Lightyear Customer Reviews

Leave a review and tell us what you think of this company to help others make more informed financial decisions.

3/5

Pros:

Easy to invest in individual stocks and good education details.

Cons:

Lightyear is for individual stocks only.

3/5

5/5

Pros:

App

Cons:

Lower fees

4/5

Pros:

Low fees

Cons:

Give us a browser based platform

1/5

Pros:

Small fees, and the UI

Cons:

they need to ad the STOP/LOSS option to the platform

4/5

Pros:

Easy to review investments on app

Cons:

Need an isa. Need international stocks on platform

4/5

Pros:

Simple and to the point great app

Cons:

Trading individual stocks

4/5

5/5

Pros:

Dividend calendar

Cons:

Already very good platform

2/5

Pros:

Easy to use

Cons:

More stocks

5/5

Pros:

Very cheap

Cons:

Add more stocks and ETFs

4/5

Pros:

Very nice. Robinhood for the UK market

Cons:

Fraccional shares and good fees

5/5

Pros:

The app is easy to use

Cons:

Every thing so far been good

5/5

Pros:

Speed of trade

Cons:

Nothing

5/5

Pros:

User interface, no fees but small fee – currency exchange

Cons:

More stocks and ETF-s to choose

5/5

Pros:

Ease of use

Cons:

Make European shares available as fractions

2/5

Pros:

Na

Cons:

Na

5/5

Pros:

Free

Cons:

More stocks

4/5

Pros:

Easy to use

4/5

Pros:

Range of stocks

Capital at risk

Expert Lightyear Review: : To infinitely low fees and beyond…

Affiliate disclaimer: We will be paid a referral fee if you open an account and deposit funds through some of the links on this page

Name: Lightyear Description: Lightyear is a new investment app that offers low cost investing in UK, European and US shares. The company was founded by one of the first Wise (Transferwise) employees, Martin Sokk with a similar objective of making investing as cheap and easy as possible. Summary: A very well-designed low-cost investing app with discounted FX charges, limit and recurring orders for investing in local and international markets. Special Offer: Sign up with a promo code GOODMONEYGUIDE deposit at least £50 and get 10 trades for free. T&Cs apply. Capital at risk. Pros Cons

Lightyear Review

Capital at risk.

Overall

4.2

Capital at risk

Lightyear Video Review

Richard Berry tests the Lightyear investing app with real money and highlights some of it’s key features.Capital at risk

Lightyear wins best business investing account at the Good Money Guide Awards 2024

Lightyear won Best Business Investing App because they simplify the process of opening a corporate investment account. By enabling businesses to invest in the stock market rather than solely holding cash, Lightyear empowers companies to make more from their funds, maximizing potential returns. Charlotte Ashdown from Lightyear said after winning the review: We’re honored to

How does the Lightyear investing app make money?

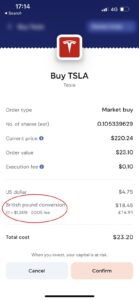

Lightyear make their money on the FX Fees. With Lightyear, they apply the FX fee on top of the interbank rate, so you can actually see the amount you are charged for the conversion. When I interviewed Martin Sokk he told me Lightyear aims to expand into different countries quickly, so they can help people to

Lightyear “shares” a refer-a-friend offer

Investment platform Lightyear has introduced a refer-a-friend offer with a difference, this one pays you in shares. Lightyear is offering the opportunity for both you and your friends to earn £10 in free stocks when they join Lightyear and fund their account with at least £50. You can invite up to five friends per month,

Breaking Into Lightyear’s High Interest Vaults

Lightyear, the online savings and investing app, has launched a new product called Lightyear High-Interest Vaults to provide its clients with a market-leading interest rate on cash deposits. The High Interest Vaults are an easy-access cash investment product with variable rates, and there are separate vaults for deposits in Sterling, Euros and US d… To

Is Lightyear just another low cost investing app?

Just after I interviewed the Lightyear founder, Martin Sokk for this review, I went to the pub with my friend Nick, a fellow ageing stockbroker. One of the things we discussed was how things have changed in the City, in particular, what is happening to Simpsons Tavern. For over 250 years, Simpsons Tavern has sold

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com