Lightyear Customer Reviews

Tell us what you think of this provider.

Best app for investing

I tried a lot of apps and Lightyear is the one I found most friendly for begginers, I learnt from the app about everything about investing and their news for stocks are spot on

Easy to use

Lightyear is user friendly. I enjoy the grapjics used to help you understand and look through their products. Also, I found their customer service team quick to respond to queries.

Value for money

A far easier and intuitive app then any other I have used over the past 5 years. No problem issues and fair pricing irrespective of currency or shares.

Jó

Alacsony díjak, jó értelemben egyszerű kezelő felület

Lightyear

Lightyear is an intuitive and highly user-friendly investment platform, suitable even for beginners

Great

Very good!

Simple

It is a simple software, not difficult.

Simple, without fee

The Lightyear is a simple, great app for trading ETF without fee.

Good for beginners

I have used this app for some time and so far I find lightyear a good beginner friendly stocks app

Best etf platform

Best ux and no fees for etfs.

6

Simple and understandible

Easy to use

Easy to use with low commission and beautiful design

Excellent Trading App

Seamless usage of the app and trade executions are swift

A free simple investment choice

Lightyear is pretty easy to use and search for a variety of ETFs

Lightyear is great!

Lightyear is perfect for long term investors.

super cool and convenient

it is my favourite investing app. very user friendly and they are very quick to answer if you ever have questions. it brings you many options from different markets and places

Brilliant service

So much info has helped me trade

Reliable and high quality app

Lightyear offers stocks and MMFs with highest rates so you can invest in whatever suits. The experience is amazing

Awesome

The best investing happens in there! Such great stats and diagrams. Love it!!

Great

Nice

Lightyear Expert Review

Affiliate disclaimer: We will be paid a referral fee if you open an account and deposit funds through some of the links on this page

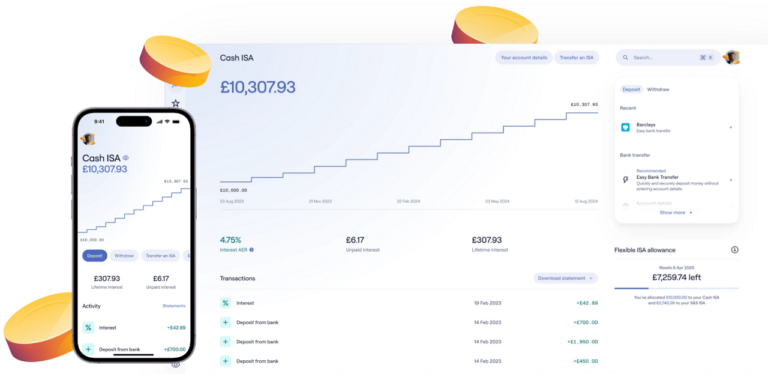

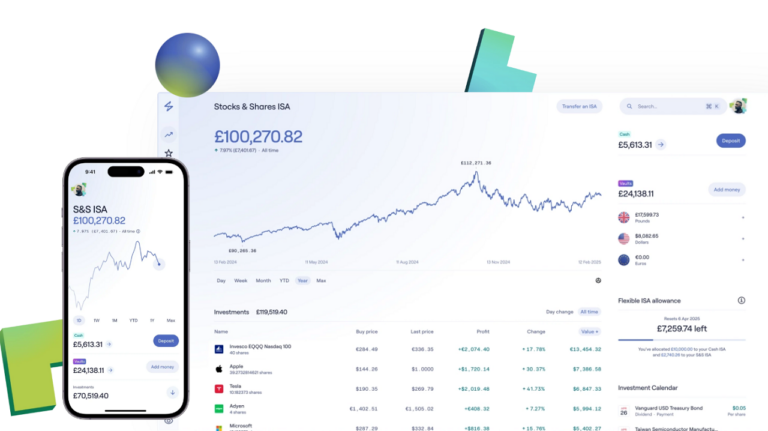

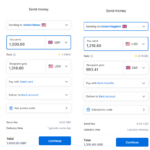

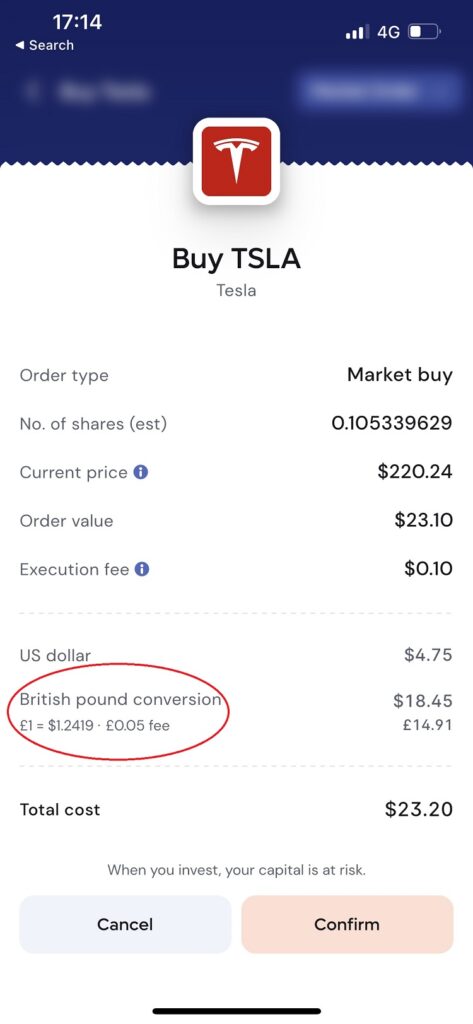

Provider: Lightyear Verdict: Lightyear is one of the better free investing apps as they provide access to US stocks and local markets with FX fees as low as 0.35%. Lightyear is a new investment app that offers low cost investing in UK, European and US shares. The company was founded by one of the first Wise (Transferwise) employees, Martin Sokk with a similar objective of making investing as cheap and easy as possible. Is Lightyear good for investing? Lightyear is a simple and approachable way to invest in stocks and ETFs without unnecessarily large fees. A very well-designed low-cost investing app with discounted FX charges, limit and recurring orders for investing in local and international markets. Special Offer: Sign up with a promo code GOODMONEYGUIDE deposit at least £50 and get 10 trades for free. T&Cs apply. Capital at risk. Fees: Lightyear is very cheap for investing, there is no account fee for a general investing account and only £1 commission for buying UK shares and a max of $1 for US stocks. Lightyear make their money on the FX Fees. With Lightyear, they apply the FX fee on top of the interbank rate, so you can actually see the amount you are charged for the conversion. When I interviewed Martin Sokk he told me Lightyear aims to expand into different countries quickly, so they can help people to invest in their local stock markets, but also in America, which is where a large percentage of people want to buy stocks. And rightly so, US shares are all household names, and one of the key drivers for investing is to buy companies you love and use. Lightyear will make money charging 0.1% per trade (or $1 what ever is bigger) and converting GBP, HUF & Euros, etc. into USD when people buy US stocks. They charge, 0.35%, which is higher than Interactive Brokers’ 0.02% but much lower than the 0.5% charged by AJ Bell, Saxo Markets and IG, or the 1% from Hargreaves Lansdown and Interactive Investor. FX, therefore, is a key part of Lightyear’s monetisation strategy because, if you charge very low commission and account fees you have to make money somehow. So Lightyear, aim to make it’s money in the background, initially from foreign exchange fees. FX is a very good way to make money, because, a) no-one really understands how the pricing works, and b) because you don’t see the charge, it’s built into the buy/sell spread. You can see in the below example what the fees would be when I bought some Tesla shares testing the app. Market Access: Lightyear has just added 1,300 new instruments, bringing the total up to almost 5,500. These include well-known UK names such as Rolls-Royce, easyJet and IAG; to defense ETFs, US stocks. This is great becuase one of my concerns about new investing apps is that they normally just cater to the most heavily traded apps. It’s great to see Lightyear providing wider market access. Plus, they are proactive about it too. Lightyear says they have put live 98% of non-complex US instruments asked for by customers in the past 3 months. One of the other really cool things about Lightyear is that you can listen to earnings calls directly on the app. Multicurrency account & order types Another point to make here is that you also get a multi-currency account, where you can hold foreign currency. The advantage of this is that you don’t need to do as many FX conversions which can help keep costs down. Related guide: Compare FX rates for buying US stocks from the UK. Lightyear comes with features like fractional US shares, limit orders, and regular investing. You can also quickly see which shares pay the highest dividends or make the most money relative to their share price to help you pick stocks. Progression to servicing local customers and local markets When Lightyear first started, you could only invest in a handful of UK stocks, and they were ADRs listed in the US denominated in USD, rather than the local listings on the LSE. So, you were paying an FX fee when you really shouldn’t have to, admittedly, there is no stamp duty so technically paying 0.35% on FX rather than 0.5% to HMRC is cheaper. Lighyear have a cash and investment ISA, but no SIPP account, but I suspect that is next on the “product roadmap”. But anyway, they’ve sorted that now, and if you want to invest in UK shares like Lloyds, you can actually buy them on the LSE, something that eToro is yet to do. With them, you still have to buy USD-denominated shares. I’ve mentioned how annoying that is many times and yet they continue serve themselves as a global broker instead of their customers as locals. It’s nice to see that Lightyear, fixed that problem early on. Like Transferwise, like Lightyear To draw on one final Transferwise comparison, it is very easy to use app-as-a-tool to help you start investing as cheaply as possible. The thing is though is that, transferring money is like car insurance. No-one really has any loyalty to their insurer, they just do it and move on. Investing is different. Investing is not like insurance, when you open an investing account, you could be using it for the next 30 years. I think there will always be a place for traditional investment platforms because they provide excellent customer service and brand loyalty, they are mature platforms for mature investors and fees will eventually come down, as they have done in the past. Same as with Simpsons Tavern, it may not be as good for you as veganism, but if it survives, people will continue to go because they like it. But, if low-cost investing apps are a gateway to getting more people to invest for their future, then they are the future too and will hopefully mature along with their customers, and Lightyear, in particular, is a great place to get started. Pros Cons

Lightyear Is An Easy To Use Investment App With Very low Fees

Capital at risk.

Overall

4.2

Capital at risk

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

To contact Richard, please ask a question in our financial discussion forum.