Overall we rate InvestEngine as a very good investing platform with a GMG rating of 4 stars and excellent customer feedback of 4.8 stars from over 1,500 client reviews.

InvestEngine Customer Reviews

Leave a review and tell us what you think to help others make more informed financial decisions.

5/5

Pros:

Low cost

Cons:

Nothing

5/5

Pros:

simple and intuitive app

5/5

Pros:

Simple UI

Cons:

Na

5/5

Pros:

Price

5/5

Pros:

Great choice of investments

Cons:

I canÔÇÖt think of anything

5/5

Pros:

SIMPLE TO USE AND GOOD VALUE

Cons:

PROVIDE MORE DETAILS

5/5

Pros:

Easy to invest

Cons:

Make LISA savings

5/5

Pros:

able to invest in ETFs

Cons:

not able to easily select between accumulative vs income funds

5/5

Pros:

Ability to invest long term at very low cost

Cons:

Nothing

5/5

5/5

Pros:

Simplicity and low cost

Cons:

Have more details about the products

4/5

5/5

Pros:

Low fees for stocks and shares ISA and ETF focused investing

Cons:

notification for dividends received

5/5

Pros:

Low cost for ETFs

5/5

Pros:

Easy to use, good communication

Cons:

Offer a larger variety of products

4/5

Pros:

Fees

Cons:

Allow better timing of trades

5/5

Pros:

Very easy to set up and trade straight away.

Cons:

Allow more personalisation of accounts.

5/5

Pros:

Low fees

5/5

Pros:

Low fees

Cons:

Swapping between accounts

5/5

Pros:

Easy to use app

Capital at limit

InvestEngine Expert Review

InvestEngine Review

Name: InvestEngine

Description: InvestEngine is a low cost ETF investment platform that lets you buy around 600 exchange traded funds with zero commission. They also have a managed ETF investment service, for those that want help with what to invest in.

Is InvestEngine any good?

Yes, InvestEngine is a good way to buy ETFs. InvestEngine makes it really simple to get started by investing in ETFs with zero commission, although the market range is a bit limited if you are looking for more complex asset classes. Plus, they also have a managed service for those that want an expert to build a diverse portfolio of ETFs for them.

Pros

- Fractional ETF investing

- Zero commission ETFs

- Managed ETF portfolio service

Cons

- Limited to ETFs

- Early stage company

-

Pricing

(5)

-

Market Access

(3.5)

-

Platform & App

(4)

-

Customer Service

(4)

-

Research & Analysis

(3.5)

Overall

4I’ve never had any doubts about InvestEngine as an investment account, but in the past, I’ve always been a little worried about new ‘free’ or very low-cost investing accounts. In particular, because investing is a very complex business and the last thing you need to worry about is your investment platform going bust.

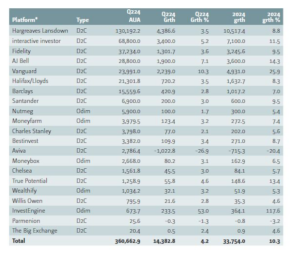

But InvestEngine is doing great business at the moment. I recently saw Andrew Prosser (who incidentally collected InvestEngine’s award for Best ETF investing Platform in 2023) at the London Trader Show talk about their growth. And the good news is that they now look after more client money than ever and around 35% of that is in InvestEngine’s managed ETF account. This means that as well as you are able to make money by investing in ETFs through their free account.

InvestEngine Ratings Explained:

- Pricing: Top marks as it is actually free to buy and hold ETFs in a GIA and ISA (although keep in mind you have to pay ETF charges to the exchange). Plus, the InvestEngine SIPP and managed accounts are very low cost too

- Market Access: InvestEngine only offer about 600 ETFs on their platform so are marked down a bit here. However, they do offer enough to build a diverse portfolio of exchange-traded funds

- Platform & App: Both are well built and easy to use, intuitive and cross-device

- Customer Service: InvestEngine are easy to contact through chat (even on weekends) plus an active community board. There is no published phone number on the site though

- Research & Analysis: A bit on the blog, but they are more insights, with a fairly active social channel (mainly investing tips or product highlights).

Capital at limit

InvestEngine Managed Portfolios

Watch as we chat to Andrew Prosser, the Head of Investments at InvestEngine about their managed portfolios for investors who don’t have the knowledge or experience to invest themselves.

Capital at limit

InvestEngine Facts & Figures

| ⬜ Public Company | ✔️ |

| 👉 Number Active Clients | 38,000 |

| 💰 Minimum Deposit | £100 |

| 💸 Client Funds | £390m |

| 📅 Founded | 2019 |

Account Costs | |

| 👉 Investment Account | 0% |

| 👉 SIPP | 0.15% |

| 👉 Stocks & Shares ISA | 0% |

| 👉 Junior ISA | ❌ |

| 👉 Lifetime ISA | ❌ |

Dealing Costs | |

| 👉 UK Shares | ❌ |

| 👉 US Stocks | ❌ |

| 👉 ETFs | £0 |

| 👉 Bonds | ❌ |

| 👉 Funds | ❌ |

Capital at limit

InvestEngine – Good Money Guide Award Winners

InvestEngine won our award for best ETF investment platform in 2024 and 2023.

Capital at limit

InvestEngine wins best ETF platform at Good Money Guide Awards

InvestEngine won the Best ETF Platform award this year because it’s one of the few platforms that lets you invest in ETFs with zero commission. Plus, if you need a bit of guidance with ETF investing, they offer a managed ETF service as well. https://youtu.be/tTIo_m6ONmA Elspeth Brown from InvestEngine said:“We’re really excited to be here

InvestEngine’s client assets more than double since start of 2024

InvestEngine’s client assets have more than doubled so far this year, making it the UK’s fastest growing investment platform in terms of relative growth. Assets under administration on the ETF trading platform have shot up 117.6% since the start of 2024 to reach £674 million, according to Fundscape data. Much of that growth came in

Andrew Prosser Head of Investments at InvestEngine explains their managed portfolios

We talk to Andrew Prosser, the Head of Investments at InvestEngine about their managed portfolios for investors who don’t have the knowledge or experience to invest themselves. InvestEngine have a range of 10 risk-rated model portfolios that cater to different risk profiles. The portfolios are constructed using ETFs, which helps keep the costs low. InvestEngine

InvestEngine hits half a billion AUM milestone

InvestEngine reaches a key AUM milestone in a climate of ETF demand. InvestEngine, the investment platform that offers commission-free ETF trading, has announced it has reached a major milestone, surpassing a figure of £500 million in assets under management or AUM. This achievement is driven at least in part by a +70.0% increase in assets

InvestEngine raises another £2m via Crowdcube valued at £27m

ETF-focused Fintech InvestEngine has closed another successful crowdfunding round on Crowdcube, with the commission-free investment platform picking up almost £2.0 million in new funds. InvestEngine valued at nearly £30m InvestEngine had targeted £1.25 million from its latest crowdfunding round, which was managed by Crowdcube, however, it comfortably surpassed that figure and raised £1.94 million. This

Richard is the founder of the Good Money Guide (formerly Good Broker Guide), one of the original investment comparison sites established in 2015. With a career spanning two decades as a broker, he brings extensive expertise and knowledge to the financial landscape.

Having worked as a broker at Investors Intelligence and a multi-asset derivatives broker at MF Global (Man Financial), Richard has acquired substantial experience in the industry. His career began as a private client stockbroker at Walker Crips and Phillip Securities (now King and Shaxson), following internships on the NYMEX oil trading floor in New York and London IPE in 2001 and 2000.

Richard’s contributions and expertise have been recognized by respected publications such as The Sunday Times, BusinessInsider, Yahoo Finance, BusinessNews.org.uk, Master Investor, Wealth Briefing, iNews, and The FT, among many others.

Under Richard’s leadership, the Good Money Guide has evolved into a valuable destination for comprehensive information and expert guidance, specialising in trading, investment, and currency exchange. His commitment to delivering high-quality insights has solidified the Good Money Guide’s standing as a well-respected resource for both customers and industry colleagues.

You can contact Richard at richard@goodmoneyguide.com