Private pension provider PensionBee has launched a new partnership that aims to unify retirement planning and credit management.

Partners PensionBee and ClearScore have unveiled a venture aimed at transforming how individuals manage their financial futures.

The collaboration inserts PensionBee’s retirement planning capabilities, directly into ClearScore’s Credit Health platform.

What will this new service allow users to do?

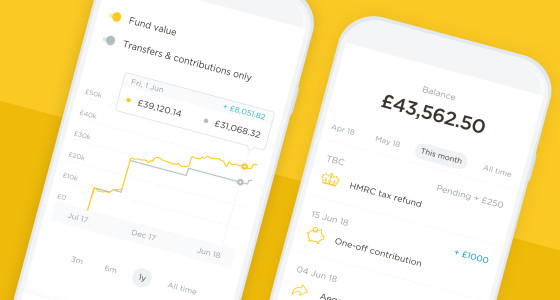

The integration will allow users to track their pension portfolios, alongside their credit scores and lending potential, providing them with a fuller picture of their financial standing.

ClearScore, which was established in 2015 to provide free access to credit reports, scoring and open banking now has 24 million users, across the UK, South Africa, Australia, New Zealand, and Canada.

This development means streamlined access to sophisticated pension management tools through their existing ClearScore accounts.

PensionBee emphasised the initiative’s focus on financial empowerment that’s been achieved by integrating their pension services into ClearScore’s platform, to make pension management more accessible and straightforward for millions of users.

Is this partnership part of a wider trend within Financial Services?

The new partnership reflects broader trends in financial technology, under which services that were traditionally separated, are now converging to create more holistic financial services solutions.

ClearScore’s Corporate Communications Director, Joe Wiggins, reinforced this perspective when he said:

“Our platform gives people the data and insights they need to master their borrowing and have a healthy relationship with credit. But being money savvy goes beyond borrowing, and this is where we can really enhance our user experience by bringing in like-minded and innovative partners such as PensionBee”

Adding that

“We share a common goal of making personal finance clearer and more straightforward, so the more people we can help, the better”

Head of Partnerships at PensionBee, Jordan Lowe said of the tie-up:

“We are thrilled to grow our partnership with ClearScore to help savers take control of their financial wellbeing. By integrating our pension services into ClearScore’s widely used platform, we aim to make pension management more accessible and straightforward for millions of users.”

He also commented

“This partnership underscores both companies’ commitment to enhancing financial literacy and providing users with the tools necessary to plan effectively for their future”

Just what the customer wants

The new offering ties in with the findings of PensionBee’s recent survey of UK Pension Investors, which found that they are receptive to the use of technology, when it comes to keeping track of their finances and investment performance. But they very much still value and require the human touch when it comes to guidance and decision-making.

The integration is set to launch this month, from when users of the service will have access to tools that allow them to simultaneously evaluate their borrowing potential while planning for their retirement.

With over 35 years of finance experience, Darren is a highly respected and knowledgeable industry expert. With an extensive career covering trading, sales, analytics and research, he has a vast knowledge covering every aspect of the financial markets.

During his career, Darren has acted for and advised major hedge funds and investment banks such as GLG, Thames River, Ruby Capital and CQS, Dresdner Kleinwort and HSBC.

In addition to the financial analysis and commentary he provides as an editor at GoodMoneyGuide.com, his work has been featured in publications including Fool.co.uk.

As well as extensive experience of writing financial commentary, he previously worked as a Market Research & Client Relationships Manager at Admiral Markets UK Ltd, before providing expert insights as a market analyst at Pepperstone.

Darren is an expert in areas like currency, CFDs, equities and derivatives and has authored over 260 guides on GoodMoneyGuide.com.

He has an aptitude for explaining trading concepts in a way that newcomers can understand, such as this guide to day trading Forex at Pepperstone.com

Darren has done interviews and analysis for companies like Queso, including an interview on technical trading levels.

A well known authority in the industry, he has provided interviews on Bloomberg (UK), CNBC (UK) Reuters (UK), Tiptv (UK), BNN (Canada) and Asharq Bloomberg Arabia.

To contact Darren, please ask a question in our financial discussion forum.