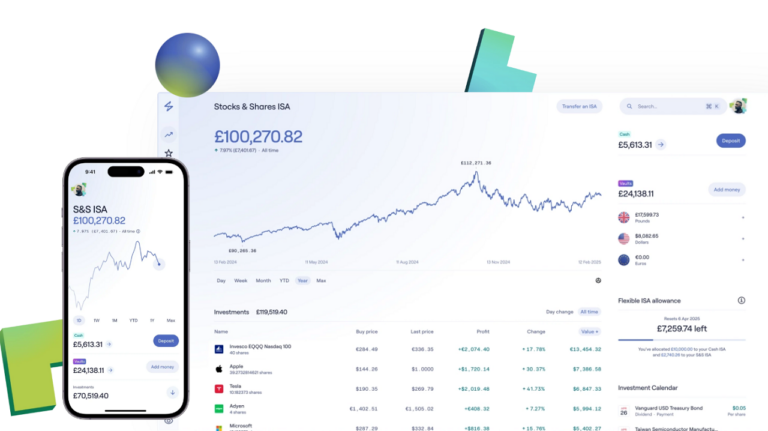

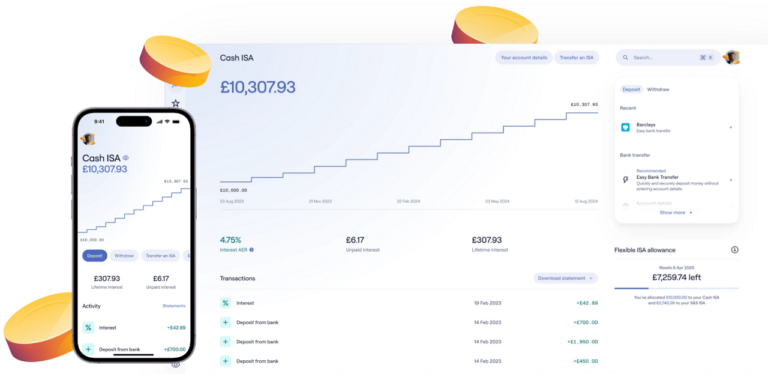

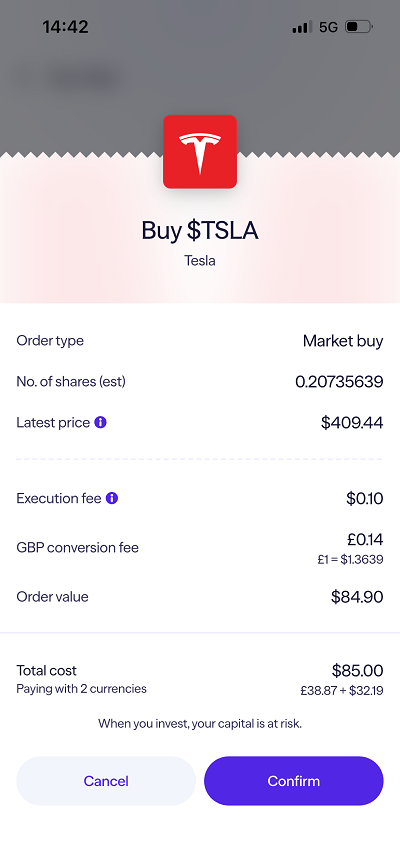

Provider: Lightyear Verdict: Lightyear is one of the better free investing apps as it provides access to US stocks and local markets with FX fees as low as 0.35%. Lightyear is a new investment app that offers low cost investing in UK, European and US shares. The company was founded by one of the first Wise (Transferwise) employees, Martin Sokk with a similar objective of making investing as cheap and easy as possible. Is Lightyear Good for Investing? Lightyear was voted best investing app in the 2026 Good Money Guide Awards and is a simple and approachable way to invest in stocks and ETFs without unnecessarily large fees. A very well-designed low-cost investing app with discounted FX charges, limit and recurring orders for investing in local and international markets. Special Offer: Sign up with the code GOODMONEYGUIDE to get up to £100 in fractional share to your GIA. Capital at risk. – – Terms apply: https://lightyear.com/en-gb/signup-promotion-terms. You must be a new user and deposit at least £100 within the first 15 days after signing up. The reward can be withdrawn 6 months after it’s credited. Fees: Lightyear is cheap for investing. The GIA has no account fee and charges only £1 commission for UK trades and up to $1 for US stocks but free for trading ETFs. If you are investing in a stocks and shares ISA, there is no commission on buying and selling stocks and shares. Much like the founders’ alma mater, Lightyear makes its money from FX fees which it adds to the interbank rate, so conversion costs are transparent. When I interviewed Martin Sokk, he told me Lightyear planned to expand internationally fast so that its users could invest in both their local and the US markets, since many people want to invest in US stocks. And rightly so: US shares are all household names, and one of the key drivers for investing is to buy companies you love and use. Lightyear will make money charging 0.1% per trade (or $1, whichever is bigger) and converting GBP, HUF & Euros, etc. into USD when people buy US stocks. Lightyear charges 0.35% for converting money into USD and EUR, which is higher than Interactive Brokers’ 0.02% but much lower than the 0.5% charged by AJ Bell, Saxo Markets and IG, or the 1% from Hargreaves Lansdown and Interactive Investor. FX must be a key part of Lightyear’s monetisation strategy: if you charge very low commission and account fees, you have to make money somehow. So Lightyear aims to make its money in the background, initially from foreign exchange fees. FX is a good way to make money because a) no-one really understands how the pricing works and b) you don’t see the charge, it’s built into the buy/sell spread. You can see in the example below what the fees were when I bought some Tesla shares while testing the app for this Lightyear review. Quite a nice touch is that you get the option of making purchases repeat orders, a great way to build good investing habits. Just by investing small amounts each month, the genius of compounding returns will help you build a larger portfolio over time. Check it out with our investing returns calculator. Market Access: Lightyear constantly adds new instruments, bringing the total up to almost 6,500. These include well-known UK names such as Rolls-Royce, easyJet and IAG; to defence ETFs, US stocks. This is great because one of my concerns about new investing apps is that they normally just cater to the most heavily traded stocks, which means they are not great for more adventurous investors. It’s great to see Lightyear providing wider market access. Plus, it’s proactive. Lightyear says it has put live 98% of non-complex US instruments asked for by customers in just 3 months. One of the other really cool things about Lightyear is that you can listen to earnings calls directly on the app. As well as being able to buy fractional US shares, ETFs though limit orders and regular investing, you can also quickly see which shares pay the highest dividends or make the most money relative to their share price to help you pick stocks. Multicurrency account & order types Another point to make here is that you also get a multi-currency account, where you can hold foreign currency. The advantage of this is that you don’t need to do as many FX conversions which can help keep costs down. Related guide: Compare FX rates for buying US stocks from the UK. Progression to servicing local customers and local markets When Lightyear first started, you could only invest in a handful of UK stocks, and they were ADRs listed in the US denominated in USD, rather than the local listings on the LSE. So, you were paying an FX fee when you really shouldn’t have to. Admittedly, there is no stamp duty so technically paying 0.35% on FX rather than 0.5% to HMRC is cheaper. Lightyear has a cash and investment ISA, but no SIPP account, but I suspect that is next on the “product roadmap”. But anyway, if you want to invest in UK shares like Lloyds, you can actually buy them on the LSE, something that eToro is yet to do. With eToro, you still have to buy USD-denominated shares. I’ve mentioned how annoying that is many times and yet eToro continues to serve itself as a global broker instead of its customers as locals. It’s nice to see that Lightyear fixed that problem early on. Are your investment safe with Lightyear? Yes, it’s safe to invest with Lightyear. Lightyear U.K Ltd is authorised and regulated by the Financial Conduct Authority (FRN 987226). Lightyear is protected by the Financial Services Compensation Scheme (FSCS). FSCS protection applies to client money only where held with banks, not where held in QMMFs. In the unlikely event of anything happening to Lightyear, there’s no way for creditors to get hold of the investments or cash that customers hold with us. Keep in mind, though, that your investments are not safe from losing money with Lightyear. Overall, the market generally goes up, but there are peaks and troughs along the way. Like Transferwise, like Lightyear To draw on one final Transferwise comparison, it is very easy to use app-as-a-tool to help you start investing as cheaply as possible. The thing is though is that, transferring money is like car insurance. No-one really has any loyalty to their insurer, they just do it and move on. Investing is different. Investing is not like insurance, when you open an investing account, you could be using it for the next 30 years. I think there will always be a place for traditional investment platforms because they provide excellent customer service and brand loyalty, they are mature platforms for mature investors and fees will eventually come down, as they have done in the past. Same as with Simpsons Tavern, it may not be as good for you as veganism, but if it survives, people will continue to go because they like it. But, if low-cost investing apps are a gateway to getting more people to invest for their future, then they are the future too and will hopefully mature along with their customers, and Lightyear, in particular, is a great place to get started. Pros Cons

Lightyear Review: Voted Best Investing App 2026

Capital at risk.

Overall

4.2

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please see his Invesdaq profile.